Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

thx1139

Active Member

Can I get a brief summary of Chanos and MegaPack? Are we expecting some drastic change in Q4 report next week or is this all about future state?Jim Chanos doesn't believe in MegaPack production and financials, so this means it's definitely going to happen. Bullish.

Last edited:

LoL, our smallest metropolitan in FL, but largest city in the US.Wow, Jacksonville must have really increased in Population recently!

Shows you the prowess of FL!

Stretch2727

Engineer and Car Nut

Zerosumgame33 claiming the megapack will have over 50% margins. If true expected to start to show up in Q4 and obviously much more as we move forward with the tax credits etc.Can I get a brief summary of Chanos and MegaPack? Are we expecting some drastic change in Q4 report next week or is this all about future state?

Personally, I have a hard time believing they have taken margins from 0 to 50% in one design cycle and much of the analysis is bottom up assumptions on costs rather than the delta from where we are today.

Is your neighbor aware that Mercedes was involved in the diesel emission cheating scandal? Is she ok with Mercedes making people sick? Is she a moron?I had a neighbor ready to get a Tesla. She now adamantly refuses and will wait and pay more for Mercedes to get their EQB to market.

I'd expect that's an example of a lifetime customer loss right there. And she's not gonna be the only one.

Last edited:

Thanks for the summary.Great video. Lots of good info and very little fluff. I took some notes and thought I’d share here.

[snip]

$35k estimated cost of long range AWD 3 in 2018 (not inflation adjusted)

SR LFP 3 costs thousands less, maybe $31k

Front drive module costs well over $1500

Front motor is induction so cheaper because no magnets in rotor. Also rotor and stator are smaller

Cheaper power electronics bc silicon instead of silicon carbide and also depopulated (fewer components)

No front half-shaft

[snip]

I may need to go watch, but I don't understand this.

An AWD vehicle would need half shafts, unless:

1) It has a solid axle (no way Tesla is doing this)

2) It has 2 motors at that location, both Left and Right... as far as I know that's only on the rear for the Plaid

I wonder if he was referring to something in a different context...

Last edited:

trayloader

Member

That´s what I meant earlier with infantile. They lost their way. Full collision with Mini, plus the profits are toast.Looks like something out of a cartoon movie. Do they have a tie in with a new Disney Cars movie?

Is BMW now a small boyracer brand? WTF

Guess the whole competition is effed besides Porschäää and Hyundai/KIA.

Catch 22 to the fullest.

You turn electric, You loose against the Gorilla.

You keep on, goes down even faster.

If just this 420 secured "suit" wouldn´t happen right now.....I see Elon in a corner here. And one knows what´s happening when he´s cornered:

full blown lashing out through other channels, insultings, extremes.

SebastienBonny

Member

If those are sold puts, anticipation of those expiring out of the money so rising SP above 160.

If bought puts...

I suspect that a lot of the 160 put action is from Uncle Leo, he was selling puts at 160 to try to support the stock. (At least I think that is what he said.)

SebastienBonny

Member

Weren't those assigned already? Well, maybe he has them for all weeksI suspect that a lot of the 160 put action is from Uncle Leo, he was selling puts at 160 to try to support the stock. (At least I think that is what he said.)

Weren't those assigned already? Well, maybe he has them for all weeks

I think he made comment recently about more forced buying later this month.

Two days ago:

CEO of Qualcomm explains the changes in the auto and other industries in supplier relationship to ensure chip shortages should never happen again for competent OEMs.

In short, my understanding of the auto industry chip shortage was caused when the pandemic hit and OEMs reduced their supplier orders, and those suppliers reduced their chip orders, which caused the chip manufacturers to divert their chip manufacturing schedule to other customers. But once diverted or for worse shutdown of legacy manufacturing capacity, it is not possible for chip makers to change their commitment to other customers and quickly restart the making of auto chips.

The change in auto OEM/chip supplier relationship is simply that auto OEMs are now forming direct relationship with the chip industry to ensure this never happens again.

He said that currently, for the most part, there is no chip shortage for the auto industry, and none with Qualcomm.

Other points discussed in the interview:

- Qualcomm makes chips in the 4nm through 100nm sizes for cellular through power applications

- China remains a important supplier of the legacy technology chips

Link to YouTube segment starting at 3m07s where he talks about chip supply process for auto OEMs

In short, my understanding of the auto industry chip shortage was caused when the pandemic hit and OEMs reduced their supplier orders, and those suppliers reduced their chip orders, which caused the chip manufacturers to divert their chip manufacturing schedule to other customers. But once diverted or for worse shutdown of legacy manufacturing capacity, it is not possible for chip makers to change their commitment to other customers and quickly restart the making of auto chips.

