Why would a short try to cover above $420 though? Still trying to learn how this works..

Even though Tesla will pay you $420 for 1 of your shares...

what if you valued that share at more than $420?

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Why would a short try to cover above $420 though? Still trying to learn how this works..

Me tooI don't want to give any advice... All I can say is that I exited all my LEAPS right after Musk uttered the words "taking Tesla private" and bought shares with the proceeds.

Why would a short try to cover above $420 though? Still trying to learn how this works..

Because of leverage. Someone please tell me if I'm doing this math wrong.

265 J20 call option, buy for 135.75x100=13,575

On the last day, hopefully the SP will be around 420. 420x100 =42,000

Cost of conversion = 265x100=26,500

42000-13575-26500 = 1,925 gain per call option

If I buy 10 such call options for 135,750, I'll walk away with 19,250 gain, or 155,000 total

If I buy the equivalent in shares (assuming385), that's 352 shares, x420 = 147,840 total

Is my math correct?

It might not be possible to close out. If the holder exercises tonight, you will have sold your stock for $300 before the market open tomorrow.have a short covered call @300 8/17, anyone have any idea whats going to happen to this? should i (assuming i believe the price will rise) close out ASAP?

Because he just got a margin call. Or the broker just does it on his behalf without asking, after liquidating his other holdings as necessary.

Why would a short try to cover above $420 though? Still trying to learn how this works..

If Tesla goes private, are shareholders essentially guaranteed $420/share? So buying now around $380 will guarantee a ~10% gain in the short term?

The great thing about this thread is that has made me completely forgot about where my Model 3 order is. Forgot to refresh my order page all day.

Why would a short try to cover above $420 though? Still trying to learn how this works..

Maybe we should start discussing other stocks/trading strategies. Anybody want to suggest a proper venue?

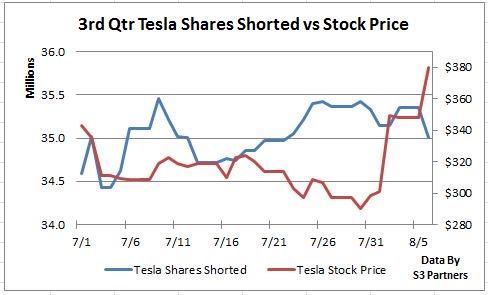

A short squeeze could push the price well above $420 and force Elon to raise the buyout bid.

Can you explain how they can wait and cover at 420$?

They dont own any shares - and get no right to buy shares at 420$.

They need to buy them back before Tesla goes private?

If Tesla goes private - they need to fin a way to buy shares from this private entity. They then have to be on board with Elon already and part of the plan to go private?

A short squeeze could push the price well above $420 and force Elon to raise the buyout bid.

It's a lot more like just selling the stock (which protects against big drops!). Since you said big drops, this means you sold it recently, while it was DITM. So consider your stock sold because selling a call definitely protects against big gains which you just presumably missed. I feel your pain. I sold an Aug 10 345 strike call (and 345 put, it was part of a straddle) this morning for a net $12.00. Lost out on all but $12.00 of the big move on 100 of my shares. Fortunately I have more shares that were not covered. Of all the days to sell a straddle. At least the call side was covered.why the surprise? it protects against big drops. I cant believe anyone expected this to happen today... ive made quite a bit of money doing this.

I'm actually curious on this. While a short squeeze would raise the value of the stock, it only has that effect as long as the squeeze continues. Couldn't Elon just wait out the short squeeze until all shorts have covered and then proceed at the lower value?

I'm actually curious on this. While a short squeeze would raise the value of the stock, it only has that effect as long as the squeeze continues. Couldn't Elon just wait out the short squeeze until all shorts have covered and then proceed at the lower value?

Seems obvious - you either sell during short squeeze if it happens or go private.Even though Tesla will pay you $420 for 1 of your shares...

what if you valued that share at more than $420?