Yeah, I'm also strongly considering just letting the whole lot exercise rather than kicking the can down the road and sell a ton of puts...You could take a cautious first step while readying more complicated tactics in response to early week news, i.e.., do “b” today and watch what Max-Pain does Tues and Wed and the inflation reports. Remember a roll of one week and $5 would be worth $45k ($5 x 9000) less any debit cost of the roll. Or you could try to guess what news is coming this week and move in anticipation. Still seems unlikely we’ll reach $180 by Fri, but who knows? I have 12May$180, so. Will probably roll up and out if we are still $175+ later today or tomorrow. Keep in mind the low correlation imho of pre-market.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

intelligator

Active Member

P165 is stacked +16k, P160 +9.5k, P162.5 +6.2k, call strikes 170, 172.5, 175, 177.5, 180 average about +8k each ... I have -c177.5 and -c180 , $10 wide BCS. If we don't see a pullback, will close the lower with proceeds from the other, reposition the second.

If this is anything like the January 2022 recovery trajectory, then watch out above! Definitely wrong time to sell short calls without careful thought.

Difference is that the drop to $100 was fake, this current pull-back is based on underwhelming earnings, that's why I don't trust it at all...If this is anything like the January 2022 recovery trajectory, then watch out above! Definitely wrong time to sell short calls without careful thought.

I am worried about my 182.5CC for Friday. When I sold them last week they were over 12% OTM. I might roll them up and out aggressively in case this is a run back over 200. I disagree that earnings were bad for any investor that can look toward the future at all.

Well that's kinda the job description.I am worried about my 182.5CC for Friday. When I sold them last week they were over 12% OTM. I might roll them up and out aggressively in case this is a run back over 200. I disagree that earnings were bad for any investor that can look toward the future at all.

Well that's kinda the job description.

Do you still see a retest today?

Yes. It's not uncommon for the stock to overshoot a resistance before pulling back instead of outright getting rejected.Do you still see a retest today?

juanmedina

Active Member

I sold $182.5 at open at $0.98. My thinking is that we are range bound from $200 to $160 at least until ER so I have some time to figure things out if the trade goes wrong. I am also ok with going cash at this point because of the possibility of a recession... I might regret it lol but that's my thinking right now.

Yikes, $174-$175 in PM. Looks like I’ll need a Plan B if this keeps up

(Short squeeze?)

View attachment 935678

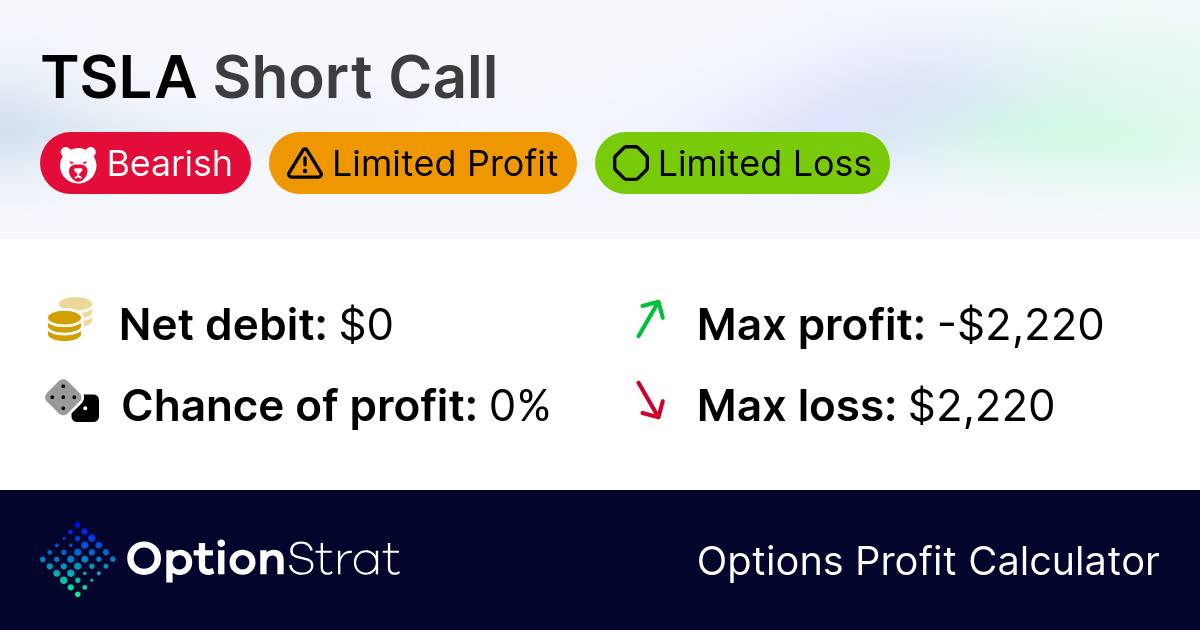

TSLA Jun 21st '24 300 Short Call (30) | OptionStrat

View my options strategy on OptionStratoptionstrat.com

TSLA May 12th 180 Short Call (30) | OptionStrat

View my options strategy on OptionStratoptionstrat.com

TSLA May 12th 182.50 Short Call (60) | OptionStrat

View my options strategy on OptionStratoptionstrat.com

Went flat on the short calls for a loss at $171 dip (am too anxious to wait for lower dip), and STO 50x -P160 for 5/12 for $0.65.

