Lots of spoofing into the close. Large, capping orders being put in and pulled. As TSLA looked like it might run a bit towards $1,005, it started happening. There was an order that kept getting put in and pulled for 1,300 shares. It was very effective at capping the price below $1,004. Now someone just started also using an order to sell 2,000 shares.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

⚡️ELECTROMAN⚡️

Village Idiot

The two owners and founders of The Motley Fool are very bullish on TSLA and recommend buying TSLA shares. Not sure why they allow such lame articles to be published in their name.Company name (The Motley Fool) and web address (fool.com) checks out!

Pretty dumb article.Tesla's market cap is much too high relative to the opportunity set in front of it and its current financial profile.

Why Tesla Is the 1 Stock I'd Avoid in 2022 | The Motley Fool

The stock has been a big winner over the past five years, but expectations are too high for this company going forward.www.fool.com

What do you’all say? Typical skeptical reasoning?

Look at this little nugget

"You might ask: Won't capex decrease once Tesla is done expanding its business? This is not likely. Toyota (NYSE:TM), the largest car manufacturer in the world, spent almost $35 billion on capital expenditures over the last 12 months, and it is growing capacity at a much slower rate than Tesla. If Tesla starts delivering more than 10 million vehicles a year (as Toyota did in 2019), it will have a perpetual need for capital investment, which will limit the amount of true free cash flow available to pay out to shareholders."

LoL. I wonder why Toyota is spending so much on capital expenditures when they have no growth....

And, then, of course, the marcos into the close made it easy for "them."Lots of spoofing into the close. Large, capping orders being put in and pulled. As TSLA looked like it might run a bit towards $1,005, it started happening. There was an order that kept getting put in and pulled for 1,300 shares. It was very effective at capping the price below $1,004. Now someone just started also using an order to sell 2,000 shares.

Last edited:

mltv

Member

The accountant has a 70 PE for 2026 not 2022

StarFoxisDown!

Well-Known Member

Past 30 mins of trading has actually be GOOD for TSLA considering how it was trading verses the macro's for most of the day.Wow if this is the closing rally on the QQQ......no buying vol. All selling.

I'd rather the macro's crap themselves and TSLA only be down 3X the Nasdaq verses it being down like 10X of the Nasdaq that it was earlier. We need to get to peak fear before any of tech (including TSLA) can go meaningful higher. QQQ is only 1% away from correction (10%) territory. Nasdaq has now confirmed it's correction and S&P needs about another 4% to complete it's correction. It's a bummer TSLA couldn't hold 1,000 for close but if the S&P itself is going to complete a full correction, $1,000 before earnings wasn't going to hold anyways.

