ReflexFunds

Active Member

It's not true and very misleading. The resale value guarantee liabilities are more than off set by Operating Lease Vehicles on the asset side of the Balance Sheet.

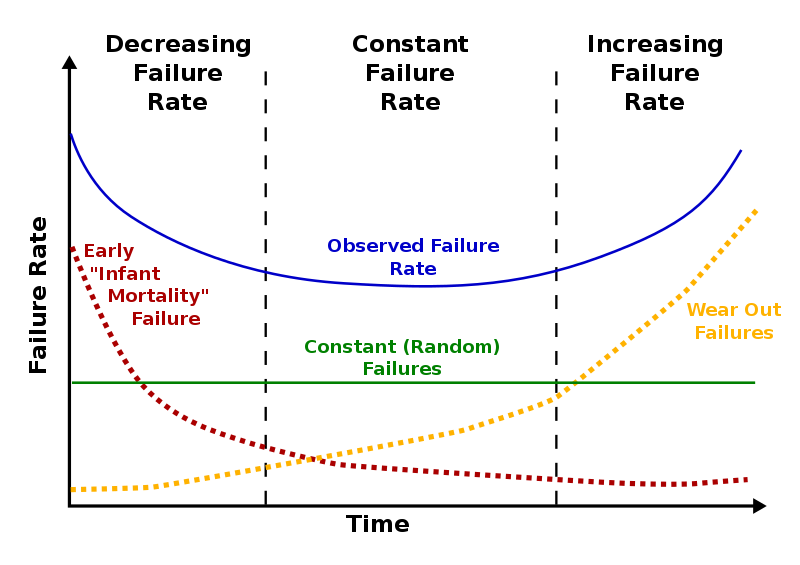

When a Resale/Residual Value Guarantee transaction was originated, ALL the cash for the full purchase price was paid up-front when the vehicle was first titled by the individual buyer or Banking Affiliate lessor. Over the term of the guarantee, the deferred revenue is recognized ratebly and the cost of the vehicle is depreciated so that at end of the guarantee period, both the liability and the depreciated asset value are equal at the guaranteed value. If the beneficiary of the guarantee keeps rather than returning the vehicle at the end of the guarantee period, both the remaining liability and the vehicle's remaining net asset value are removed from the Balance Sheet with no effect on the Income Statement (other than a small amount of warranty reserve is booked since warranty costs are expensed during the guarantee period.)

If the guarantee beneficiary returns the vehicle at the end of the period, cash is used to pay the beneficiary the contractually agreed guaranteed amount, and the vehicle becomes part of Finished Goods Inventory at the lower of cost (remaining un-depreciated ledger value in Operating Leases) or market.

The most recent Cash Flow from Operations section shows Tesla used $2.8 million for Operating Lease vehicles in 3Q18 and $188.9 million YTD

This is correct, but it's worth noting new operating leases are still costing Tesla c.$150m per quarter. Cars sold under Tesla's inhouse leasing program were 3% of deliveries in Q3 or 2,513 S/X in Q3. Assuming average cash costs of these at c.$62k means Tesla funded $157m new leases.

The reason operating leases in cash flow statement consumed $3m rather than $157m cash in Q3 was likely because old lease cars returning to Tesla were reclassified from operating lease vehicles to finished goods inventory.

On the cash flow statement this would have corresponded to c.$154m cash generated by operating leases and $154m cash consumed by inventory. These cars would later be sold second hand and recorded as service revenue, so the inventory cash burn is then cancelled out by booking it as revenue.

So net net, Tesla is currently funding direct new leases by selling second hand cars once they are returned to Tesla from leases started 2 years ago.

Most leases are now actually sold through third parties rather than Tesla's direct lease program, so Tesla collects cash upfront from leasing partners and books revenue immediately as if it was a customer sale.

Last edited: