Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

UkNorthampton

TSLA - 12+ startups in 1

Around Dec 13 according to youtube. Grimsz (Claire Elise Boucher) is on towards the end as is their baby (ah, cute).Podcast from Dan Carlin talking to EM about engineering.

Edit if the above link does not work here is Dan's page and the podcast is under HH Addendum.

As far as Tesla is related, having a happy/high-functioning/less distracted Elon has relevance. I think they can be happy in an off-on unconventional relationship. They both have their own intense interests & careers. Let Elon Elon. Let Grimsz Grimsz. I think no concern over personal turmoil at present.

Elsewhere - purported split was described as a way to get Paparazzi off her back & troll via the Karl Marx book photo. Just saying as some may have missed this & there were some posts back in September (I think) worrying about Elon. I think Elon seems in fine fettle.

Elon jet seems to do mostly Texas flying (last I looked/stalked), having several Musk companies in Texas is probably useful and time-saving.

StarFoxisDown!

Well-Known Member

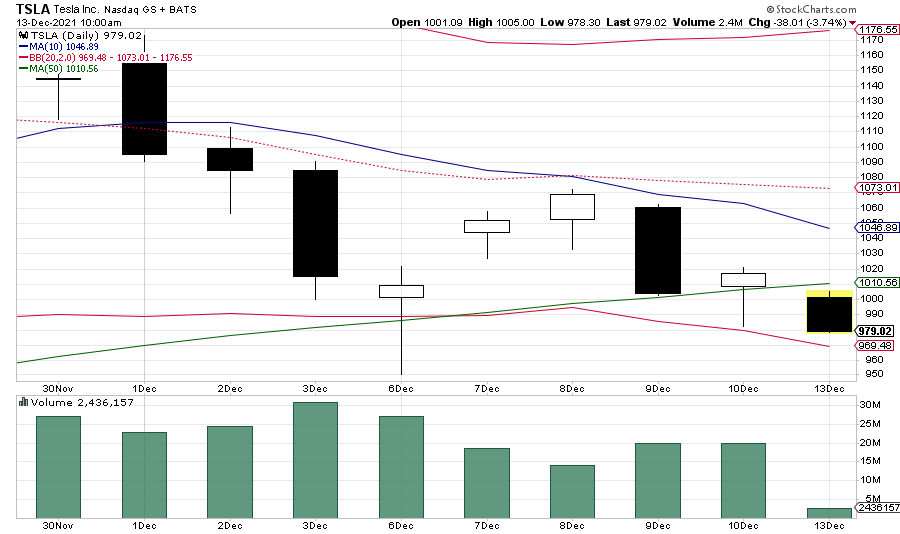

And let the weekly hedge fund front running begin......That Time piece is worth at least an 2-3% drop for no reason

Something has to got to give at this point though. 50 day moving average which this thing has bounced off of many times now is 1,006 and is moving up. So there's hardly any buffer room to drop this without truly breaking the 50 day.

Edit: So annoying how blatant it is.

Something has to got to give at this point though. 50 day moving average which this thing has bounced off of many times now is 1,006 and is moving up. So there's hardly any buffer room to drop this without truly breaking the 50 day.

Edit: So annoying how blatant it is.

Last edited:

I’m shocked Mary Barra didn’t make the cover.Elon was just announced as Time magazine's person of the year for 2021.

