Artful Dodger

"Neko no me"

Check out TSLA's volume in the Pre-market: (over 1.8M shares now at 08:59)

This page refreshes every 30 seconds.

Data last updated May 12, 2022 08:51 AM ET.

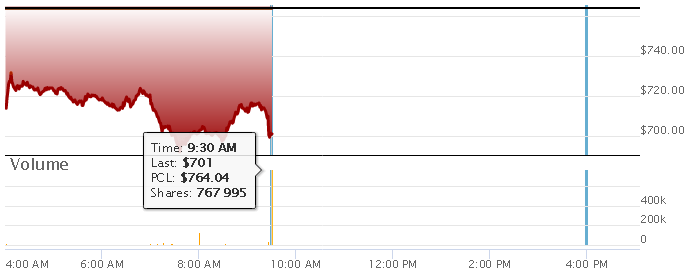

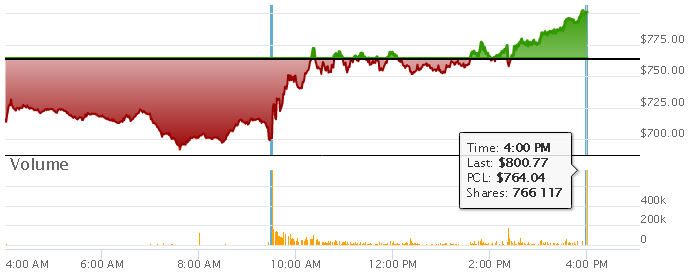

The chart below is NOT from today's pre-market session. It's the NASDAQ realtime chart from the last time we hit $700 (Feb 24, 2022)

TL;dr relax, everything will be fine in the long run. And that's the proper way to play TSLA.

Cheers to the Longs!

TSLA Pre-Market Quotes Live

This page refreshes every 30 seconds.

Data last updated May 12, 2022 08:51 AM ET.

| Consolidated Last Sale | $700.8 -33.2 (-4.52%) |

|---|---|

| Pre-Market Volume | 1,698,011 |

| Pre-Market High | $731.59 (04:00:00 AM) |

| Pre-Market Low | $697.14 (08:40:03 AM) |

The chart below is NOT from today's pre-market session. It's the NASDAQ realtime chart from the last time we hit $700 (Feb 24, 2022)

TL;dr relax, everything will be fine in the long run. And that's the proper way to play TSLA.

Cheers to the Longs!