Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Fact Checking

Well-Known Member

Its demand will of course continue to grow, as demand for petrochemicals will continue to grow.

The price of oil is already super sensitive to 1-2% year-over-year fluctuations in demand.

The drop from 99-101% levels to 16% levels is going to tank the price of oil for years down to the margin of production, creating a Big Depression like environment for oil investments (outlined in @neroden's article), which could last up to a decade ...

The new oil industry rising out of the ashes of the fossil fuel industry will be different, and it's also not inconceivable that synthetic and renewable sources of hydrocarbons will be preferred instead, synthesized directly from convenient forms of biomass, because they are a lot simpler to operate than crude oil refineries that have to clean up and organize the rather complex chemical mixtures of ancient, dead marine life with sulfuric and other contaminants ...

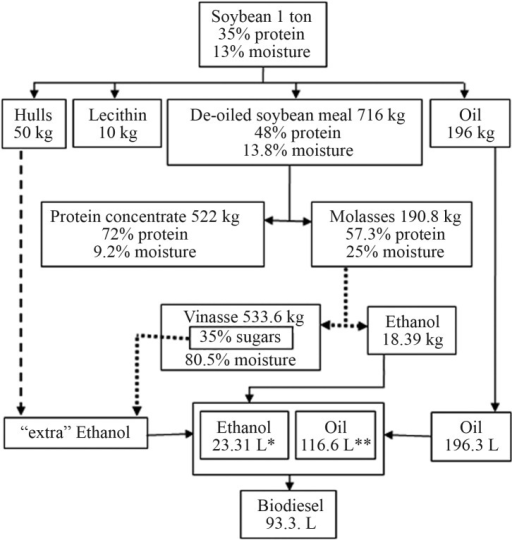

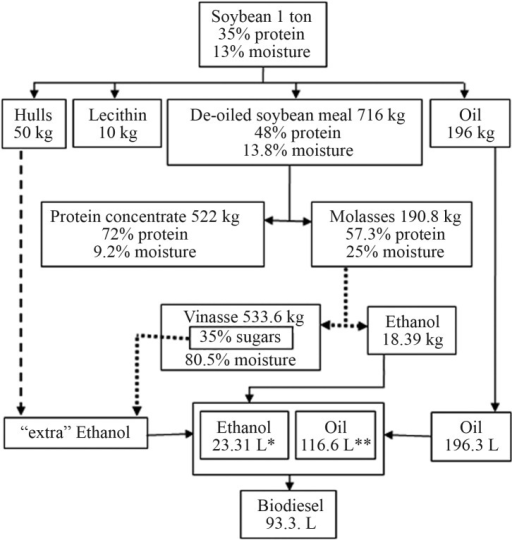

The economics of 'bio-polymers' doesn't look bad:

This might be especially true in the U.S./Canada which has a lot dirtier sources of crude that are expensive to extract and refine.

I'd also not be surprised if Elon was interested in entirely synthetic polymer production, made from water and carbon dioxide from the atmosphere (with methane rocket fuel as a potential output if copious amounts of electricity are invested

This would be one level beyond 'green polymer', it would be called 'blue polymer': which would help reduce atmospheric CO₂ levels and save the blue planet. You heard it here first.

Fact Checking

Well-Known Member

New SWIFT transfer secured. It's buying-day in Teslaland.

Nice, now we know the reason for the pre-trading spike in $TSLA: Wall Street was of course informed about the completion of your SWIFT wire transfer before you were.

bhtooefr

Active Member

There is also Tatra, which exists to this day (although it did spend a few decades nationalized (due to communism), and in recent years it's been passed between parent companies).A ~120 years ago carriage makers and horse breeding was a source of national pride and of profound economic military importance - yet Studebaker Brothers Manufacturing Company was the only wagon and carriage making firm that survived the automobile age in corporate form, up until the 1960s-70s, and horse breeding isn't that strategic anymore either.

Yamantasdivar

Member

JRP3

Hyperactive Member

I can't figure out BFRP.(I'm actually building my home with BFRP rebar. Would much rather CFRP, but it's much more expensive. But BFRP is better than GFRP!)

Big Fricken Rocket Product?I can't figure out BFRP.

The price of oil is already super sensitive to 1-2% year-over-year fluctuations in demand.

The drop from 99-101% levels to 16% levels is going to tank the price of oil for years down to the margin of production, creating a Big Depression like environment for oil investments (outlined in @neroden's article), which could last up to a decade ...

The new oil industry rising out of the ashes of the fossil fuel industry will be different, and it's also not inconceivable that synthetic and renewable sources of hydrocarbons will be preferred instead, synthesized directly from convenient forms of biomass, because they are a lot simpler to operate than crude oil refineries that have to clean up and organize the rather complex chemical mixtures of ancient, dead marine life with sulfuric and other contaminants ...

