Great summary, thanks!Because the catalyst for all the call buying that led to the gamma squeeze was the knowledge that underweight funds would be buying. Once there was a real or anticipated supply of shares (no different than a cap raise) to quench the demand, leveraged players know the party is over. Call options are rapidly closed out, leading to sale of the underlying shares. This may have been synergistic with Elon’s actual selling but it is also possible he hasn’t sold yet.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

How likely would it be that’s not Elon’s shares? I don’t pay much attention to dark pools regularly so how often do we have that kind of volume?

If avg. volume is 37.94% as stated and avg. volume 21.85M = maybe 8.3M shares usually traded off-exchange (vs 24.7M today)

Q3 EPA non-GAAP diluted = 1.86 on 0.241M deliveries = $7.71 per million cars * 5M = 38.55 per share. $1000/38.55 = 26x P/E.The other day I was playing around with this arithmetic ...

One share is ~ 1/1E9 of the company

Every million cars produced is equivalent to the the share equaling 1/1000th of a car

At $10k gross margin per car, the share is $10

So ...

3M cars is $30

4M cars is $40

5M cars is $50

... ...

Earnings will be less OPEX, so I conclude that P/E will be over 200x even at 5M car production annually at a SP of $1,000.

I realize that some people may disagree with my guess of $10k/car gross margin, but is there any arithmetic error in the calc ?

Or as @deshkart points out: $1000/$50 = 20, not 200 (which is $1000/ 5 million cars)

Except he evaluated the company's 200x earnings on just the car business - no robotaxis, primus, energy, Dojo, or the phone on wheels.No arithmetic error I can see.

$10k gross margin per car is much too low. Only the $25k car will have margin of $10k.

Also should include taxes. Tesla will have to pay corporate earnings tax and eventually when they distribute the profits as dividends those will be taxed too. Net tax is 40% roughly, I think. Not a tax expert.

woodisgood

Optimustic Pessimist

If avg. volume is 37.94% as stated and avg. volume 21.85M = maybe 8.3M shares usually traded off-exchange (vs 24.7M today)

Sure seems to add up!

Can u elaborate on how you arrived at 0.5m delivery for q4. We only delivered 0.25m in q3. How come the 100% jump without a new factory coming online. And I don’t think Berlin or Austin will have any meaningful production in q4With China numbers out for Oct, I am getting more confidence in 500k deliveries for Q4, 2022.

30 billion revenue . $4 to $5 EPS - $6 possibly ?

Could easily justify 2.5 to 3 trillion market cap. 100 PE for FY 23 of 25 to $30.

Question is when does market see this ?

SageBrush

REJECT Fascism

Do you mean P/E will be at 20 at 5M car production annually and SP @ $1000?

Show me my error ! I'd love to be wrong

Just when I thought that *one* legacy ICE wasn't corrupted:

Fox Business: Hyundai whistleblower gets $24 million from NHTSA in engine recall case.

www.foxbusiness.com

www.foxbusiness.com

Just imagine if this was Tesla...

Fox Business: Hyundai whistleblower gets $24 million from NHTSA in engine recall case.

Hyundai whistleblower gets $24 million from NHTSA in engine recall case

A former Hyundai engineer has been paid $24 million by NHTSA as part of a whistleblower program that pays for information that leads to civil penalties.

Just imagine if this was Tesla...

SageBrush

REJECT Fascism

Ahhh .... YESOr as @deshkart points out: $1000/$50 = 20, not 200 (which is $1000/ 5 million cars)

Thanks you two for pointing out the error.

I feel much better now about my encroaching senility

Last edited:

Artful Dodger

"Neko no me"

How likely would it be that’s not Elon’s shares? I don’t pay much attention to dark pools regularly so how often do we have that kind of volume?

I suggest you do the stats for avg daily "Off-Exchange" volume (a.k.a. Dark Pool) and see how much it's increased yesterday and today vs. its typical volume as a proportion of the total day's trading.

The historical data is right there on the same page. Let us know what you find for an estimate of how many "extra" shares were in Dark Pools over the past 2 days.. That'd be our estimate for Elon's share sales.

Of course, Form 4 will settle this, but I think in only has to be filed with the SEC within 3 days.

2

22522

Guest

This seems insane unless sidewalks (partitioned paths) the whole way.why I got hit twice riding my bike to work from Fremont to Palo Alto as I was emphatic about sustainable transportation,

deshkart

Member

This is for next year Q4 2022Can u elaborate on how you arrived at 0.5m delivery for q4. We only delivered 0.25m in q3. How come the 100% jump without a new factory coming online. And I don’t think Berlin or Austin will have any meaningful production in q4

Pretty classic example of a gamma squeeze unwinding. We saw an example of this just earlier this year after S&P 500 inclusion.

The sheer size of the options market on TSLA, the most active single ticker options market in the world, means we should get used to this happening over and over again going forward.

I know I will be adjusting my own strategies in the future based on the two gamma squeeze events this year.

[Goes and checks strategies: 'Buy the Dips' and 'Otherwise Play Dead']

No, I think I'm good...

