You are overlooking the social unrest that is coming in the petro-states (ROPEC) and their client-states (primarily but not exclusively the Arab League).

Just using simple numbers for illustration, Saudi Arabia (KSA) may have an average oil production cost of (say) $20/bbl, but it takes approx $80/bbl for KSA to balance its budget. A very large part of that budget is spent on social subsidies (i.e. bribery to stop the peasants revolting) and a fair chunk goes on military, and another substantial chunk goes on keeping the client states (such as Egypt) from collapsing. So when KSA pushed oil price down to $45/bbl to bankrut the US fraccers (and burn Wall St enough to never try bankrolling the fraccers again) that was a decision to run down the sovereign wealth fund (SWF) to bridge the gap.

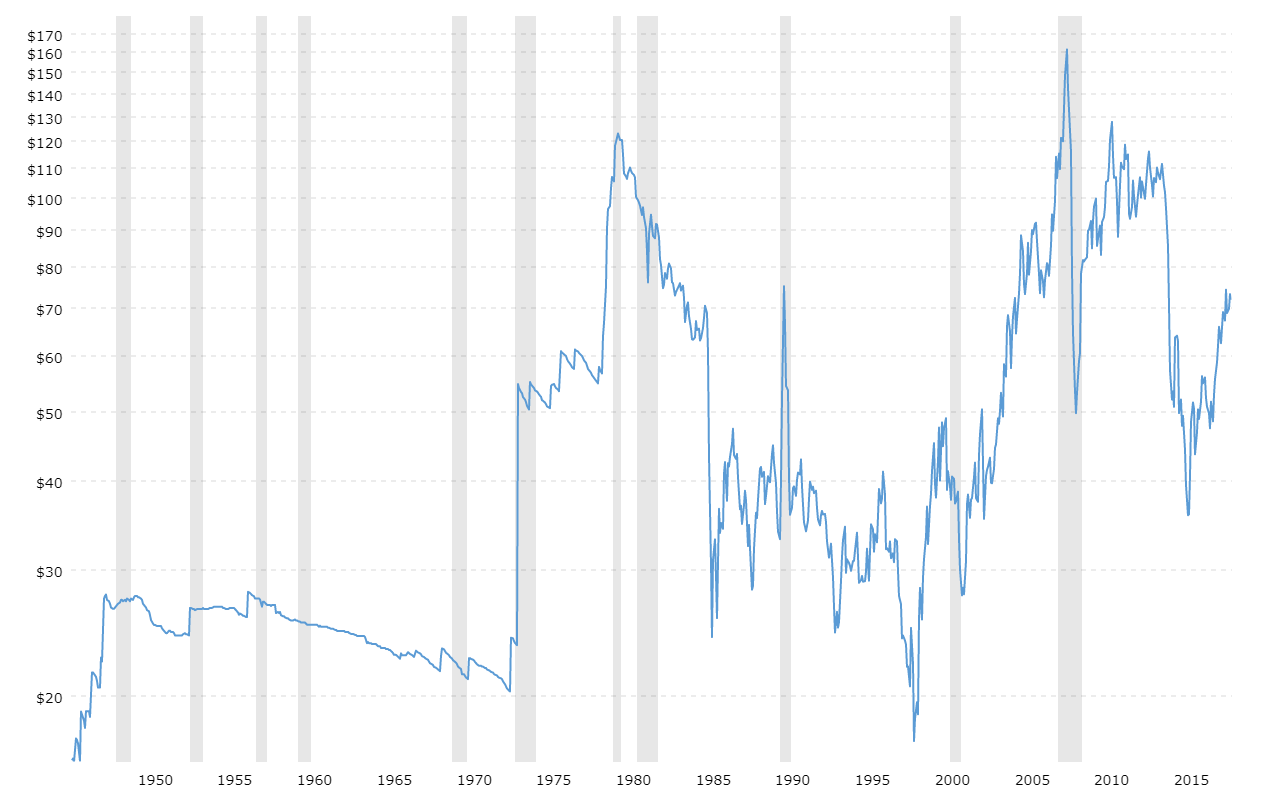

Interactive charts of West Texas Intermediate (WTI or NYMEX) crude oil prices per barrel back to 1946. The price of oil shown is adjusted for inflation using the headline CPI and is shown by default on a logarithmic scale. The current month is updated on an hourly basis with today's latest value.

www.macrotrends.net

An analyst says that as many as one third of hydraulic-fracturing companies could face extinction.

fortune.com

But in the coming world, when renewables are the dominant energy source, the tipping point comes quite quickly for the fossil fuel prices. This is a forecast I ran in early 2019

View attachment 811733

The point to note is that total annual build of new fossil-fuel (for increasing demand) + replacement of declining field output (that has to also be built, and is an issue in coal as well as oil & gas was about 816 mtoe in 2018*. So by the early 2030s the implication is that the renewables build rate is such that not a single $ would be spent on drilling another oil or gas well, or digging another coal mine. Clearly along that path there will be periods - because it will be episodic - that fossil fuel prices will spike downwards, and others when they will spike upwards (like now) but by c. 2032 there will be almost no pricing power left in fossils. That point happens to be just before the timing of the peak build-out rate for renewables in 2035.

That in turn is going to collapse the economies of (especially) the petro-states and their client-states, plus the coal-states. Yes, they too may be able to make the transfer to renewables thereby accelerating their own demise, but they will not have anywhere near as great a rentier profit stream from renewables as from oil & gas. At $120/bbl the Saudis are rebuilding their SWF quite quickly - they are in fact banking not $ 120-20=100/bbl into the SWF, but $120 - $80 = $40/bbl into rebuilding the SWF. But as soon as renewables push the oil price much below $80 then it is only a matter of time.

And in the long term there is nothing that KSA can do that will make their sunshine worth $80/bbl. Yes, they might be able to do things that are worth $40/bbl equivalent (and something at about that point might be where the medium-term price settles at as the Western nations do the fastest-switch to renewables), but that $40 ain't going to stop the peasants in Saudi from revolting. And there is no significant extra value in Saudi sunshine vs (say) New Mexico sunshine or (say) Spanish sunshine. Whether in Saudi or Kuwait, or Russia, or their client states such as Egypt, Syria, there is going to come a time that makes the Arab Spring look like a kindergarten warm-up act. I reckong the ruling class have about 10-years left to finalise their exit plans.

Any industrialised nations that are laggards in making this switch are also going to be very vulnerable, but that is a different point arising from the same underlying analysis. In a way we are witnessing that right now with the squealing coming from Orban in Hungary where access to cheap (Russian) oil was what has kept him in power all this time. Come the day when the competitor nations have all switched to (by then) cheaper renewables, the laggard industrial nations still running on fossils will hurt badly. China can see this coming and are moving fast, India on the other hand might struggle to ever get properly established on the development ladder; indeed India will likely be counting its blessings if it can encounter the middle income trap.

===

Footnote: This forcast is mine, the source data for the analysis is

View attachment 811734

* strictly speaking I included nuclear in the 816 mtoe