Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I see where you are coming from, and I do have an affinity for cats, as noted in the avatar picture, so let me just ask, “Does your statement apply to Elon as well when he does the same?”No, I don’t believe they do. A person who feels a need to judge and criticize another, particularly publicly on the Internet, doesn’t truly appreciate the person, their uniqueness, or their achievements, otherwise they wouldn’t do it in the first place. It’s atrocious, unnecessary behavior.

I'm just now seeing some headlines about it and stuff like thisI have not seen any risk of that. Yes, Republicans want some spending cuts, but there is plenty of other places to cut spending

But don't follow politics much outside of geopolitics, so I'm not sure what might be bouncing around in there

Wtf. Uber only makes $31.8 billion a year and they are charging 2X what an autonomous taxi would charge so why would Tesla's ride hailing makes 5-10x this in 4 years?? Even if Tesla solved autonomy yesterday and is already deploying robotaxies today, it's not mathematically possible in the real world to hit 613 billion in total revenue for the next 4 years. You have to assume all the cars and public transportation had an explosion, or a massive EMP disabled all cars except Teslas for this to happen.ARK's Regular Bull case is an ASP of $26k within four short years, 1/2 of the actual 2022 ASP

$613billion in autonomous ride-hail revenue also in those four years

These kind of ridiculous models give ARKK zero credibility and I don't even know why it exist. Too much of this and people will start treating arkk like Cramer and just inverse everything they say. SARKK already exist and is doing better than ARKK that's for sure.

Last edited:

The IRA reductions wouldn’t touch the EV battery stuff.I'm just now seeing some headlines about it and stuff like this

But don't follow politics much outside of geopolitics, so I'm not sure what might be bouncing around in there

“Republicans now want to rescind key aspects of the law that were designed to combat climate change, including provisions establishing a high-efficiency electric home rebate program and home energy efficiency contractor training grants.”

That is not surprising to me, partly because of FUD, partly because of general apathy about many subjects and partly because most Uber clients might tend to not be new car buyers (my data on that is market-specific and with questionable methodology anyway and it was sponsored by parties with a vested interest).I started driving Uber a couple of weekends ago. So far after giving about 45 rides (probably 60 passengers), no one has had a good understanding of Tesla, electric cars, charging, or the current state of battery technology.

In general large parts of most populations are ignorant of many basic issues, not just BEV's.

In the US case check Gallup polls on nearly any knowledge-based subject.

For Tesla we ought to be concerned if new car buyers who are not brand loyalists and who reside where tesla is available display equal ignorance. That would be even more concerning because the US ones then are highly likely to know nothing at all about the Inflation Reduction Act, hence unaware of how much money they could save on their next Chevy, Hyundai, Kia or Ford, for example, or Tesla.

Gigapress

Trying to be less wrong

I just found another youtube channel to subscribe to for EV learning.

Automotive engineering professor John Kelly from Weber State University presents teardown analysis similar we get from Munro Live and Ingeneerix. This channel doesn't post often but the two videos I've watched thus far have been awesome.

MissAutobahn

Elon, please ramp up Semi production!

I haven't logged in on TMC since 03/26/2022 with $TSLA at $1,020.00 (340 after the split now). Since that last log in the stock just went south .

.

Now I'm back.

This should be a good sign for all that want to buy more shares right now.

Now I'm back.

This should be a good sign for all that want to buy more shares right now.

Gigapress

Trying to be less wrong

Have you seen the TSLA price lately?Out of curiosity, what was your reason for giving Uber rides? Other than doing a Tesla sentiment analysis, I mean

bkp_duke

Well-Known Member

We need a CEO focused on Tesla, not Twitter or SpaceX: NYC Comptroller Brad Lander

CNBC - this morning:

This BS always cracks me up.

The FACTS are simply this:

20% of Elon's time as CEO is better than 100% (literally 24/7) of anyone else you could put in that position.

Anyone who disputes this FACT doesn't understand the once-in-a-generation kind of disruptor that Elon is.

