Shortville Times: SEC retains Michael Cohen as lead counsel in lawsuit against Elon Musk

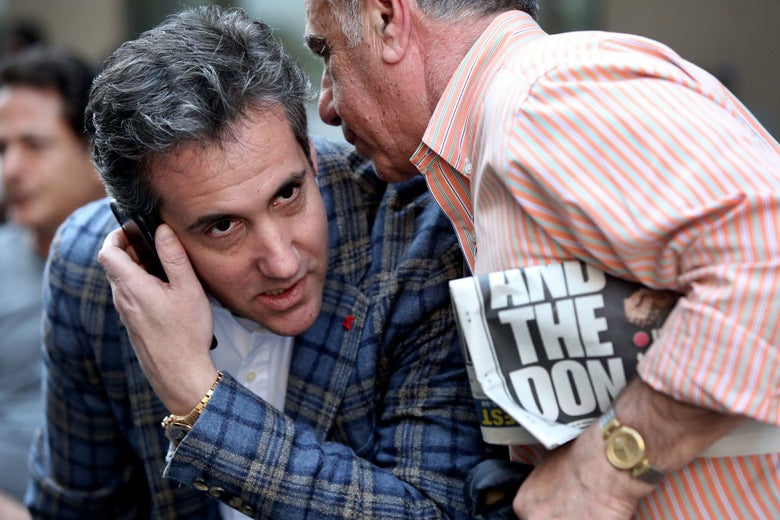

Michael Cohen, well-known lawyer with decades of business connections to Russian interests, has been retained by the SEC as lead counsel in their lawsuit against Elon Musk.

"We are pleased to announce that Michael Cohen, former personal attorney of Donald Trump, has agreed to take lead of the lawsuit against Elon Musk" the SEC said in a press conference. "He brings decades of experience of shady legal tactics and questionable ethics, making him the perfect match to the SEC's enforcement against Elon Musk" Stephanie Avakian, co-director of the SEC's division of enforcement, said during the press conference.

Yesterday, in a widely mocked legal filing, the SEC uncritically adopted arguments of so-called "short-sellers", who are shady investors who earn money when Tesla shareholders lose. "While short sellers are undoubtedly parasitic barnacles on the hull of Tesla living at the expense of shareholders who are operating on the thin boundary of legality here, personally I find them adorable rouge actors" said Dana Hull, widely respected expert of the automotive industry, adding that "Michael Cohen, while not the sharpest tool in the shed, is also such a cutie".

The SEC explained their decision in a statement: "The fact that Michael Cohen is now a convicted felon was an extra quality in favor of our decision to hire him, as no other attorney would be willing to take this case.

Technically Michael Cohen is not disbarred yet as an attorney."

The SEC further added: "That we rushed to bring enforcement action and asked for unprecedented sanctions against Elon Musk just two trading days before Tesla releases their third quarter delivery report, which is widely expected to show large growth, was entirely intentional: we needed to get this filing on the docket before the delivery report belied a central thesis of our legal argument. We certainly cut it close but fortunately made it! Go Team Shorts, we here at the SEC are rooting for you! #$TSLAQ FTV!"

Copyright (c) 2018, The Shortville Times, Fake News Edition