2daMoon

Mostly Harmless

It is a slow day, what did you expect?

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

They keep track of when you last viewed it, and you only get an update every 30 minutes. (I think it is 30 minutes.) That and the data is delayed 15-30 minutes.

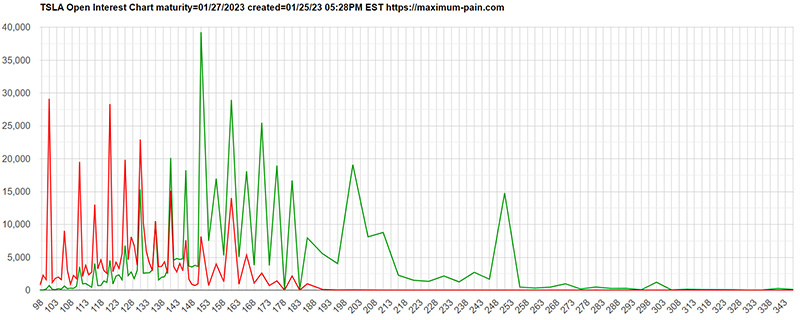

Take a look at that call wall at 150.

I thought the same thing right as he said it. But this is how Elon sets the goals internally. Then he announces them publicly as part of his direction.Solid if conservative guidance of 1.8 million units (which Elon immediately and stupidly torpedoed by resetting expectations to 2 million -- there was no benefit in doing so ... sorry i know this is supposed to be the positive portion of the post)

To pick a nit: 1.8 million production does not equal 50% YoY growth. Rather, you would need 2.05 million production.The discontinuity lies in that Tesla can hit 50% YoY (1.8m) with basically zero QoQ growth.

Not that there is a problem with that, Cybertruck is a 2024 volume item as is Semi; but it looks a little weird since Berlin and Austin would theoretically increase output to the 2.0m+ level.

Possibilities:

Sandbagging/ expectation management

Lack of factory growth

Some other short term limit

Demand issues

Slow roll due to product step change

They will conveniently remember it when the market turns south and then put out a FUD piece (They always have built up ammunition), this is almost guaranteed.Will the "analysts" remember the ~ 30k undelivered cars this quarter when Q1/2023 ends ?

That is over $1.5B in revenue

To pick a nit: 1.8 million production does not equal 50% YoY growth. Rather, you would need 2.05 million production.

That seems like a good summary but I think Wall Street had serious concerns about demand and profitability and much less so after the call. Hence the reaction. (I think)I'm a little surprised at wall street's unsubdued reaction to the earnings call. Personally i heard as many questions as answers. I thought it was a decidedly mixed bag. I'm an optimist so i'll start with the cons, and end on a positive note with the pros:

Cons:

- Cybertruck volume production in 2024 at the earliest (and I think that's optimistic based on its radical design and where they are in the process).

- 4680 volume production is still not close.

- Margins will probably tighten further.

- Sales in China do not appear to be growing quarter over quarter.

- Next-gen FSD will not be retrofittable to existing cars (so much for the whole "Teslas will become appreciating assets" line)

- Primary focus seems to be on maintaining the short-term margin and cash numbers rather than R&D (and to a lesser extent, service). I would prefer Tesla were less worried about Wall Street's reactions quarter to quarter, and made fewer choices based on ruthless cost cutting and more choices based on providing a superior product to the market.

- Solar? Do we still do that? Looking at P&L it looks like Solar makes up less than 1% of profit and is low margin at best, and its growth is anemic. Hard to glean specifics since it's lumped in with Energy Storage on several charts, which is doing much better.

Pros:

- Immediate bottom line still extraordinarily healthy in terms of free cash flow, cash on hand, and margins relative to the industry.

- Model 3 and Model Y are crushing it everywhere around the world.

- Solid if conservative guidance of 1.8 million units (which Elon immediately and stupidly torpedoed by resetting expectations to 2 million -- there was no benefit in doing so ... sorry i know this is supposed to be the positive portion of the post)

- Energy storage revenue is growing at a very healthy rate, even faster than Auto, and looks like it will continue to do so.

So like I said, kind of a mixed bag. Obviously I'm happy that Wall Street is happy, but I definitely have my own set of serious risks and questions in my personal valuation of the company that I would love to see addressed somehow. I know we're all banking on future product reveal events to clear some of these up. We shall see.

I like the suggestion but ...I have a THEORY for the sandbagging 1.8m production number for 2023.

Please note, this is just my reading of the tea-leaves, but it fits the limited and available data we have.

In a nutshell - Project Highland for the Model 3.

Why? Tesla is going to take one or more lines in Fremont offline and completely retool them, including for casting. This is a major rework, which will cause months of lost production from each line that goes offline for the rework to a casted production line. Each line will also be slow to spool back up.

In the end, this will result in a lower cost Model 3, with higher customer demand, and higher overall production capacity.