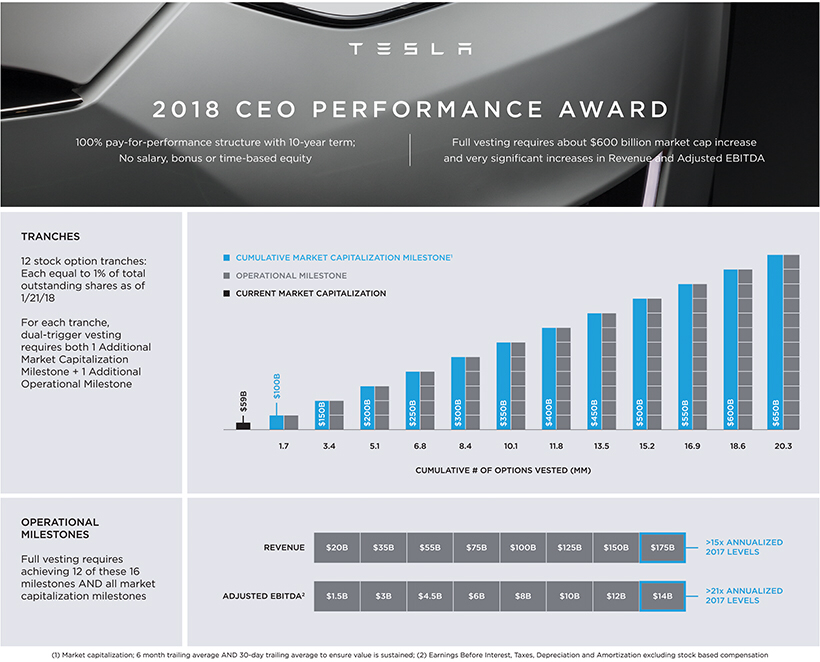

have been looking more at SEC form 4 options compensation packages specifically for Elon.

there is a whiny complainer on another forum moaning about dilution ‘n such.

So on 3/21/2018 there is a form 4

granting (presplit) 20,264,042 at cost of $350.02/ share

which should be, if math correct 101,320,210 shares at $70/share, costing Elon $7,092,424,700 in 12 tranches between then and 2028, final tranch vests when Tesla is worth $650 Billion, which it already is long ago

edit: worth today, around $100 Billion, and by 2028…..

Elon definitely seems to have made 1 set of milestones, the market cap, but i would appreciate help telling me if operational milestones are or have been or are being met

——————————-

“The performance award consists of a 10-year grant of stock options that vests in 12 tranches. Each of the 12 tranches vests only if a pair of milestones are both met.

For each of the 12 tranches that is achieved, Elon will vest in stock options that correspond to 1% of Tesla’s current total outstanding shares (1% of that amount is approximately 1.69 million shares). If none of the 12 tranches is achieved, Elon will not receive any compensation.”

—————————-

i personally don’t see much if any downside of an approximate 10% dilution of 100 million shares between now and 2028, since my overall gains are well over 20x (i was late to party) (boo boo, only made 18x gains not 20x gains)

but anticipate stock price to be far far higher by 2028 so a non issue to me

however, “i am but a rank beginner” so am i vaguely correct?

(and a lot of extremely insincere thanks to a short BC whom was whining and insulting me about my lack of Tesla knowledge since they scrape these comments continuously)(for his $$$$$ losses)

(as an aside, is it reasonable to consider the ~$60 Billion the shorts have lost to date could be considered their involuntary contributions to building giga factories or is that a stretch for humorous jab?)

i’m a bit unsure about when in time these need to be met since it’s 12 tranches ending in 2028, 10 years after the form filed so a little help on dates please…..

there is a whiny complainer on another forum moaning about dilution ‘n such.

So on 3/21/2018 there is a form 4

granting (presplit) 20,264,042 at cost of $350.02/ share

which should be, if math correct 101,320,210 shares at $70/share, costing Elon $7,092,424,700 in 12 tranches between then and 2028, final tranch vests when Tesla is worth $650 Billion, which it already is long ago

edit: worth today, around $100 Billion, and by 2028…..

Elon definitely seems to have made 1 set of milestones, the market cap, but i would appreciate help telling me if operational milestones are or have been or are being met

——————————-

“The performance award consists of a 10-year grant of stock options that vests in 12 tranches. Each of the 12 tranches vests only if a pair of milestones are both met.

• | Market Cap Milestones: To meet the first market cap milestone, Tesla’s current market cap must increase to $100 billion. For each of the remaining 11 milestones, Tesla’s market cap must continue to increase in additional $50 billion increments. Thus, for Elon to fully vest in the award, Tesla’s market cap must increase to $650 billion. |

• | Operational Milestones: To meet the operational milestones, Tesla must meet a set of escalating Revenue and Adjusted EBITDA targets (the only adjustment to EBITDA is for stock-based compensation). These milestones are even more directly aligned with shareholder value creation than those used in Elon’s 2012 performance award. They are designed to ensure that as Tesla’s market cap grows, the company is also executing well on both a top-line and bottom-line basis. |

—————————-

i personally don’t see much if any downside of an approximate 10% dilution of 100 million shares between now and 2028, since my overall gains are well over 20x (i was late to party) (boo boo, only made 18x gains not 20x gains)

but anticipate stock price to be far far higher by 2028 so a non issue to me

however, “i am but a rank beginner” so am i vaguely correct?