This doesn't surprise me at all, considering the large number of FUD "news" articles I have seen lately, all touting "why you should wait for the next model 3 2024 model", or the next model Y 2024". Who is funding this BS?she brought up 4 concerns: lack of parking sensors and when Tesla vision would come out, the new "hardware" coming (i.e. HW4), the refresh next year and, of course, chances for more price cuts.

Gigapress

Trying to be less wrong

Also, in the long run SpaceX will be synthesizing the rocket fuel by using electricity generated from renewables to convert from water and CO2 captured from the atmosphere into pure CH4 and O2, which is the same plan for fuel production on Mars where natural gas resources do not exist. SpaceX will be using electrolysis and the Sabatier process and so Starship/Superheavy flights will be carbon neutral and require no fracking or other harmful hydrocarbon mining.You summed up man’s perpetual ignorance right there. A friend of a friend of a friend on social media made a comment about how Elon doesn’t put batteries in his rockets; so he was a fraud and his rockets are poking holes in the ozone and he needs to be stopped.

Naturally, I explained batteries don’t work for rockets or he’d use them, etc., etc…. Went on to compare a couple rockets a month vs millions and millions of cars each day dumping emissions for decades, and hundreds of thousands of premature deaths. Finished with, I drive electric, how about you?

Thus followed strawman, have you seen lithium mines, double edged sword blather, then I can’t afford an EV and I don’t want one anyway.

I further explained potential options of different brands, leasing, used, price differences of fuels, maintenance etc…. And then I shut the conversation down with; if you’re not willing to try then you probably should not comment on Elon’s rockets lest you be labeled a hypocrite.

I continue to be entirely disgusted with people.

Additionally, this will create more demand for solar power which will help push down costs in accordance with Wright's law, so the rockets will actually help accelerate the move away from fossil fuels.

We need a CEO focused on Tesla, not Twitter or SpaceX: NYC Comptroller Brad Lander

CNBC - this morning:

Even CNBC is calling him a Troller!

You do make a good case for tradition. Paid EV advertising has been around for quite some time. Nissan for Leaf, GM for Bolt, and several others. Most recently Mercedes Benz, BMW and Peugeot have used advertising, mostly in EU but also some in US. At the core the question is whether there is enough density in coverage to actually allow advertising metrics to work. If anywhere that approach might be practical it might well be selected California or Norwegian markets.I come from the marketing attribution world, and one of my former clients is an auto manufacturer with a global marketing budget in the billions of dollars. With the more recent theoretical developments in this field such as market response model and hierarchical Bayes, and with the availability of internet data, both marketing consulting shops and in-house marketing teams have been developing marketing mix models and multi-touch attribution models with increasing accuracy and business impact.

To make the story short, advertising in the auto industry accounts for around 15% of sales in the US market, with ROAS in the single digits. Some marketing channels are more efficient than others. I remember that spot TV was actually the most efficient marketing channel, for both dealership-driven advertising and brand-driven advertising. Paid Search was up there too. The numbers are a bit misleading from a financial point of view because return on ad spend was measured on unit sales and revenue rather than profit because the marketing department's job was to increase sales, not profit, an example of how a big company often has teams that don't align on the same goals. That said, with some extrapolation from the financial reports, I estimated that advertising was a net positive for their bottom line, at least in the US market. ROAS was trending down, however, as the auto market was becoming more and more saturated in the years before Covid.

Unfortunately, I left that world before Tesla exploded, so I never had a chance to study the impact of advertising on EV sales, even though my team started preparing for an EV model launch for our client. Their production numbers were small anyway, and we'd have to use number of orders to approximate sales.

I suspect that traditional paid advertising is still relevant, though it needs to be more data-driven. The average US adult still spends hours a day on TV, on average. People use mental shortcuts more often than they should. When it comes to buying a new vehicle, they often think of what they have been regularly and recently exposed to. An ad campaign that is well pulsed will stay on the audience's mind longer and influences the top-of-mind consideration. They know that the local Toyota is running a financing deal or that Ford has this 2023 vehicle with powerful features, and they know how much these vehicles cost. They may have seen Teslas in their neighborhood but they assume the vehicles are out of reach for them price-wise, not being aware of the recent price reductions. There are people who make purchases based on the ads they are frequently exposed to. Younger demographics trust their Instagram influencers, and older demographics trust the TV ads they see.