The economics of 'bio-polymers' doesn't look bad:

This might be especially true in the U.S./Canada which has a lot dirtier sources of crude that are expensive to extract and refine.

I'd also not be surprised if Elon was interested in entirely synthetic polymer production, made from water and carbon dioxide from the atmosphere (with methane rocket fuel as a potential output if copious amounts of electricity are invested) or plastic output with very little energy invested.

This would be one level beyond 'green polymer', it would be called 'blue polymer': which would help reduce atmospheric CO₂ levels and save the blue planet. You heard it here first.

Biopolymers are not the same thing. They have specific applications, but are not drop-in substitutes for the vast majority of the chemicals that industry needs. And oil is used as a feedstock - rather than Fischer-Tropsch or any of the alternative techniques - because it's by far the cheapest form of feedstock, because it's already roughly in the chemical form that you want, as well as containing its own energy.

But yes, the price will collapse - at least for a good length of time - which is why I accounted for the mean price per barrel being $40 rather than $70

15 years may sound like a long time, but it's a huge economic problem for any oil infrastructure with a long lead time - say, deep sea drilling platforms - that can take a decade or more to start producing and which are expected to produce for decades.

Last edited:

Carl Raymond

Active Member

Did Tesla produce 7,000 M3’s last week or is it delayed or was that next week?

Pretty sure they are only stress testing that rate initially. If all systems hold up, then they set a date to make 7000 the new normal. Assuming some part of the process doesn't cope, they address that first then set a date.

I can't figure out BFRP.

Basalt fibre reinforced polymer. Rather similar to glass fibre, but it's more chemically complex. Rather than made from pure silica sand, it's made from molten basalt. It has a somewhat lower environmental footprint and is somewhat stronger and more durable. But it's also somewhat harder to produce - it has a higher melting point, and it's opaque, so it can't be radiatively heated effectively.

Basalt fibre is the only one of these (CF, BF, and GF) which occurs in nature (Pele's Hair)

** -- Much rock wool is made from slag, which is sort of like "basalt plus a bunch of calcium oxide".

Last edited:

sweter

Member

BTW., while I agree with the points you made, we probably disagree on this one: I believe Toyota, Honda, Ford and Chevrolet are not relevant mainly not because Tesla isn't at their sales level "yet" to be able to compete, but mostly because they are not building enough of an EV manufacturing infrastructure to survive the EV transition with their current market power even remotely intact.

I.e. I think it would be fair to leave them out of the list because they literally do not matter, by choice Toyota, Honda, Ford and Chevrolet are competing in the mostly detached, dying market of ICE vehicles that has only tenuous connection to the fledging EV market by way of superficial and entirely deceptive similarities between Teslas and ICE vehicles. In reality there's probably more of a product and technology overlap between Dyson vacuums and Tesla cars than Toyota cars and Tesla cars...

In reality the iPhone never competed with Blackberry phones either, it superseded and killed them without much of a competition.

The ICE vehicle market is 'big' in the sense of the Titanic having been the largest ship floating on the seas, before that iceberg came along.

Since we're all excited about how Toyotas and Hondas are common trade-ins for Model 3, I think their market share is very relevant.

Fact Checking

Well-Known Member

But I'm surprised that in your immediately prior analysis of oil price factors you make no mention of EVs. I'll grant that it's too early for transport electrification to be affecting the oil price, but that day is not far off.

So my comment was already way too long, and I intended to covered that angle with my reference to @neroden's article:

(Note that the various long term factors @neroden pointed out in his recent excellent article about the upcoming crash in the ~100 trillion dollar worth of fossil fuel corporate and mineral assets values are comparatively 'long term' processes that take years to realize, with a very visible 'crash' phase that will be short and televised. Today these effects probably don't have immediate effects on the price of oil which is mainly set by the above forces - but very likely there's already a material change in investor sentiment towards future fossil fuel investments and corporate valuations.)

Basically IMHO there's a fundamental, order of magnitude speed difference between the 'EV transition' and 'the electrification of transport':

- The automotive industry largely depends on 'new car sales'. In Norway EV sales already crossed the 50% threshold when EVs were only something like 10% of the total vehicle fleet. With the average car life cycle of 7 years, increasing steadily, that's a multiplication factor of 7x.

- The transportation industry depends on the current commercial vehicles fleet. EV conversion is slower in that space due to commercial transport being a lot more fuel cost sensitive than consumers to whom convenience and transport of transportation and refueling has a big value as well. Growth could easily be another ~40% lower in this space.

- There's a lot of fuel used by the airline industry, and there kerosene has obvious mass density advantages. Planes also have even longer life cycles: if maintained properly a plane can last for decades.

Inevitably this results in different time scales - and the price of oil is generally impacted by events a few months down the line and futures contracts rarely go beyond a year and the time premium is massive.

Gas stations might long be on the decline and owning a gasoline car might already be a social stigma, while much of commercial transport will still be using diesel. Then there's also the various industrial processes that use oil for heating - those take time to replace as well.

