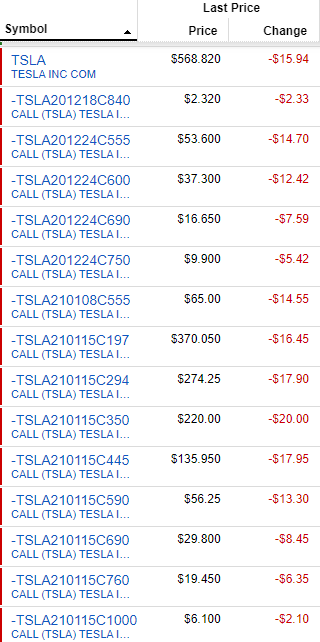

All my options were bright red today - some of the crazy aggressive ones are down over 50%.

I am not going to do anything till week of Dec 14th.

I am not going to do anything till week of Dec 14th.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

You may have timed it perfect with the Goldman upgrade after hours. I, on the other hand, closed out my 12/11 calls this morning for a big loss (so much so that I don’t even want to look at it). I couldn’t take the heat anymore. I’m was guessing that two tranches inclusion would cause a steady SP rise. Instead, the single tranche announcement temporarily depressed the SP and killed my short term calls. I had bought calls for 12/4, 12/11, 12/18, 12/24, and 12/31. Obviously the 12/4 will expire worthless, but it was only a joke buy anyway and cost $35, less than a decent meal. My biggest bet is on 12/18 700c which went very green for me initially. I should have sold for 50% profits early on, but got greedy. They’re down significantly, but I’m hoping that GS upgrade will juice the SP by early next week. I’m definitely taking some profits on that one if we get a SP over $600. My lesson for this week is that options volatility is very, very stressful and watching mine go from +50% to -50% in a few days has been too much. I will be cashing out at least half from now on anytime the trade goes my way. I did that with some NKLA puts, got my trade cost back, now letting the remainder ride for a few more days.Well, the action these past days are beyond stupid.

I bought 15x 12/18 $950 calls yesterday, and bought a other 15 today, as they were $0.7.

30 calls is enough.. expect sp to jump any time now.This drop is just pure stupid..

maybe not abvoe 950 be 18th, but if it does I am prepared.

..but my timing if often kinda off, so I guess 12/24 would have been a better bet.

All my options were bright red today - some of the crazy aggressive ones are down over 50%.

I am not going to do anything till week of Dec 14th.

View attachment 613929

Something I've learned the last couple of weeks, is that options that get deep ITM are a lot less stressful, and have a much different behavioral profile.

couldn't agree more. after burning my fingers a number of times with short expiration/OTM options, I've switched to DITM LEAPS.

What do you guys think about going 650c 12/31 on 12/17 and insta sell at open on 12/21 after inclusion? If it goes up then big gains and if it stays the same then I’ll probably lose 10% on decay. My thoughts are that there will probably be more than 120m shares that the s&p and those mimicking it will have to buy. Daily volume is around 50m shares or so and assuming traders have racked up around 50m shares to sell to the s&p (2x daily volume) they still have another 70m+ to go. This is all based on the assumption that the price won’t drastically drop creating a 10% downside vs a 200% upside. Can someone give me counter arguments or more scenarios of this going wrong for thoughts?

I'm also looking for a fill on some 12/11 600s I have.

Lol, wait, the addtion date is Dec 21st, but you think the Index funds will be all done BEFORE then?!

Previous S&P 500 additions show that the largest single day of buying is the actual day of addition (go figure).

Imma call it Dec 28 for most of the buying to be done, with some funds allowed +/- 7days, and nearly all finishing up by end-of-day on Dec 31st (end of FY20).

Cheers!

That plan is similar to what I'm keeping an eye out for between now and 12/17, including the specific strike and expiration date, and for similar reasons. Having the specific dates planned out ahead of time doesn't seem as wise to me, but I buy calls rarely and my opinions on that should be eaten with a boulder of salt.

You might find that you get a better entry before 12/17. I expect flattish trading next week, with a reasonable possibility of a significant move down in the final week before the serious buying begins. (And of course, a significant possibility of a big move upwards, with some buyers front running the buyers in the week of 12/18). I don't know have a strong opinion on what will actually happen, so I've got positions for a variety of upward moves.

You might also find a better exit on 12/17 or 12/18 - more time decay still in the option and possibly a significant IV spike that makes the overall position so profitable that waiting the extra day to see what happens after isn't worth it.

So my main idea is to have your specific idea as one scenario for entry and exit, but don't fixate on that one specific circumstance too closely. If shares are already $800 on 12/17, would you still enter with either $650s or update the plan to $850s? If we see $550 on 12/9 next week, will you continue waiting to enter the position?

The primary counter argument / scenario that I have for you, as well as the rest of this thread, is that one dynamic I've witnessed several times over the last 7 years with TSLA, is that when "everybody" in the main thread is confident of what will happen next, what happens next is the opposite. My interpretation is that the trade for the direction expected gets overcrowded and that leaves few buyers to actually push the shares in that direction - they've all already bought.