I don't know how effective advertising for EVs would be, but the only way to know is to experiment. I don't know why Tesla has never experimented with paid advertising, and I don't think any poster on this forum knows either - all we can do is speculate. My guess is that Tesla is going to start experimenting with paid advertising this year amidst the slowdown in demand and the quick ramp-up in production. They have the scale to make advertising work, and if it doesn't, cut the losses and move on. From a business standpoint, reducing prices is the last-resort option to drive sales. Constantly cutting prices is a much worrisome sign of lack of financial discipline than experimenting with paid advertising.

Anyway it is clear that cherished mythology trumps hard reality. And so it is with 2023 vs 2010. When I find new data that changes my traditional view, I change my view... not that when I first used the internet in 1993, at SRI succeeding Darpanet, I had a clue of the future. I did not! I never imagined Google would have a >25% share of advertising revenue online, because I never thought such a thing would exist.

This world is changing so rapidly that people who were state-of-the-art ten years ago are obsolete now. Bluntly, the US Post Office cannot find COBOL programmers. When Google first had paid placements COBOL was still significant.

Everyone! This is 2023! Even cable TV is no longer dominant. Back to Google: Can someone tell me where they make more advertising and promotional revenue between Google search and YouTube. Even asking the question might spawn the idea that things like YouTube and social media platforms might be displacing TV to a significant extent. Perhaps, just perhaps, that might be a factor in the types of Ads that appear on either cable or, horrors! broadcast TV (it still exists, for Viagra, Depends and Metamucil )

Benzinga - 1:21 pm EDT

Donald Trump Praises Elon Musk With One Word Answer, Remains Critical Of Electric Vehicles

Donald Trump Praises Elon Musk With One Word Answer, Remains Critical Of Electric Vehicles

bigsmooth125

Member

Please tell me the irony in this statement was intended.No, I don’t believe they do. A person who feels a need to judge and criticize another, particularly publicly on the Internet, doesn’t truly appreciate the person, their uniqueness, or their achievements, otherwise they wouldn’t do it in the first place. It’s atrocious, unnecessary behavior.

