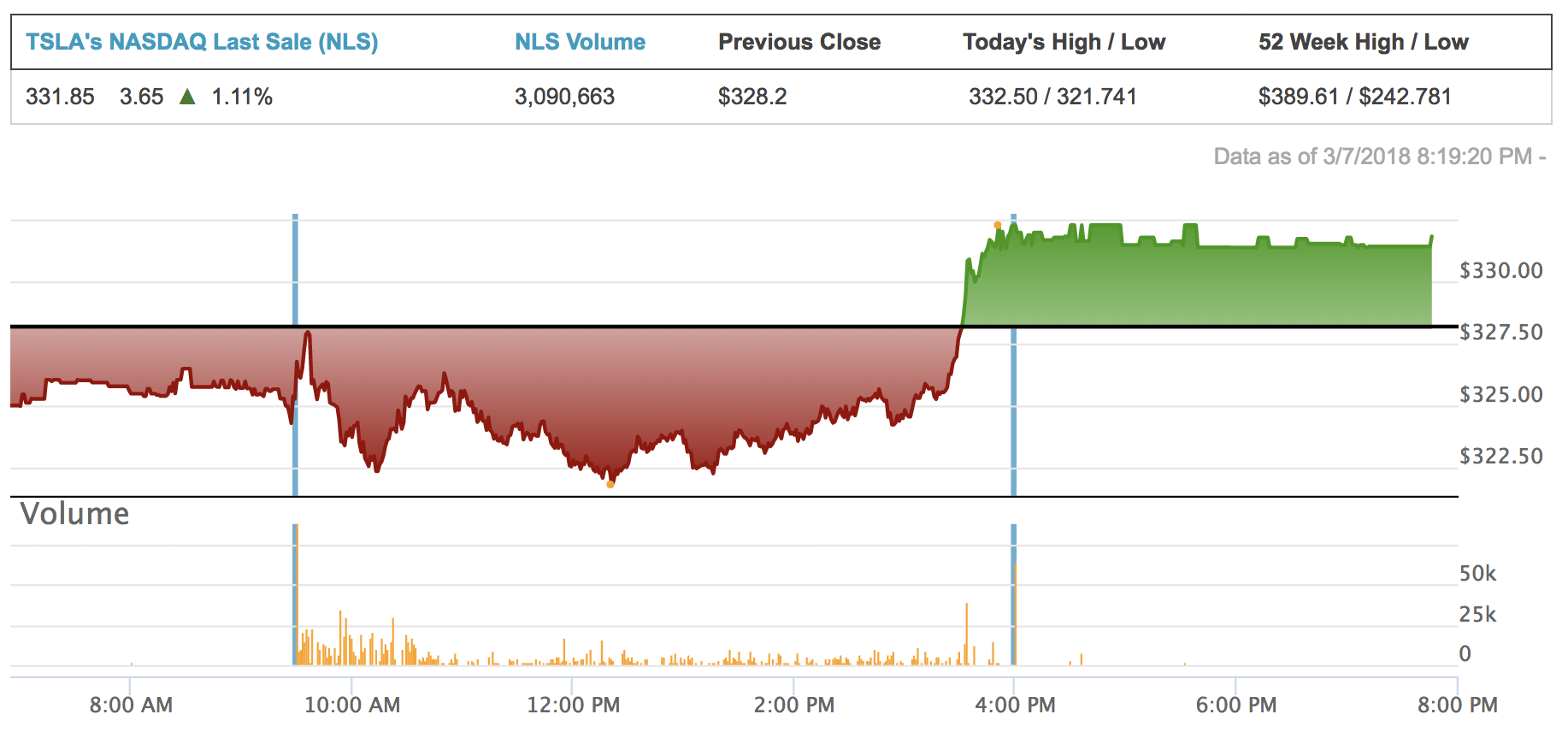

On Friday the second shoe dropped on the Trump tariffs, and the broader markets fell sharply. TSLA fell almost exactly the same amount as the NASDAQ, which explains the stock's poor performance. For the week, the markets endured their worse week since 2016.

