Looks like a straight line up so far...me like.NO!!!

Give me two more days...just 2 more! A little more rebound and then you can reload as much as you want. LOL!

(You know why)

Dan

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

mickificki

Member

Love this guy, he’s not afraid to speak his mind but will also be a gentleman while doing so.

Setting aside the question if whether Gali is the best person to represent retail shareholders, it's nice to see Tesla continuing to put action behind Elon's words and give Hyperchange the same tour access they gave the big fish.

Dan Detweiler

Active Member

I am counting on one of those sales jobs once I retire from teaching at the end of the year. What a great way to "retire". Hope I can make it happen.Has anyone been keeping an eye on tesla.com/careers ?

I just went there and looked at open positions in 'Sales' for the USA. This returns a large number of 'Associate Delivery Manager', 'Customer Experience Specialist', 'Delivery Experience Specialist', 'Delivery Supervisor', 'Owner Advisor' and 'Vehicle Prep Specialist'.

So I deduce that deliveries are handled by the 'Sales' department - and that a significant expansion is still foreseen for the US.

I then do the same 'Sales' search, but this time for Europe and get a much smaller number (71) of open positions. Fair enough.

Of these 28 (40%) are German language (Junior) Sales advisors, half in Germany (the other half in Austria/Switzerland).

The second largest group of (25) open sales positions (35%) is for a 'Product Specialist' (who just has fun talking about how great the cars are without trying to sell anything. Tesla could fill these with TMC people who have a clean shirt), these 25 positions are all open in non-German speaking countries, incl. the UK.

The same search for Asia/Pacific returns a list dominated by 'Product Specialist' for China.

So is it reasonable to interpret this to mean that Tesla is indeed preparing to significantly increase their sales in Germany and German speaking countries? (a quick search seems to indicate Austria has a 3k€ BEV-incentive in 2019H1).

And that for the remainder of Europe (+ China) Tesla is preparing to increase if not directly their sales staff then staff that indirectly lead to sales?

Has anyone looked at Tesla's careers page some time ago, so an idea can be formed of what kind of change there is in their hiring pattern?

Thanks.

Dan

beachbum77

Banned

Your friend misread the article. PEBB is remodeling the old Volvo dealer for Tesla's use. They also bought the Gander Mountain property and are planning a possible office complex there.(note: google picture is probably 1-3 years old)

View attachment 334206

There is a thread for the new Tesla dealership with photos New Tesla store in West Palm Beach!

Last edited:

@lklundin My understanding is uptake on the current incentive is very low. Do you have a feeling on how that may change with Model 3?

Agreed, it has so far been very low.

I expect the German authorities to abide by their own laws. They could maybe try to delay the formal approval of the Model 3 for import in Germany, but the rest of the EU would probably not agree to such shenanigans. So with the 19 Model 3 VINs announced to have been registered for Europe, I expect Tesla to be well on their way to be ready for sales in Europe after New Year, and that the incentive programs from the various, relevant countries will see significant amounts of money going towards sales of the Model 3. See also my previous post.

There are other German EV incentives, yes. E.g. the added income tax on company cars goes from 1.0% of list price per month to 0.5% for EV’s. For reasons of German unemployment rates, hybrids are considered EV’s as well.Is a €4k incentive really a show-stopper? Just asking? I assume you get other benefits too, like minimal car tax and for companies good tax deductibility?

As things look like now, there will be an EU import duty of 10% on Tesla Model 3. So far these duties were bypassed by assembling S and X in Tilburg, The Netherlands. This will not be the case for Model 3.

Just returning the 10% EU import duty would be an equally good incentive as the German one, when replacing it EU-wide.

Fact Checking

Well-Known Member

Is there information from Tesla

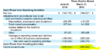

Q4 '17 letter said some CapEx was deferred to Q1 '18

Q1 letter said more than half of the 656 Million CapEx was for 3 at Fremont, GF1, and tooling. Projected < 3 Billion for the year down from > 3.4 Billion.

Q2 letter projected <2.5 Billion CapEx for 2018. Currently at 1.27 Billion.(610 million for Q2)

So expected spend is ~612 million a quarter.

My recollection from conference calls is that the existing 3 CapEx should be mostly wound down, so the additional is new equipment.

Given their slowed pace of 3 volume increase and talk of 8k, I'm expecting even lower CapEx for Q3/Q4.

I believe they already paid $1.2b in 2018, so there's about $1.3b left for the year: ~$650m for Q3 and Q4 if evenly split.

These are contracted for payments mostly I believe, for equipment already ordered and delivered, or delivered by the end of the year.

In early 2019 the full force of capex savings should start kicking in - it might already help Q1/2019 cash flow significantly. Tesla has not guided about it yet, but it would be surprising if there was much left, given how much they paid in 2017+2018 already.

This is why they delayed the Semi and the Y earlier this year, they want to self-finance from 2018 and 2019 internal cash flow.

They're not going to call bonds with that low a coupon interest rate. Not with the current interest rate trends.

Callable with 15%profit in short term.

Dan Detweiler

Active Member

Look! Somebody has finally uncovered what's underneath the foundation at CNBC! LOL!

Dan

Dan

Tslynk67

Well-Known Member

No, not for me as a buyer. Keep in mind, no one in Europe knows the Model 3 pricing (except what guesses may be made from current Model S/X US vs EU pricing), so there is already plenty of uncertainty regarding the price.

