When I am 88, I want FSD to drive me to casino so I can play the slot machineAnd more FUD; news says Ralph Nader wants fsd banned. Ralph is 88 years old and may still use a land line. Powers that be will say anything and use anyone to smear or slow Tesla. I wonder if Ralph has been snookered.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

StarFoxisDown!

Well-Known Member

I'm very aware of the P/E compression for TSLA for the past 2 years........your chart is kinda proving my point.The P/E Ratio has slowly been climbing again in Q3 which is encouraging, but the overall slope over the past year has been declining. I expect that a trailing P/E ratio of between 70-90 for the coming few quarters until the next Big Thing.

View attachment 839835

Even with a market crash and a terrible quarter because of factors outside of Tesla's control, at it's low, TSLA's TTM P/E bottomed in the 80's. Wall St essentially said that's the floor for Tesla's metrics/valuation. It's trended higher ever since. The stock can move higher after Q3's earnings significantly and still stay above the TTM P/E metric of 80.

While I'm bearish on the stock action for the next two months, it's mainly towards any upside potential. I don't see a breakout until Q3's number are out at the earliest. But I do think there's too many series of catalysts/data out for the next two months to really drive TSLA significantly lower. The stock split covers the next two weeks and then it'll be about another 2 weeks before we get Aug CPCA number which will end the FUD narrative about Shanghai.Don't hate me, but for personal, selfish reasons I hope they hit TSLA hard in the next week or so. I want to buy up more-would have a couple months ago but no dry powder and all my other holdings were gutted horribly. They have made somewhat of a comeback, to the point I can stomach selling and locking in some modest losses to free cash up for more TSLA. If they succeed in pushing SP down, I can't see it holding-too many positive things on the short term horizon.

1) AI day

2) Record production numbers for July-expect to see even more in AU

3) Q3 production and earnings reports

4) The new EV credit bill, which looks like it will be more positive for Tesla than any other company

5) New FSD release coming

7) Hopefully a prototype Teslabot

8) Semi

9) Investment rating upgrade

I have trouble seeing the FUD-Packers holding it down for any length of time.

Last edited:

why wait till 88....you play the casino every day in the stock marketWhen I am 88, I want FSD to drive me to casino so I can play the slot machine

Yep. We were spending $600+ per month during the summer in San Jose, which doesn't get as hot as many parts of LA. This is before we had EVs. We put solar on our roof, and now we pay $10 per month year round (mostly minimum connection charges) while charging two Teslas daily.Dang, I didn't realize it was that much anywhere! .089 +~.024 "adjustment here so ~$0.115. Can't imagine what AC costs must be in the summer. I can see why home solar is so popular.

I despise PG&E more than I despise oil companies.

I can guarantee the SP will be held down to an unconscionably low level at least through January.Don't hate me, but for personal, selfish reasons I hope they hit TSLA hard in the next week or so. I want to buy up more-would have a couple months ago but no dry powder and all my other holdings were gutted horribly. They have made somewhat of a comeback, to the point I can stomach selling and locking in some modest losses to free cash up for more TSLA. If they succeed in pushing SP down, I can't see it holding-too many positive things on the short term horizon.

1) AI day

2) Record production numbers for July-expect to see even more in AU

3) Q3 production and earnings reports

4) The new EV credit bill, which looks like it will be more positive for Tesla than any other company

5) New FSD release coming

7) Hopefully a prototype Teslabot

8) Semi

9) Investment rating upgrade

I have trouble seeing the FUD-Packers holding it down for any length of time.

Wanna know how I know? Because I'm long January 2023 Call Leaps.

Thekiwi

Active Member

The P/E Ratio has slowly been climbing again in Q3 which is encouraging, but the overall slope over the past year has been declining. I expect that a trailing P/E ratio of between 70-90 for the coming few quarters until the next Big Thing.

View attachment 839835

When it comes to PE/growth ratios, Investors have to factor in the terminal growth rate for Tesla, once the company has scaled to 20 million cars annually. Yes, Elon has said that he thinks 50% annual growth (on average) will be possible to get to 20 million vehicles in ~2030, but he has also made fun of ridiculous long term growth assumptions that end up bigger than the known universe - acknowledging that eventually there is an end to fast paced growth.

When it comes to vehicles, It is entirely reasonable to model growth slowing as we approach 2030, and after that date reducing to growth below 20%, which would still be an extremely high volume increase of up to 4 million additional units in 2031 if 2030 is 20 million units, probably better to use a terminal rate closer to 10% post 2030.

