WTI $107.7/bbl

Brent $110.4/bbl

EU tweaking Russian oil plan

The European Commission proposed changes to its planned embargo on Russian oil to give Hungary, Slovakia and the Czech Republic more time to shift their energy supplies, EU sources said, although failed to reach a breakthrough on Friday.

www.reuters.com

and gas

The meeting of the Transport, Telecommunications and Energy Council was organised in the wake of cuts by Gazprom to Bulgaria and Poland,

www.enlit.world

India has left itself no choice, coal

India is planning to reopen more than 100 coal mines previously considered financially unsustainable, as a heatwave-driven power crisis forces the world's third-biggest greenhouse gas emitter to double down on the fuel after months of low consumption.

www.reuters.com

REviewing the EU elec price review in ever narrowing circles (YMMV)

Why exactly is the EU so reticent about redesigning its failed energy markets?

www.energyflux.news

US middle distillates under pressure, JohnKempReuters chartbook

US SPR buyback plan signalled

DOE to Initiate Transparent, Competitive Process to Replenish U.S. Emergency Crude Oil Distributed to Alleviate Global Supply Disruptions Caused by Putin’s War

www.energy.gov

US oil capex up, market forces work, shock horror

www.eia.gov

UK contemplates neutering market forces, Con shock horror

North Sea developments aren’t about lowering bills or securing energy supplies – they’re just business as usual, says Tessa Khan, director of Uplift UK