(and a lot of extremely insincere thanks to a short BC whom was whining and insulting me about my lack of Tesla knowledge since they scrape these comments continuously)(for his $$$$$ losses)

(as an aside, is it reasonable to consider the ~$60 Billion the shorts have lost to date could be considered their involuntary contributions to building giga factories or is that a stretch for humorous jab?)

i’m a bit unsure about when in time these need to be met since it’s 12 tranches ending in 2028, 10 years after the form filed so a little help on dates please…..

Last edited:

@The Accountant has been covering the milestones.have been looking more at SEC form 4 options compensation packages specifically for Elon.

there is a whiny complainer on another forum moaning about dilution ‘n such.

So on 3/21/2018 there is a form 4

granting (presplit) 20,264,042 at cost of $350.02/ share

which should be, if math correct 101,320,210 shares at $70/share, costing Elon $7,092,424,700 in 12 tranches between then and 2028, final tranch vests when Tesla is worth $650 Billion, which it already is long ago

Elon definitely seems to have made 1 set of milestones, the market cap, but i would appreciate help telling me if operational milestones are or have been or are being met

——————————-

“The performance award consists of a 10-year grant of stock options that vests in 12 tranches. Each of the 12 tranches vests only if a pair of milestones are both met.

For each of the 12 tranches that is achieved, Elon will vest in stock options that correspond to 1% of Tesla’s current total outstanding shares (1% of that amount is approximately 1.69 million shares). If none of the 12 tranches is achieved, Elon will not receive any compensation.”

—————————-

i personally don’t see much if any downside of an approximate 10% dilution of 100 million shares between now and 2028, since my overall gains are well over 20x (i was late to party) (boo boo, only made 18x gains not 20x gains)

but anticipate stock price to be far far higher by 2028 so a non issue to me

however, “i am but a rank beginner” so am i vaguely correct?

(and a lot of extremely insincere thanks to a short BC whom was whining and insulting me about my lack of Tesla knowledge since they scrape these comments continuously)(for his $$$$$ losses)

(as an aside, is it reasonable to consider the ~$60 Billion the shorts have lost to date could be considered their involuntary contributions to building giga factories or is that a stretch for humorous jab?)

View attachment 743772

They are also in the 10Q

As to dilution, the CEO plan gives hypothetical Elon vs rest of world returns. Proxy Statement

Potential Ownership of Securities As a Result of the CEO Performance Award

As of December 31, 2017, Mr. Musk beneficially owned 37,853,041 shares of Tesla’s common stock, including 33,632,421 shares held of record by the Elon Musk Revocable Trust dated July 22, 2003 and 4,220,620 shares issuable to Mr. Musk upon exercise of options exercisable within 60 days after December 31, 2017. Based on 168,796,945 shares of Tesla’s common stock outstanding at December 31, 2017, and assuming that all shares of common stock subject to options held by Mr. Musk that were exercisable within 60 days of December 31, 2017 were outstanding as of such date, Mr. Musk beneficially owned 21.9% of the outstanding shares of Tesla common stock as of December 31, 2017.

For illustration purposes only, if (i) all 20,264,042 shares of common stock subject to the CEO Performance Award were to become fully vested, outstanding and held by Mr. Musk; (ii) all shares of common stock subject to the other options held by Mr. Musk that are currently vested and exercisable were outstanding, (iii) the 527,491 shares of common stock subject to the tenth and final tranche of the 2012 Performance Award were to become fully vested, outstanding and held by Mr. Musk, (iv) estimated dilution as a result of potential exercises or conversions from the existing employee equity pool and the outstanding convertible notes and warrants were to be considered; and (v) there were no other dilutive events of any kind, Mr. Musk would beneficially own 28.3% of the outstanding shares of Tesla common stock.

Harley-Davidson is taking their electric motorcycle division public via SPAC.

