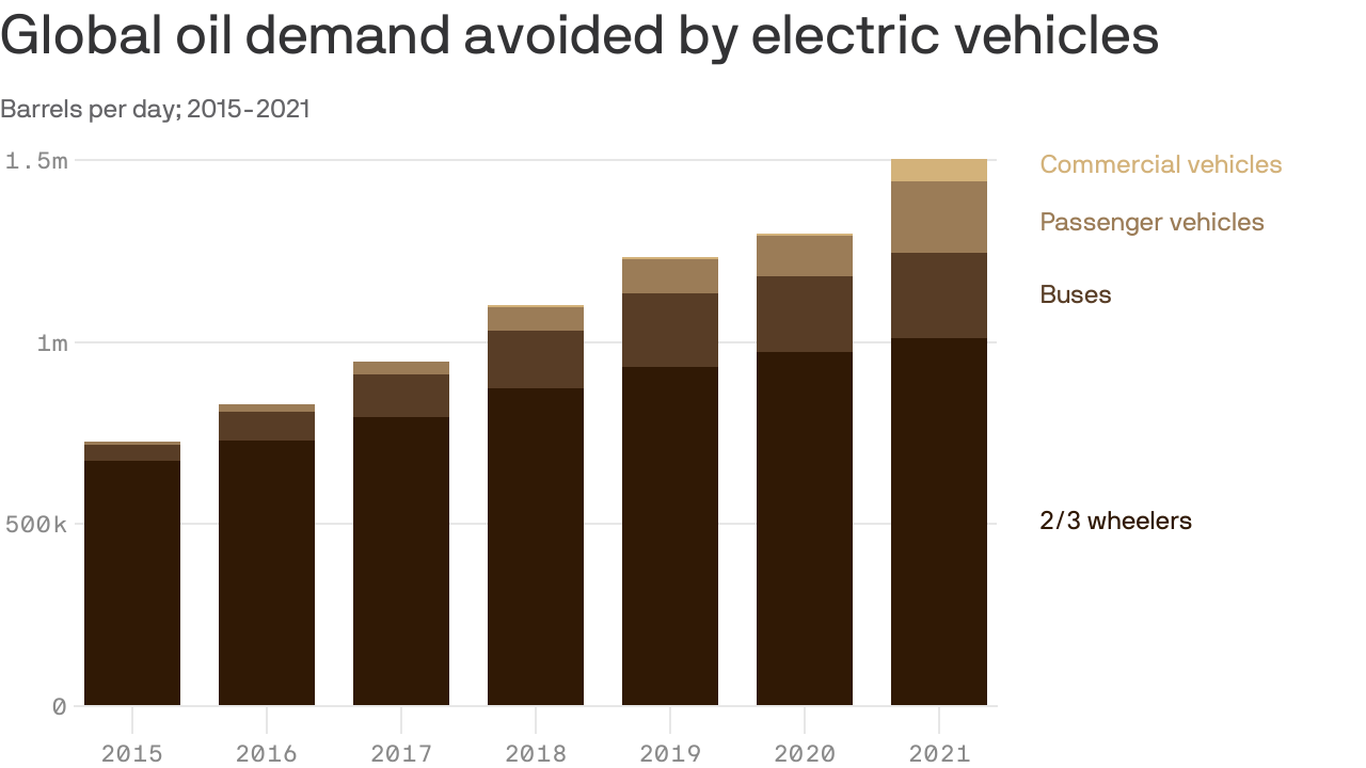

EVs are shoving aside real volumes of oil, report shows

New estimates help to show EVs are shedding their status as a niche climate technology.www.axios.com

The intrigue: What kinds of EVs are doing the heaviest lifting right now is surprising (to me anyway!).

The big picture: BloombergNEF said last year's displaced oil demand amounts to roughly one-fifth of Russia's pre-invasion exports.

- "Two- and three-wheeled EVs accounted for 67% of the oil demand avoided in 2021," the report notes, citing rapid adoption in Asia.

- Buses were next at 16% and then followed by passenger vehicles at 13%, though BloombergNEF adds that they're the fastest-growing segment.

I remember reading that 2 wheelers are more polluting than cars. So this is great news. Tesla not opening in India makes sense, they need 2 and 3 wheelers due to population density.