Has anyone tried using the Cars.com loan vs lease calculator. I filled in the numbers for both the loan vs lease (based on the numbers tesla gave me). They didnt give me the money factor but I played with it till I got the monthly payment to the same price. Cost to own would be a little over $4k more for the lease. I keep going back on forth with leasing vs buying and need to make a decision soon. My X is in paint, so I would think 3-4 weeks before I get it?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Model X Financing questions

- Thread starter Vizir

- Start date

loganintx

Member

What was the money factor you ended up with?They didnt give me the money factor but I played with it till I got the monthly payment to the same price.

What was the money factor you ended up with?

0.00232 or about 5.5%. The real money factor might be lower, I had them role in the sales tax which is 6.25% and you pay the full amount in Texas.

MonsterCarter

Member

Sounds good. Will they ask for any supporting docs at the time of making the payment?

Start off by opening a checking account to become a member, it doesn't require any human interaction.

Once a member, they won't ask for verification so applying for the auto loan will be a breeze.

I'm in Austin and the buy option was much better for me. Especially since I will drive 15-20k miles / year. Have you used my spreadsheet to see the Loan costs I put together?

Yes I have, thanks. I am leaning towards buying but my wife is more towards leasing now. I think we are getting to hung up about the value of the car in 36 months. I still think if we buy we would end up a few grand ahead compared to leasing. We drive about 15k and I would like to black out our chrome and powder coat the wheels. Black out the car with white interior.

dwebb66

Member

Yes I have, thanks. I am leaning towards buying but my wife is more towards leasing now. I think we are getting to hung up about the value of the car in 36 months. I still think if we buy we would end up a few grand ahead compared to leasing. We drive about 15k and I would like to black out our chrome and powder coat the wheels. Black out the car with white interior.

And name it 'Oreo'.

And name it 'Oreo'.

Lol. Good idea. I was thinking Darth or Vader.

It is 50% of the base price plus 45% of the options price. The fed tax credit etc., has no wearing on this.

If I am not mistaken, I believe the RVG is 50% of the base price, and 43% of all options (including battery pack upgrades).

Diavel

Member

And name it 'Oreo'.

Lol. Good idea. I was thinking Darth or Vader.

Im getting mine all black with white seats...

I may actually name my x darth oreo!!!

Diavel

Member

sounds like bottom line may be sales taxes in ca and 2500 state incentive might make or break the difference? the 2500 here is disappearing now after the mar31 cutoff so that may tighten the two decisions up but the sales tax... Hmmm

I think I'm a little more confused now. So is leasing better? I'm in California too and was opting to buy. Wanted to use sec. 179 but I would have to get. A business loan and interest rates on those are higher than the 1.49% 6 years I'm getting.

I am pretty certain you don't need a business loan. I'm no accountant but my accountant ok'd it. Business use is all that matters, not the paper behind it.I think I'm a little more confused now. So is leasing better? I'm in California too and was opting to buy. Wanted to use sec. 179 but I would have to get. A business loan and interest rates on those are higher than the 1.49% 6 years I'm getting.

Diavel

Member

Hmm... If that is the case then that's great. I'm already so upset that California is one of the handful of states that don't allow bonus depreciation and heavily limits sec. 179 use to a measly $25,000.

ModelS8794

Member

I think I'm a little more confused now. So is leasing better? I'm in California too and was opting to buy. Wanted to use sec. 179 but I would have to get. A business loan and interest rates on those are higher than the 1.49% 6 years I'm getting.

Apologies if I missed it upthread, but did you post any details on where you found 1.49% financing for 72 months? Would like to review that one, thanks!

Diavel

Member

I didn't post it. I may still try lightstream to beat this and get an unsecured loan but it's through School's first credit union. Unfortunately it is pretty difficult to sign up with them. You need to have a family member in the education system. My sister was a TA almost 2 decades ago and got in. They used to be called Orange County Teachers Federal Credit Union or OCTFCU.

