Yes, at this point I care a less what the stock is doing, but the macros are on my monitorI'm taking today's share price over @The Accountants earnings projection for 2022. Just as an indicator of it's ridiculousness.

Edit: And apologies, I'm gonna endeavor to be more clear and detailed when talking out my a$$

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I’m not converting to LEAPS because of the taxes I would have to pay selling my main position. But if the stock trade sideways for 6 months, then I will surely buy some LEAPS with the extra cash I have on hand. Instead of building my core share position which I am happy with, my be building 2024 LEAPS positions if volatility drops.Every time I look at The Accountant's earning projections, I wonder why I'm not converting to LEAPs.

If we can drift all the way to Tuesday >$1050, it almost has to be done. On the extra throw-in value of a few cheap 1/28 & 3/18 YOLO's alone.

40% ITM Jan 2024 LEAPs, 50% ITM Jan 2023 LEAPs, 10% $1200c YOLO's.

No one has to guess anymore, it's just earnings and math.

Why start now?I'm taking today's share price over @The Accountants earnings projection for 2022. Just as an indicator of it's ridiculousness.

Edit: And apologies, I'm gonna endeavor to be more clear and detailed when talking out my a$$

You know what you need to do....start the machine!A macro power hour would be heavenly

It's dangerous at this point......the unleashing begins sometime next week.....I'm thinking WednesdayYou know what you need to do....start the machine!

Never too early to start but i guess keep it on the charger for now!It's dangerous at this point......the unleashing begins sometime next week.....I'm thinking Wednesday

I would but are you familiar with a "China syndrome" picture that once Gordo lowers his suspendersNever too early to start but i guess keep it on the charger for now!

Thank you @Papafox , your posts are so helpful: Papafox's Daily TSLA Trading Charts

How about a house painter that got rich thanks to Tesla stock!There is something so poetic (not quoting poetry) about the forklift drivers becoming millionaires working at Tesla.

It absolutely warms my heart knowing that all that choose to get into the drivers seat with TSLA can benefit and grow while changing the future.

Kudo's to your neighbors son and all the Tesla employees making it work!

bkp_duke

Well-Known Member

TSLA down 10X compared to NASDAQ (2.3% vs. 0.22%).

Nope, no manipulation here. Move along, nothing to see.

Nope, no manipulation here. Move along, nothing to see.

bkp_duke

Well-Known Member

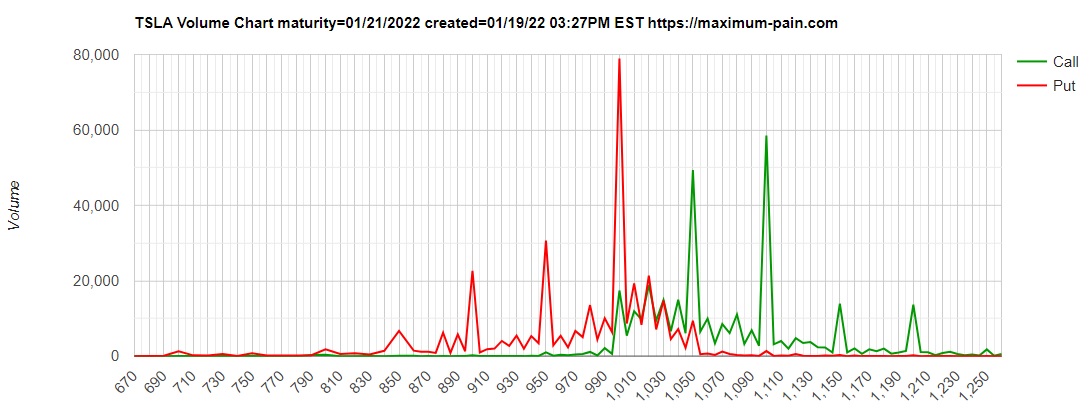

Looks like they want it to be between 1000 and 1050 for Friday.

Today's options volume so far:

Today's options volume so far:

The more I think about this, the more bullish I become as I lived in Austin when the Prius came to market. My engineering friends were all going into oil companies of some kind and they thought I was crazy to want a highly fuel efficient car (and yes, it wasn't the best looking car)...oh how times have changed!I have a neighbor who’s son started working at Tesla Fremont factory a few months ago (partly based on my advising him to apply) he drives a forklift on the M3 line and he loves it…he can’t shut up about how 2 of his colleagues (also forklift operators) are millionaires from their willingness to put half their paychecks into stock purchases.

He says that it’s the best job he’s ever had and that he rarely talks to anyone who isn’t “totally stoked” on the future of Tesla!

Bullish me thinks.

I just love imagining how your friend and most likely 1000's more who are working at Giga Texas will become millionaires by investing in an electric car company.

I wonder how much it would cost to rent a billboard by Giga Texas that said something like, "Buy $TSLA stock!" with a picture of the Cybertruck

Tesla's market cap is much too high relative to the opportunity set in front of it and its current financial profile.

Why Tesla Is the 1 Stock I'd Avoid in 2022 | The Motley Fool

The stock has been a big winner over the past five years, but expectations are too high for this company going forward.www.fool.com

What do you’all say? Typical skeptical reasoning?

Company name (The Motley Fool) and web address (fool.com) checks out!

He might be right for a while while macros suck, but he completely ignores the actual profit numbers and fantastic growth rates Tesla has shown and is continuing. And he assigns a 10 PE when this would only happen with essentially zero growth on a profitable company. Like Toyota. Do not know when Tesla hits zero growth. 2040?Tesla's market cap is much too high relative to the opportunity set in front of it and its current financial profile.

Why Tesla Is the 1 Stock I'd Avoid in 2022 | The Motley Fool

The stock has been a big winner over the past five years, but expectations are too high for this company going forward.www.fool.com

What do you’all say? Typical skeptical reasoning?

"Tesla, the biggest pure-play EV maker, is seeing just shy of 10% operating margins on $47 billion in revenue. ...the likelihood they will be much higher than 11% on average over the long term seems unlikely.

... automotive businesses require tons of capital expenditures relative to their sales just to stay afloat. For example, Toyota spent almost $35 billion on capital investments over the last 12 months. Given its profit margins, that makes it very difficult for the company to return excess cash to shareholders -- which is the only driver of shareholder value in the long run. This is why Toyota's stock historically trades at a price-to-earnings (P/E) ratio at or around 10. And EV stocks will have a similar fate due to this capital intensity."

Totally ignores the fact that Toyota revenue numbers have been topped out for years and recently have been shrinking:

- Toyota annual revenue for 2021 was $255.817B, a 7.1% decline from 2020.

- Toyota annual revenue for 2020 was $275.356B, a 1.22% increase from 2019.

- Toyota annual revenue for 2019 was $272.031B, a 2.88% increase from 2018.

As all auto OEMs have been. Except for one.

Not much else to say but 'we will see'.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M