www.theguardian.com

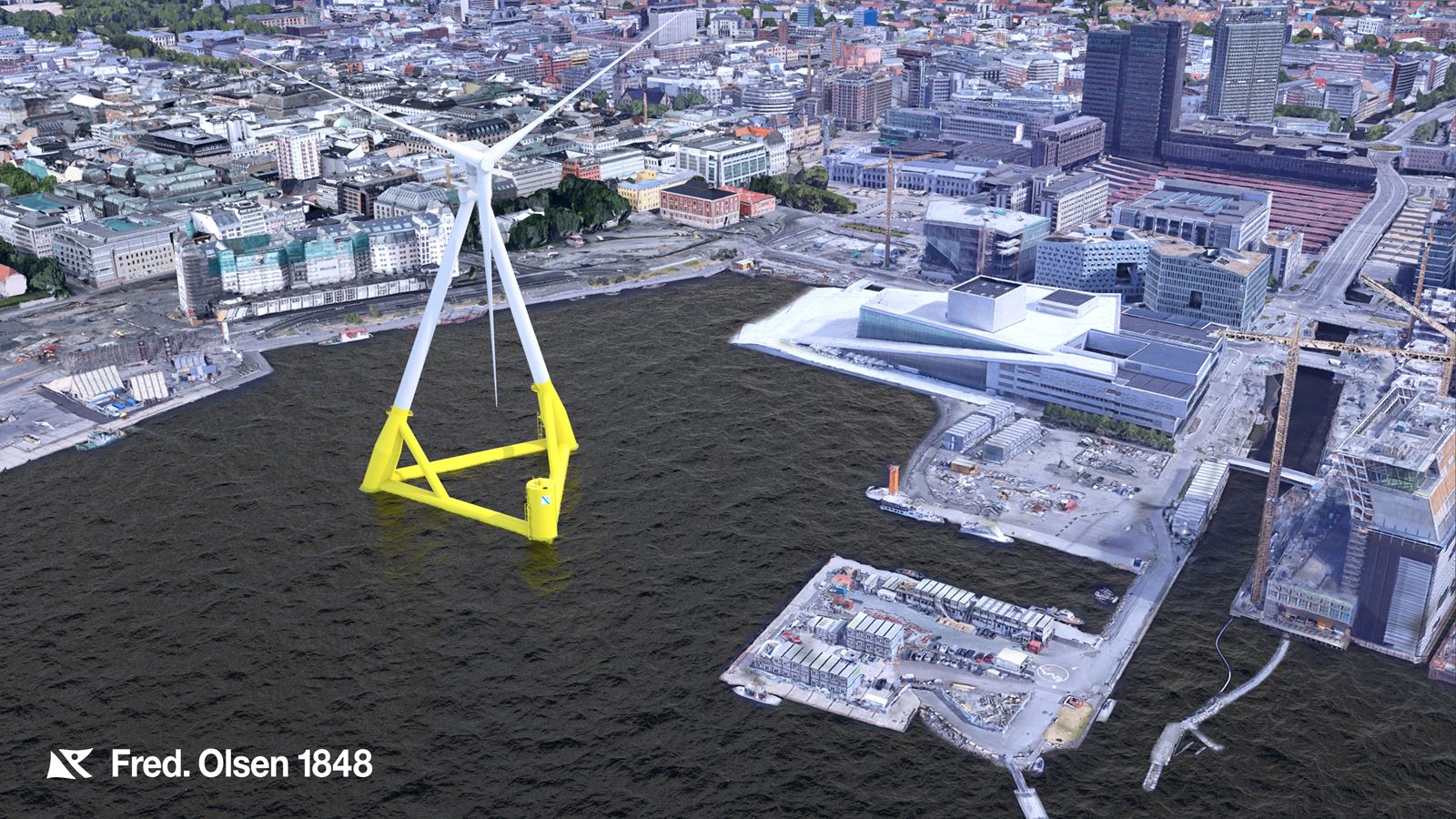

Olsens go interestingly modular for floaters, pay attention

Norway-based Fred. Olsen 1848 has launched a new floating offshore wind turbine foundation named BRUNEL after several years of development.

www.offshorewind.biz

GOM offshore wind acoming pdq

As the US Bureau of Ocean Energy Management (BOEM) is working towards the first offshore wind auction for the Gulf of Mexico early next year, current legislative developments in Louisiana could lead to the state being the first to build an offshore wind farm in the Gulf, as well as to expanding...

