This isn't particularly advanced but wasn't sure where else to post this. The SCTY options are supposed to turn into TSLA options post merger (thanks Neroden), and the 2019s are trading. I was able to purchase some 2019 20 calls where the price+premium equates to buying TSLA at about 223. I think that's a pretty good deal to buy TSLA over two years from now since I wouldn't be surprised if it clears 400-450 at some point between now and then. But I guess the added risk in addition to the normal sort would be that the merger falls through.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Advanced TSLA Options Trading

- Thread starter smorgasbord

- Start date

-

- Tags

- TSLA

Jonathan Hewitt

Active Member

For those following my Nov/Dec $200 Calendar spread I have closed it. Not knowing what is going to happen tomorrow makes me want to take a profit while I have it. Last time the morning after earnings my calendar would have sold for an even higher profit than the day before thanks to the front month IV collapsing much fast than the back month but we also had ~0 move in the share price to help. A large share price move would have undone those gains so selling before earnings is the safer thing to do.

I spent $2.40 per spread and sold at $3.2 per spread his time, which is a 33.3% percent return. While this wasn't nearly as good as last time thanks to IV not going up as much and earnings being sooner this was a pretty great return over a period of not much more than a month.

With earnings being sooner this time than expected I wonder if I had done the October/November spread I would have done better. The October options would have expired worthless and I would have the November put still. The problem when I priced out the Oct/Nov spread was that because of earnings October was a lot cheaper than November so my spread would have been more affected by price fluctuations.

I spent $2.40 per spread and sold at $3.2 per spread his time, which is a 33.3% percent return. While this wasn't nearly as good as last time thanks to IV not going up as much and earnings being sooner this was a pretty great return over a period of not much more than a month.

With earnings being sooner this time than expected I wonder if I had done the October/November spread I would have done better. The October options would have expired worthless and I would have the November put still. The problem when I priced out the Oct/Nov spread was that because of earnings October was a lot cheaper than November so my spread would have been more affected by price fluctuations.

neroden

Model S Owner and Frustrated Tesla Fan

"This concludes the merger arbitrage portion of our program. We now return to our regularly scheduled program of selling put options."

With the merger drama over, my merger arbitrage gains have mostly been realized. I acquired some SCTY stock directly, I am set to acquire some through now-in-the-money puts on SCTY (effectively at good prices), and I realized good income from some now-out-of-the-money puts on SCTY. I also bought a few lottery ticket deep OTM calls on SCTY for Jan 2019, *before* the merger was final, because it was a better deal than doing so for TSLA. (It isn't any more.)

And now, as of 9:30 this morning, the prices for SCTY options are suddenly worse than on TSLA options (wider spreads everywhere, probably because they're about to become weird TSLA1 options and be thinly traded), and we're back to unusually high (compared to other stocks) premiums on TSLA put options.

I may get to make money on the puts for a third year running... I thought the premiums would normalize two years ago, but nope.

With the merger drama over, my merger arbitrage gains have mostly been realized. I acquired some SCTY stock directly, I am set to acquire some through now-in-the-money puts on SCTY (effectively at good prices), and I realized good income from some now-out-of-the-money puts on SCTY. I also bought a few lottery ticket deep OTM calls on SCTY for Jan 2019, *before* the merger was final, because it was a better deal than doing so for TSLA. (It isn't any more.)

And now, as of 9:30 this morning, the prices for SCTY options are suddenly worse than on TSLA options (wider spreads everywhere, probably because they're about to become weird TSLA1 options and be thinly traded), and we're back to unusually high (compared to other stocks) premiums on TSLA put options.

I may get to make money on the puts for a third year running... I thought the premiums would normalize two years ago, but nope.

Jonathan Hewitt

Active Member

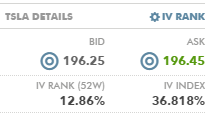

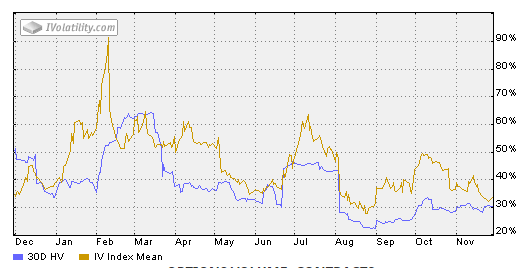

TSLA IV is at a low again. In fact, it has only been lower 12.86% of the time over the last year.

