Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

The sad thing the social media brought was the extreme positions without anything in the middle. Arguing with someone in 140 characters format made it impossible to have reasonable detailed and rational justified discussions. The people who did not understand Tesla started to read FUD, they started believing in it and they went on Twitter to spread their hate. Tesla and Elon Musk in MSM are portrayed as irresponsible and unreliable. This all became the basic rhetoric of one of the extreme of the Twitter and social media Tesla haters. They say they oppose Tesla fanbois. It is hard or practically impossible to have a reasonable discussion about Elon Musk goals, Tesla future and TSLA on social media. All those baseless assumptions and the hatred online has made a part of the consumers unlikely to ever consider Tesla because of the FUD they read online. They suddenly became immune to common sense and logics. Seems like everyone is entitled to their own truth online and accusing anything else of fake news.I've been discussing cars with some taycan owners and people waiting for one and... omg. Its like a reality distortion field around these people. The Taycan MUST be better than the model S because... I dunno... reasons?

I'm told very clearly by them that the taycan is the same spec but you get a much higher quality car for a bit more money.... when the specs are not VAGUELY comparable (the taycan is laughably inferior in many metrics), the taycan has no supercharger network, and no OTA updates, and the price is stupidly higher...

And when i point out the vast difference in top spec WLTP ranges, I am assured that it is 'common knowledge by everyone' that tesla overstates their range and porsche understate it...

the WLTP figures...

MUST be wrong!

And if they are wrong, it must be tesla who lie, and porsche (part of the VAG mess who should be imprisoned for lying about dieselgate) who are just being super chivalrous and modest and understating...

What drugs are people on that they swallow all this? honestly feel sorry for people whose blind hatred (i suspect mostly jealousy) of Elon Musk is so strong that they believe all this crap. If this is the kind of lies and hand-wavey nonsense that people are having to resort to in order to buy a taycan, it makes me think the plaid is going to absolutely vaporize the profits of the 'luxury' car makers. Its going to cost a LOT of media-bribes to get people to keep parroting this FUD.

It’s completely useless to argue with someone who is not ready to change his mind when faced with mathematical facts. A vast majority of people on social media are not ready to read anything they do not agree with. This way of knowing the absolute truth is slowly disseminating everywhere.

Interesting that ARK dumped about $180,000,000 of TSLA today

Maybe with the recent run up it got over their 10% comfort zone

Interesting that ARK dumped about $180,000,000 of TSLA today.

TSLA remains far and away the largest holding in each of the three ARK funds that contain it. Nearly 12% in each of them after today's market close, and almost double those in second place. If it grew any larger, investors would wonder why consider a fund with fees, when they can straight buy TSLA.

ARK's methodology is to shave off a bit of its winners, for money to buy promising stocks that are languishing. The ARK CEO says TSLA is still her highest conviction stock. But she has an obligation to fund owners to actively manage the holdings in line with her stated plan of lowering risks by selling on hops and buying on dips. ARK fund owners expect such diversity and risk spreading, while those who focus on individual stocks may not.

Either ignore or counsel those you see on Twitter who do not (or pretend to not) understand ARK's methodology.

EDIT: ARK will conduct a quarterly report webinar tomorrow (Thursday) beginning a half hour after the market close. You can submit written questions. It's not necessary to be an ARK investor. Registration: ARK Q1 Webinar

Last edited:

MTL_HABS1909

Active Member

Do we really have to go through this every time?Interesting that ARK dumped about $180,000,000 of TSLA today.

Yeah his estimate went from may to june in the course of a 15min twitter thread. Ridiculous

To download FSD Beta click on the button below.

Artful Dodger

"Neko no me"

"Disgraced investor Bernie Madoff dies in prison at age 82" | CNBC

Gives new meaning to the words.... “I’m sorry for your loss”"Disgraced investor Bernie Madoff dies in prison at age 82" | CNBC

No offense @capster but I think this scenario is exactly what the Pimp slap was invented for....I had a woman tell me she was going to buy a Rivian and another tell me her husband was buying a Taycan. I told them both the same thing I tell anyone who intends to buy some other EV than a Tesla: “Any EV is good EV."

Nobody wants to hear arguments against the car they want or have decided to buy. I try to only volunteer them if the car in question is an ICE car.

“I’m buying the Rivian” ... slap

“I’m buying the Taycan” .... slap

tschmidty

Member

What's interesting about it?Interesting that ARK dumped about $180,000,000 of TSLA today.

