Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

ThisStockGood

Still cruising my Model S 70 2015

I wanna be optimistic… and believe that when Elon is stating “epic q4” he is referring to earnings and not delivery numbers…

But maybe I’m just a fool…

But maybe I’m just a fool…

Still, just about where we closed off last Friday…

Will be interesting to see tomorrow.

I’m getting pretty weary of interesting days

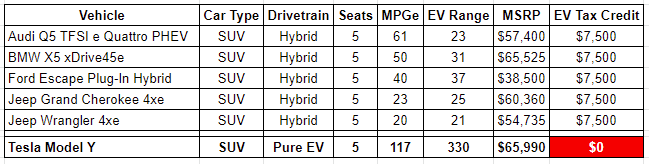

... while politically giving the appearance of caring about the planet, and becoming energy independent to end the wars.Giving an 11.4% tax credit for a 50 MPGe "EV" that costs $65.5K does not advance the Mission. It slows it by supporting fossil fools.

This IRA is all about SLOWING the transition to renewable energy (by pretending hybrids are EVs), while extending the life of the mine-and-burn economy.

thx1139

Active Member

Yeah, but doesnt take into account that entering the quarter already had 35K in inventory. So now 70K.Martin Viecha provided some explanation for the increase in difference between production and deliveries. It makes sense that increasing volume of deliveries would lead to increase in transit

Yes, including an additional count of between 50-100 vehicles would have made a huge difference - NOT.Yes, this would certainly have been a great quarter to have included the delivery numbers for Semi and for Megapacks as well

And Megapacks are not vehicles. This report is strictly about vehicle production and delivery. Perhaps it would have been nice to have the Semi listed, but the quantity delivered is immaterial.

As time goes on, the report will become more and more immaterial. The only production and deployment that reflects Tesla's true business model is production of batteries and where they were used, be it storage or vehicles. Treating Tesla as strictly a vehicle manufacturer is quickly becoming more and more irrelevant.

willow_hiller

Well-Known Member

Thoughts on the Investor Day press release wording?

"Our investors will be able to see our most advanced production line as well as discuss long term expansion plans, generation 3 platform, capital allocation and other subjects with our leadership team."

I'm expecting at least one new Gigafactory announcement. "capital allocation" could be referring to the buyback. Unsure what the generation 3 platform is referring to. Could be Cybertruck, Robotaxi, or Highland, I suppose.

"Our investors will be able to see our most advanced production line as well as discuss long term expansion plans, generation 3 platform, capital allocation and other subjects with our leadership team."

I'm expecting at least one new Gigafactory announcement. "capital allocation" could be referring to the buyback. Unsure what the generation 3 platform is referring to. Could be Cybertruck, Robotaxi, or Highland, I suppose.

TrendTrader007

Active Member

so much pessimism- great from contrarian standpoint

selling TSLA at -70% or shorting it here, probability of it ending well is rather low in my opinion

it is not uncommon after a severe selloff like TSLA had over last 14 months, to test lows 2 to 3 times

i am looking at stock to bottom within a matter of days to weeks, if not much sooner

we will see, but i am not half as pessimistic as many on this board

selling TSLA at -70% or shorting it here, probability of it ending well is rather low in my opinion

it is not uncommon after a severe selloff like TSLA had over last 14 months, to test lows 2 to 3 times

i am looking at stock to bottom within a matter of days to weeks, if not much sooner

we will see, but i am not half as pessimistic as many on this board

bigsmooth125

Member

Are you criticizing everyone else in this forum who listens to and quotes Elon's tweets, too? If so, go ahead.Just taking a step back, you're relying on...what a person that leads 100,000's of people says, in 140 characters or less at a time, on a platform that allows you real-time access to him (and who chooses to give you real time access to what he wants to say in 140 characters or less in the public)...

...for your personal financial decisions?

EVNow

Well-Known Member

Well, epic in the sense of highest quarterly deliveries and first time > 400k ?I wanna be optimistic… and believe that when Elon is stating “epic q4” he is referring to earnings and not delivery numbers…

But maybe I’m just a fool…

"priced in". Good one trax! Glad to see you still have a sense of humor!

But there is a company specific reason the market trashed the stock 60% over six weeks, and it is not beyond the pale that includes missing 'expectations'.

What are we looking at anyway? Will TSLA test 100 tomorrow because of this record quarter? More likely will retest the last week lows. Plenty of buyers thought TSLA was a great buy there, and I would guess they would still. Plus there were a couple of EOY of sellers which seemed to be done last week.