If you believe that IV tends to be mean reverting then this could be a great time to buy options and not as great as a time to sell/write options (though selling is still usually better than buying). I try to avoid buying straight options as it is usually a losing proposition for me (and it is for most people) so I am going to use this low IV to buy a calendar spread as that gives a higher probability of making money than buying straight options.

The Calendar spreads I have done before were only separated by a month and had very close prices. This made IV the main component that determined the price. The spread I am doing this time will also be affected by IV heavily but time decay should help quite a but more than the other spreads.

To take advantage of low IV that will almost certainly rise before earnings I am putting on a Jan/Mar 2017 $200 call calendar. There are 53 days until expiration for the January call and 109 days for the March call. Because the March call expires in about twice the time as the January call this means that if the share price doesn't move and IV doesn't change (aka only time passes) then that means that when the January call expires the March call should be worth at January expiration what the January call is worth now. Using numbers to show this, the January call is currently worth ~$8.0 and the March call ~$14. If you buy the March call and short the January call your total outlay is $6. So if nothing changes except time passing then you would pay $600 ($1400-$800) now and sell the spread at January expiration for $800 ($800-0).This gives $200 of profit per spread, which is 25% return on capital in 2 months (150% annualized).

Obviously the price and IV will change. Price changing away from $200 will hurt potential profit and could lead to a loss as would lowering IV. My goal is to have an IV increase surpass any loss due to price change as the January call would still expire worthless but the March call would be worth a lot more than otherwise expected due to higher IV.

If the share price shoots up a ton I may lose ~100% of what I paid for the spread (but no more) but I will make a lot of money on all the other positions I have. If it drops a ton I will shift additional capital to TSLA assuming long term prospects are still sound.

If you believe that IV tends to be mean reverting then this could be a great time to buy options and not as great as a time to sell/write options (though selling is still usually better than buying). I try to avoid buying straight options as it is usually a losing proposition for me (and it is for most people) so I am going to use this low IV to buy a calendar spread as that gives a higher probability of making money than buying straight options.

The Calendar spreads I have done before were only separated by a month and had very close prices. This made IV the main component that determined the price. The spread I am doing this time will also be affected by IV heavily but time decay should help quite a but more than the other spreads.

To take advantage of low IV that will almost certainly rise before earnings I am putting on a Jan/Mar 2017 $200 call calendar. There are 53 days until expiration for the January call and 109 days for the March call. Because the March call expires in about twice the time as the January call this means that if the share price doesn't move and IV doesn't change (aka only time passes) then that means that when the January call expires the March call should be worth at January expiration what the January call is worth now. Using numbers to show this, the January call is currently worth ~$8.0 and the March call ~$14. If you buy the March call and short the January call your total outlay is $6. So if nothing changes except time passing then you would pay $600 ($1400-$800) now and sell the spread at January expiration for $800 ($800-0).This gives $200 of profit per spread, which is 25% return on capital in 2 months (150% annualized).

Obviously the price and IV will change. Price changing away from $200 will hurt potential profit and could lead to a loss as would lowering IV. My goal is to have an IV increase surpass any loss due to price change as the January call would still expire worthless but the March call would be worth a lot more than otherwise expected due to higher IV.

If the share price shoots up a ton I may lose ~100% of what I paid for the spread (but no more) but I will make a lot of money on all the other positions I have. If it drops a ton I will shift additional capital to TSLA assuming long term prospects are still sound.

Jonathan Hewitt

Active Member

I got filled at $5.82/spread. Assuming IV does not change my predicted breakeven range is $187.27-$215.15. An increase in volatility will raise the breakeven range and a decrease in volatility will shrink the breakeven range.

neroden

Model S Owner and Frustrated Tesla Fan

The very low IV means I'm postponing my regular put sales for a while. It's a good time for it, I'm more comfortable having extra cash the next few months (I have some expenses of uncertain price coming up).

neroden

Model S Owner and Frustrated Tesla Fan

Oh, yes of course you could exercise TSLA1 options *if you hold them long*.