The loss in 3 production will be offset by increased ramps from Austin and Berlin on the Y.

Those profit estimates are based on switching to LFP cells, US $45/kWh battery credits, Megapack XL which is priced much higher than the original Megapack, and economies of scale at Lathrop. None of this was really in effect in Q4.What a cool graphic. Some points:

- Service cost & revenue is a wash, which exactly jibes with Musk's contention that they will not make Service as a profit cost center.

- Energy made a small profit 0.1B over 1.3B revenue = 7% profit. So this puts to rest the astronomical claims of 50% profit on Megapacks by some internet Tesla enthusiasts.

There's another wall today at 160 in case you're interested.Yup, big call wall at 150 means MMs will want to manipulate the SP to that level (at least). Also, the Upper-BB is at $151.02 as of 10 a.m. so technical traders will see that as a sell signal as well:

View attachment 899987

To pick another nit: @mongo was talking production YoY rather than deliveries YoY.Tesla has never stated it plans for 50% YoY growth. They have stated, since 2020, they plan for 50% CAGR growth (Compounded Annual Growth Rate). That means an average over time, not a singular number per year.

2021 was an 87% growth. 2022 was a 40% growth. They are guiding for 2023 to be a 37% growth. The average of those three years combined is 54% (still over 50%).

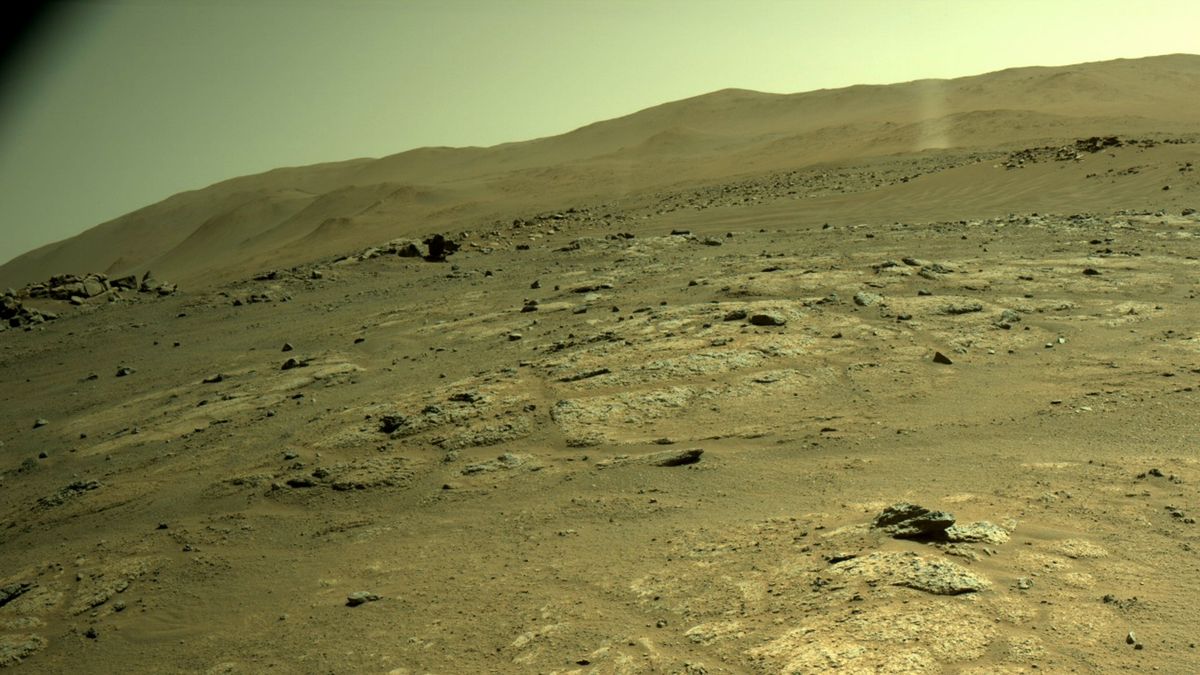

Elon/SpaceX/Teslabot can't use them on Mars (atmosphere is < 1% of the density of Earth). So let the Earthlings make wind turbines...

cool! thanksI don't think SpaceX or Tesla will ever make wind turbines for Earth or Mars but someone will make them for Mars

Wind farms on Mars could power future astronaut bases

If wind power could prove useful on the Red Planet, it might play important roles that other forms of power do not.www.space.com

The scientists discovered that out of 50 proposed Martian landing sites, wind speeds at 40 of the sites could supply at least some useful power. At three sites, wind speeds could generate 24 kilowatts — enough to support a six-crew team — for more than 35% of the year. At seven others, wind energy can supply more than 50% of total power needed either during winter months or dusty times. If wind power is needed only for scientific instruments, it could prove useful for another 30 sites.