They are amazing by the way. Penfed is good too and much easier to join

They are amazing by the way. Penfed is good too and much easier to join

Last edited:

ModelS8794

Member

I didn't post it and it's for 60 months max to get 1.49%. I may still try lightstream to beat this and get an unsecured loan but it's through School's first credit union. Unfortunately it is pretty difficult to sign up with them. You need to have a family member in the education system. My sister was a TA almost 2 decades ago and got in. They used to be called Orange County Teachers Federal Credit Union or OCTFCU.

They are amazing by the way. Penfed is good too and much easier to join

Gotcha, thanks much. At 5 years the EnergyFCU deal for 1.83% - .75% EV discount seems the way to go (though lots of folks seem to be looking for 100% financing which I don't think the EnergyFCU can do). I will see if Lightstream will top that by another .10 or if they punt on the .75% EV thing as a non-publicized rate or something like that.

FYI you might wanna edit the post upthread where you say 6 years.

Cheers!

Diavel

Member

ssq

Member

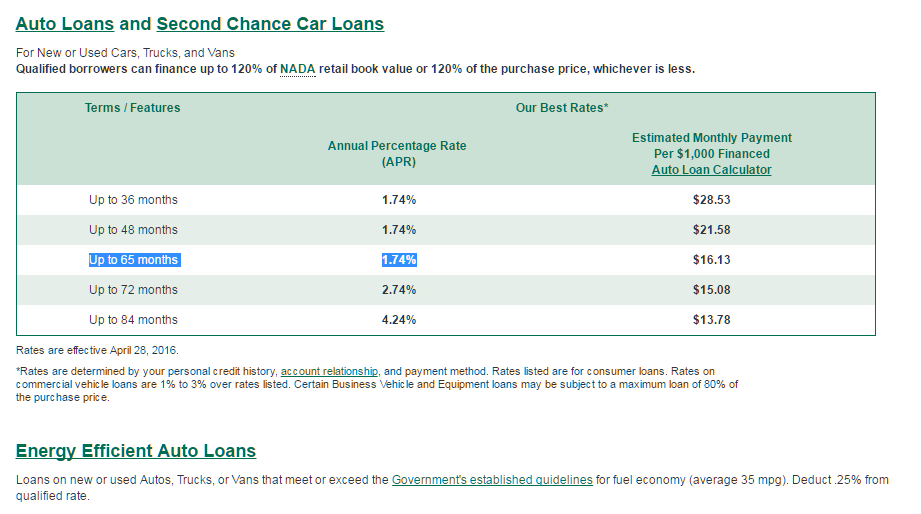

Hi All, I am new to this thread and have not gone through all the offers and rates that have been discussed - just wanted to chime in quick and mention that DCU does 1.49% APR (1.74 -0.25% EV discount) for up to 120%. Working with them is as easy as sending couple of emails and simple forms online.

Vehicle Loan Rates | DCU | Massachusetts | New Hampshire. I currently have a 1.74% 65 mo with them on an ICE.

Vehicle Loan Rates | DCU | Massachusetts | New Hampshire. I currently have a 1.74% 65 mo with them on an ICE.

ssq

Member

somebody has their priorities called out in CAPS !!Your sheet does offer a SEX SEAT option where as mine only has the SIX SEAT option... I can see why people would pay more for that

Last edited:

Diavel

Member

Hi All, I am new to this thread and have not gone through all the offers and rates that have been discussed - just wanted to chime in quick and mention that DCU does 1.49% APR (1.74 -0.25% EV discount) for up to 120%. Working with them is as easy as sending couple of emails and simple forms online.

Vehicle Loan Rates | DCU | Massachusetts | New Hampshire. I currently have a 1.74% 65 mo with them on an ICE.

View attachment 174336

Way to start on this thread. I had to change my rating to love. 120% at 1.49 over 65 months? More free money I'll take it.

Similar threads

- Replies

- 4

- Views

- 1K

- Replies

- 9

- Views

- 3K

- Replies

- 1

- Views

- 2K

- Replies

- 14

- Views

- 1K