For the most part I have *sold puts* (short puts) and of course in that case I don't have the choice of when to exercise, the other guy does; the high spreads mean I'd lose to the market makers if I tried to buy to close; so I'm pretty much locked in until expiration, or until someone else early-exercises and I get assigned.

In the case of my Jan 2019 out-of-the-money TSLA1 calls, the spread is now astronomical. It's a good thing that I intend to wait and exercise them in 2019, because if I try to sell them before then, the market makers will eat most of my profits. I could obviously exercise them now but that would make no sense; the entire point of these was to get a little leverage while limiting downside risk, so I have no intention of doing so before late 2018.

For the most part I have *sold puts* (short puts) and of course in that case I don't have the choice of when to exercise, the other guy does; the high spreads mean I'd lose to the market makers if I tried to buy to close; so I'm pretty much locked in until expiration, or until someone else early-exercises and I get assigned.

In the case of my Jan 2019 out-of-the-money TSLA1 calls, the spread is now astronomical. It's a good thing that I intend to wait and exercise them in 2019, because if I try to sell them before then, the market makers will eat most of my profits. I could obviously exercise them now but that would make no sense; the entire point of these was to get a little leverage while limiting downside risk, so I have no intention of doing so before late 2018.

Thanks for the clarity, yeah, they're long, I figured as much, but I've normally always just held the contract for profit and sold that, never exercising the upside gain myself. With the case of these the liquidity is so messed up I doubt I'd ever sell the contract to anyone else. I'm in a similar boat on my 2018 leaps, They'll be long after 02/04/2017, but a strike of 55. I'll probably exercise when the price makes more sense.

neroden

Model S Owner and Frustrated Tesla Fan

Ah, I see! Yes, the point of buying options is to have the option to exercise them.I figured as much, but I've normally always just held the contract for profit and sold that, never exercising the upside gain myself.

Bingo. That was the primary downside of holding SCTY options through the conversion; basically no liquidity and huge bid-ask spreads after the conversion. It makes little sense to trade them under those circumstances. It makes exercising the options much more attractive, assuming they're in-the-money shortly before they expire.With the case of these the liquidity is so messed up I doubt I'd ever sell the contract to anyone else.

neroden

Model S Owner and Frustrated Tesla Fan

Oh, this isn't correct. They're still quoted at "SCTY prices".With the TSLA1 options is it possible to exercise them yourself? The strike multiplier is 1x even if the share multiplier is 0.11

One TSLA1 call with a strike price of $25 has a "multiplier" of 100 -- executing the contract costs $25 * 100 = $2500 -- but a "deliverable" of 11 shares, so one contract gets you 11 shares of TSLA. So it amounts to a TSLA price of $227.2727272727272727.... (really).

You may be confused. Yes, 10 SCTY calls @25 are the right to buy 110 shares of TSLA, but not at $25/share. It's the right to buy those shares at 10 contracts * 100 multiplier * $25 strike == $25,000 total, which amounts to $227.272727.../share.Shouldn't 10 SCTY calls @ 25 be equivalent to 110 shares TSLA @25?

100 SCTY or TSLA1 call contracts with strike price $25 (costs $250,000 to execute, get 1100 shares)

are equivalent to 11 TSLA call contracts with strike price $227.27272727272.... (costs $250,000 to execute, get 1100 shares).

Get it yet?

If you're sitting on an SCTY call with a strike of $55, it will only be in the money if TSLA goes over $500 before the expiration date. Good luck. If you don't think that will happen, you might as well sell it, even though the market makers will gain a lot on the spread. Whether you think that will happen or not probably depends heavily on the expiration date.

Yeah, effectively a big ol' FU to investors holding long or bull positions on a company that has effectively been sabotaged for longtime investors. 8 billion in assets and a paltry 2.4 billion payout. Nice Musk, real nice. Should use non-GAAP for SCTY like they did for TSLA financials. Paints a completely different picture when you include the long-term gains. Such is gambling though.

neroden

Model S Owner and Frustrated Tesla Fan

Musk doesn't care about short-term speculators, doesn't like them, and has made this ABUNDANTLY clear.Such is gambling though.

