Short and sweet:

* Low volume and 64% of trading done by shorts = lots of manipulation

* Broader markets recovered throughout the day but mid-day TSLA was held back by short selling (often, if shorts can convince traders that TSLA will not rise with the broader markets, such big up days are not good for TSLA. The shorts succeeded with their mischief today, but had to deploy lots of resources to do so).

* No major Tesla news

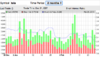

Today TSLA began with a mandatory morning dip, right on schedule and a buying opportunity as expected. As the broader markets rose on reduced concerns of a trade war, so did TSLA. Up until about 11:30am, TSLA's movement was influenced by the broader markets, but once TSLA broke into the green, the shorts began a prolonged game of whack the mole to keep TSLA from climbing with the NASDAQ. At about 1:30pm, shorts pushed TSLA down into the red and held her there. About 15 minutes prior to close, buyers started bidding TSLA back up towards the green, but because of the low volume shorts were able to throw enough resources forward to thwart the mini-rally..

The mandatory morning dip required resources from the shorts, as did the capping throughout the day. For this reason, today's trading was not profitable for the manipulators and they are slowly taking their licks. A disparity exists between bears and bulls at the moment. Shorts believe that TSLA Model 3 production is severely gorked and when production finally ramps, if it does, the car will be unprofitable. This is a very unwise position to take. Bulls, on the other hand, see that Musk stuck his neck out with the 8K statement that Tesla can reach 2500 M3/week in Q1 without the German battery module line, which is going to be installed this month. I see Tesla as having a lot on the line in getting Model 3 close to 2500/week by the end of this month and that the stock will fly upward if that rate can be achieved and it will lose value if the significant ramp up doesn't come. The good thing for bulls, though, is we get second chances if there's a miss. The stock would head south if there's a significant miss, but when Tesla achieves 5,000 Model 3s/week it will soar. I would just caution you about not trying to time these events because Tesla is almost always late (but eventually achieves its aim).

Tesla should have continued to run up with the broader markets today but manipulation held it back. Here is the NASDAQ daily chart

Although short percentage of TSLA trading dipped a few points from Friday, it is still about 2/3rds of all shares traded, which is crazy high and explains the lack of price appreciation today. The exceptionally low volume suggests that longs are hanging tough, waiting to see Model 3 ramp up and for good things to happen.

Looking at the technical chart, you can see why the shorts are throwing so many resources at TSLA at the moment. TSLA is just below the 50 DMA and not far below the 200 DMA. The shorts don't want to see TSLA rising above these two number when a golden cross of the 50 DMA rising above the 200 DMA takes place. If you want to understand why the shorts pushed TSLA down to about 333 today and held it there, the 50 DMA and 200 DMA tell you why.

Conditions:

* Dow up 337 (1.37%)

* NASDAQ up 73 (1.0%)

* TSLA 333.35, down 1.77 (0.53%)

* TSLA volume 3.8M shares

* Oil 62.62 up 0.05 (0.08%)