Corporate valuations of fossil fuel companies is a different matter - there the long investment cycles work against their valuation, as many investors will try to look 1-2 decades into the future.

I.e. there's a lot of natural short-termism in the price of oil, but, somewhat paradoxically there's a lot of long-termism in the valuation of fossil fuel related companies.

Fact Checking

Well-Known Member

Most people are familiar with basalt fibre in the form of (some types of) rock wool, which are the basalt equivalent of fibreglass.

Why am I not surprised about a lot of molten rock related know-how coming from ... Iceland?

A German Journalist was wondering:

"if Tesla produces 7000 cars/week how many EVs do German manufacturer BMW, Daimler and VW ect produce today?"

Its been a simple and straight forward question and this is what he got as a reply

BMW: 800

Daimler: 0

Opel: 0

Porsche: 0

VW: 1000

Vergleich mit Tesla: Wie viele Elektroautos bauen BMW, Daimler, Opel und VW?

"if Tesla produces 7000 cars/week how many EVs do German manufacturer BMW, Daimler and VW ect produce today?"

Its been a simple and straight forward question and this is what he got as a reply

BMW: 800

Daimler: 0

Opel: 0

Porsche: 0

VW: 1000

Vergleich mit Tesla: Wie viele Elektroautos bauen BMW, Daimler, Opel und VW?

Simple and straightforward answer...not nearly enough.A German Journalist was wondering:

"if Tesla produces 7000 cars/week how many EVs do German manufacturer BMW, Daimler and VW ect produce today?"

Its been a simple and straight forward question and this is what he got as a reply

BMW: 800

Daimler: 0

Opel: 0

Porsche: 0

VW: 1000

Vergleich mit Tesla: Wie viele Elektroautos bauen BMW, Daimler, Opel und VW?

Fact Checking

Well-Known Member

Big Fricken Rocket Product?

Since @KarenRei was talking about Icelandic housing construction technologies, the more probable one would be Big Fricken Rock Product?

Why am I not surprised about a lot of molten rock related know-how coming from ... Iceland?

Heh, it's one of the reasons I'm using BFRP. The construction industry (everywhere, not just here) is extremely resistant to change, as the things they build have to last for so long and few builders nor customers have interest in "experimenting" with something new, even when it's promising. I want to help break the path for others to follow. Because if it were to become popular here, we could produce it locally, in an extremely environmentally-friendly manner (geothermal energy, local basalt). And let me tell you, if there's anything we'll NEVER run out of here, it's basalt!

I'm also using a pozzolan-heavy concrete mix (pozzolans are a class of materials which lead to a slower-setting but longer-lasting concrete, more akin to Roman concrete). Specifically, the pozzolan will be basalt dust. Which again, is basically in unlimited supply here. It can displace a good chunk of the cement in the mix (cement having a huge CO2 footprint). So the (dry) mix is ~80% aggregate, ~10% basalt dust, and ~10% cement, so 90% local material, and half the normal CO2 footprint. Not counting the reduced footprint from using BFRP rebar. Unfortunately I can't use BFRP rebar everywhere - I have to use stainless in certain key locations - but it's mostly BFRP.

Note the repeated emphasis on longevity (pozzolans, FRP, stainless, etc). Because a house you have to rebuild every 50 years has twice the environmental footprint of one you have to rebuild once every hundred years, which has twice the environmental footprint as one you have to build every 200 years.... etc. While it's very hard to pinpoint just how long mine should last, with the amount I'm overdoing the rebar, and trying to keep structures in compression rather than tension, it should at least be in the hundreds of years, and potentially the thousands.

Fact Checking

Well-Known Member

"if Tesla produces 7000 cars/week how many EVs do German manufacturer BMW, Daimler and VW ect produce today?"

BTW., since Tesla is now peak-testing 7,000 Model 3's per week now, and there's about 2,000 Model S/X's made per week, the better rate is probably that Tesla is making 9,000 EVs per week, to go up to ~12,000 EVs per week next year.

I.e. Tesla will be growing EV output faster within the next ~6-9 months than the entire current German EV production is today - and that ignores the fact that basically all of the current German EVs are non-competitive with Tesla's offerings to begin with, most of them are escaping to lower price segments and are using the fact that there's very high demand for even mediocre EVs to be sold.

A German Journalist was wondering:

"if Tesla produces 7000 cars/week how many EVs do German manufacturer BMW, Daimler and VW ect produce today?"

Its been a simple and straight forward question and this is what he got as a reply

BMW: 800

Daimler: 0

Opel: 0

Porsche: 0

VW: 1000

Vergleich mit Tesla: Wie viele Elektroautos bauen BMW, Daimler, Opel und VW?

VW CEO Mueller a year ago: "The break through of new technology does not come with world champions in announcements. It comes with those who bring a new technology in masses on the streets"

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 96

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K