WTI $86.6/bbl

Brent $91.9/bbl

NL TTF gas €162/MWh (

EU Natural Gas - 2022 Data - 2010-2021 Historical - 2023 Forecast - Price - Quote)

Russia’s Gazprom said gas flows via Austria to Italy are resuming following the suspension of flows over the weekend amid regulatory challenges. [Q. How has the payments issue been solved - EUR, USD, or roubles at an artificial rate ?]

ZNPP boss released

UPDATED International Atomic Energy Agency Director General Rafael Mariano Grossi has welcomed the release by Russian forces of Ihor Murashov, the director general of Ukraine's Zaporizhzhia nuclear power plant. He had earlier warned his detention was "detrimental to nuclear safety and security"...

www.world-nuclear-news.org

Burning primary forest as coal substitute is BAD

The owner of the UK's biggest power station, Drax, is cutting down key forests in Canada.

www.bbc.com

JohnKempReuters gas storage chartbook : looking hopeful, not certain

Finland powers up

Power output from the 1600 MWe Olkiluoto 3 EPR in Finland has reached 100% as commissioning tests of the reactor continue, operator Teollisuuden Voima Oyj has announced. Regular electricity production is scheduled to start in December.

www.world-nuclear-news.org

Ukraine looks ahead --- nuclear BEV chargers

Ukrainian nuclear power operator Energoatom is entering retail electricity through a network of electric vehicle chargers branded ATOMcharge. A network of 120 charging stations is to begin construction within two years, the company said.

www.world-nuclear-news.org

Germans have agreement ..... note the French nuclear news in this

The German government has reached an agreement with the operators of Isar 2 and Neckarwestheim 2 on keeping the nuclear power plants on standby to supply power over the coming winter if needed.

www.world-nuclear-news.org

UK does not yet have agreement

Energy giant EDF says it will review the case for a "short extension" for the Hartlepool and Heysham 1 nuclear power plants to generate beyond the current forecast of March 2024.

www.world-nuclear-news.org

Shell seeks known amount of pain

Ben van Beurden also warns against EU moves to cap price of gas and electricity to protect consumers

www.theguardian.com

because .... talk is cheap

An EU-style revenue cap on power firms could be simplest solution for UK energy crisis

www.theguardian.com

... but the bill is coming

Exclusive: Liz Truss’s intervention to freeze domestic energy bills could cost between £72bn and £140bn, analysis finds

www.theguardian.com

fossils never miss an opportunity to prove dinosaur ancestry

Exclusive: Note setting out business secretary’s views looks for ways to accelerate schemes, including streamlining HSE requirements