Even if you bought SCTY stock at $55/share, I personally believe the TSLA stock will end up being worth well over $500 eventually, and will probably give you a good rate of return. But you have to be in it for the long haul, because Musk is interested in the long haul, not in the short term. Warren Buffett has pointed out that if you're a long-term investor, unless you need to raise capital by issuing stock, and unless you're worried about a takeover, you want your stock price to be low so that you can grab more and more of it. You only want the stock price to be high when you're getting out...

Musk's taste for long-termism over short-termism does mean that making bullish options trades where time decay is against you is likely to be setting yourself up for disappointment. I only risked it on the Jan 2019 because I can't believe that the stock market will fail to price in the success of Model 3 by *then*.

MitchJi

Trying to learn kindness, patience & forgiveness

I don't understand why you are so obsessed with the spread. I've never paid more than about half way between the bid/ask when buying or sold for less than about half way between the bid/ask.In the case of my Jan 2019 out-of-the-money TSLA1 calls, the spread is now astronomical. It's a good thing that I intend to wait and exercise them in 2019, because if I try to sell them before then, the market makers will eat most of my profits.

The J19 $240's that I bought the second day that they were available have been green ever since, except for the following day when the SP dropped a little bit.

Crowded Mind

Member

@neroden, how far out do you generally sell your put options for? I have been mostly playing in the 2 weeks to 1 month area as I learn more. Those Jan 19 puts sure look enticing though. But those are more limiting to my flexibility since I sadly do not have unlimited money yet to cover naked puts with yet.

neroden

Model S Owner and Frustrated Tesla Fan

That's all very well when you're trading liquid issues. Most TSLA contracts are pretty liquid, but some of the deep ITM and deep OTM strikes on faraway dates are not. I've had to unwind positions at the bid or ask when dealing with illiquid, unpopular contracts, and if you ever find yourself with one, you will too.I don't understand why you are so obsessed with the spread. I've never paid more than about half way between the bid/ask when buying or sold for less than about half way between the bid/ask.

Have you been trading TSLA1 LEAPs? They're completely illiquid now. And I was talking about TSLA1s. I have deep OTM ($30) Jan 2019 TSLA1s. There's not much of a market. Most days they don't trade at all. The bid/ask spread is *very* relevant if I ever tried to sell them. Of course I plan to hold to expiration, but the point is, if I'd been planning to sell, it would have been a bad plan.

For reference, I'm seeing a bid of $0.90 and an ask of $1.90, and (unsurprisingly) no volume. You're not likely to get a price "halfway between" under these circumstances.

Last edited:

neroden

Model S Owner and Frustrated Tesla Fan

I've typically scattered them across different expirations, initially because I didn't feel I knew what I was doing, and later to avoid glutting the market for any one contract. I've picked a strike price I liked, and then looked at that strike for a large number of different expiration dates.@neroden, how far out do you generally sell your put options for?

I compared the static rate of return (the annualized rate of return on the "tied up" cash assuming the option expires) on the different dates and tried to find a "sweet spot". Later expiration dates mean a lower static rate of return, but they also mean that you're guaranteeing that rate for longer. The tradeoff partly depended on whether I thought I'd be able to rerun the put sale at similar prices after the first one expired, or whether I figured it wouldn't be available at the same prices any more (which is a guess, and I guessed wrong several times; I kept expecting this trade to go away). I also looked at the effective purchase price (assuming the option executes), which is of course lower for later expiration dates, making sure that was low enough for my tastes. I also pushed my expiration dates out to January when I didn't want to realize the income for tax purposes in the current year.

And sometimes if I knew I wasn't going to be able to follow the market properly for a month, I simply set the expiration date to several weeks after I got back from the things occupying my time and mind that month, so I wouldn't be tempted to try to reinvest the money when I wasn't thinking clearly.

Yeah, I was deploying quite a lot of money to cash-secure my puts (for me it was basically an alternative to buying TSLA stock).I have been mostly playing in the 2 weeks to 1 month area as I learn more. Those Jan 19 puts sure look enticing though. But those are more limiting to my flexibility since I sadly do not have unlimited money yet to cover naked puts with yet.

I probably would have sold more shorter-term puts if I was more on the ball; but I really do have months when I can't properly look at the market for one reason or another. Accordingly, for me, if I sell a 2 week put, and then can't go back to look at the market and reinvest the cash for 6 weeks, it wasn't such a great deal and I probably should have sold a 6-week put. This has caused me to tend to lock my positions in longer so that I can "file and forget".

