Can someone please explain to me how a judge can override the shareholders vote for Elon musk pay package.

She

can't (but it'll still take a year or more to undo what she's done). Another case was overturned on appeal in the

Delaware Supreme Court which ruled that the

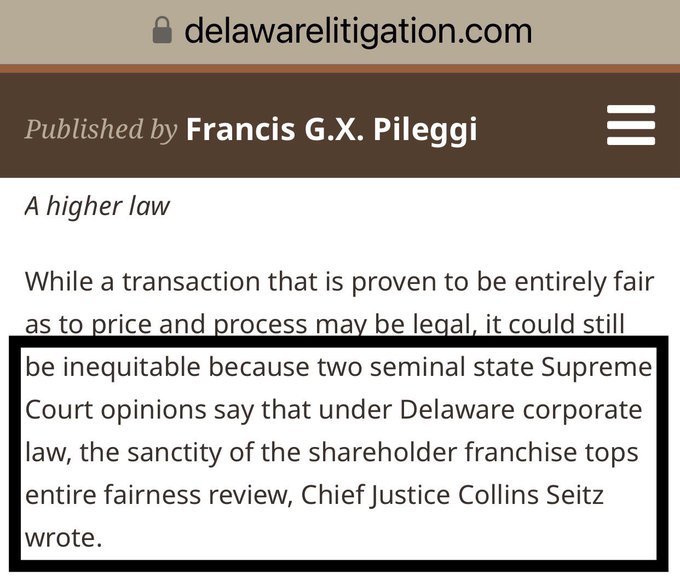

"entire fairness doctrine**" DOES NOT overrule the Investor franchise. Simply put, the judge isn't allowed to put her view on a contract above Investor's will as expressed in a vote. This is

IMPORTANT, so here's more:

**The "entire fairness review" is the legal mechanism by which Judge McCormick shifted the burden-of-proof in this case from the plaintiff to the defendant: (more here as a start)

Entire fairness requires the court to strictly scrutinize all aspects of a transaction to ensure fairness, and, as such, “fairness as to one prong will not necessarily sterilize or immunize a defendant from liability.”

[PDF] The Business Judgment Rule and the Entire Fairness Doctrine | rc.com

The Judge

doesn't get to override Shareholders on 'whole fairness' grounds, in spite of her attempt to paint the vote as being invalid because Investors were 'uninformed'. Yeah, like the way she didn't inform readers of her 200 page Manifesto that Elon was also voted in by Shareholderes as

CHAIRMAN of the Board and he was relected numerous times (so

of course he had

influence and close relationships with the Board. So what?! That's

NORMAL. Show that's a problem, or illegal! Else, fizzle...)

So here's the

Legal Deal:

- WE ARE LEGAL ADULTS;

- WE ARE LEGALLY RESPONSIBLE,

- WE VOTED AS LEGALLY ENTITLED

- THE JUDGE CAN'T OVERIDE THAT, LEGALLY.

Judge McCormick was also wrong in law on her dependance on the notion that Board Members weren't "

truly independant". That has no meaning in law. The NASDAQ stock exchange itself defines an

Independant Board member as follows:

“Independent director” means a person other than an officer or an employee of the company or its subsidiaries, or any other individual having a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Corporate Governance Guidelines - nasdaq investor relations | ir.nasdaq.com

Only Tesla's Independant Board Members participated in the CEO Comp Plan negotiations, and the plan itself was devised by an outside group of professional Compensation consultants and acedemic advisors. In the Financial Press at the time, the CEO Comp. plan was widely touted as wildly ambitious, impossible, and a great deal for shareholders if it works. Which it did. That group no longer exists; it is not a simple matter of voting again with new information (the Judge set up this problem for the future of any comp. plan).

So, this judgement inevitably will be overturned on appeal. An experienced Judge shirley would know this (she's the Chief Justice of the Chancery Court, BTW so she's

not inexperienced). No, very likely she knew that, and issued her 200 page Manifesto on Billionaire "Fair Pay" anyway, knowing full-well that the appeal would stretch well beyond Jan 2025 before her judgement is overturned.