Tesla‘s mission to 20 million cars probably looks like an S curve - and while at 50% growth we are in the steep ascent on that curve, but as we approach 20 million it flattens out, along with the growth rate - and so does its forward expected growth multiple valuation.

Tesla Energy will follow a similar trajectory - but with lower product margins as its more of a commodity product lines (others disagree probably).

Now if you are a believer in RoboTaxis & Optimus/AI and other future non-vehicle tesla product lines conquering the world - then you dont care about a terminal growth rate for vehicles and energy post 2030, because you think that profits from those alternative product lines will continue to drive high tesla growth rates for many decades to come (I actually am closer to this way of thinking, especially on Optimus).

But currently to Wall Street and vast majority of institutional investors TESLA = CARS, and their valuation models are mostly based on that. They wont start including Energy or Services properly until it starts generating significant profits past the current rounding error size, and it definitely wont start including Optimus/Robotaxi in valuation models etc until they are shipping products.

At present most institutional valuations are assuming tesla growth rate slows significantly by the end of this decade, and that tesla gets nowhere near 20 million annual vehicle run rate. The current PE ratio reflects that.

StarFoxisDown!

Well-Known Member

I don't think anyone here is ignoring terminal growth rate. It's the consensus expectations that the larger Tesla grows revenue, the smaller the % of growth. So far Tesla has been defying that logic. It's CARG rate for a company already posting billions of dollars of revenue has wildly exceeded anything Amazon, Apple, or any other company with that base scale of revenue ever did.When it comes to PE/growth ratios, Investors have to factor in the terminal growth rate for Tesla, once the company has scaled to 20 million cars annually. Yes, Elon has said that he thinks 50% annual growth (on average) will be possible to get to 20 million vehicles in ~2030, but he has also made fun of ridiculous long term growth assumptions that end up bigger than the known universe - acknowledging that eventually there is an end to fast paced growth.

When it comes to vehicles, It is entirely reasonable to model growth slowing as we approach 2030, and after that date reducing to growth below 20%, which would still be an extremely high volume increase of up to 4 million additional units in 2031 if 2030 is 20 million units, probably better to use a terminal rate closer to 10% post 2030.

Tesla‘s mission to 20 million cars probably looks like an S curve - and while at 50% growth we are in the steep ascent on that curve, but as we approach 20 million it flattens out, along with the growth rate - and so does its forward expected growth multiple valuation.

Tesla Energy will follow a similar trajectory - but with lower product margins as its more of a commodity product lines (others disagree probably).

Now if you are a believer in RoboTaxis & Optimus/AI and other future non-vehicle tesla product lines conquering the world - then you dont care about a terminal growth rate for vehicles and energy post 2030, because you think that profits from those alternative product lines will continue to drive high tesla growth rates for many decades to come (I actually am closer to this way of thinking, especially on Optimus).

But currently to Wall Street and vast majority of institutional investors TESLA = CARS, and their valuation models are mostly based on that. They wont start including Energy or Services properly until it starts generating significant profits past the current rounding error size, and it definitely wont start including Optimus/Robotaxi in valuation models etc until they are shipping products.

At present most institutional valuations are assuming tesla growth rate slows significantly by the end of this decade, and that tesla gets nowhere near 20 million annual vehicle run rate. The current PE ratio reflects that.

But even factoring in terminal growth naturally slowing, the valuation today is laughably low. And that's factoring in no Robotaxi or Optimus. Just cars and energy, which is a viable thing to factor in since the limiting factor has always been supply. Once the supply is there, there's nothing holding that business from being the same scale as the auto business. Margins are debatable. Energy is easier to produce with none of the baggage cars have with them. It also requires less humans per dollar of revenue through the entire process of manufacturing, sales, and logistics to location of delivery,

Another thing to point out is that while Tesla car sales/production is in the steep curve of the S curve, the operational leverage and efficiencies trail by about a year. We saw this in action in 2021 with Shanghai. The earnings/profits continually keep growing exponentially faster than revenues/sales. This trend will continue.

I don't have some outrageous PT of Tesla having a market cap of 10 trillion by 2030. Even when I factor in for terminal growth and P/E compression to account for that, the valuation for Tesla is detached. And will be majorly detached after Q3's earnings. Tesla's forward P/E would be at levels that it shouldn't be at until 2024/2025.

