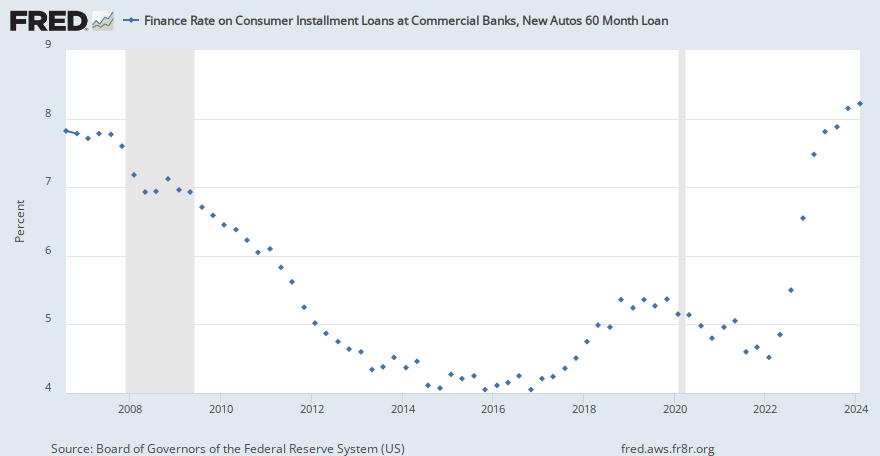

So last year, for example, June 2022 it was $62,990 for a Model 3 Performance (peak price that was around for most of 22 until mid-Jan 23)- and 60 mo loan rates history is here:

Graph and download economic data for Finance Rate on Consumer Installment Loans at Commercial Banks, New Autos 60 Month Loan (RIFLPBCIANM60NM) from Aug 2006 to Nov 2023 about installment, financing, consumer credit, vehicles, new, loans, consumer, interest rate, banks, interest, depository...

fred.stlouisfed.org

You're looking at 4.85% here- so your monthly on 62,990 (ignoring fees/tax/etc since those vary by state) is $1,184.38

Most recent loan rate on the Fed chart for 60 mo is 7.88%, but the car price is down to $50.990. Your monthly is $1,030.97

It's over $150 a month cheaper NOW with high rates than it was with low rates and a more expensive car.... or over $8000 cheaper over life of loan

today than mid last year.

$58,490 is all they needed to cut the price to if they were just wanting to keep the monthly payment the same now as June 2022.... Instead they cut it MUCH further.

This "it's much cheaper now" would get even bigger using the Y, their best selling model, since the drops there were even larger...a Performance Y for example, using same dates and rates, goes from $1315.99 a month June of 22 to $1061.30 a month.... almost a $300

per month cheaper payment today.

It's not the rates.

It's basic econ--- that to find more buyers once you've exhausted all those able and willing to pay existing prices, you have to lower your prices. Which is what they've done.... and would have to continue to do if you grow production (of the same vehicles) another 20-40% next year. At over 60k on these cars they had 1.3M buyers in 2022. But at just over 50k they had 1.8M in 2023 (ignore S/X, they're steadily approaching rounding errors in volume). If they want to find 2M (or 2.4M as some of the VERY optimistic here think) they're gonna need to go lower to find that many people able and willing.

Elon has raised this exact point himself- it's not lack of demand, it's a question of demand from those ABLE to buy- and as the math shows the amount you need to move the price to add like 40% more buyers is a lot more than the difference interest rates make.

Well, that blew my case without a deep dive on Tesla's process.