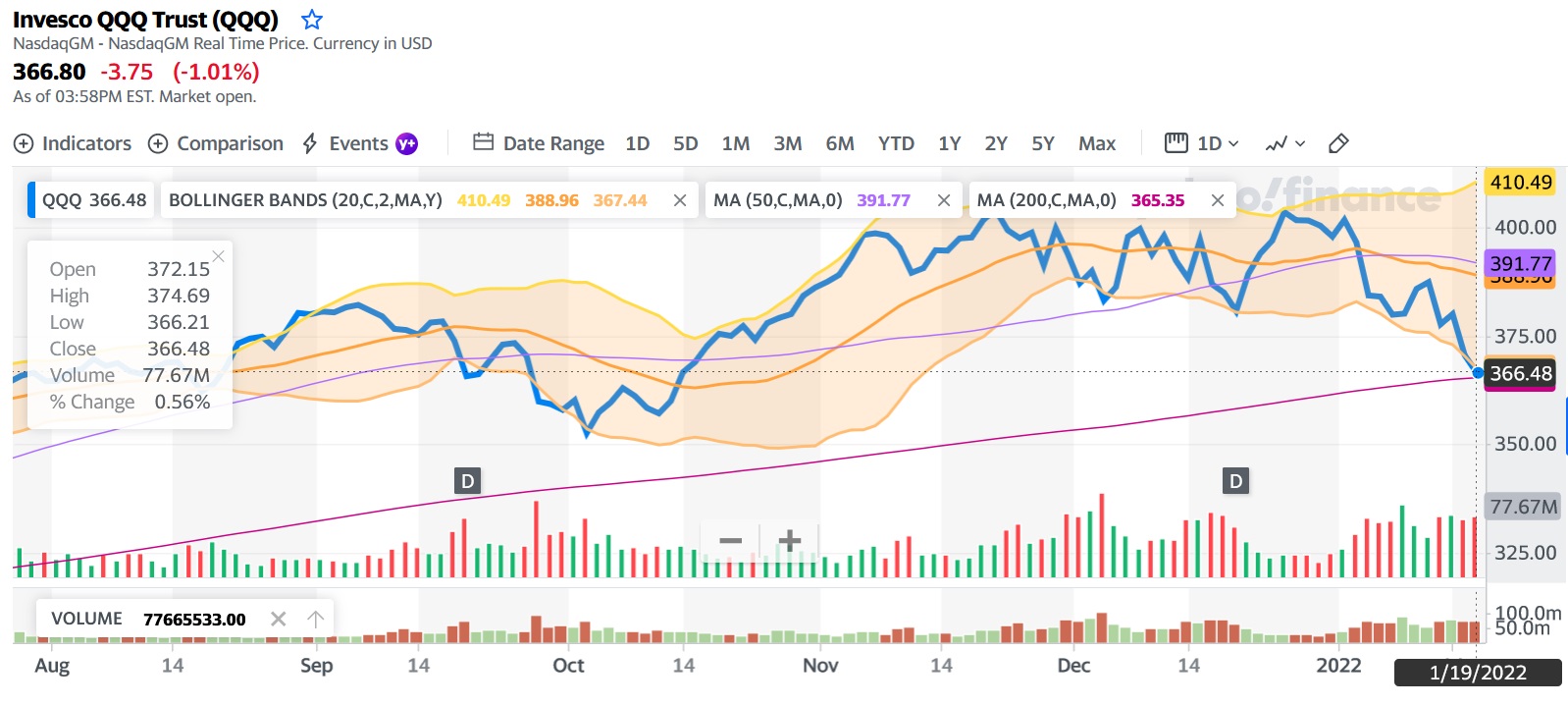

QQQ sitting right on the 200 DMA and lower BB. If no bounce tomorrow, look out below it is. One would think a churn would be due before another leg down, especially with recent economic reports looking shaky and 10yr holding steady today, but what do I know?

StarFoxisDown!

Well-Known Member

I think it's likely that it closes below 200 DMA for a day or two to complete the "correction" and then it bounces back and rides the 200 DMA until Fed meeting next week where a relief rally will occur.QQQ sitting right on the 200 DMA and lower BB. If no bounce tomorrow, look out below it is. One would think a churn would be due before another leg down, especially with recent economic reports looking shaky and 10yr holding steady today, but what do I know?

View attachment 757557

Buckminster

Well-Known Member

Nice article - Including:

UK Tesla user Petit Bateau wrote on the Motors Club forum. “The UK could benefit from a bit more love and attention.”

How Tesla's supercharger network is transforming for all EV owners | Autocar

UK Tesla user Petit Bateau wrote on the Motors Club forum. “The UK could benefit from a bit more love and attention.”

How Tesla's supercharger network is transforming for all EV owners | Autocar

The article incorrectly states that there are Belgian and German superchargers open to non-Tesla’s. So far, the 10 SUC sites open to the non-Tesla‘s are all in The Netherlands.Nice article - Including:

UK Tesla user Petit Bateau wrote on the Motors Club forum. “The UK could benefit from a bit more love and attention.”

How Tesla's supercharger network is transforming for all EV owners | Autocar

Yes indeed. The confusion is probably because only people living in The Netherlands, Germany and Belgium can access these Dutch 10 supercharger sites. If you're living out of these 3 countries and have a non-Tesla EV, you're out of luck on those 10 sites.The article incorrectly states that there are Belgian and German superchargers open to non-Tesla’s. So far, the 10 SUC sites open to the non-Tesla‘s are all in The Netherlands.

Buckminster

Well-Known Member

Hoping this will be the first and last time I'm not as bullish as most here. The shorts, MMs and hedgies remain formidable. Don't be surprised if they can hold us under 1200 for at least another quarter.