Last edited:

Doesn't seem to bother the oil company executives any.I agree, it would be very unlikely for charges to actually be filed. The point is it wouldn't be a good look. Knowing you were responsible for thousands of deaths would go far beyond embarrassing.

Then consider reduced windshield replacement due to Tesla glass, vs 1 or 2 annual replacements. The reduced jackknife accidents and wind driven loss of control…The 10% number I threw out was admittedly a wild guess and seems absurdly conservative to me. Thinking about the value the semi platform will deliver, I expect that sales will only be limited by the ability of Tesla to scale cells as early estimates guess this to be a HUGE number of cells. 500 miles of range with an efficiency of 2kWh/mile is 1000 kWh or 1 mWh of cells.

Even without any caravanning, FSD this seems should an excellent choice.The only negative is time supercharging vs diesel refueling. Longer range would help with that. Still the vast majority of us semi use is for <250 mike trips IIRC

Thanks for the excellent post.Tesla Energy will follow a similar trajectory - but with lower product margins as its more of a commodity product lines (others disagree probably).

When you said "others disagree probably", I suspect you were referring to "lower product margins". I don't disagree.

What I might disagree with is the first part of the sentence. I don't expect Tesla Energy to follow a similar trajectory to Tesla Autos.

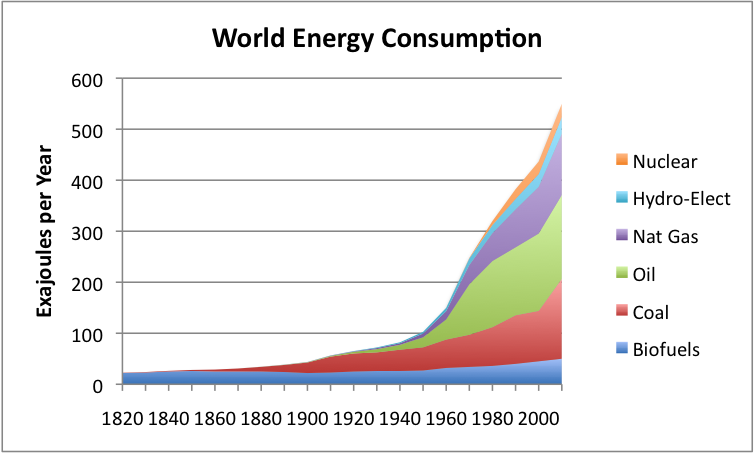

Where demand for EVs might level off in 10 to 15 years, I don't see that happening for energy storage. I expect that demand for energy storage will follow a trajectory that is more similar to energy consumption. Overall, it stays very steep for a very long time.

The only question is, how much of the storage market will Tesla command? Will it be a large chunk of a growing market like oil or will it be a tiny sliver like nuclear?

Last edited:

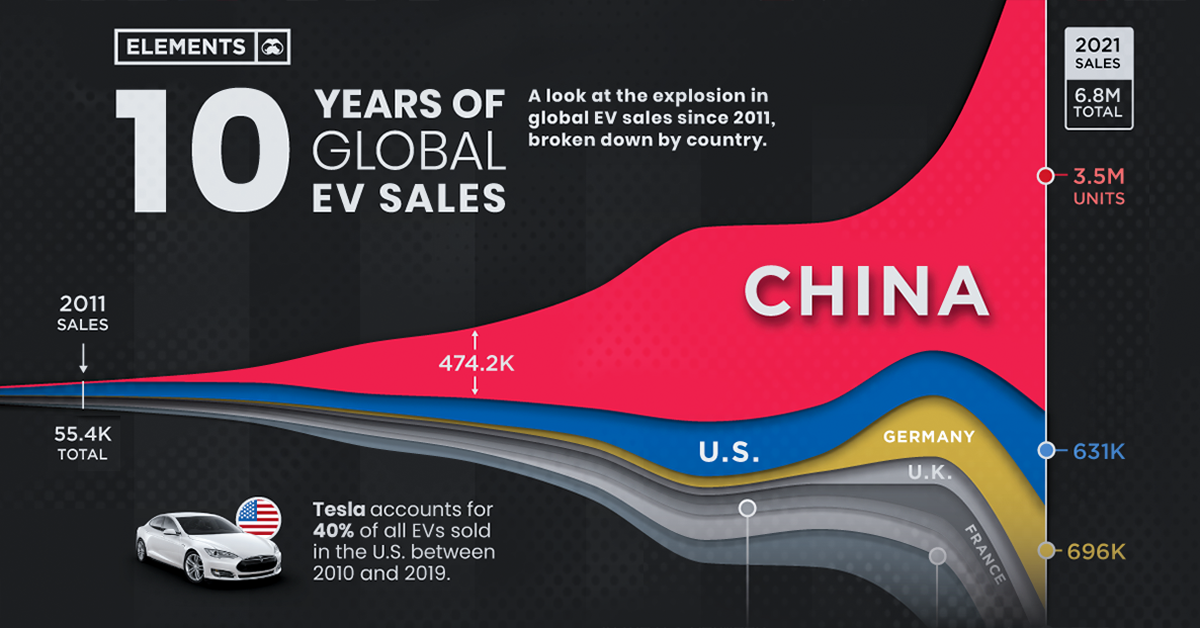

Another powerful message from The Visual Capitalist web site:

August 8, 2022

www.visualcapitalist.com

www.visualcapitalist.com

August 8, 2022

Visualizing 10 Years of Global EV Sales by Country

Global EV sales have grown exponentially, more than doubling in 2021 to 6.8 million units. Here's a look at EV sales by country since 2011.

www.visualcapitalist.com

www.visualcapitalist.com

Artful Dodger

"Neko no me"

If I wasn't currently extremely strapped for cash I'd probably reserve one myself. 150k* - 40k EV credit = 110k for a semi that will probably have 600+ miles of range without any load and can tow whatever I want? That's less than a plaid.

Without knowing the details. I'd say its more likely that the new heavy truck EV credit helped prompt Elon to move Semi production forward. So I'd think Telsa will get $180K* + $40K.

BTW Elon specified the 500 Mile Range Semi would go into production in 2022, that's the $180K version. The $150K version was the 300 Mile Range Semi.

Artful Dodger

"Neko no me"

How is Joe not blocked yet from all those clowns?

If you block the owner of the 'Lackey block list b4 u tweet, that staves off the inevitable....

Cheers to the longs!

S

Sofie

Guest

You bring up a good point. I realize we are in a better place now than when most of you all started investing. Thankfully I’m really not very much in the red actually.( I bought the majority of my holdings in the 200$s), so that’s good. The ups and downs with the market are not Tesla specific either, and I recognize that.People freak out if they are under from a year ago. Try going all in, holding for about 4 years only to be in the red > 40% in 2019 and all these newcomers get in at a lower price than I did. Annoying as fk. But I held, continued to buy and it paid off.

This handful of months in the red for some is nothing. At least this time around there is no threat of bankruptcy. And talk about FUD from the media saying Tesla was dooooomed. Now that was certainly more stressful than this time around.

Thank you and @capster for your encouragement.

