Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

Give it some time we will make new lows. I'm looking for that 10% to 30% down day with one billion in volume. That's what I call capitulation.

Haha, there were 3B shares traded the week of 03-07 Feb 2020, which included a 30% drop in the SP over 2 sessions (really 1 session, plus the last 20 min of the previous session).

That wasn't "capitulation" either (at least not by Retail). SP rebounded to multiple new ATHs over the following 2 years.

This time, it seems some Retail have sold though. The FUD has been relentless. People who want to hold but are feeling the heat need to zoom out. Tesla has never been in a better place as a business. The future is bright, this storm will pass. Will you still own your shares, or will shortie?

Cheers!

Last edited:

StealthP3D

Well-Known Member

Here are my thoughts:

If there is purely a demand problem in China for cars that *cannot be sold elsewhere*, why wouldn’t Tesla drop prices? They certainly have the margin to do it, especially since Elon recently said they prefer volume over profits and would sell a car at zero margin if need be.

So, I think a reasonable explanation is one or more of the following:

-Cars are getting shipped elsewhere which can sell for higher prices (e.g. Australia) that more than make up for the additional logistics costs.

-Covid-related problems, either with suppliers or at the Shanghai factory itself, are preventing Tesla from making more cars even if they wanted to.

-Tesla decided that with Covid problems, now would be a better time to do retooling (Highlander?) and other upgrades and pulled that work forward earlier than expected. Better to do this work now while there are external factors out of their control.

I've found it does little good as a long-term investor to speculate about things we don't have enough information on to draw solid conclusions. I look at the overall picture and, to me, it looks like the result of orderly strategic decisions in the face of unexpected challenges, not chaos and poor planning.

I've also long cautioned about drawing long-term inferences from the granularity of results at a single location over a single period. It's the big trends that matter and the big trends continue to favor Tesla winning. The market is well-known to be over-reactive to unavoidable impacts. That's understandable when you have a company valued for perfection, but when it's valued this reasonably, it's just an over-reaction.

The plan to grow EV sales to huge volumes at increasingly lower price-points looks as intact as ever, and no one is better positioned in terms of production capacity and cost structure. Investors must remain clinical and calculated, not emotional and prone to bouts of imagination and fear. That's how you get taken advantage of. Remember, stocks can go higher than you ever dreamed of and lower than you ever thought possible. That's largely due to the fact that a lot of investing and trading decisions are made under the pressures of human emotion rather than a cold, calculated decision incorporating all the facts in an objective manner. Fear is the absolute worst enemy of an investor's performance. And if you are long without margin or time constraints, it's a heck of a lot easier to not let the chemicals associated with fear curse through your body and ruin your happiness and cause easily avoidable investing mistakes.

Last edited:

MagicStock

New Member

tslalala

Member

NEV includes hybrids, whose subsidies are permanently expiring this year (with future subsidies for EVs only). There is a major blowout/last hoorah for hybrids in China since it’s game over starting in 2023.It is probably hard to say what the underlying effect of Covid is.

If we look at the overall NEV market, insured units increased compared to last week:

China PV 12-18 Dec insured units NEV: 162K

China PV 19-25 Dec insured units NEV: 182K

At the same time, we see a decline for Tesla:

12-18 Dec: 10,254

19-25 Dec: 8,915

If this is only due to Covid, I would assume to see the same effect for other NEV cars. However, NEV also includes plug-in-hybrids. Someone mentioned some ending incentives for plug-in-hybrids which could affect their sales close to the end of the year. Furthermore, we don't know how many cars Tesla has available for local deliveries and how much the price decrease affected last week's insured units.