Skryll

Active Member

Sure would be nice if somebody knew something.

That's exactly what I've been asking for! A small motor on the trailer itself just to reduce range loss in the main vehicle. I can only hope it winds up being Tesla SC compatible. (or full on Tesla guts)Thor Industries AirStream eStream concept - saw it first on elektrec but figured y'all prefer the original video. This is exciting because it shows a model X and an airstream that supports it in forward motion with its own motor and battery as well as that it can park it self separately from the Model X. This is amazing if this actually works, and I wonder if Tesla had their hand in making this advanced tech working? Sounds like a game changer...

tivoboy

Active Member

Well, most won’t like it but we’ll see 9XX again and possibly 8XX by 1/31/21. Global macro and global geo-political are creating a bunch of near term uncertainty that isn’t going to spare really anyone or anything - other than GOLD (have you seen GOLD lately, it’s quite the tell and the reverse move in the 10-yr) There is a lot of fed auctions between now and then, and funding date for the last round is 1/31/21. For TSLA, many have noted that outside of truly upside earnings and production projections, most expectations are built in and price movement after P/D. and even earnings has tended to be DOWN in the post earnings window vs. further upside. So, I’m keeping the powder dry but reserve the right to start to add - but I haven’t done it yet.To those who are wondering what's going on lately, @tivoboy has warned about impending drop in stocks, and I sided with tivoboy on this. I was starting to get impatient with the predicted drop of TSLA into the $900's, but it finally did today. But it still hasn't dropped enough for me to really buy TSLA in chunks. Any changes to your prediction tivoboy? The options at $1000 is looking to be a big driver for TSLA stock to get drawn to.

Today, towards the close I DID take off half my QQQ puts from December, but will hold the remainder for the next two weeks most likely (feb expiry). Same with S&P puts at 4375 which I continue to hold. I’ll let all other calls written back in December for 1/21 and 1/28 just expire worthless. Like the 1200 TSLA 1/21 I wrote when I sold 4/5 of the position at 1210. If I hadn’t sold the calls then I’d be flat on the last tranche.

Starting to add RIVN to my ‘getting close’ stack we’re back at my entry price point on my monitor list, but I think we’ll see sub $60 there if we get another overall market push, at that point I’ll be a buyer.

As I said last week, things are getting pretty darn attractive for longer term positions, but we’re not there YET IMHO.

Government might be giving out free money to curb Climate change, passing parts of the BBB.

www.cnbc.com

www.cnbc.com

Biden says he thinks Congress can pass parts of broken-up Build Back Better plan

Biden said he believes Congress will support climate and early childhood education policies contained in his Build Back Better plan.

After 1/26 ER we’ll see 8XX by 1/31?Well, most won’t like it but we’ll see 9XX again and possibly 8XX by 1/31/21.

So you are saying ten to twenty percent down in the next seven trading sessions through earnings on 1/26?Well, most won’t like it but we’ll see 9XX again and possibly 8XX by 1/31/21. Global macro and global geo-political are creating a bunch of near term uncertainty that isn’t going to spare really anyone or anything - other than GOLD (have you seen GOLD lately, it’s quite the tell and the reverse move in the 10-yr) There is a lot of fed auctions between now and then, and funding date for the last round is 1/31/21. For TSLA, many have noted that outside of truly upside earnings and production projections, most expectations are built in and price movement after P/D. and even earnings has tended to be DOWN in the post earnings window vs. further upside. So, I’m keeping the powder dry but reserve the right to start to add - but I haven’t done it yet.

Today, towards the close I DID take off half my QQQ puts from December, but will hold the remainder for the next two weeks most likely (feb expiry). Same with S&P puts at 4375 which I continue to hold. I’ll let all other calls written back in December for 1/21 and 1/28 just expire worthless. Like the 1200 TSLA 1/21 I wrote when I sold 4/5 of the position at 1210. If I hadn’t sold the calls then I’d be flat on the last tranche.

Starting to add RIVN to my ‘getting close’ stack we’re back at my entry price point on my monitor list, but I think we’ll see sub $60 there if we get another overall market push, at that point I’ll be a buyer.

As I said last week, things are getting pretty darn attractive for longer term positions, but we’re not there YET IMHO.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K