The change in auto OEM/chip supplier relationship is simply that auto OEMs are now forming direct relationship with the chip industry to ensure this never happens again.

He said that currently, for the most part, there is no chip shortage for the auto industry, and none with Qualcomm.

Other points discussed in the interview:

- Qualcomm makes chips in the 4nm through 100nm sizes for cellular through power applications

- China remains a important supplier of the legacy technology chips

Link to YouTube segment starting at 3m07s where he talks about chip supply process for auto OEMs

Last edited:

bkp_duke

Well-Known Member

I suspect that a lot of the 160 put action is from Uncle Leo, he was selling puts at 160 to try to support the stock. (At least I think that is what he said.)

The 170 puts at 100,000 in volume is over 17 Billion in value if assigned. I think that's even out of Uncle Leo's wallet size.

petit_bateau

Active Member

"we leave 2022 with much better visibility of our future silicon supply chain than we entered with. As a result, we can say with confidence that, after a lean first quarter, we expect supply to recover to pre-pandemic levels in the second quarter of 2023, and to be unlimited in the second half of the year."CEO of Qualcomm explains the changes in the auto and other industries in supplier relationship to ensure shortages should never happen again for competent OEMs.

In short, my understanding of the auto industry chip shortage was caused when the pandemic hit and OEMs reduced their supplier orders, and those suppliers reduced their chip orders, which caused the chip manufacturers to divert their chip manufacturing schedule to other customers. But once diverted or for worse shutdown of legacy manufacturing capacity, it is not possible for chip makers to change their commitment to other customers and quickly restart the making of auto chips.

The change in auto OEM/chip supplier relationship is simply that auto OEMs are now forming direct relationship with the chip industry to ensure this never happens again.

He said that currently, for the most part, there is no chip shortage for the auto industry, and none with Qualcomm.

Other points discussed in the interview:

- Qualcomm makes chips in the 4nm through 100nm sizes for cellular through power applications

- China remains a important supplier of the legacy technology chips

Link to YouTube segment starting at 3m07s where he talks about chip supply process for auto OEMs

