With

@petit_bateau kind permission, I am posting a private conversation I started with him.

For context, I am including the original question:

I follow your energy thread and figured you may have a source I could go to for the following:

I have a friend in the RCAF and he is half way through an exchange posting in Australia, he and his wife return to Canada in the summer of 2024.

They own a home (Frankford ON) that they will return to and want to install a backup power system for that home that is not a generator, but a battery with solar panels.

They asked me to do some research on this topic as I had a (12 year old) grid tied solar system on the house we just sold last year.

You seem to have deep knowledge regarding home solar/battery systems and was hoping you could steer me in the right direction as to a recommendation for research.

It sounds like you have enough experience that you could recommend something beyond “just get a Tesla Powerwall“ unless, of course, that is the best option.

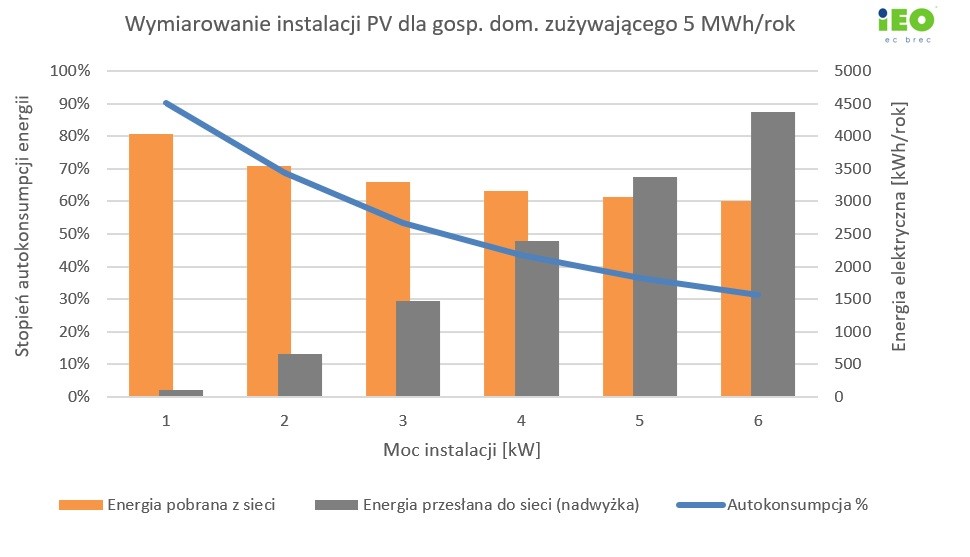

I did tell them that I would expect the battery to be LFP, I hope that is a correct assumption.

And your (@petit_bateau) answer:

I'm happy to help although I'd need to contact all my old distributors etc to discuss any Canadian specifics as it is a while since I have updated myself on the Canada-specific availability of products. And to be honest that process of re-establishing contact with them could be lengthy as it has been ?? 7/8 years since I dealt with that group. Since then I was working in high voltage which is at the polar opposite end of the spectrum and a different group.

So let me give you a first starter, and as you see it will be appropriate to do nothing right now. Which is fine as their exchange tour has 12-18m to run.

I am assuming from what you write that they wish to be grid-tied with the ability to come off-grid when there is a grid supply failure.

The solar itself is easy, I assume they don't need their hand holding on that ? Ask if I am wrong.

This on/off grid functionality is fairly well built into the Tesla Powerwall for the US market, and I believe it is also functionality that is also provided for the Canada market. It is NOT functionality that is made available to most of the rest of the world, because Tesla has not gone through the necessary certification processes. There is huge demand in the rest of the world for that functionality, so why not go through the certification processes. The Tesla Powerwall runs on NMC/NCA batteries and I am 99% sure that Tesla will want to switch to LFP soon. For these two reasons that suggests to me that there is a Powerwall refresh (P5 ?) coming up and that Tesla may go on to obtain a fuller certification for the whole world subsequently. Switching to LFP ought to reduce costs (maybe also price) and is likely to be associated with a Powerwall factory refresh, which I suspect is sitting in the to-do pile behind getting Latrop ramped. And a factory refresh, plus switch to LFP, ought to make Tesla Powerwall supply increase massively. So it is worth waiting until closer to the time to see how/when/if the Tesla option is worth pursuing.

At the moment for the non-Tesla options, the only one that appears to have all of the functionality operating (that you want) out-of-the-box in a non-bespoke manner available widely to generic domestic users seems to be Huawei. They use LFP and have the modular approach that allows (from memory) 3kWh modules to be successively added to 12kWh frames, and multiple frames. This makes moving everything into position much easier than the SolarEdge 10kWh in one box strength test for two big men (me !). Also Huawei seem to have their on/off grid functionality working and available. In contrast SolarEdge are still in beta on that and have yet to release the relevant software to the wider market, even after about 18m of client beta testing. I am expecting that SolarEdge will solve whatever is holding them up over the course of 2023 and then that would be put three globally available first-division competitors in the market. And by then I would expect them all to have the three or four basic modes operating (minimise import; time-of-use import; on/off grid; play nicely to put excess into cars).

All else being equal, if at that point SE-Tesla-Huawei were all widely available in Canada in 2024, then I would at that time pick SE. This is because they can go with on-module optimisers and track constantly the overall health and performance of their system in real time, without being forced to buy a specific module solution. So they can select from the widest spread of modules in the marketplace, add the SE optimisers, and then SE inverters and battery.

There are a zillion other players in the market, and a new one every day. Having lived through a few of these cycles the real worry to my mind is whether one will get supported in 10-20 years time. It may be that in the next 12-18m a few of the other middle division players percolate to the top tier. And of course one should also listen to the opinions of the local installers, whilst also considering carefully to what extent they are truly knowledgeable and why they are motivated.

So long story short: wait and watch developments over the next 12-18 months.

Does that help ? Feel free to ask more.

pv-magazine-usa.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/BTGDHZAJUBJ7JBNGGMUWDOL7NE.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FZUIZV3U6FLEHDYW4S4ZF4LMWU.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/OUG4IDEK5NLDPMDM2K6NXTBAE4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IPUH2CD4CFMGPPIDLJVGQTBOHA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MJBPOPVXKRIYDPIHLED4PM7AZE.jpg)