I'll put you on the ignore list when you don't respond, and it won't be the least bit interesting but boringly predictable instead.

dhanson865

Well-Known Member

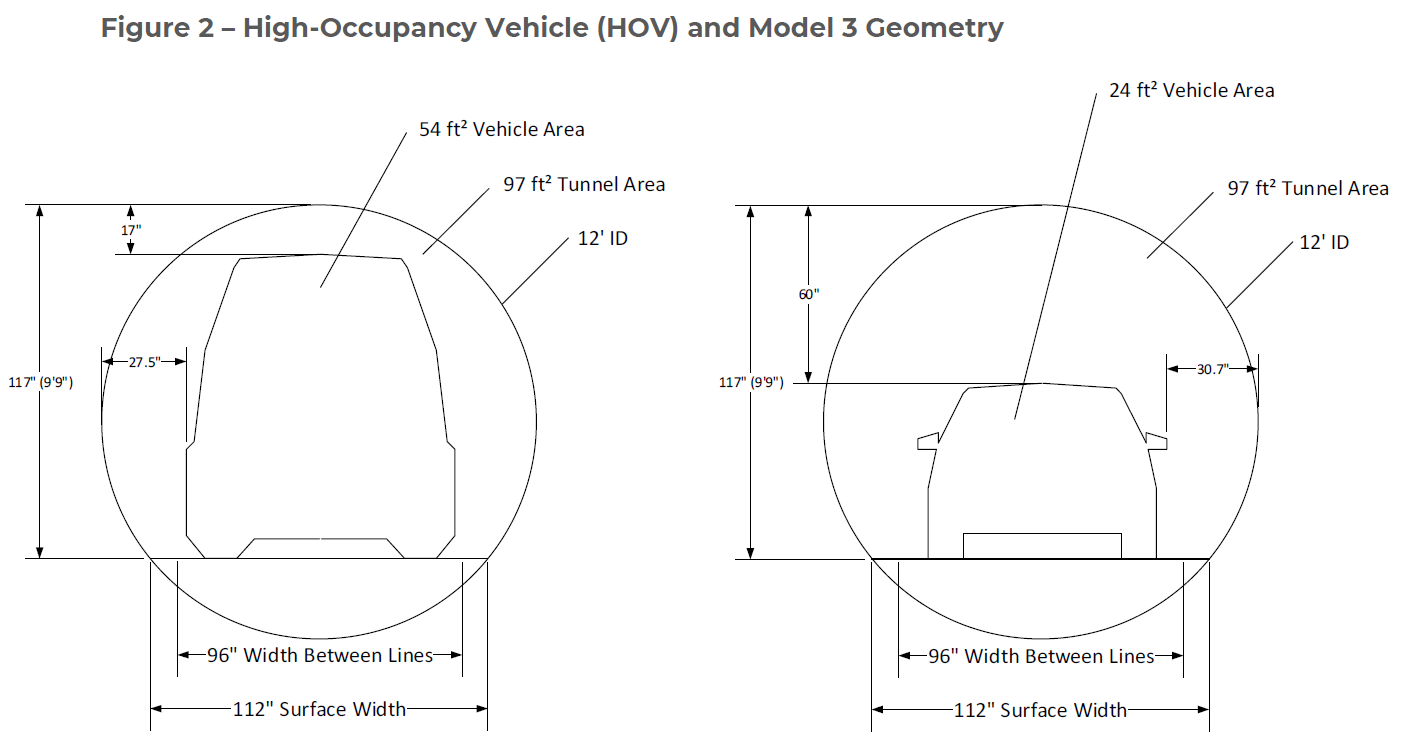

Silhouette / measurements of the new Tesla High Occupancy Vehicle for the Boring company LVCC loop and essentially a side by side with the Model 3 they are using temporarily.

The file is from 2020 but it was previously confidential, not sure when it got filed publicly, maybe the 08/10/2020 date?

Boring - Tunnel - Fire Protection Report_20200427.pdf

Type of Facility: Underground Public Transportation System

Name of Facility: Campus-Wide People Mover

Facility Address: 3150 Paradise Rd, Las Vegas, NV 89109

Date of Submittal: April 27, 2020

Application Number: BD19-48204

Revision 8 4/27/2020 from here 08/10/2020

Each vehicle is anticipated to have a load of 12 people, however for conservatism, each vehicle’s load is assumed to be 15 people for tunnel egress calculations. Vehicles are not expected to interact in the tunnels, however as an additional safety measure, the egress calculation assumes two full vehicles, which is a total of 30 people.

The file is from 2020 but it was previously confidential, not sure when it got filed publicly, maybe the 08/10/2020 date?