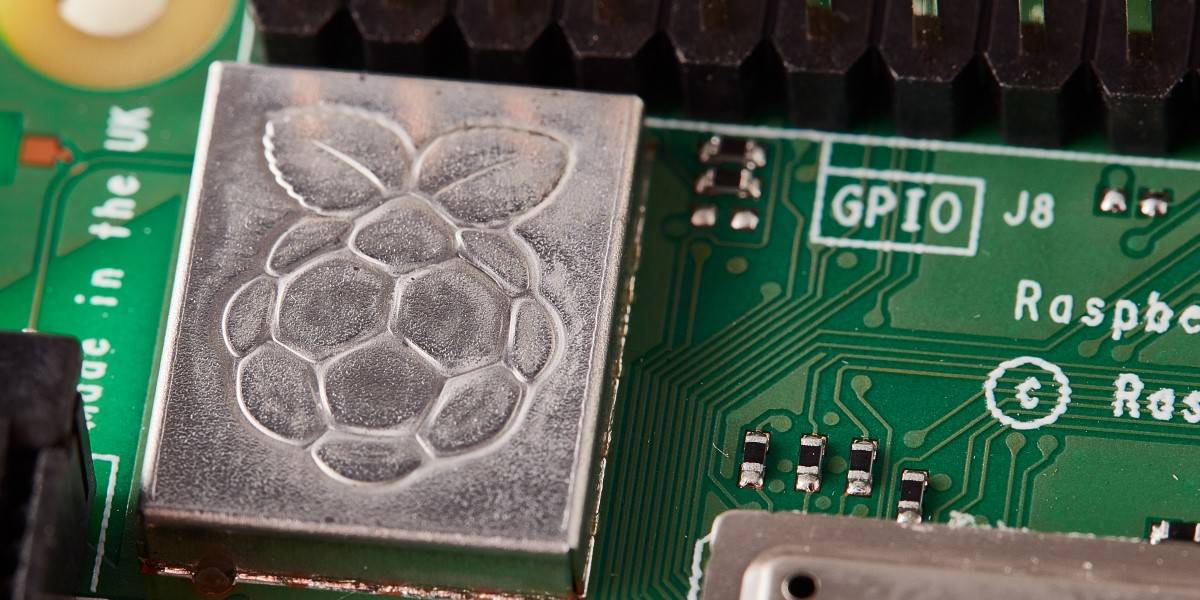

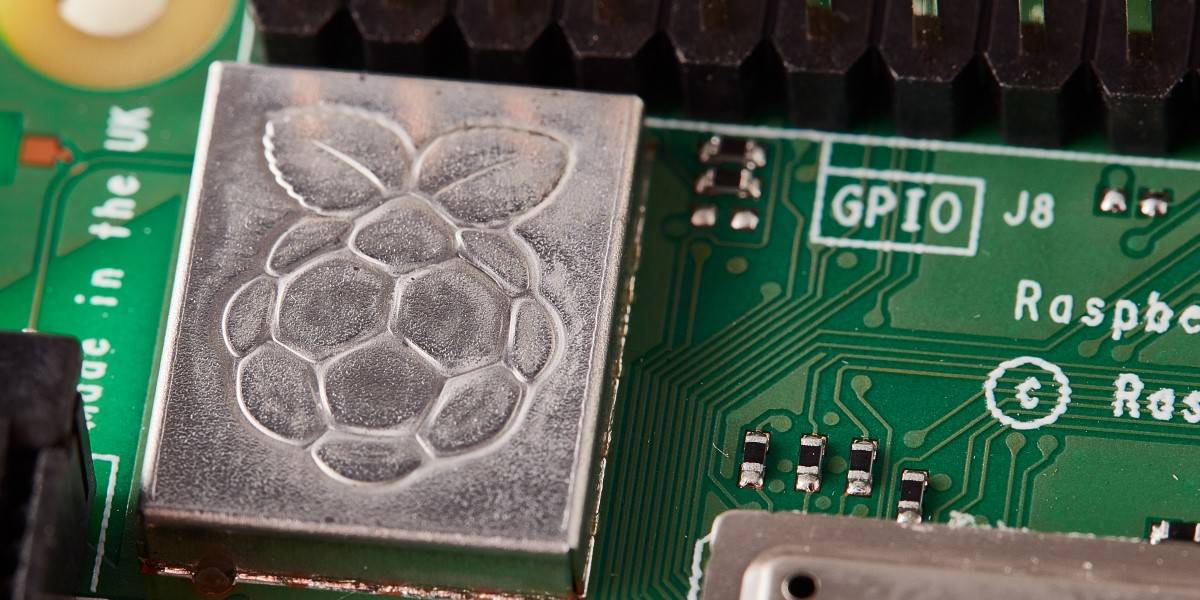

Supply chain update - it's good news! - Raspberry Pi

For the first time in a couple of years of semiconductor supply chain hell, we've got some good news for you. A bump in single-unit availability this month, and a cheerful outlook from the second quarter of next year onwards.

Raspberry Pi shortage is abating just in time for holidays

100,000 units being sent to resellers as thanks for consumer patience, says CEO Eben Upton

bkp_duke

Well-Known Member

"we leave 2022 with much better visibility of our future silicon supply chain than we entered with. As a result, we can say with confidence that, after a lean first quarter, we expect supply to recover to pre-pandemic levels in the second quarter of 2023, and to be unlimited in the second half of the year."

Supply chain update - it's good news! - Raspberry Pi

For the first time in a couple of years of semiconductor supply chain hell, we've got some good news for you. A bump in single-unit availability this month, and a cheerful outlook from the second quarter of next year onwards.www.raspberrypi.com

Raspberry Pi shortage is abating just in time for holidays

100,000 units being sent to resellers as thanks for consumer patience, says CEO Eben Uptonwww.theregister.com

Wasn't a large part of the problem that Auto OEMs wanted to continue using chips manuf on 35 and 45nm processes, and when orders dried up the fabs decommissioned those ancient lines in order to deploy more capacity at current nodes?

You are off by an order of magnitude. It would only be $1.7 Billion. (And are you actually talking volume, which is meaningless for this, since it could be just one option traded 100k times.)The 170 puts at 100,000 in volume is over 17 Billion in value if assigned. I think that's even out of Uncle Leo's wallet size.

And I'm not seeing open interest anywhere near those levels. For what expiration are you seeing that level of open interest?

bkp_duke

Well-Known Member

You are off by an order of magnitude. It would only be $1.7 Billion. (And are you actually talking volume, which is meaningless for this, since it could be just one option traded 100k times.)

And I'm not seeing open interest anywhere near those levels. For what expiration are you seeing that level of open interest?

My bad, I was looking at papafox's trade chart as the OI chart and did the calc from there.

Best guess based upon the actual OI chart was that someone was taking advantage yesterday of the dip in share price to close out those positions and reduce risk come Friday.

SebastienBonny

Member

Ok, but wouldn't those sold puts only be in the open interest chart and not the volume chart?I think he made comment recently about more forced buying later this month.

Two days ago:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K