Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

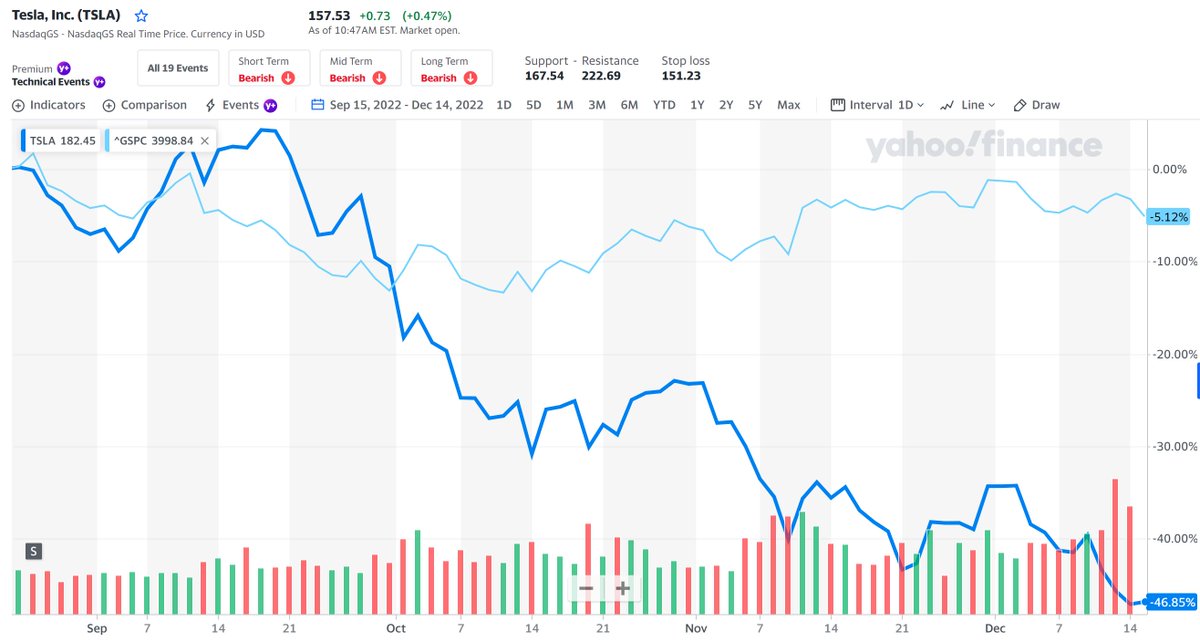

Seems like it almost touched 150They really eye that 150 treshold to trigger stops

How about that new Giga in Mexico?

TSLA Pilot

Active Member

Me, and at less than $154.Who's selling at $154 ? Has someone lost his mind?

Some of us didn't anticipate the never-ending bird fiasco, the unhinged Tweets from our CEO/Technoking, and the resultant and continuing alienation of a large number of Telsa owners (and possible loss of many, many prospective future owners).

Thus, with constant margin calls, the real world loss of many, many thousands of dollars in protective puts, and so forth, have all conspired into the sale of some 7-figures worth of TSLA, to close out some $160 protective puts (and $203.33 calls). At least the margin calls will stop now.

It's been a friggin' nightmare over the past few months, almost all of self-imposed by our own CEO/Technoking's antics.

It feels as if Elon needs a "sit down," or a "time out." Or perhaps a smack on the backside. Where has Tesla's board been for all this?

Q4 coming in weak enough not to be epic may be personally problematic for EM and his sales this week.Unpopular speculation:

1) Elon is selling a bit more today (last day to do so);

2) Q4 will not be epic… recent discounts in China and U.S. indicate challenges in delivery numbers (IMO).

I hope to be very wrong on at least #2.

Frustrated if #1 is accurate.

We have an established event today with rebalancing which certainly mean TSLA selling by funds. Think this actually has been happening all week, but more so today.

Artful Dodger

"Neko no me"

He was in Rome, met the Pope with his kids, and I think Grimes at the time. That was in the last year or so, no?

That was a weekend sidetrip on his way to Germany I think. He also had 2 weekends with his boys in Wyoming over the past 3 years. So a few long weekends then? But that's hardy a vacation (which at this level and tenure he would be entitled to at least 4-6 weeks per year.

Todesbuckler

Member

I don't think this is how it works. The S&P is market cap weighted. When a stock is down that reduces the percentage of ownership for a fund. Rebalancing is needed for the companies that are added or removed from the index

I suggest you do the math. Elon's selling since in Q4 hasn't increased the float by as much as TSLA has declined vs. the S&P 500.