Crowded Mind

Member

I've typically scattered them across different expirations, initially because I didn't feel I knew what I was doing, and later to avoid glutting the market for any one contract. I've picked a strike price I liked, and then looked at that strike for a large number of different expiration dates.

I compared the static rate of return (the annualized rate of return on the "tied up" cash assuming the option expires) on the different dates and tried to find a "sweet spot". Later expiration dates mean a lower static rate of return, but they also mean that you're guaranteeing that rate for longer. The tradeoff partly depended on whether I thought I'd be able to rerun the put sale at similar prices after the first one expired, or whether I figured it wouldn't be available at the same prices any more (which is a guess, and I guessed wrong several times; I kept expecting this trade to go away). I also looked at the effective purchase price (assuming the option executes), which is of course lower for later expiration dates, making sure that was low enough for my tastes. I also pushed my expiration dates out to January when I didn't want to realize the income for tax purposes in the current year.

And sometimes if I knew I wasn't going to be able to follow the market properly for a month, I simply set the expiration date to several weeks after I got back from the things occupying my time and mind that month, so I wouldn't be tempted to try to reinvest the money when I wasn't thinking clearly.My biggest loss came from the time I failed to do that...

Yeah, I was deploying quite a lot of money to cash-secure my puts (for me it was basically an alternative to buying TSLA stock).

I probably would have sold more shorter-term puts if I was more on the ball; but I really do have months when I can't properly look at the market for one reason or another. Accordingly, for me, if I sell a 2 week put, and then can't go back to look at the market and reinvest the cash for 6 weeks, it wasn't such a great deal and I probably should have sold a 6-week put. This has caused me to tend to lock my positions in longer so that I can "file and forget".

Thanks, that's similar to my process as well. I love getting the easy money from selling puts, and I love getting shares at a low price if they're exercised, but my consistent fear is that I'm going to tie up my capital and when TSLA finally moves up, I won't have accumulated the number of shares that I want. I'm newish to options and need to read up to see if there are paired trades I can make to earn on selling puts but still protected (lol) from a big increase. Seems like a sale of an ITM put and purchase of an OTM call would do that, but need to investigate further.

neroden

Model S Owner and Frustrated Tesla Fan

Yeah, being worried about that, I just bought some shares outright. Just so I could sleep at night.Thanks, that's similar to my process as well. I love getting the easy money from selling puts, and I love getting shares at a low price if they're exercised, but my consistent fear is that I'm going to tie up my capital and when TSLA finally moves up, I won't have accumulated the number of shares that I want.

I'm newish to options and need to read up to see if there are paired trades I can make to earn on selling puts but still protected (lol) from a big increase. Seems like a sale of an ITM put and purchase of an OTM call would do that, but need to investigate further.

Two points: first, check the complex tax laws related to "constructive ownership", hedges, and wash sales.

Second, remember that the put could get executed early and you would still own the OTM call and possibly lack the cash to execute it.

Sounds like it would work to me, though. :shrug:

Jonathan Hewitt

Active Member

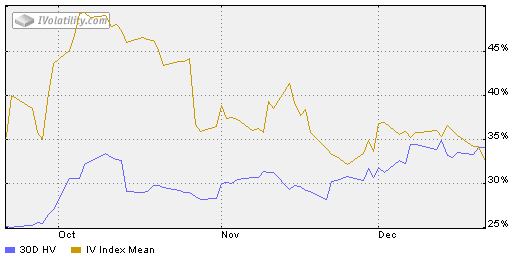

Wow, I guess it's probably because of the holidays but Volatility is crazy low. The only time it was lower over the past year was in August for a little bit. I'm going to put on a Feb/Mar calendar for a pure volatility play. This is going to be the type of calendar I did this year a couple times with success. The $200 Jan/Mar calendar I have currently on is a time decay/volatility mix and was a new thing I wanted to try for TSLA.

Similar threads

- Replies

- 28

- Views

- 1K

- Locked

- Replies

- 0

- Views

- 4K

- Poll

- Replies

- 16

- Views

- 2K

- Replies

- 2

- Views

- 760