StealthP3D

Well-Known Member

I would like to offer my support to everyone here who has sustained their greatest portfolio loss on paper in their life.

I wouldn't know. I haven't looked at my portfolio since last week.

I'm more of a fair weather portfolio watcher. It's been working great for decades now.

StealthP3D

Well-Known Member

Because the catalyst for all the call buying that led to the gamma squeeze was the knowledge that underweight funds would be buying. Once there was a real or anticipated supply of shares (no different than a cap raise) to quench the demand, leveraged players know the party is over. Call options are rapidly closed out, leading to sale of the underlying shares. This may have been synergistic with Elon’s actual selling but it is also possible he hasn’t sold yet.

The stock market is like musical chairs. As long as the music is playing, there is no shortage of chairs. But when the filing is released that Elon has sold his chairs the music will stop. And suddenly there won't be enough chairs to go around.

Artful Dodger

"Neko no me"

#ChinaY

www.teslarati.com

www.teslarati.com

Tesla Model Y Standard Range officially sold out until 2022 in China

The Tesla Model Y Standard Range is officially sold out in China for 2021. Last week, the Model Y sold out in the United States for the rest of the year, revealing the strong demand for Tesla affordable crossover. According to Tesla China’s order page, the estimated delivery date for the Model...

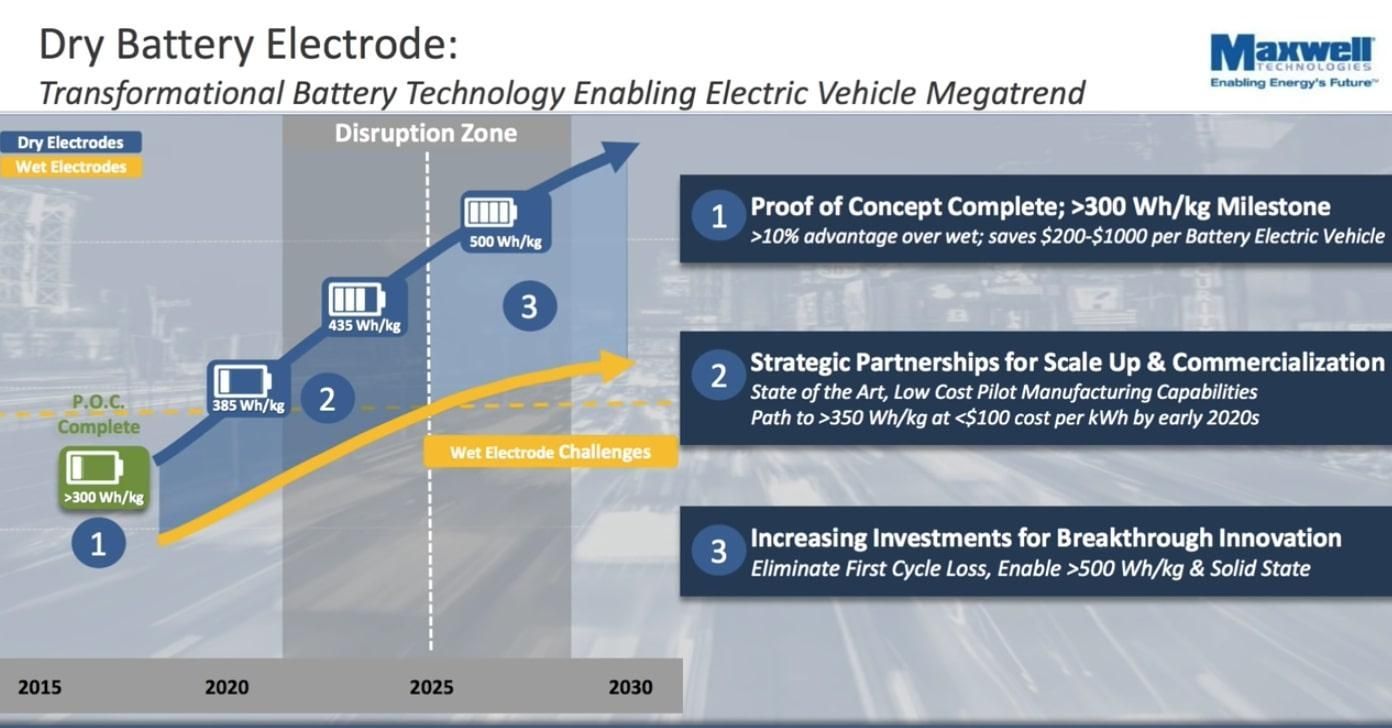

A quick reminder for anyone who is suffering from the short term noise:

We have entered the disruption zone:

4680 cells with Maxwell dry-electrode is on the verge of flooding the entire BEV market!

I personally believe that Tesla will reach a 2$T market cap this year!

We have entered the disruption zone:

4680 cells with Maxwell dry-electrode is on the verge of flooding the entire BEV market!

I personally believe that Tesla will reach a 2$T market cap this year!

We rebounded here in Europe yesterday too. If that is any indication for today…. ;-)1042$ in Europe right now. +2%

Rebound today?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K