Last edited:

Went flat on the short calls for a loss at $171 dip (am too anxious to wait for lower dip), and STO 50x -P160 for 5/12 for $0.65.

I am. Will decide tomorrow. I think this is just the sudden realization by people that Tesla is not going to crash and so they rushed to buy back the calls they sold. I rolled my short puts up to 175. Betting we will see 180 after the retest.

You’re still holding out?

Call flow is coming in. This is not what you want to see if you're stuck with ITM CCs. However, this fits the 3 day pump schedule perfectly.

Again:

1st day was Friday

2nd day is today with call IV ramping up

3rd day tomorrow blow off before pulling back

It can get a bit nerve wrecking if you have ITM CCs. Hang in there it's almost over.

Last edited:

@MaChiMiB ,How crazy would a leap of faith be?

I'm currently 100% in simple TSLA stock (since 2019), but more and more interested in LEAPS.

Especially OTM Dec25 Calls like $300 or even $450.

I'm a strong believer that Teslas rapid speed of innovation and efficient execution will accel them to the most valuable company.

The last 2 years were a period of little visible innovation for mainstream consumers. That will change in the coming 2.5 years (Cybertruck and Semi on roads, $25k Tesla, better FSD, Megapack,...). There will be enough demand, if the economy isn't crumbling hard and recovers in 12 to 18 months.

The P/E ratio got compressed a lot, and will hopefully reflect Teslas 50% groth some better once the general market loses some fear.

I see a lot of upside potential until 2026 and feel the probabilities are much higher than for the downside scenarios.

I'm not old and don't need the invested money. Am I crazy getting in 100% on those OTM longtime LEAPS?

Risky, not crazy. I'm a LEAP kind of guy, I just don't know when to cash them in and buy shares. I have lots of Dec 25 $390's, but lots of HODLing shares.

Farthest OTM I see in the option chain is $390 strike; are you seeing $450's offered anywhere?

@Cosmacelf , I rolled my 2024 LEAPS into 2025 expirations long ago. I can't wait to see if my "strategy" will pay off.Yeah, that’s what I thought when I bought my March 2024 LEAPs.

Last edited:

I decided to roll half of my 182.5CC to next week 190 for 0.17 credit (close to my weekly goal of 0.2). Probably didn’t need to, but I feel a little better about those. Will watch the other half for now. The nice thing is macros red, and if they stay red, they tend to pull TSLA down by the end of the day.

It already did. Market has been trying to front run CPI and FOMC all year. It always try to "revert to the mean" before a big announcement only to do nothing or even the complete opposite of what you'd expect on the day of the announcement.We have CPI on Wednesday, and that can put a lot of our positions in jeopardy….

All,

This pattern seems to be a TSLA staple. Study it and you'll be much better off. Or not. TA doesn't work.

1st time in January was a real breakout

2nd time in March was a dead cat

but both times the stock made new high after the retest. This time, the natural target is 180.

So when we see sub 170 tomorrow or Wednesday, prepare to make the hard decision to cut your loss on ITM CCs, or not. Up to you really.

I'm making my moves early this week because I don't like to watch paint dry.

The 10 x p152.5 and 10 x p155 I sold last week for $2 had come down to $0.14 and $0.24 and I don't like to waste a week on those last few cents. Rolling to a higher strike for this week doesn't get me much premium, so I rolled 10 x p152.5 to 162.5 for next week, netting €2,20 in premium. Ofcourse we went down immediately afterwards, but I still have dry powder with the other 10 puts which can also be rolled.

The 10 x p152.5 and 10 x p155 I sold last week for $2 had come down to $0.14 and $0.24 and I don't like to waste a week on those last few cents. Rolling to a higher strike for this week doesn't get me much premium, so I rolled 10 x p152.5 to 162.5 for next week, netting €2,20 in premium. Ofcourse we went down immediately afterwards, but I still have dry powder with the other 10 puts which can also be rolled.

I have buy orders set for my 30x -c$180s at 50% profits (would be at .35 per share) - we’ll see if those trigger today. I still feel pretty good about them expiring OTM, but would prefer closing them early.

We hit $169.19..

I shouldn’t have doubted. As a noob I still need to work on my anxiety…and stretch my risk tolerance a bit more.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 11K

- Replies

- 5

- Views

- 6K