Overall, I assume that Tesla China's sales are currently limited by demand at the current price point of their cars. However, this is still likely a record quarter for local China deliveries. While there are a lot of concerns right now because of demand issues, I think Tesla will manage this just fine in the future. Tesla can decrease prices further or export more cars in the medium term. Either way, margins are good and Tesla is profitable and growing.

tslalala

Member

I feel you. We’re all hurting, but at least we’re together and unified in mission and convictions. This too shall pass.This really hurts :/

tslalala

Member

Why not $69 SP and 450k deiveries in the short term? Short options traders currently control SP. Long term we know Tesla wins!So are we gonna hit 420K delivery

Or $69 SP

2daMoon

Mostly Harmless

Great advice...I've found it does little good as a long-term investor to speculate about things we don't have enough information on to draw solid conclusions. I look at the overall picture and, to me, it looks like the result of orderly strategic decisions in the face of unexpected challenges, not chaos and poor planning.

I've also long cautioned about drawing long-term inferences from the granularity of results at a single location over a single period. It's the big trends that matter and the big trends continue to favor Tesla winning. The market is well-known to be over-reactive to unavoidable impacts. That's understandable when you have a company valued for perfection, but when it's valued this reasonably, it's just an over-reaction.

The plan to grow EV sales to huge volumes at increasingly lower price-points looks as intact as ever, and no one is better positioned in terms of production capacity and cost structure. Investors must remain clinical and calculated, not emotional and prone to bouts of imagination and fear. That's how you get taken advantage of. Remember, stocks can go higher than you ever dreamed of and lower than you ever thought possible. That's largely due to the fact that a lot of investing and trading decisions are made under the pressures of human emotion rather than a cold, calculated decision incorporating all the facts in an objective manner. Fear is the absolute worst enemy of an investor's performance. And if you are long without margin or time constraints, it's a heck of a lot easier to not the chemicals associated with fear curse through your body and ruin your happiness.

as I sit poised to sell, eyes glued to the ticker, hoping for a slight upward bump in the SP to close out a meager margin balance today.

Dikkie Dik

If gets hard, use hammer

StealthP3D

Well-Known Member

It would be nice if Charlie Munger's recent admiration for Tesla/Elon, which coincides with TSLA's PE ratio approaching that of Berkshire Hathaway, would translate into a magnitude of share purchase of TSLA by BRK that coincides with that they did with AAPL years ago. Maybe an appreciation for the pricing power, growth potential and raw material acquisition foresight of the energy storage side of things will get them in the game.

We don't need to hang our hat on or hope for any particular investor (like Buffet) to turn-around. It will happen naturally when people begin to understand the very real structural advantages Tesla has over the rest and how much stronger the transition to electrification is vs. common projections. The first investors to act on these realizations will be the big financial winners and it doesn't matter to me if it's Buffet or other smaller players. The change in perceptions will happen and the valuation is low enough right now to create another round of huge TSLA winners that will, for the most part, be a different subset of those who rode it all the way to the top last time. As investors, we don't need to worry about who the other winners will be. Those who follow the herd will win the least.

tslalala

Member

And Buffet’s biggest criteria: moat. Tesla’s got the biggest moat of any company looking into the next 20+ years!It would be nice if Charlie Munger's recent admiration for Tesla/Elon, which coincides with TSLA's PE ratio approaching that of Berkshire Hathaway, would translate into a magnitude of share purchase of TSLA by BRK that coincides with that they did with AAPL years ago. Maybe an appreciation for the pricing power, growth potential and raw material acquisition foresight of the energy storage side of things will get them in the game.

Sustainable competitive advantage, we know or think we know it has, the mktAnd Buffet’s biggest criteria: moat. Tesla’s got the biggest moat of any company looking into the next 20+ years!

has not realized that yet.

Does the Form 4 only recognise vested options when they are exercised? I was assuming vested options would show up in the "beneficial ownership" but haven't done any research on it. Perhaps they're just considered "derivative securities" until they are exercised and are therefore excluded.

I'm not @The Accountant ( not even @mongo ), but from what I've heard vested shares which have not yet been excercised show up in the "Fully-Diluted EPS" reported in quarterly financial reports.

HTH.

Indeed, Elon is not a share owner (does not control them) as reported by Form 4 until post-exercise.

