juanmedina

Active Member

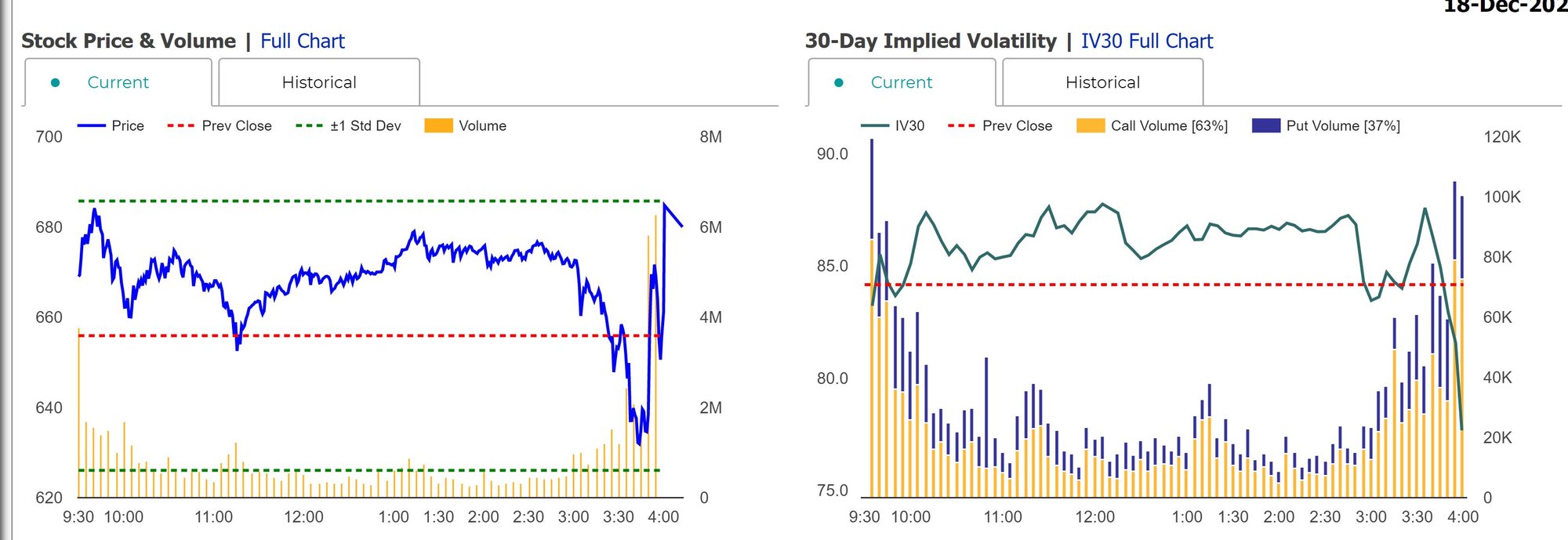

What happened the options contracts at the end of the day on Friday? I have been offline since Friday afternoon so I assume this may have been discussed somewhere else already but I never seen options go down on price so fast. All the options closed at about what they were worth on Wednesday the 16th; SP around $620 with an IV of 83%. Will we see farther IV crush on Monday with the options opening at a even lower price? I sold some of my options Thursday morning so it seems that I could rebuy some of my contracts at a small discount. @FrankSG @brx140 @ggr