www.offshorewind.biz

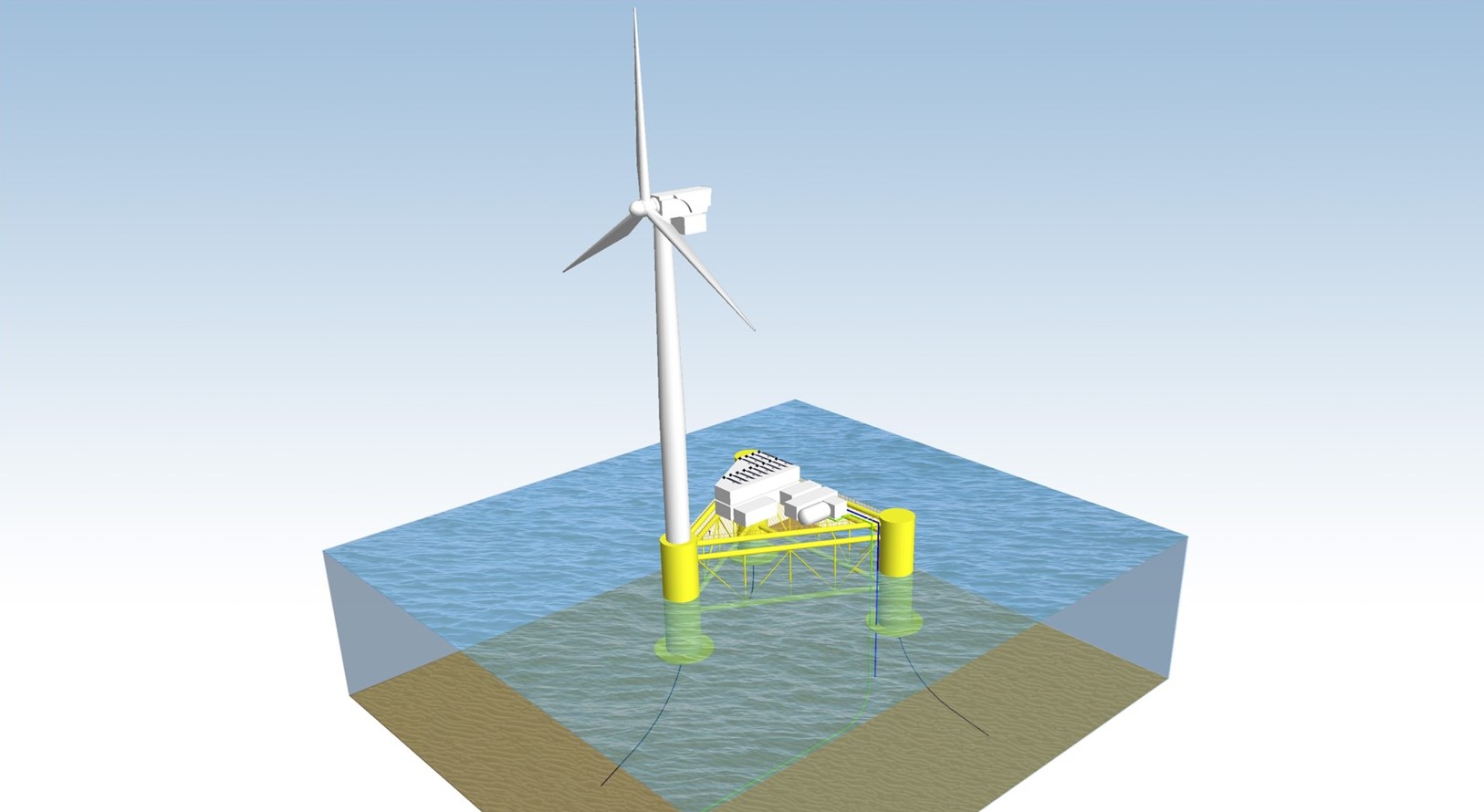

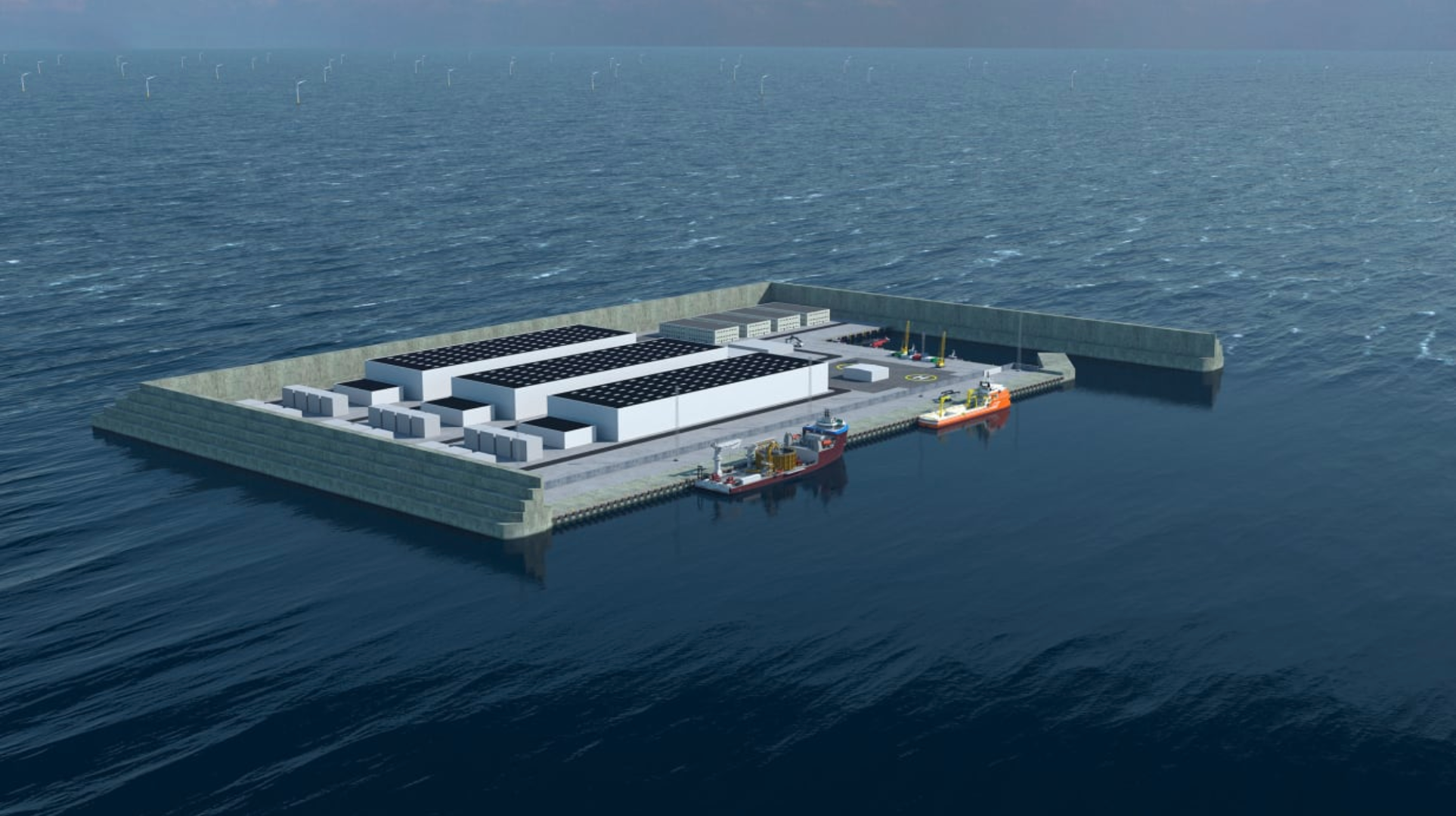

Those hydrogen nodes offshore again

Norwegian companies, Arendals Fossekompani, Kongsberg, and Moreld, have joined forces on the Hydepoint project to develop a combined offshore substation and hydrogen factory.