Also, this week's selling won't be counted by S&P DJI for the Q4 float adjustment because it came after the cut off date for corporated events in the quarter. These will show up in 2023 Q1

Let's look at a numerical example:

Assume Tesla is 10% of an index.

Now, Tesla falls 50% and all other components of the index do not move.

Index decreases to: 90*1+10*0,5=95

Tesla share of index is now: 5/95=5,26%

Let's say Tesla was worth 200 $ and the index 2000 $. (Tesla 10% weight)

The index owned 1 Tesla share for 200 $ and 1800 $ in other shares.

After the price decrease, the index owns 1 Tesla share for 100 $ and 1800 $ in other shares. The index value is 1900 $ now. (Tesla 5,26% weight)

Hence, there is no need to rebalance based on the price decrease as long as the index owned the appropriate amount of Tesla shares in the first place.

As mentioned in an earlier post, Elon's sales do increase the free float, which ultimately results in index funds buying more Tesla shares (However, I am not sure about the timing)

Huskyf

Member

No it's simply the result of the fed two days ago ! All automakers are deep red some more than tesla and today all macros are redUnpopular speculation:

1) Elon is selling a bit more today (last day to do so);

2) Q4 will not be epic… recent discounts in China and U.S. indicate challenges in delivery numbers (IMO).

I hope to be very wrong on at least #2.

Frustrated if #1 is accurate.

Skryll

Active Member

With all due respect, and while I do feel your pain, I yet fail to see how bird antics are responsible to bring the whole market down, Tesla, Amazon, Netflix, ... they all track down in similar fashion. It has been a brutal year, and we are caught up in a large deleveraging unwinding related to interest rate hikes, war uncertainties, ftx/crypto meltdown. The only reason why we would object to being grouped with the rest is because of our anticipation of unprecedented growth very specifically to the EV revolution playing out and cash flows being redirected towards renewable energy. But I also thought that teslas iPhone moment was going to happen 5 years ago, and only now and only on the coastal states we start seeing that play out that way. Give it another 18 months and it all will be fine. Selling shares for options/buying on margin was a great play in the bull market but since 2021 that was no longer the case. In hind sight I could have made a killing selling calls and buying puts, but I was just too much of a bull market person...Me, and at less than $154.

Some of us didn't anticipate the never-ending bird fiasco, the unhinged Tweets from our CEO/Technoking, and the resultant and continuing alienation of a large number of Telsa owners (and possible loss of many, many prospective future owners).

Thus, with constant margin calls, the real world loss of many, many thousands of dollars in protective puts, and so forth, have all conspired into the sale of some 7-figures worth of TSLA, to close out some $160 protective puts (and $203.33 calls). At least the margin calls will stop now.

It's been a friggin' nightmare over the past few months, almost all of self-imposed by our own CEO/Technoking's antics.

It feels as if Elon needs a "sit down," or a "time out." Or perhaps a smack on the backside. Where has Tesla's board been for all this?

larmor

Active Member

Yes alot of equities gained significantly, by multiples in the past few years, partly due to US government printing money so people were stuck at home and could not spend on goods and services. What separates tesla from other companies is that they have increasing production and maintained profit, new product--Semi, and ramping new factories in setting of world ending supply chain shortages. Receding tide will expose many companies' valuations, but tesla growth continues.No it's simply the result of the fed two days ago ! All automakers are deep red some more than tesla and today all macros are red

It's been a friggin' nightmare over the past few months, almost all of self-imposed by our own CEO/Technoking's antics.

It's been self-imposed by yourself. It's important to accurately evaluate this because it will protect you in the future.

This drawdown is more or less garden variety for a stock with this much volatility.

TSLA Pilot

Active Member

Yes, it's about being a responsible adult CEO, monitored by the Tesla Board of Directors.Yes. Definitely Elon's fault.

And Elon has NOT been acting like one, and the BoD has been AWOL.

"Fortunately" the losses are all in my trading account--my retirement accounts just show massive, 60%-ish declines.

Yet here we have yet another Tesla apologist for completely unacceptable behavior . . . so much love and so little critical evaluation.

Time to wake up and smell the coffee.

I don't think that is accurate. I think if anything they need to buy, because Elon increased the float by selling.

Yes, it's been discussed here this week. There's even been a separate thread started for it (which nobody appears to visit).

I don't think this is how it works. The S&P is market cap weighted. When a stock is down that reduces the percentage of ownership for a fund. Rebalancing is needed for the companies that are added or removed from the index

I added words to S&P500 rebalancing and non-index buying/sellingI suggest you do the math. Elon's selling since in Q4 hasn't increased the float by as much as TSLA has declined vs. the S&P 500.