Here's a rough outline of the timing for the Appeal process:

- Her findings were published on Jan 30, 2024 which starts a clock ticking

- she has 60 days after that to issue a final judgement (after negotiations inevitably fail between the parties)

- That's April 1st, 2024 which is the earliest possible date on which Tesla can file an appeal, but I believe they have at least 30 days to do so

- That's May 1st, at which time the Delaware Supreme Court has to decide if they will hear the appeal (they'd risk chaos if they said no), then they have to schedule oral arguements for the appeal, give that at least another 120 days (or more)

- That's takes us to at least Sep 01; Call it 5 days of oral arguments, a round of final remarks from each side, and then the appeal goes to the members of the Court to deliberate. Then its likely 6 months to get a ruling, that takes us to ~Mar 1st, 2025

Here's the cynical part: the timing of the

2024 U.S. Senate election cycle in Delaware:

- there is no incumbent running for re-election in Nov 2024 (Dem Senator is retiring)

- there's 1 announced Dem. candidate who is a 1-term Member of the House (junior)

- Democratic nominations for Senate close on Sep 08, 2024 in Delaware

- by that time (according to the timetable above), Judge McCormick will have finished her legal role in the Elon Musk's CEO Comp case, and will feel free to pursue any larger political ambitions she may have... (did you READ THE MANIFESTO?)

- She began "Does the richest man in the world deserve"

- The Senate seat will be voted on on Election Day: Tues, Nov 05, 2024

- Newly elected Senators will be sworn in at Noon E.T. on Jan 03, 2025

So you see, this judge (and her Anti-Billionaire Manifesto / Campaign platorm) could well run for Senate, be elected, and sworn in ALL before the Delaware Supreme Court issues a ruling on their appeal of recinding the CEO Comp. Plan.

Why is this CYNICAL you may ask? Well, the Judge wrote in her 'findings' that Elon "controlled the timing" of the Comp Plan negotiations? (yeah, so? didn't show that it affected the outcome, though). And per the above, we see that Judge McCormick, by wating 14 months from the close of oral arguments until delivering her decision, CONTROLLED the timing of the appeals outcome (which she shirley knew would be negative for her), so that the APPLEAL would not influence or affect her election to the U.S. Senate.

Why is that a problem? Her agenda is clearly Anit-Billionaire, and specifically Anti-Elon because of the out-sized confidence placed in him by Tesla shareholders (81% per your comment). Would-be Sen. McCormick could very possibly co-sponsor a Senate Bill to impose a 1% annual Tax on Billionaire's stock holdings.

This is bad. Bad for busines, bad for the economy, and bad for investors. Elon 's shares are not readily negotiable for cash (as would be required to pay annual taxes). When a large insider sells, the stock crashes (we saw 100:1 drops in Market Cap vs. value of Shares sold). The stark reality is that Market Cap is not the same thing as Enterprise Value, and it makes extremely poor business sense to sell a fixed portion on a predictable timetable (c.f. hedge fund 'snarks' smelling blood in the water). Some things take time, like Model 2, which will be 8 years in the making.

TL;dr Judge McCormick may be setting herself up to us this Delaware Chancery Court decision to launch a political career in the U.S. Senate with omious consequences for any business which trades in public markets, as does TSLA on the NASDAQ stock exchange.

P.S. The Judge in this case closed here opinion by writing "The Plaintiff is entitled to recision". I counter that the Defendant is entitled to spend any amount he sees fit in the U.S. Senate race in Delaware in 2024, and he'd be doing us all a favor if he does so boldly, as he excercies his 1st Amendment Rights. As the U.S. Supreme Court ruled in 2010, "

Money is Speech". I hope Elon will speak LOUDLY if this Judge/U.S. Senator wannabe acts as I have outlined is possible above, and with the full leverage of all his social media influence.

Regards,

Lodger

#Predict