Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hi, I’m a short seller

- Thread starter ShortSeller

- Start date

Electroman

Well-Known Member

Helllooo. Anyone home?

It’s quite and scary in here

It’s quite and scary in here

Helllooo. Anyone home?

It’s quite and scary in here

BOO!

Quite scary or quiet and scary?

woodisgood

Optimustic Pessimist

FlatSix911

Porsche 918 Hybrid

AquaMan

Member

Confession: I shorted before the last earnings. YEP! I did that. Not even joking. And I love the company.

WHY??? Why???

Here's the thing. I often bet both ways on stocks, even the very same stock, I reverse my position when I think the stock will reverse. I trade actively, as more of a hobby... It's like gambling really, so I'm not using my retirement account. This means I've been wrong a lot and I've been right a lot. This time I was wrong. Very wrong. But I've had worse.

So, before earnings, I was betting on a short-term dip. At the time, the number of cars sold was already known, and if you recall they were disappointing compared with expectations. I thought their financials would reflect the same, so the confirmation would cause a dip. As you may also recall, it WAS a surprise to almost everyone, certainly traders. (Which is why it shot up like a rocket instead of climbing gradually.)

Technically I wasn't short the stock, I had bought put options, which of course amplifies everything. I only had a $10,000 account, and $7,000 went away overnight, but if I had bought calls, $19,000 would have appeared by magic the same evening.

I had fully intended to jump back aboard for the ride back up. But that dip... uh, yeah that didn't happen. More like it "anti-happened". And believe me, it stings.

I'm long again, with call options. Let's see if I can get my $10K account back from the $3K I have left. If not, I'll live. This is play money.

There's nothing wrong with shorting a stock, even if you believe in the long term future of a company. You can't sell short without eventually buying to cover, so every trade influences the stock both ways, balancing out when you exit your position.

WHY??? Why???

Here's the thing. I often bet both ways on stocks, even the very same stock, I reverse my position when I think the stock will reverse. I trade actively, as more of a hobby... It's like gambling really, so I'm not using my retirement account. This means I've been wrong a lot and I've been right a lot. This time I was wrong. Very wrong. But I've had worse.

So, before earnings, I was betting on a short-term dip. At the time, the number of cars sold was already known, and if you recall they were disappointing compared with expectations. I thought their financials would reflect the same, so the confirmation would cause a dip. As you may also recall, it WAS a surprise to almost everyone, certainly traders. (Which is why it shot up like a rocket instead of climbing gradually.)

Technically I wasn't short the stock, I had bought put options, which of course amplifies everything. I only had a $10,000 account, and $7,000 went away overnight, but if I had bought calls, $19,000 would have appeared by magic the same evening.

I had fully intended to jump back aboard for the ride back up. But that dip... uh, yeah that didn't happen. More like it "anti-happened". And believe me, it stings.

I'm long again, with call options. Let's see if I can get my $10K account back from the $3K I have left. If not, I'll live. This is play money.

There's nothing wrong with shorting a stock, even if you believe in the long term future of a company. You can't sell short without eventually buying to cover, so every trade influences the stock both ways, balancing out when you exit your position.

Last edited:

Electroman

Well-Known Member

There's nothing wrong with shorting a stock, even if you believe in the long term future of a company.

Don't disagree with you. Shorting is another bet in one direction, just as going long is a bet in other direction - both can be based on fundamentals and execution capabilities. That is where the similarities end.

You seem to be a nice guy. But i guarantee most shorts are third rate scumbags. Longs cannot really work towards pushing the stock up. They have to entirely depend on other factors that they don't control. There are not much avenues for that. All they can do is, make the bet and sit tight.

But Shorts don't sit quiet after making the bet. They work hard to influence the stock downwards, by spreading lies about the company and their products, actively working with like-minded MSM reporters and in social media. Because negative news (made up or real) spreads quickly and easily. That is what most Tesla shorts do. Scum of the earth.

