I've been buying the dips regularly since mid December and now have far more Tesla shares than I planned. Looking at pre-market, it seems I'll be out shopping again today. I will probably offload some when the price gets to around 900 for a nice profit and to restore some liquidity.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

I've been buying the dips regularly since mid December and now have far more Tesla shares than I planned. Looking at pre-market, it seems I'll be out shopping again today. I will probably offload some when the price gets to around 900 for a nice profit and to restore some liquidity.

Sounds like a good plan! I've been trying to apply this "buy low sell high" method too.

RobStark

Well-Known Member

This blimin market does like to scare me a lot lately!!

I know I should ignore premarket dips on very low volume, but it still affects my real time balance :O

Artful Dodger

"Neko no me"

Options Open Interest levels have been quite small for expiries between Feb 19 and Mar 19, 2021. I have suspected for some time that recent MM actions to drive down the SP have not been motivated by weekly options expiries, so now may be a good time to discuss that.

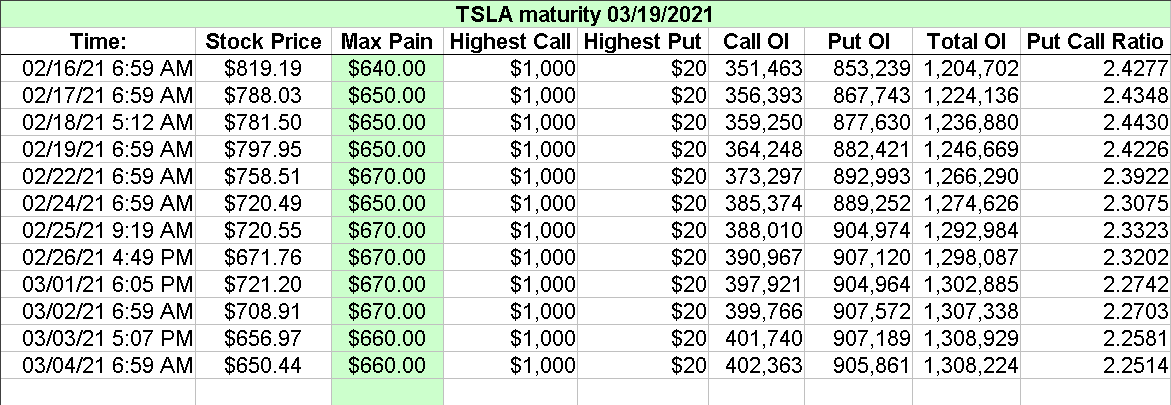

I believe Options writers (mostly MMs) are getting in position for the most significant "triple-witching" Friday in some time, March 19 2021 with over 1.3 M contracts expiring (controlling 130 Million shares or about $85B in shares at current SPs)

This table summarizes daily Open Interest for Mar 19 expiries over the past 3 weeks:

Not saying that the SP can't go lower in the meantime (eg: we already touched yesterday's Closing value for the Lower-BB at $636 shortly after 4:00 a.m. ET today), or that Max-Pain itself can't move, but with such large Open Interest already in play for March 19, IMO it would take an enormous effort to move the SP far from that value.

Finally, it was March 18, 2020 when TSLA bottomed out in Q1 last year (indeed for the entire year).

Also, not an advice...

Cheers1

I believe Options writers (mostly MMs) are getting in position for the most significant "triple-witching" Friday in some time, March 19 2021 with over 1.3 M contracts expiring (controlling 130 Million shares or about $85B in shares at current SPs)

This table summarizes daily Open Interest for Mar 19 expiries over the past 3 weeks:

Not saying that the SP can't go lower in the meantime (eg: we already touched yesterday's Closing value for the Lower-BB at $636 shortly after 4:00 a.m. ET today), or that Max-Pain itself can't move, but with such large Open Interest already in play for March 19, IMO it would take an enormous effort to move the SP far from that value.

Finally, it was March 18, 2020 when TSLA bottomed out in Q1 last year (indeed for the entire year).

Also, not an advice...

Cheers1

Highway2Heel

Member

A battery plant in Tennessee has been much discussed for the last 18 months. I live ten minutes from one of the sites still in the running...a site that’s right beside GM’s largest North American plant.

Artful Dodger

"Neko no me"

Further, I think that the rebalancing date for Q1 for S&P 500 weights coincides with the "triple-witching" day (3rd Fri of the 3rd Mth of the Qtr).I believe Options writers (mostly MMs) are getting in position for the most significant "triple-witching" Friday in some time, March 19 2021

However, I recall that the weights are frozen for some period of time previously (vagely recall maybe 2nd Tue or Thu?). Paging @mongo

If this is the case, there may be some addtional selling pressure on or around Mar 19 due to rebalancing by Index Funds. As in Dec 2020, most Index funds trade at the Closing Cross on the Friday, but can buy or sell within 3-5 days, according to their own bylaws.

I remind you, I have ZERO experience with this procedure, anyone with ACTUAL knowledge please step forward with your comments. To me, this feeling like some big sharks are fixin' to take ~12M cheap shares off the hands of the Indexers...

