Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

Pro tip: Set your buy order for 421 - could execute before it rebounds above the buy-wall at 420.69

Lol, and hey! they still have that gap to fill at $51.23 from Oct 23, 2019. Isn't that some weirdo analyst's price target?

/SSS

Last edited:

Artful Dodger

"Neko no me"

PPI report coming out this morning… it will be another interesting day in the market

U.S. Economic Calendar - MarketWatch

| Time (ET) | Report | Period | Actual | Median Forecast | Previous |

|---|

| THURSDAY, MAY 12 | |||||

| 8:30 am | Initial jobless claims | May 7 | 194,000 | 200,000 | |

| 8:30 am | Continuing jobless claims | April 30 | -- | 1.38 million | |

| 8:30 am | Producer price index (final demand) | April | 0.5% | 1.4% |

Last edited:

juanmedina

Active Member

Artful Dodger

"Neko no me"

Lol, the 'new normal' is competitors sales cratering, then blaming it on 'chips'...

Nissan warns of flat profit as chip shortage becomes 'new normal'

/cloudfront-us-east-2.images.arcpublishing.com/reuters/TFKHVHGUARPF7MXDACHBTNFTY4.jpg)

www.reuters.com

www.reuters.com

Nissan warns of flat profit as chip shortage becomes 'new normal'

/cloudfront-us-east-2.images.arcpublishing.com/reuters/TFKHVHGUARPF7MXDACHBTNFTY4.jpg)

Nissan warns of flat profit as chip shortage becomes 'new normal'

Nissan Motor Co expects flat operating profit this fiscal year, far below analysts' expectations, as Japan's third-biggest carmaker grapples with a global chip shortage, rising material costs and China's COVID restrictions.

StarFoxisDown!

Well-Known Member

TSLA continuing to be extremely weak against its beta. Down more than 3X it’s beta yet again today. Stock is absolutely being targeted at this point.

jkirkwood001

Active Member

My best guess is that bad Q2 P&D numbers are starting to show. Some buyers are delaying their purchases, some traders shorting until the delivery numbers. If this is true, we might see some relief right after the numbers even if they suck.TSLA continuing to be extremely weak against its beta. Down more than 3X it’s beta yet again today. Stock is absolutely being targeted at this point.

ZeApelido

Active Member

I'm relaxed, just having some coffee this morning.

The Accountant

Active Member

Core PPI (month over month) came in lower than forecast but no reaction from the Market.

0.4% - Core PPI Actual

0.6% - Core PPI Forecast

0.5% - PPI Actual

0.5% - PPI Forecast

0.4% - Core PPI Actual

0.6% - Core PPI Forecast

0.5% - PPI Actual

0.5% - PPI Forecast

JRP3

Hyperactive Member

Desire for exposure on Twitter may override that and he can always blame other people for the DWAC failure.There is a 90%+ chance IMHO that Trump has a exclusivity deal with his dumpster fire DWAC/Truth app, and even if he doesn’t going back on Twitter is basically admitting Truth is done and his ego wouldn’t allow that.

I’ll take no reaction over irrational plunge right nowCore PPI (month over month) came in lower than forecast but no reaction from the Market.

0.4% - Core PPI Actual

0.6% - Core PPI Forecast

0.5% - PPI Actual

0.5% - PPI Forecast

JayNT

Member

If this continues a split won’t be necessary to make the stock more attractive to new investors.

So glad it's not just a TSLA thing ...

back in 2013-1016 ... dumps like this used to be just a TSLA thing ....

more shuffling in my personal account(final account) ... whole market is cheap ... might has well take some losses on TSLA calls and buy shares/calls in other names ....

back in 2013-1016 ... dumps like this used to be just a TSLA thing ....

more shuffling in my personal account(final account) ... whole market is cheap ... might has well take some losses on TSLA calls and buy shares/calls in other names ....

That's like the worst best guess I have seen when Elon just 2 days ago said the biggest complaint is that Tesla is not making cars fast enough, making people angry that their wait time is extended.My best guess is that bad Q2 P&D numbers are starting to show. Some buyers are delaying their purchases, some traders shorting until the delivery numbers. If this is true, we might see some relief right after the numbers even if they suck.

Yes, you raise a good point, and I will roll them out much further if the SP does not recover by the end of summer.I've no objection at all to you leveraging into LEAPs on a big dip.... I've got a little bit of one regarding doing it with less than a full year of time though.... Jan and Jun 2024 LEAPs are available, and average bear market is a little under 10 months. And especially when buying DITM LEAPs the time cost is pretty low to go out a bit further for safety.

I am hoping that the split will happen in August-Sept time-frame and that will cause enough rally to recover above 1100.

If that happens I plan to sell a portion of the LEAPs and use the money to exercise the rest, converting back to shares, hopefully to more shares than I had before this leveraging move. On the other hand if we are still in the ditch in September, then I roll out as far as I can and do the back conversion later.

ZachF

Active Member

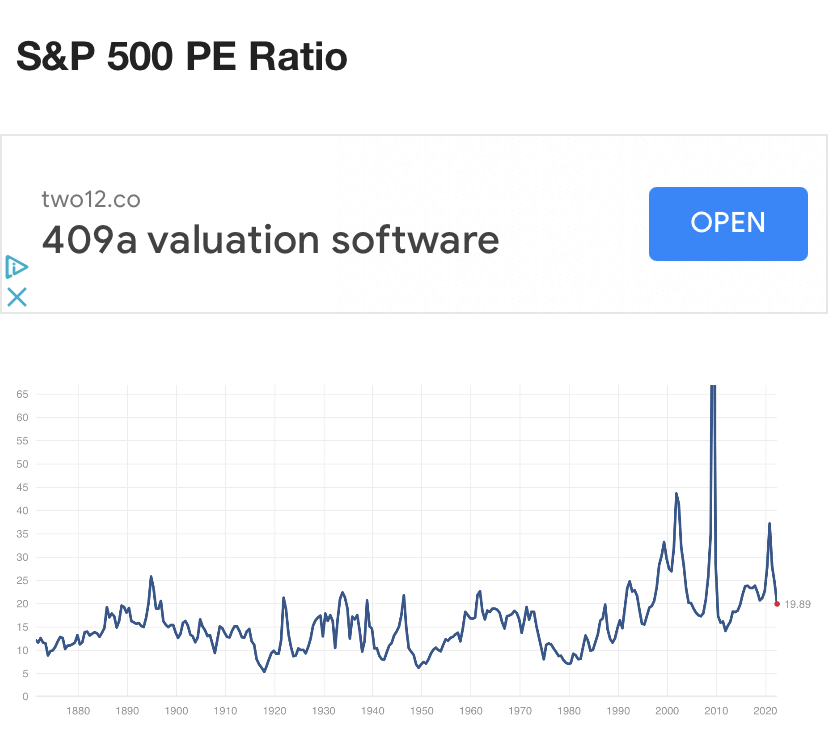

S&P 500 P/E ratio under 20, lowest since ~2014:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K