damonbrodie

Member

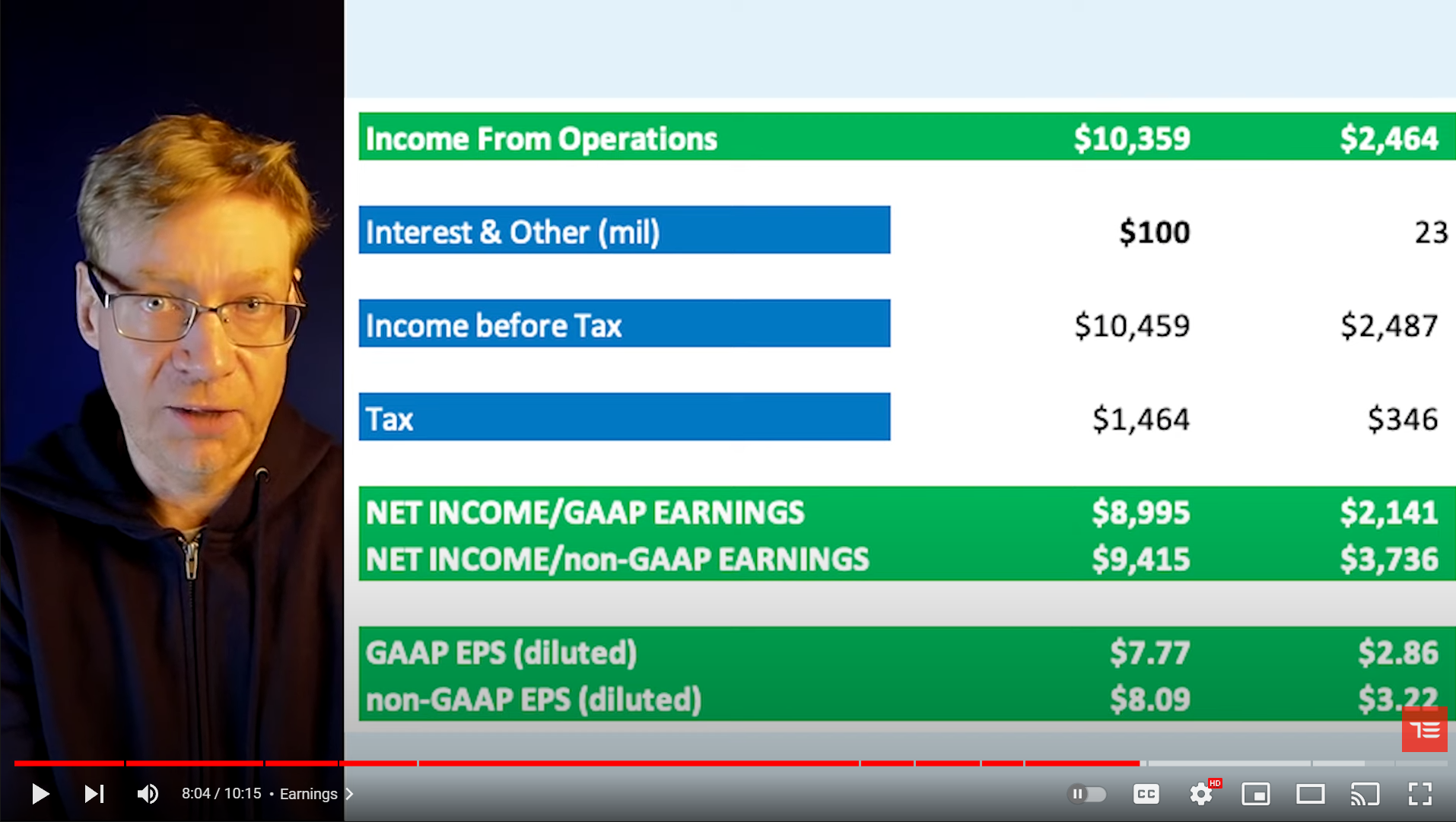

TeslaEconomist's latest video has non-GAAP EPS (diluted) at $8.09 for Q4 which is a lot higher than I've seen in other models. What do people think of this estimate?

The Accountant

Active Member

Record Q3 Production Incoming. . . Fremont Continues to Impress.

At 3:10 mark, you will see 22 trailers at the logistics lot. I have never seen that many at one time; I think 15 was the highest I have seen in the past.

At the 11:15 mark, very clear footage of the casting equipment in operation showing 110 seconds per cycle.

At 3:10 mark, you will see 22 trailers at the logistics lot. I have never seen that many at one time; I think 15 was the highest I have seen in the past.

At the 11:15 mark, very clear footage of the casting equipment in operation showing 110 seconds per cycle.

Artful Dodger

"Neko no me"

Do you think we could get Gordon Johnson to stand still for that long?

Nuttin' u couldn't fix with a Hilti gun.

Artful Dodger

"Neko no me"

Can anyone explain why macros have been overall so muted to the CPI/PPI reports put out the last two days? Yes, they advanced yesterday, but seem to be retreating today despite more good news.

Profit-taking.

MC3OZ

Active Member

Storage is a crowded field with lots of competitors.The only question is, how much of the storage market will Tesla command? Will it be a large chunk of a growing market like oil or will it be a tiny sliver like nuclear?

But as with cars, having volume production at a reasonable price, when customers want it is all important. Timing is everything.

Also most of the competition doesn't scale well below 1 MWh, at domestic / light industrial scale, the best solution is batteries.

And even large grid sites with another type of funky storage, will probably want to have a small amount of batteries.

IMO the 100 year chemistry Jeff Dahn is researching is potentially big for energy storage, extra cycles for little additional cost, is something customers will find attractive.

Ultimately I can't see why most free standing houses, factories, shops and workshops will not have a battery, at grid scale, batteries might be 10-30% of gird storage, perhaps more.

It is all about having the right product, at the right price, at the right time. As with EVs energy storage batteries will reach a market saturation point at some stage. But the world is a big place, with a lot of demand for energy storage.

When we can say safely is, it is likely current Tesla energy sales are a small percentage of peak sales.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K