Cheers!

mickificki

Member

You can even go further & enter a contract that i.e. let the other automakers accure longer-term-debt to tesla. Then that money would not even flow in the current quarter but at a later date (albeit more predictable!).@RobStark is right. The pool has to pay penalties to the EU depending on how much the pool's cars exceed emissions limits. The pool members pay Tesla to help them reduce these penalties. How much, how often no one knows.

Like "i need 300m in fine-prevention now. Can i pay you 5 years down the road?" Could be a valid position as Tesla would not need the cash right now - but as a security against their own debt.

Like every time in the EU the details are always behind closed doors & non-public. We only see the amount fined & the amount paid to Tesla in their balance-sheet. Everything else is up for speculation.

Artful Dodger

"Neko no me"

Analysis: Fixed-income markets wary of Fed decision on bank capital relief

Better source than ZeroHedge

Bond scares linger, investors look to Powell | Reuters (7:54am EST)

"Worries about lofty U.S. bond yields hit global shares on Thursday as investors waited to see if Federal Reserve Chair Jerome Powell would address concerns about a rapid rise in long-term borrowing costs."

Feels like we need Eddie Murphy and Dan Akroyd up in here!

Cheers!

Quick update on European deliveries in Q1 so far. Based on the TMC data collection led by @hobbes and &Troy, with Portugal outstanding, we are at ~7100 cars in the first two months vs. 6900 last year.

Interesting that the UK is super weak, but this is probably due to Brexit impact on shipping. Until now, ships to Europe usually docked at Zeebrugge (Belgium) before making a second stop at Southampton for British deliveries. This time though, you have 2 ships specifically designated for Britain, with no pitstop at Zeebrugge. The first arrived 2/18, second expected today - I expect March to have 99% of UK deliveries.

*EDIT. Another explanation for direct UK ships may be that these are now all made in Shanghai.

Interesting that the UK is super weak, but this is probably due to Brexit impact on shipping. Until now, ships to Europe usually docked at Zeebrugge (Belgium) before making a second stop at Southampton for British deliveries. This time though, you have 2 ships specifically designated for Britain, with no pitstop at Zeebrugge. The first arrived 2/18, second expected today - I expect March to have 99% of UK deliveries.

*EDIT. Another explanation for direct UK ships may be that these are now all made in Shanghai.

Last edited:

Still in the running = being constructed?A battery plant in Tennessee has been much discussed for the last 18 months. I live ten minutes from one of the sites still in the running...a site that’s right beside GM’s largest North American plant.

2daMoon

Mostly Harmless

FWIW, Canada is in America. North America in fact. So Canadians are Americans, as are Argentinians for that matter.you clearly aren’t American.

But, yeah, the "Ugly Americans" only come from that one part of NA.

Last edited:

Artful Dodger

"Neko no me"

Lol, no delay gittin' da nudes out on usetube, neither...

CNBC = DUDS.

Artful Dodger

"Neko no me"

FWIW, Canada is in America. North America in fact. So Canadians are Americans, as are Argentinians for that matter.

Hey! This is the Americas! Speak

Lol, no delay gittin' da nudes out on usetube, neither...

CNBC = DUDS.

I think it was interesting Baron still sees a triple or more in Tesla. He lists all the free businesses you get with Tesla. Then most important to me was the mention that it is much easier to grow from here to 20 millions vehicles a year than it was to get to this place. The heavy lifting has largely been done.

I think this harmonizes with EM mentioning that he will not be CEO forever. The crank is turning and it gets easier and easier to turn.

Artful Dodger

"Neko no me"

I think this harmonizes with EM mentioning that he will not be CEO forever. The crank is turning and it gets easier and easier to turn.

Elon's not going anywhere soon (maybe *consolidating* in Texas). His CEO comp. plan calls for him to remain CEO and either Chairman of the Board or Chief Product Architect throughout the minimum 5-year redemption period for shares awarded by each of his 12 tranches. Besides, Elon says he won't need the money for a decade:

Elon Musk on Twitter: "@valleyhack Essentially. Long-term purpose of my Tesla stock is to help make life multiplanetary to ensure it’s continuance. The massive capital needs are in 10 to 20 years. By then, if we’re fortunate, Tesla’s goal of accelerating sustainable energy & autonomy will be mostly accomplished." (July 7, 2020)

Personally, I'm glad that Zach is still a young man, because I see him stepping up eventually as CEO when Elon returns to his 1st love (engineering) as Chief Product Architect.

#Prediction: Model 1 will be a cast stainless steel foam unibody autonomous robotaxi, and they'll make 10M per year on 5 continents...

Cheers!

Last edited:

Anyone else feel that we are getting close to peak FUD?

Close to Nashville?

Going to be a swingin' LG factory. Yeeha!

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

Anyone else feel that we are getting close to peak FUD?

Yes! I sometimes do a quick check of my shortlist of stocks that I have programmed in the stock app on my iPhone, and see the headlines the app point me to. Almost never click on them, but just reading them tells me how our system always somehow feeds us bogus FUD when the stock price is down, and sometimes a bit of the opposite (not as much though) when we are in bull mode. Things that come to mind that I've seen in the last few days are things like: "Ford Mach-E eat in to Tesla's EV market share", lots of instances of TSLA being clumped together with either low-end chinese EV makers and/or companies that have yet to deliver a single car to a customer, Tesla's future presented as now being married to whatever BTC does. etc. etc.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K