SebastienBonny

Member

Well I think there is one big difference between premium and strike improvement.Keep in mind that rolls, even if for debits, can still pay for themselves by capturing capital gains through strike improvements. If you have the cash. Perhaps at some point selling shares to raise the cash could be needed. Keep rolling and eventually dip(s) will allow you to get out whole.

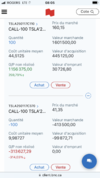

I now have a 225 CC, which I prefer to roll for credit and not for strike improvement, as long as it's worth it.

I could also get some small weekly strike improvement, but the big difference between the two is the premium is in the pocket (shares can be called away anytime, premium stays in the pocket), while strike improvement is gone when the SP tanks and let's your contract expire worthless.

Actually, when you roll with strike improvement, you have to let the contract expire ITM to get your gains, while rolling for premium nets your gains whatever happens to the SP and your contract.

On the other hand, I'm also covered now for most of my long shares, which isn't the best position to be in, but I do have a 270 strike right now for the end of the year. Obviously that's not a strike I would sell them for.

Not really looking to gain premium here, but rather looking for a strike I'm willing to sell for at a certain point (of course, it would've been better letting these uncovered, but that's the way it is now). EOY 23 270 CC can be rolled higher than 400 somewhere in 25, which would be okay to let those shares go at that time. Meantime I can add long shares again when there's an opportunity.

So, yeah, think the big difference is what you want to do with the shares that are covered and what you want to get for them. This is a big run, but I do think we will see new opportunities to close CC's, buy cheaper shares,... I know history is what it is, but stocks always go up and down. Who thought we would ever see low 100s again? Why wouldn't we see low 200s again this year? Just don't make decisions too quickly here:

- Watch out flipping calls to puts

- Don't overreact by rolling sold puts higher to finance rolling sold calls higher

- ...