Also, this week's selling won't be counted by S&P DJI for the Q4 float adjustment because it occured after the S&P cut off date for Corporate events in the quarter. The effect of his sales on the float will show up in the 2023 Q1 rebalancing.

Elon selling would improve IWF (investable weight factor) raising the weight, ONLY for sales before the annual cut off of five weeks prior to the third Thursday of Septemeber (I don't think his sales qualifies for quarterly or accelerated review. ).

Tesla stock price dropping reduces market cap target reducing weight, however reduced stock price also reduces holdings. So that part is self correcting (assuming brokerages use live weights) other than:

Tesla's lower market cap lowers the total fund value which has upward impact on all weights (including its own, but only a fraction (like 1%) of the drop due to share price).

Skryll

Active Member

Work and vacation combined. IRDA gigapress in Italy.He was in Rome, met the Pope with his kids, and I think Grimes at the time. That was in the last year or so, no?

TSLA Pilot

Active Member

Yeah, near two-year lows, despite massive increases in every other metric (revenue, profits, etc.)? Ah, no.It's been self-imposed by yourself. It's important to accurately evaluate this because it will protect you in the future.

This drawdown is more or less garden variety for a stock with this much volatility.

I put the ongoing and massive drop in SP on the recent antics of the Technoking, but we'll just have to agree to disagree.

With Elon you get the full package of great and terrible, sort of like the Palladium Model S and X with a yoke instead of roundy steering "wheel."

EVNow

Well-Known Member

Oh, so clever. When you get out from under the Twitter rock, check this out ...Well, as I've mentioned before, it is incredible the effect the purchase has had on AMZN.

Last edited:

I put the ongoing and massive drop in SP on the recent antics of the Technoking, but we'll just have to agree to disagree.

Even if you do put them at the feet of the CEO, which I do not, you must be in an acceptable position for these types of drops. These happen and will happen with some frequency. Judging by your anger, you are not in an acceptable position. That is 100% on you.

If you lose an hour of sleep on this, you should reevaluate whether TSLA is a suitable investment for you.

EVNow

Well-Known Member

In the old days Elon used to say he has 2 objectives for the year.

- FSD wide rollout (seems to be done)

- Starship test

But now all he talks about is how best to alienate a large section of Tesla customers.

- FSD wide rollout (seems to be done)

- Starship test

But now all he talks about is how best to alienate a large section of Tesla customers.

As dumb as this sounds, I expect an afternoon rally after failing for the 8th time at 150.

Gigapress

Trying to be less wrong

For the main credits that will impact Tesla the most what's the uncertainty? At the end of the day the executive branch has to follow the law that Congress passed and POTUS signed, and the rules are pretty much black and white here.Sadly the Biden administration continues to change the parameter of the IRA, so it's actually impossible for any company to know with full certainty how much they will qualify for. Companies will try to comply the best they can within reason. Tesla is best positioned to maximize and capitalize on IRA incentives.

Clean Vehicles

To be eligible for the full $7.5k credit:

- At least 7 kWh of externally rechargeable battery capacity used for propulsion via an electric motor

- Gross vehicle weight rating less than 14k lbs

- For 2023, at least 40% of the value of critical minerals must have been sourced from the US, recycling in North America, or a country with a free trade agreement with the US, with the percentages increasing yearly according to a prescribed schedule

- For 2023, at least 50% of the value add of the battery manufacturing and assembly must be performed in North America, with the percentages increasing yearly according to a prescribed schedule

- Taxpayer receiving the benefit must have modified adjusted gross income under the specified thresholds ($300k for joint, $150k for single or separate, $225k for head of household)

- Under $80k MSRP for vans, pickups, and SUVs; or under $55k for other vehicles

- Final assembly in North America

- Starting in 2024, no battery manufacturing for the vehicle may be done in foreign entities of concern (including China and Russia) and starting in '25, no critical minerals from them either

The only real gray area I see here for the Biden administration to decide on is the small chance that the IRS criteria for defining SUVs somehow could exclude Model Y. However, the EPA already classifies the Y and other similar vehicles as SUVs and the IRA specifies that the IRS needs to select "criteria similar to that employed by the Environmental Protection Agency and the Department of the Energy to determine size and class of vehicles."

Advanced Manufacturing battery credit

- Battery capacity-to-power ratio no more than 100:1

- Produced by the taxpayer

- Sold to unrelated person

Commercial Clean Vehicles credit for the semi

- Weigh at least 14k lbs for max credit

- No diesel or gasoline engine for max credit

- Comparable in size and use to gas/diesel-powered competition

- At least 15 kWh of battery for propulsion

- Of a character subject to the allowance for depreciation

- Manufactured primarily for use on public streets, roads, and highways

I'm not a lawyer or tax expert though. This is my amateur understanding of the law.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M