Because a car is a very expensive product, a particular model gains respect or notoriety based on :

a) what they read in media (aka CR, MT, C&D, etc..)

b) what is being said in social media - Twitter, YT, FB

c) Opinion of their friends and colleagues who drive that car .

Shorts are very active spreading bad things about Tesla through their sympathetic friends in media - which is almost all of the media. But the haters are not gaining a foot hold in social media, due to very active presence Tesla owners. And lastly universally the opinions of current owners is overwhelmingly positive, and so the short fueled negative onslaught from media is totally ineffective.

Last edited:

AquaMan

Member

by spreading lies about the company and their products

I think the shorts you hear from are like that, obviously. I don't do that, and I don't have enough respect for my own "persuasiveness" to even try it. (Nor would I.)

I doubt they're very effective. The only tool they really have is the internet, and I would hope most stock traders are smart enough not to trust "somebody on the internet."

EVNow

Well-Known Member

I have bought puts & calls before ER earlier. But this time I didn't buy anything. Big missed opportunity.Technically I wasn't short the stock, I had bought put options, which of course amplifies everything. I only had a $10,000 account, and $7,000 went away overnight, but if I had bought calls, $19,000 would have appeared by magic the same evening.

EVNow

Well-Known Member

Nothing compared to the loss many of us suffered this year holding on to calls for too long.I'm $26,000 poorer than I would have been.

Electroman

Well-Known Member

and I would hope most stock traders are smart enough not to trust "somebody on the internet."

The intent of the shorts is not to sway institutional or smart retail investors. They know they cannot do that, as most savvy investors are smart and they know media and shorts are dishonest.

The intent of the shorts is to kill demand for the car by dissuading John Doe's of the main-street who still think what they read in WSJ, NYT and LAT has an element of truth in it. So a constant barrage of negative news has an impact on the general soccer moms and car buying public. Once you curb demand, Tesla is toast and its a downward spiral for the stock and the company. So far that strategy has not worked.

AquaMan

Member

Longs cannot really work towards pushing the stock up. They have to entirely depend on other factors that they don't control. There are not much avenues for that. All they can do is, make the bet and sit tight.

This part I didn't really understand. What powers do you feel you're supposed to have to push any stocks up or down?

When I buy a stock, I do exactly that... I make the bet and sit tight. What else would you suggest?

nwdiver

Well-Known Member

I saw this posted somewhere a while back. Thought it might be helpful for the TSLA shorts. You're welcome

TSLA_Hopeful

Member

One of my "friends," who is actually slightly autistic, harassed me for four months about how I'm going to lose my money and how much he is making. Now he has me on ignore and block. These guys are cowards. Can dish but not take

nwdiver

Well-Known Member

I buy naked shares, why don’t shorts sell naked?

I sense you're being sarcastic but I'm biting anyway

If you buy $100 in TSLA the most you can lose is $100. If you short $100 in TSLA @ $100/share and it goes to $300 you've lost ~$200.