The good news is that Tesla does indeed look to be attempting to greatly expand its Model 3 production as the end of March approaches. Twice this week Tesla registered over 2000 new Model 3 VINs and hugely increased the number of invitations to configure Model 3. Upcoming Model 3 deliveries to Canada were announced. James Albertine, a bullish analyst, spoke with Tesla and announced his belief that Tesla would be producing at 2,000 Model 3s/week by month's end. I think Albertine was likely used by Tesla to deflate expectations about Model 3 output at end of March while simultaneously declaring that investors will be satisfied with this number because is shows substantial progress. The market did not respond unfavorably to Albertine's remarks, and so he is probably right. At this point, few investors expect to see 2500M3/week production rate in little more than a week's time.

One encouraging sign is that three VINs of greater than 12000 were announced this week. Another positive sign is the large number of Teslas appearing daily in the Fremont delivery lot and briskly being whisked away by delivery trucks. It's too early to either assume that Tesla will hit 2000 Model3s/wk in March, and too soon to assume they will fall substantially below that number. Again, longer-term investment strategies are suggested when there is so much short-term uncertainty. Personally, I'm sitting on my J19 leaps and shares because if we hit the high Model 3 production numbers, TSLA will move up very quickly and if the numbers fall short, we will still move up substantially from here when Model 3 hits higher production rates this year. I also did a small buy at 304 this week, locking in what I believe will be a great price once the stock recovers from this current dip. I have kept additional powder dry just in case we go lower.

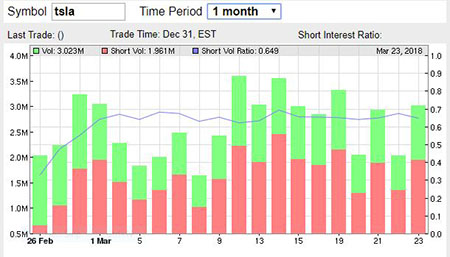

Short-seller percentage of TSLA trading has been brutal at about 2/3rds of TSLA trading since early March. Investors can correctly assume that this level of manipulation has artificially lowered the stock price. We longs are currently being offered a nice discount on shares. Typically, TSLA makes a large correction upward after the shorts chisel away at the SP over time. I suspect that correction is not too far off.

Looking at the technical chart, you can see that TSLA has descended below 306 five times since early November. Notice that these descents either didn't dip below the lower bollinger band or that the stock price rose to within the lower bb within 3 days after pushing through the lower bb. If there's bad news in the delivery report in early April, it is possible that TSLA could drop lower, but without such news (unless the macros get really funky), TSLA should bounce in the 290s at some point. It takes some really bad news to keep TSLA below the lower bb for more than 3 days.

For the week, TSLA closed on Friday at 301.54, down 19.81 from last Friday's 321.35. Most of this loss can be attributable to bad macros.

In conclusion, TSLA continues to be a volatile stock, and dips to the low 300s or the 290s have been fairly common since November. In each case, TSLA has bounced back. The company is sound. There's high interest in Model S and X because with low inventories but high production, Tesla seems to be able to sell all the S and Xs it can make. Further, Tesla is producing these large numbers of S and X with 2 shifts instead of 3, which suggests efficiencies and better S and X margins in Q1. Model 3 has been shown to be a truly exceptional vehicle at its price range and demand will continue to soar as more people are exposed to this vehicle. Model 3 production is apparently ramping fast in these final weeks of March. The only really bad news has been that deliveries in Q1 have been somewhat constrained by the drawdown in inventory that took place in Q4 and that Model 3 ramp-up has been slow until the last week or so. I suspect the investor community would be happy to hear 2,000 Model 3 deliveries/week at the end of March, especially if accompanied with promising words about the ramp to higher numbers in Q2.

Better days lay ahead. Have a good weekend.

Conditions:

* Dow down 425 (1.77%)

* NASDAQ down 175 (2.43%)

* TSLA 301.54, down 7.56 (2.45%)

* TSLA volume 6.7M shares

* Oil 65.88, up 1.58 (2.46%)