www.offshorewind.biz

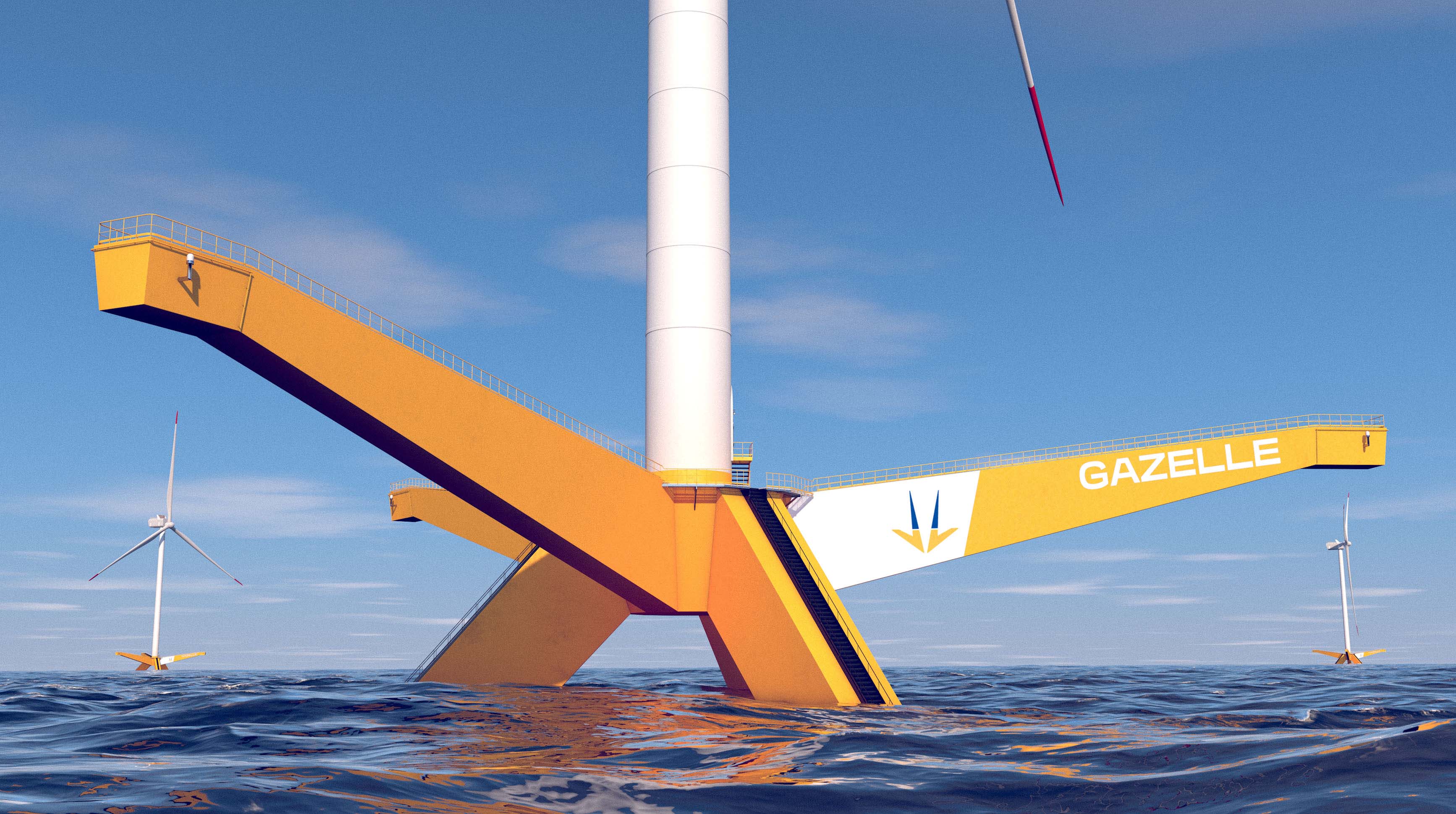

Flexible foundation/tower vessels

Denmark-based Cadeler has revealed that the company is in advanced talks with COSCO Shipyard regarding a possible order to build a new “hybrid” offshore wind farm foundation installation vessel. The potential foundation installation vessel could be delivered in the fourth quarter of 2025, with...

www.offshorewind.biz

No bitcoin mining here, NY

New York State assembly has passed a bill with a moratorium on new proof-of-work crypto mining operations, unless 100% renewables powered.

www.smart-energy.com

Somehow the idea of a dominant design emerging in DER software seems unlikely to me

Yusuf Latief spoke to Sabine Erlinghagen on distributed energy resources (DERs), grid management and software as the answer.

www.smart-energy.com

Malaysia will go solar, someday far away

Sepang solar plant is a 50MW large-scale solar plant owned and operated by TNB Renewables Sdn. Bhd. (TRe), a wholly-owned subsidiary of Tenaga Nasional Berhad, Malaysia’s national electricity utility company.

www.smart-energy.com

Rich people flying soars

More trips by wealthy passengers as Covid controls eased also improved demand for IAG in first quarter

www.theguardian.com

Lukashenko's Belarus stinks

Russian citizen held along with boyfriend a year ago when flight she was on was forced to land

www.theguardian.com

pv-magazine-usa.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7FENNH7OEVL57PW447YY5RTU7A.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/WJCK22JRYRPWTNH3AFONQYNTII.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/AXX4JUUSSBJZRHSCV5W3EXUKLE.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/DOJOXP4VIVP77FBPZXIU443AFE.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/XYTL2CCRDVL6LHWOHEJDLVCAFE.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7WYHTRSZUVLZ7BBW75YLAKN7SI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JK4GQ7XLMBN5LDCRUCVMXXMYBA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/6CMM67X45RKGZIUY22QWEIJ4RU.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/PEMYRDPUJRORXGONTQGSJWOZTQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RNLAFZCRMVKW5OXYEMJT44TPKY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/EWDZ66KJCRKX5PRTHOH23GRANM.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/PCPMV3JFZ5KSFGCPQXHLQVLWYU.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/6IGHUG6H6JKM5LQQ4ULQPP7DFQ.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/C5LSOYCKWBMH3EAFQCPZ3KWO4I.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/Z7DVWBAR2FOE5D6TQUFHUF7ETU.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/UC7DU36IDVJ5NKOYFSKNPDKHKY.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JTQKVUUKQZNLTH44K3VAGUEBX4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/TOHXWGLCZNKCTHCVV6C4MC6VI4.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/archetype/UGSMUUK6EBF4HDR2ICCUUSZOT4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/UNXPTNGYARKUTLTTXSEHAFTDMI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/6PFU362LIVNEXJU4GNPIBYI6AA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FL2WNTQ4TBLWBNMIEZ67R7C4JA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/HRLUBBCD6BNTVMIUTOZFJV3FCE.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/IQ6KQIPVOE3ZTQIVBT7R7V2KFM.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/PBJVT4LB6JINTCVLQYUYBKGZOA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/6Y3QCYTATJNDHC2GI4XJPRFO3Y.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/P3PEJIMYBRN5THML4TCMYYVIP4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/3FLXUEAK7VO4JL5F5DAS4UAKXE.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/5FRE2B5GLBOKBDZKDFK6AA6AQY.jpg)