ZeApelido

Active Member

Japanese auto companies form a coalition to explore other options than BEVs.

This is a bigger troll job than the U.S. government ignoring Tesla's existence.

europe.autonews.com

europe.autonews.com

This is a bigger troll job than the U.S. government ignoring Tesla's existence.

Toyota, Subaru, Mazda will explore greener fueling options for internal combustion

Japan's top automaker believes technological breakthroughs, such as hydrogen engines, can give internal combustion a new lease on life — saving jobs as well as the environment.

ZachF

Active Member

Japanese auto companies form a coalition to explore other options than BEVs.

This is a bigger troll job than the U.S. government ignoring Tesla's existence.

Toyota, Subaru, Mazda will explore greener fueling options for internal combustion

Japan's top automaker believes technological breakthroughs, such as hydrogen engines, can give internal combustion a new lease on life — saving jobs as well as the environment.europe.autonews.com

Man I feel bad for Japan….

They really are gonna get rekt in the coming decades. Demographics, debt, dependence on ICE exports and a near total dependence on imports for resources…

Woke up this morning thinking about how this would be a good day.

Might have to head out for a walk as watching the ticker is not doing it for me today.

Might have to head out for a walk as watching the ticker is not doing it for me today.

Artful Dodger

"Neko no me"

Lower-BB was $969.48 at 10 a.m. ET:

2

22522

Guest

In the interest of letting others learn from my mistakes, rather than just crowing about successes. Purchased some shares at $1000.

This was based on the questions asked and answered on this forum.

Have no idea how it will turn out. Just a marker.

This was based on the questions asked and answered on this forum.

Have no idea how it will turn out. Just a marker.

MartinAustin

Active Member

Devil's advocate here... usually the internet commentary I read about Time Magazine POTY is "who cares?" / "TIME is irrelevant" / "TIME still magazine exists?" etc.. All of a sudden we are enthralled by their choice this year.

Picked up some more stock this morning at $990 and $992. Elon's stock sales will probably go down as the last significant buying opportunity that we could actually see coming.

Picked up some more stock this morning at $990 and $992. Elon's stock sales will probably go down as the last significant buying opportunity that we could actually see coming.

It will turn out wellIn the interest of letting others learn from my mistakes, rather than just crowing about successes. Purchased some shares at $1000.

This was based on the questions asked and answered on this forum.

Have no idea how it will turn out. Just a marker.

Mike Smith

Active Member

Barron's is out with an important piece this morning. An education on investing really.. and on life. See they studied 30 years of stock market and what they've uncovered is that after a stock goes up a lot, sometimes it goes down. Here's the full article so you can learn:

www.barrons.com

www.barrons.com

/s

Tesla Stock Could Be Primed for a Big Drop. Here's the Tell.

The bigger the premium a stock's price is to its long-term moving average, the more enthusiastic investors are about its upside prospects. But when expectations become too ebullient, a funny thing happens to its chart.

/s

The Accountant

Active Member

I've learned that it is virtually impossible to buy at the bottom or sell at the top; I am happy with a good entry point and a great exit point.In the interest of letting others learn from my mistakes, rather than just crowing about successes. Purchased some shares at $1000.

This was based on the questions asked and answered on this forum.

Have no idea how it will turn out. Just a marker.

IMO, you have a great entry point! If you're a Buy and HODL investor, you will be rewarded.

Hardly a limitation if you require less time charging before getting underway, especially when you can re-charge for FREE en-route.Not only that. I am pretty sure the Semi could keep itself under control with half the motors and battery knocked out. And from what we know, it probably has four independent systems of batteries and motors. This won't be an issue. There could be some instructions not to fully charge at the top of an unusually big grade, but that is about it. There are all kinds of required knowledge and rules with ICE class 8 trucks too, so this limitation (if it exists) is minor.

StarFoxisDown!

Well-Known Member

Now that we've broken the 50-day in a convincing fashion (barring some sort of miraculous turnaround like ya know buyers actually stepping in), to me it's clear the target is to drive it down to the 100 day moving average.

That's currently at $862/share. It moves up about $4-5 every trading day. By the end of the year it will be about $910/share. That's the target.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K