Now I'm positioned like "everybody", and my rationale is that this time is different, due to the large volume of announced and programmed buying.

In fact I think that this inclusion could be sufficiently bad for the index that S&P changes how they add and rebalance in the future. Something like tell the index funds what is changing about a week before so they can establish the new positions, and then announce the changes after they have happened. Frankly, anybody with a significant fraction of the market shouldn't be preannouncing changes (MHO) because it's too easy for the rest of the market to front run.

This dynamic is what happened to the oil market back in May, when oil briefly hit $-38/bbl (owners were paying buyers to take their oil).

I think I'll hold on the 12/24 800s until the week of 12/18 as my high strike / shares to the moon position with high leverage.

This is what’s keeping me up at night and watching daily. Look at the put-call ratios on the max pain site through month end. Damn, everyone seems to have calls. What if the MM have been quietly collecting TSLA shares since the S&P announcement that Etsy would be added instead of TSLA? If they have enough shares, then they could manipulate the SP anyway they want and still sell to the indexes. Definitely a nightmare scenario for many. On the other hand, the GS upgrade suggests that they want the price a little higher. Watchful waiting for the next few weeks for me.....snip.....The primary counter argument / scenario that I have for you, as well as the rest of this thread, is that one dynamic I've witnessed several times over the last 7 years with TSLA, is that when "everybody" in the main thread is confident of what will happen next, what happens next is the opposite. My interpretation is that the trade for the direction expected gets overcrowded and that leaves few buyers to actually push the shares in that direction - they've all already bought.

Now I'm positioned like "everybody", and my rationale is that this time is different, due to the large volume of announced and programmed buying....snip....

You may have timed it perfect with the Goldman upgrade after hours. I, on the other hand, closed out my 12/11 calls this morning for a big loss (so much so that I don’t even want to look at it). I couldn’t take the heat anymore. I’m was guessing that two tranches inclusion would cause a steady SP rise. Instead, the single tranche announcement temporarily depressed the SP and killed my short term calls. I had bought calls for 12/4, 12/11, 12/18, 12/24, and 12/31. Obviously the 12/4 will expire worthless, but it was only a joke buy anyway and cost $35, less than a decent meal. My biggest bet is on 12/18 700c which went very green for me initially. I should have sold for 50% profits early on, but got greedy. They’re down significantly, but I’m hoping that GS upgrade will juice the SP by early next week. I’m definitely taking some profits on that one if we get a SP over $600. My lesson for this week is that options volatility is very, very stressful and watching mine go from +50% to -50% in a few days has been too much. I will be cashing out at least half from now on anytime the trade goes my way. I did that with some NKLA puts, got my trade cost back, now letting the remainder ride for a few more days.

This is what’s keeping me up at night and watching daily. Look at the put-call ratios on the max pain site through month end. Damn, everyone seems to have calls. What if the MM have been quietly collecting TSLA shares since the S&P announcement that Etsy would be added instead of TSLA?

FrankSG said:So where did these ~60M shares go? If these shares suddenly showed up on the market, that has the potential to drastically change TSLA's S&P 500 inclusion. I believe I have found a likely explanation in Softbank.

100% the same for me. There are so many calls open whose worthless expiration would make a fortune for the MMs -- those entities that IMHO have shown over the last few years that they're very good at provoking stock movements in their favor.

Then there's the curious case of 60M missing shares, as reported by @FrankSG in his blogpost.

Let's hope they don't sit with an entity that plans to aggressively sell into the S&P rise, because they're short calls. (according to @FrankSG 's research, they aren't held by the big US MM's)

This fact -- the incentive misalignment between us longs and the powerful MM's -- along with the fact that everyone is super certain that the stock will go up -- makes me a little bit skeptical (but not skeptical enough -- by far -- to not be superlong).

On the positive side, the huge delta hedging as the stock is going up might feed a reinforcing feedback loop (aka "infinity squeeze").

thanks, this is a new perspective for me.MM manipulations are far overblown. Read up on pin risk to understand better what some think is manipulation. I'm not saying here that there's never manipulation, but I think a lot of price movements often attributed to MM manipulation can be better explained by this pin risk.

it doesn't necessarily have to be a short-term trade by intention? it could also happen that the position goes above the position size or the price target that the entity has decided is their threshold to start selling?It's possible, but it'd probably the largest short-term trade ever? I'm also not sure of an entity large enough to put about $30B on the line for a short-term trade. The only entities that have that kind dough aren't the type of entities to make short-term bets I'd think.

Timeline.

- Throughout - speculative purchasing from active funds that benchmark against S&P500 (plus other funds etc.)

- 11th December - S&P announce who Tesla will replace

- 14th December - Some indexes can start purchasing

- 16th December - Most indexes can start purchasing

- 18th December - Some indexes to have completed purchases

- Premarket 21st December - Inclusion

- 24th - More indexes to have completed purchases

- 28th December - Most indexes must have completed purchasing

- 4th? Jan - P&D

If the SP goes up massively on the 18th, some may put off buying pre the 21st. Peak could be post 21st.So historically when is the best time to sell for an S&P inclusion? The 21st or the 18th?