ZeApelido

Active Member

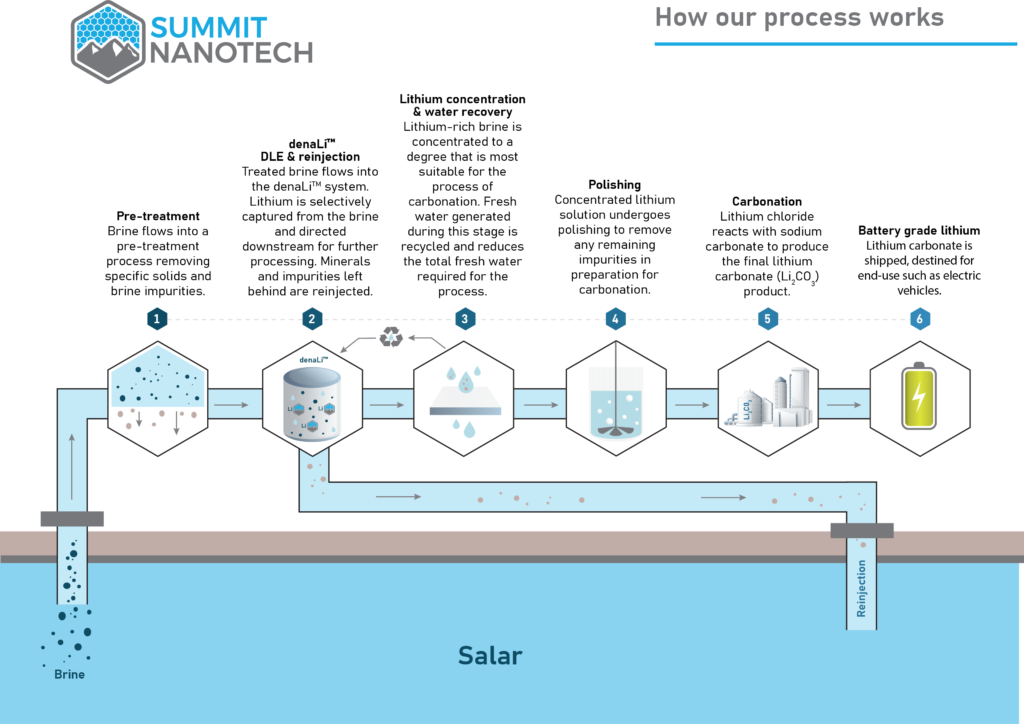

This project shortens time to produce battery grade lithium from 18 months to 1 day.

It sounds quite similar to Musk's Battery Day claim that you can just mix lithium clay in a solution, extract the lithium, and put the rest back into the ground...

It sounds quite similar to Musk's Battery Day claim that you can just mix lithium clay in a solution, extract the lithium, and put the rest back into the ground...

“We use advanced lithium-selective nanomaterials through our patented sorbent material to selectively pull the lithium from a brine solution resulting in a high-purity, high-yield lithium concentrate, Hall said. “Our sorbent limits the need for chemicals, a cost that adds financial and environmental impacts to today’s mining operations.”

Summit Nanotech’s CEO pointed out that a key component of the denaLi technology is the management of water, an issue that tends to be controversial in the places where lithium brine resources are found. The water that occurs in most of those areas, such as the Andean Puna, is scarce and yet critical to local ecosystems.

“Through our water recovery process, we reinject the brine with the non-lithium associated materials, back into the brine layer to maintain associated freshwater resources,” Hall noted.

“The small amount of water that is used is re-purposed and recycled back to the beginning of our process for pre-treatment and filtration.”

This process allows the denaLi DLE technology to shorten the lithium production time from 18 months to 1 day. It also allows for customization at the polishing and carbonation stage depending on the miner’s existing infrastructure.

Krugerrand

Meow

Naturally.I see where you are coming from, and I do have an affinity for cats, as noted in the avatar picture, so let me just ask, “Does your statement apply to Elon as well when he does the same?”

Sounds like so far it's reducing material costs:I guess Tesla still isn't certain on the manuf credits and is not accounting for them. Could become a windfall later in the year.

On August 16, 2022, the Inflation Reduction Act of 2022 (“IRA”) was enacted into law and is effective for taxable years beginning after December 31, 2022. The IRA includes multiple incentives to promote clean energy, electric vehicles, battery and energy storage manufacture or purchase, in addition to a new corporate alternative minimum tax of 15% on adjusted financial statement income of corporations with profits greater than $1 billion. Some of these measures are expected to materially affect our consolidated financial statements. For the three month period ended March 31, 2023, the impact was primarily a reduction of our material costs. We will continue to evaluate the effects of IRA as more guidance is issued and the relevant implications to our consolidated financial statements.

…

Cost of automotive sales revenue increased $4.51 billion, or 41%, in the three months ended March 31, 2023 as compared to the three months ended March 31, 2022, in line with the growth in deliveries year over year, as discussed above. Further, the average combined cost per unit of our vehicles increased year over year due to increasing prices of raw materials, manufacturing, logistics and warranty costs. These costs were partially offset by manufacturing credits earned as part of the IRA during the three months ended March 31, 2023. There were also idle capacity charges primarily related to the ramping up of production in Gigafactory Texas and our proprietary battery cells manufacturing during the three months ended March 31, 2023. We had also incurred costs related to the ramp up of production in Gigafactory Berlin-Brandenburg during the three months ended March 31, 2022. These increases in costs of revenue were positively impacted by the United States dollar strengthening against other foreign currencies in the three months ended March 31, 2023 as compared to the prior period.

Tesla 2023 Q1 Form 10-QWADan

Member

(Sorry if this had been posted)

I would hire this guy to do commercial for CT (not that it’s needed):

I would hire this guy to do commercial for CT (not that it’s needed):

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K