Boring - Tunnel - Fire Protection Report_20200427.pdf

Type of Facility: Underground Public Transportation System

Name of Facility: Campus-Wide People Mover

Facility Address: 3150 Paradise Rd, Las Vegas, NV 89109

Date of Submittal: April 27, 2020

Application Number: BD19-48204

Revision 8 4/27/2020 from here 08/10/2020

Each vehicle is anticipated to have a load of 12 people, however for conservatism, each vehicle’s load is assumed to be 15 people for tunnel egress calculations. Vehicles are not expected to interact in the tunnels, however as an additional safety measure, the egress calculation assumes two full vehicles, which is a total of 30 people.

Criscmt

Member

Trying to understand, how to read some of volume and price behavior today. Would love inputs from folks here.i like to have that bigger in my TWS:

View attachment 653792

That are all outstanding options. As every option represents 100 shares you can say "The Market(tm)" has to pay 4.320.000$ to those options-buyers for EVERY DOLLAR over $800 for the 800-calls alone!

Thus it makes sense for sellers to short for some days (current borrow-rate is 0.26% - so basically free) to get the price below & buy back on monday.

A second problem: If you have to deliver on that call you actually have to own those shares! If you have a short-position then maybe the person lending you those shares wants them back - yielding higher rates and other nasties.

The puts are exactly the opposite.

If you calculate the integral over everything "The Market(tm)" has to pay you get those nice diagrams with red "cost of puts" bars left & green "cost of calls" bars right & max-pain in the middle.

But Max-Pain is just an average for "The Market(tm)" and does not include individual institutions.. Gordon may hold onto his $20-puts & skew the max-pain in that way. That is why some of us look at the chart and identify "line of defenses" for those big players. In this case: 700, 730, 750, 800 calls. On the other hand we have also a high number of puts at 800 - where other institutions may be interested in getting the price higher. So the 700s basically cancel each other out, everything below 700 is out of reach & because of the high 800-spike over 850 should be unrealistic.

the 800 puts nearly cancel the 730 calls - so the line should be somewhere between 750-800 according to this theory (more towards 750).

This theory is ONLY valid if

- manipulation is easy (e.g. low volume)

- no breaking news

- macro-assist in the right direction (i.e. macro up/down-movements in the "right" direction get enhanced)

- no crash or similar marketwide things.

At least that is my view of it

hope that helps & clears things a bit up.

Today was higher volume than yesterday on a downward price movement.

Does this indicate that pretty much all large buy orders before ER were already placed and executed.

If you think there's more planned buying-before-ER to expect in the coming days, why wouldn't they have made use of the lower price today?

LiveLong&Profit

Member

Most HODL'ers agree with Elons policy to not do traditional advertisement. But ... above stance perhaps proves that advertisement works? Or that the 5+ year campaign to smear Tesla and Elon worked? Or a kinda cultural lag making established automakers seem more reliable, despite evidence to the contrary?I've been discussing cars with some taycan owners and people waiting for one and... omg. Its like a reality distortion field around these people. The Taycan MUST be better than the model S because... I dunno... reasons?

I'm told very clearly by them that the taycan is the same spec but you get a much higher quality car for a bit more money.... when the specs are not VAGUELY comparable (the taycan is laughably inferior in many metrics), the taycan has no supercharger network, and no OTA updates, and the price is stupidly higher...

And when i point out the vast difference in top spec WLTP ranges, I am assured that it is 'common knowledge by everyone' that tesla overstates their range and porsche understate it...

the WLTP figures...

MUST be wrong!

And if they are wrong, it must be tesla who lie, and porsche (part of the VAG mess who should be imprisoned for lying about dieselgate) who are just being super chivalrous and modest and understating...

What drugs are people on that they swallow all this? honestly feel sorry for people whose blind hatred (i suspect mostly jealousy) of Elon Musk is so strong that they believe all this crap. If this is the kind of lies and hand-wavey nonsense that people are having to resort to in order to buy a taycan, it makes me think the plaid is going to absolutely vaporize the profits of the 'luxury' car makers. Its going to cost a LOT of media-bribes to get people to keep parroting this FUD.

UnknownSoldier

Unknown Member

Imagine doubting Aunt Cathie. Well, your loss I suppose.Wow ARK, I bailed on COIN quick once I saw frenzy wasn’t materializing. They really must have lost some serious dough!

I’ll be shocked if COIN goes back above 381 anytime soon. I’m sticking with TSLA.

