ZeApelido

Active Member

I really love Joe @data_ev's to-the-point and witty remarks, making people who are spreading misinfo to 'stand corrected'.

I agree. He's a total stud!

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I really love Joe @data_ev's to-the-point and witty remarks, making people who are spreading misinfo to 'stand corrected'.

"...about to be..."It also used to take many years to build new automotive factories, yet Tesla can do it in 1-2 years repeatedly. What if Tesla starts it's own mines to address that long lead time? They are about to be very cash flush, is it unrealistic to think Tesla could get a mine up and running in half the time it "usually" takes?

Are we the Borg??Resistance is futile...

"...about to be..."

Well, we're an hour into today's market and have only traded 12 million shares.

Geez, this stock really needs to up its game.

Edit: 1:06 into the day and 13 million shares traded...

Resistance is feudal.Resistance is futile...

Will we then be immigrated?Resistance is feudal.

I hope when Elon said 20M in 10 years, he’s referring back to his earlier reference from 2020.As has been mentioned before, Elon states teslas growth rate is 70-80% a year and may be even faster than that in the future.

My current guesstimates target tesla's previous stated goal of 20M vehicles produced annually by 2030, but we may soon discover our models will need to be revised up.

As a reference point I guessed at tesla's annual production and growth rate using a flat quarterly growth rate each year. I lowered the quarterly growth rate arbitrarily each year to get close to the 20m vehicles produced by 2030:

(2021's quarter to quarter growth rate shown is q3 to q4. However q1 had a growth rate of just over 14%)

annualized (in thousands) annualized growth rate quarter to quarter growth rate 2021 929 28% 2022 1,711 84% 14% 2023 2,890 69% 14% 2024 4,881 69% 14% 2025 7,682 57% 11% 2026 10,856 41% 8% 2027 13,735 27% 5% 2028 15,896 16% 3% 2029 17,891 13% 3% 2030 20,137 13% 3% 2031 22,111 10% 2% 2032 23,934 8% 2% 2033 25,907 8% 2% 2034 28,043 8% 2% 2035 30,354 8% 2%

An article that I read today said that Tesla’s market cap exceeds the Market cap of all of the companies combined, in the Russian stock index.TSLA's valuation is back over $1 T!

Of note, while TSLA is still down 20% from its all-time high ("ATH"), META (-46%), Rivian (-74%) and BYD (-88%) are down way more off their ATHs. The average of all those listed below is still -35% off their ATHs.

TSLA ($1.03 T) still worth more than the valuation of all major US, EU, and Japanese auto manufacturers combined ($840 B). All those investors complaining about SP manipulation? Methinks thou dost protest too much. Patience

One other take-away, since Oct. 2016:

View attachment 784570

- EU manufacturers' valuation combined has grown only 20%

- Japanese manufacturers combined have grown 25%

- US manufacturer combined have grown 70%

- Tesla's valuation has grown 2715% since Oct. 2016

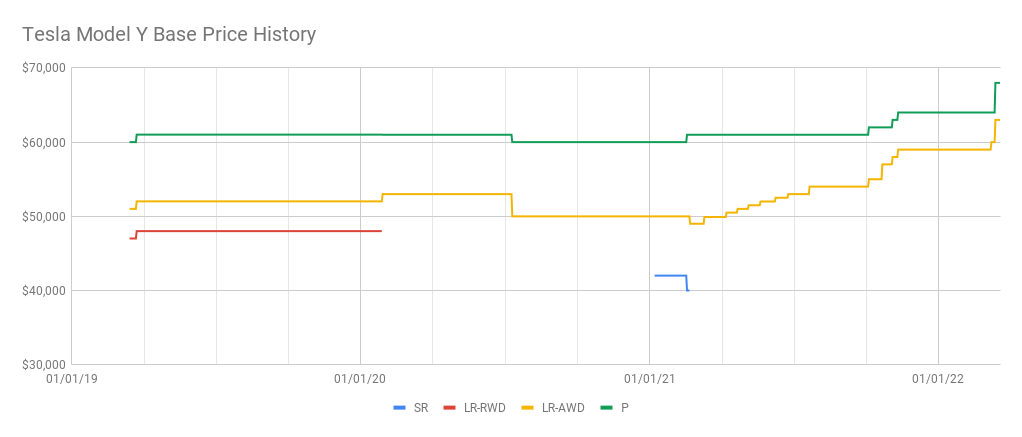

Demand is crazy high, I'm continually surprised at the price hikes not even putting a dent in the demand.Small data point - We bought our Model Y in February 2021 for $51,990, today that car on the same configuration is $64,990. We have a LR Model X on order from a year or so ago, and are expecting to use the Model Y as trade-in. Every month, the trade-in value 'expires' and I have to input the mileage for them to revalue the trade-in (you would think they could just pull the data if I authorized them to to that, anyways...).

Every month or so when I do this the re-valued trade has crept up a few hundred dollars, so that when I last updated in late-January the trade in was something like $53,500.

Yesterday it came in at $58,900. Almost $7,000 more than when new, a 13% increase. This is for a 13-month old car with 7,000 miles on it.

Almost a coin toss if I should have sold TSLA to buy appreciating Teslas!

This must have something to do with investing in TSLA, so shared here...

Way better thanks. TD is worthless for anything realtime. My screen still says TSLA in the 900's and I rebooted the App.Your volume quotes are 15-min delayed. Try CNBC or Yahoo! for near realtime volume quotes.

Calling @Curt Renz, calling @Curt Renz. All systems a go. Dust of the baton and put the Band on standby.So ATH is the resistance

Could the frequent price hikes initially trigger higher demand because of FOMO?Demand is crazy high, I'm continually surprised at the price hikes not even putting a dent in the demand