My reasoning regarding incentives is from Tesla's perspective (and thus for me as an investor): With potentially many millions of Euro in difference to the buyers, there may be a tangible difference in revenue by keeping an eye on the incentives in the different countries.

My personal interest (and thus my disclosure) is more along the lines that a focus on Germany for 2019H1 would mean that Tesla would actually meet their delivery prediction.

Here in Belgium, there's no EV incentive - well maybe some regional ones, but generally not. All cars are taxed based on their CO² emissions, which I think is the same model in much of Europe. Seems a very fair approach to me.

Where Tesla struggle without incentives is in countries like Denmark, where cars attract a 250% tax markup. This makes a Tesla incredibly expensive, so when they removed the incentive the sales went close to zero. But what you need to realize, is that all other cars of comparable price, to the Audi 16's, BMW 7's, etc., are also stupid-expensive and people don't by these either, so it's not a matter of Teslas not being wanted, just that 99.9% of the population can't afford them.

HG Wells

Martian Embassy

NO!!!

Give me two more days...just 2 more! A little more rebound and then you can reload as much as you want. LOL!

(You know why)

Dan

My train is coming on Friday. I'm counting too on BS and market irrationality.

Okay, based on the feedback so far, let's request that the universe schedule the "highly negative Tesla market event" for Monday

OH I wouldn't wait for that on this timeline.

It's now or never !

310 end of week (I hope)!

shootformoon

Member

he has a pulse on their sentiment. He is not just talking from conjecture. It’s very likely large institutional fund sentiment has shifted negative and that concerns Munster.

It makes sense to have a stronger and more independent Tesla board to act as a check and balance so that there’s a group Elon needs to answer to.

But I do understand the concern that a stronger board would slow Elon down or discourage him. Perhaps Elon has an earth-shattering idea he wants to do at Tesla that would be great, but the board resists due to practical reasons.

esults. And we have every reason to expect 50,000 to 55,000 (at least) M3 sales by end of quarter.

If there are no RWD sales in the next eight months it is most likely because they are still having trouble meeting demand for the higher margin versions. Same for twelve months or whatever. Tesla is making and delivering cars as fast as they can and this will only continue. Prognostications as to exactly when a particular model will start being delivered are, really, just guess and nothing to get that wound up about.

[edited to add clarifying link: TalkAZ 3D - Wikipedia]

[argh: that just refers to a page that ultimately has this:

"DAZ soon: 1- A general good natured attempt at relating an unspecified or incomprehensible timeframe to human understanding. 2- An expression of a theory in quantum physics where time actually stops. 3- Equal to or greater than a Epoch. 4- Wishful thinking."

My point is Tesla/Musk are much better than some other companies in regard

I didn’t get this strong of a message regarding the convertibles. They did say they would pay them back. But I could see a couple reasons other than WWIII that could make Tesla want to let them convert.

Why pay them back, do they have options to directly buy it back from the bond market and write them off.

jeewee3000

Active Member

Here in Belgium, there's no EV incentive - well maybe some regional ones, but generally not. All cars are taxed based on their CO² emissions, which I think is the same model in much of Europe. Seems a very fair approach to me.

The above is only true for consumers.

For businesses there are EV incentives in Belgium, albeit not in the form of a straight discount on the purchase price. Currently a business can fiscally deduct 120% of the purchase price, so EV's are interesting financially.

From January 1st 2020 this tax deduction is limited to 100% of the EV's purchase price.

After that (2021 and on), the Belgian legislator doesn't know yet.

I believe they already paid $1.2b in 2018, so there's about $1.3b left for the year: ~$650m for Q3 and Q4 if evenly split.

These are contracted for payments mostly I believe, for equipment already ordered and delivered, or delivered by the end of the year.

In early 2019 the full force of capex savings should start kicking in - it might already help Q1/2019 cash flow significantly. Tesla has not guided about it yet, but it would be surprising if there was much left, given how much they paid in 2017+2018 already.

This is why they delayed the Semi and the Y earlier this year, they want to self-finance from 2018 and 2019 internal cash flow.

$1.265 Billion invested in Q1+Q2, $1.235 Billion remaining or $617 million for Q3/Q4 (assuming 2.5 Billion total (I expect less, at least for Q3))

RobStark

Well-Known Member

jeewee3000

Active Member

cheshire cat

Member

Or just getting out from behind the EU graveytrain, sorry paywallThere are other German EV incentives, yes. E.g. the added income tax on company cars goes from 1.0% of list price per month to 0.5% for EV’s. For reasons of German unemployment rates, hybrids are considered EV’s as well.

As things look like now, there will be an EU import duty of 10% on Tesla Model 3. So far these duties were bypassed by assembling S and X in Tilburg, The Netherlands. This will not be the case for Model 3.

Just returning the 10% EU import duty would be an equally good incentive as the German one, when replacing it EU-wide.

Tslynk67

Well-Known Member

The above is only true for consumers.

For businesses there are EV incentives in Belgium, albeit not in the form of a straight discount on the purchase price. Currently a business can fiscally deduct 120% of the purchase price, so EV's are interesting financially.

From January 1st 2020 this tax deduction is limited to 100% of the EV's purchase price.

After that (2021 and on), the Belgian legislator doesn't know yet.

The 120% isn't because of EV, it's because of CO², no? So a FCH could get it too, in theory?

And OK, although the deductibility reduces to 100%, it also reduces for polluting cars, so it's not removing an EV subsidy.

That's how I understood it.

And plenty of time before 2020 for the tax authorities to change their minds, as they do...

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 210

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K