Fully diluted share count (worst case) is supposed to includes all options whether vested or not. At this point 11/12 are so vested so definitely should be baked in (even if this plan were abnormal) . 12th tranche should vest this quarter.

NOTE: When reading old 10Q or 10Ks it's important to know that when a company has a net loss, EPS is ONLY basic shares. This is because the unvested ones would be dilutive and make the negative number smaller/ better. Thus the jump in diluted share count from 2019 to 2020. (I mention because I was trying to verify the tranche (which I failed at)).

And with Berlin ramping up, it's better logistically to ship the remaining what's left of the supplies to them vs trying to make cars in Shanghai and then ship the entire car over.From someone who works for Tesla (Nevada) View attachment 889207

EverettRuess

Member

Sometimes the rain just takes over.

Stretch2727

Engineer and Car Nut

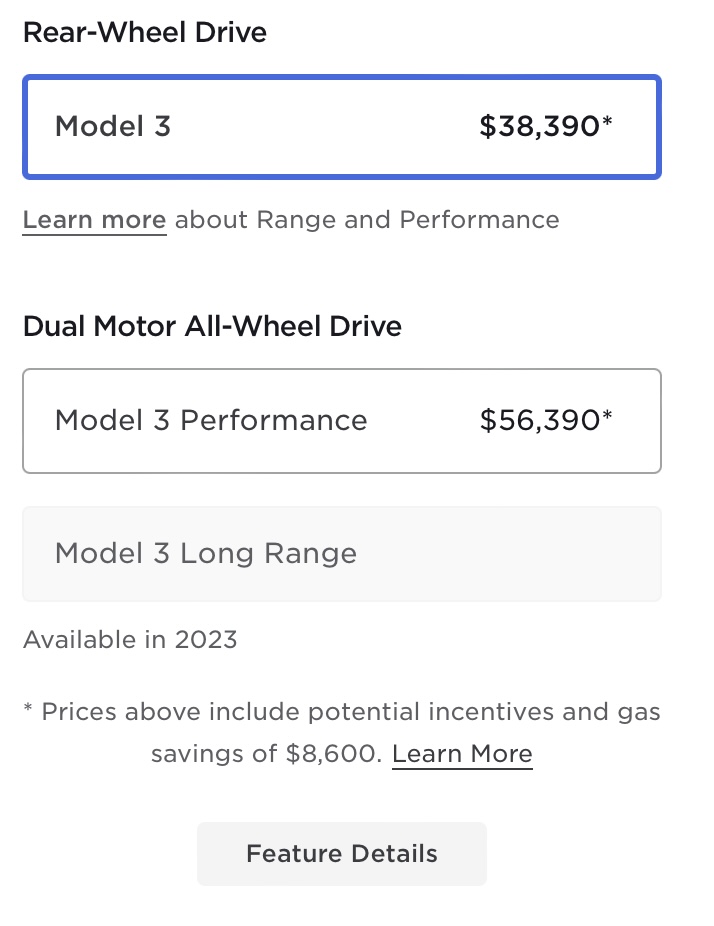

I just noticed the LR Model 3 says available in 2023 when you try to order. Did not noticed this before so it looks like they will bring back for ordering in January.

SunCatcher

Member

I know you're trying to be helpful, but actually, we're not all hurting. I've got a considerable investment in TSLA, but have not lost even 1 minute's sleep over this. I find it quite ludicrous, even curious. But it (SP drop) makes zero sense in the medium to long run. To put it bluntly; it's ridiculous.I feel you. We’re all hurting, but at least we’re together and unified in mission and convictions. This too shall pass.

If this were a one time event, it would be quite the eye opener. But how many times have these severe stock price swings occurred over the lifetime of TSLA? I've made several big mistakes in exiting Apple, Netflix, Amazon, and others in my early years of investing, when they went through these sorts of gyrations. I will not fall for that again. Not for a second.

All indications are that TSLA is a winner on a major scale. If indicators change at some point, then perhaps it's a different story. But right now it's TSLA for the win. Eyes wide open. TSLA SP aside, what do we see?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M