www.theguardian.com

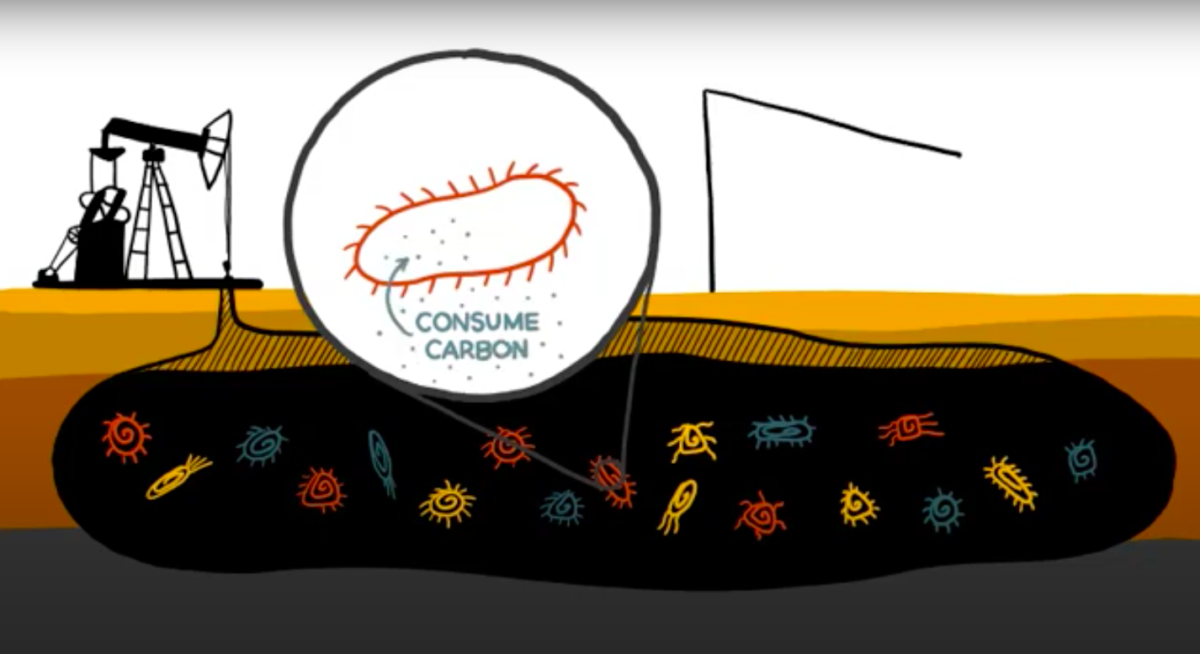

.. downhole biohydrogen in Permian fraccer future

Cemvita claims it can produce hydrogen at the "lowest possible cost,” Deutsche Bahn and Fortescue Future Industries have announced plans to jointly modify diesel engines for locomotives, and the Canadian province of Alberta has started promoting its hydrogen potential in Japan.

www.pv-magazine.com

Puerto Rico gets much needed love

Puerto Rico's latest procurement exercise is the second round of a tender scheme designed to allocate 3.75 GW of renewablesd capacity and 1.5 GW of storage.

www.pv-magazine.com

and

In the two weeks since Hurricane Fiona devastated the island, LUMA Energy says it has restored service to 93% of customers.

www.utilitydive.com

More heat pump manufacturing in EU

Panasonic's new heat pump can supply domestic hot water, heating and cooling from a single, integrated unit. It can also synchronize with the Japanese company's PV panels and its CZ-NS4P technology printed circuit board technology, while also ensuring smart-grid compatibility.

www.pv-magazine.com

more nukes for Japan anyone ?

Mitsubishi Heavy Industries has launched the SRZ-1200 advanced pressurised water reactor design. Developed in collaboration with four Japanese utilities, the 1200 MWe reactor is designed to meet the country's enhanced regulatory safety standards.

www.world-nuclear-news.org

how much is the battery doing ?

S4 Energy and ABB recently installed a hybrid battery-flywheel storage facility in the Netherlands. The project features a 10 MW battery system and a 3 MW flywheel system and can reportedly offer a levelized cost of storage ranging between €0.020 ($0.020)/kWh and €0.12/kWh.

www.pv-magazine.com

Russia-India rail route is actually via sea, but still important progress

The eastern branch of the International North South Transport Corridor (INSTC) is a fact. Six trains are currently en route overland, from Russia to India via Turkmenistan and Iran. These trains indicate the increased interest in transport by rail from Russia to India, as multiple routes are...

www.railfreight.com

post-Brexit empty shelves in UK shops may improve

Fresh produce trains from Spain are to be spotted on tracks again. Sealand, a Maersk company, is ready to launch new intermodal flows with reefer containers between Valencia and London. The service, which is currently in the testing period, will commence officially in October and offer three...

www.railfreight.com

oilprice.com

oilprice.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/LO2IIVVTLVJPRJXJBQUAACGVR4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ES26TEULLNLHXPUNNYVOWXHR4Y.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/ZQ6YKIXTCVKLBAKZIMA3P4DV5Q.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/Z4EE4NCSWJNUTAV525XDI5BKFQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JDIZPTD7LBJP7BI22LNIKZVTJI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VVQ2PNKFVFKOTAJ3HA2IZEY5VY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MOOLZ4ZO3FK6NCSEK7GJFJTFTM.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/PDT634P3I5OTTFD7LLLPQAUFK4.jpg)