FlatSix911

Porsche 918 Hybrid

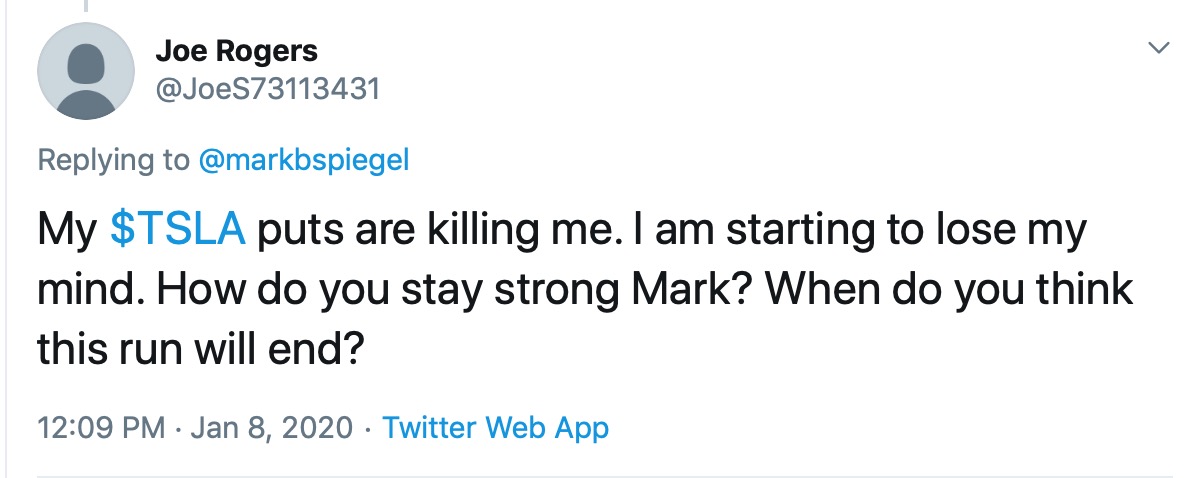

Love it... Tesla (TSLA) rallies near $500 per share as shorts go mad - Electrek

Tesla (TSLA) continues its strong rally today on positive analyst notes and a broader market rally due to a possible de-escalation of the US/Iran situation. The stock price reaches close to $500 per share, and those holding short positions are going mad. Over the last few months, Tesla’s stock has been on a strong rally that resulted in pushing several new all-time highs over the last few weeks.

Last month, the stock even reached over $420 per share, which was the controversial price at which CEO Elon Musk claimed he secured funding to take Tesla private. The new year has also been very good so far to Tesla shareholders with the stock being up 17% already, helped by another 5% surge today, following some positive notes from analysts and a broader market rally. Tesla’s stock (TSLA) is now reaching close to $500 per share as of this afternoon:

Tesla (TSLA) continues its strong rally today on positive analyst notes and a broader market rally due to a possible de-escalation of the US/Iran situation. The stock price reaches close to $500 per share, and those holding short positions are going mad. Over the last few months, Tesla’s stock has been on a strong rally that resulted in pushing several new all-time highs over the last few weeks.

Last month, the stock even reached over $420 per share, which was the controversial price at which CEO Elon Musk claimed he secured funding to take Tesla private. The new year has also been very good so far to Tesla shareholders with the stock being up 17% already, helped by another 5% surge today, following some positive notes from analysts and a broader market rally. Tesla’s stock (TSLA) is now reaching close to $500 per share as of this afternoon:

AquaMan

Member

Nothing compared to the loss many of us suffered this year holding on to calls for too long.

Actually, here's what happened to me: I had 5 contracts of TSLA200117C250. (Calls with a $250 strike price, expiring on the 17th of this month.) I bought them for $18.10, spending $9,050 using a $10,000 account I had just opened. I sold them before the last earnings and bought puts, because I expected a brief run down. The puts lost me around $7,000 that evening, but worse: it also lost me around $19,000 which I would have had in my account that evening if I had kept the calls. (Essentially it would have tripled my account overnight.)

But it's worse than that, because those same calls... The ones I had bought for $9,050 (at $18.10) actually sold for $123,000 (at $246) a couple days ago... That would have been $113,950 profit, from a $10K account, in only 2-1/2 months. (And since I believe it'll go over $500 before they expire and they're in the money, it would be even better at expiration.)

For some reason I still keep looking at the price of "the calls I should have held"... Because I guess I enjoy self-torture. Luckily they expire in 8 days so I will no longer be able to check.

The sting of this experience has made me more of a "holder" than a "trader". I'm holding calls again now, trying to get back my original $10,000.

Last edited:

Similar threads

- Replies

- 1

- Views

- 472

- Replies

- 0

- Views

- 215

- Replies

- 17

- Views

- 800