My main point is there was no guarantee that TSLA would have popped hard with a 430K delivery number which many people were predicting, and there is no guarantee that TSLA will collapse off of a 405K delivery number. TSLA will still have record profits and a forward PE of 20 with no growth at this level. Now if they were really at zero growth, the PE would collapse even more, but I think we could pencil 10% growth going forward to support the 20 PE .

If the delivery number had come in below 370K, now this would signal a real problem. That was my disaster boundary. But even that would not matter in two years!

We will find out. Don't let the pre-market terrify anyone. It is much easier to mess with the numbers there. Let's see where we are at 1pm or so. I am optimistic we will not be close to visiting 2 digits.

Thoughts on the Investor Day press release wording?

"Our investors will be able to see our most advanced production line as well as discuss long term expansion plans, generation 3 platform, capital allocation and other subjects with our leadership team."

I'm expecting at least one new Gigafactory announcement. "capital allocation" could be referring to the buyback. Unsure what the generation 3 platform is referring to. Could be Cybertruck, Robotaxi, or Highland, I suppose.

They might as well have Elon go to Wall St and stand in the rain holding a boom box over his head

thx1139

Active Member

My personal financial decisions regarding Tesla came about when the CEO wasnt coming across daily as a liar. Like many have said he isnt being a good captain of the Tesla ship. He and Tesla board knew the macro environment and yet instead of simply taking Twitter and running it he had to come out and be a master sugar poster and liar.Just taking a step back, you're relying on...what a person that leads 100,000's of people says, in 140 characters or less at a time, on a platform that allows you real-time access to him (and who chooses to give you real time access to what he wants to say in 140 characters or less in the public)...

...for your personal financial decisions?

Artful Dodger

"Neko no me"

Frankly I think a lot of this has been priced in already.

EDIT: As vocally frustrated as I’ve been over the Twitter thing, I think it’s naive to think that our December performance wasn’t primarily about serious short term demand concerns.

Won't matter in New York on Monday. If you ask a bear what's the fair price, they always say "LESS THAN THAT!"

Meanwhile, Frankfurt found a support level: (~122.17 USD at 18:47 CET)

So it is what it is.

gtrplyr1

Member

Unfortunately we’ve got a lot of time before those earnings get released. I do think that margins will show improvement but until that report comes out, it may be a tough road. Buckle up.I wanna be optimistic… and believe that when Elon is stating “epic q4” he is referring to earnings and not delivery numbers…

But maybe I’m just a fool…

TrendTrader007

Active Member

100% agree. very well statedLOL, OK maybe the SP gets trashed tomorrow.

But there is a company specific reason the market trashed the stock 60% over six weeks, and it is not beyond the pale that includes missing 'expectations'.

What are we looking at anyway? Will TSLA test 100 tomorrow because of this record quarter? More likely will retest the last week lows. Plenty of buyers thought TSLA was a great buy there, and I would guess they would still. Plus there were a couple of EOY of sellers which seemed to be done last week.

My main point is there was no guarantee that TSLA would have popped hard with a 430K delivery number which many people were predicting, and there is no guarantee that TSLA will collapse off of a 405K delivery number. TSLA will still have record profits and a forward PE of 20 with no growth at this level. Now if they were really at zero growth, the PE would collapse even more, but I think we could pencil 10% growth going forward to support the 20 PE .

If the delivery number had come in below 370K, now this would signal a real problem. That was my disaster boundary. But even that would not matter in two years!

We will find out. Don't let the pre-market terrify anyone. It is much easier to mess with the numbers there. Let's see where we are at 1pm or so. I am optimistic we will not be close to visiting 2 digits.

Highway2Heel

Member

From 499,550 in 2020 to 1,313,851 in 2022 is absolutely incredible.

B

betstarship

Guest

So, if automotive is ~$92B in annualized revenue run-rate...then Tesla would need to have sold $2B in Semi and Energy in Q4/2022 to establish a $100B annualized total company revenue run-rate.

1st time in their history if true!

1st time in their history if true!

And is that a problem? At least for Norway there has only been deliveries for the 5-6 last weeks on each quarter.Yeah, but doesnt take into account that entering the quarter already had 35K in inventory. So now 70K.

With them now wanting to have a smoother delivery schedule the number of cars in transit/inventory has to increase. Today it’s only about 10% of the quarters production.

B

betstarship

Guest

Are you criticizing everyone else in this forum who listens to and quotes Elon's tweets, too? If so, go ahead.

Introspective question, actually.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M