Jack6591

Active Member

"Disgraced investor Bernie Madoff dies in prison at age 82" | CNBC

In the words of Mark Twain:

“I refused to attend his funeral. But I wrote a very nice letter explaining that I approved of it!”

LiveLong&Profit

Member

- Charge connector physical form factor cumbersome: had to wriggle it in and wrestle it out

- Cables are stiff and unwieldy

- Design of charger/cables inelegant: Even when unused, cables are lying, floating on the ground.

- Customer forced to wade over cables to get to the payment screen. This is cumbersome for the elderly - they might trip. As for handicapped people: How to get to the payment screen in a wheelchair? Do cable limbo - twice?

- Screen placement in the sun ... not ideal: Lacks a plastic 'hood' - or re-design charger placement to keep out of direct sun.

- Payment sorta worked - but system usability ... not good.

- Booking necessary

- Either 30 min or 80% charge cap: "No more charging for you".

On reflection that might be too harsh.

I think it is more the case of: How do you design EV charging to be as close to tanking gas as possible? (given that gas pumping is your built-in, implicit bias).

It is not bad, as such, when compared to pumping gas or other charging systems.

It is only bad in comparison to Tesla.

This, perhaps, is a psychological clue to why some people have what could be perceived as irrational dislike or even hatred towards Tesla and Elon: Their accomplishments are not trivial nor are the product or services bad, they might actually be good.

It is only the shadow of Elon and Tesla that blocks the sun and puts them in perspective and in the dark.

How annoying! Would the sun not shine more fully on them if the giant went away?

I have no idea. I can take a guess if it helps. Someone can critique me.Trying to understand, how to read some of volume and price behavior today. Would love inputs from folks here.

Today was higher volume than yesterday on a downward price movement.

Does this indicate that pretty much all large buy orders before ER were already placed and executed.

If you think there's more planned buying-before-ER to expect in the coming days, why wouldn't they have made use of the lower price today?

Volume started high premarket and when market opened. Probably due to excitement that the TSLA rally would continue. It's not uncommon to see TSLA rally big when it does rally.

However at 770 + The price is getting stretched to the point where there is very little upside even with an earnings beat. A lot of big money would be reluctant to place a large bet at that price and be left with a sell the news sort of scenario. On top of that with the 43,000 800C Expiring this Friday, you can bet there is a lot of big money invested in pushing this price sub 800 come Friday. We've seen days where the macro is big green (1%+) and TSLA ends red on a Friday. It would be unwise for bigger money to buy into that. Hence the downwards price movement.

There would still be punters, retail and bigger traders and funds willing to place a bet on the stock and they would be accumulating and buying on todays lows. At this point, unless macro works against us, we'll probably be pushing low to mid 700s until Fridays 800C expire. Next week if there is enough momentum could see us push and try to take 800 in preparation for earnings the week after. It'll really depend on how the MM's are positioning their options and how they want things to play out. I think a lot of people got caught out with the huge Q1 P and D beat and they are scrambling to fix up their option positions.

TSLA followed macros for a lot of the day and trended downwards. The movement around macros would suggest there was a lot of algo trading going on in the volume of trades, not necessarily individuals buying and selling.Trying to understand, how to read some of volume and price behavior today. Would love inputs from folks here.

Today was higher volume than yesterday on a downward price movement.

Does this indicate that pretty much all large buy orders before ER were already placed and executed.

If you think there's more planned buying-before-ER to expect in the coming days, why wouldn't they have made use of the lower price today?

MC3OZ

Active Member

I would simply call it inertia or "first impressions linger".Or a kinda cultural lag making established automakers seem more reliable, despite evidence to the contrary?

People grew up admiring a particular car brand, some people follow car brands like sports teams...

Having formed an opinion it is hard to change, and some people don't like to change opinions..

Tesla drivers are mostly in the "Early Adopter" camp, we are people that actually like change, probably a minority.

People buying other EV brands may be the early stages of the "Early Majority". They think they are taking a risk buying an EV, it seems to them a more familiar brand lessens the risk. They are not overly familiar with EVs and Tesla.

Advertising may have help form their impressions, I still don't see a pressing need for Tesla to advertise.

When inventory build up is starting to threatern margins, that is the time to advertise.. because not advertising might start to cost money.

However I'm all for "marketing", which is different to "advertising" because it has an element of cleverness and invention, and does not rely on saturation.

Marketing is a surgical guided missile strike, advertising is saturation bombing.

Buckminster

Well-Known Member

SpaceX have started building their own water towers fuel storage tanks. The question is - "could it fly?"

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K