Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

thenewguy1979

"The" Dog

been chilling out on the wallstreet forum and this site is a breath of fresh air. Lot of good people with some truly good insight. TA can only take you so far. It's the experiences that count and we have it in spade here. Happy to be parts of this and a Good Friday to all!!!!

Surfer of Life

Member

Wait, what -?- you waltz in here, post a few times, and now you’re saying we all stink???been chilling out on the wallstreet forum and this site is a breath of fresh air. Lot of good people with some truly good insight. TA can only take you so far. It's the experiences that count and we have it in spade here. Happy to be parts of this and a Good Friday to all!!!!

thenewguy1979

"The" Dog

FSD and Robotaxi are currently overhype dream. When stock rises because of hypes fallback are just parts of the game. Question is how far. Seem the fall is much faster then anticipated. $249 and still falling.....

Obviously macros are helping drive today's price action, but I personally think we are finally seeing the expected P&D number get priced into the stock as well.

tivoboy

Active Member

Bought back at $5.5 don’t be greedy. (73% gain) I want to be able to sell 10 -c250 at the close probably today for 10/20 for ~ $15.Looking to buy back the 7 10/20 -c275 today at <6$ (at $250 SP or below we should be there)

we may rally back up to 250/253 today, at the close most likely, but I doubt we’re going back over $262 before getting to 23X.. $234 is now my next intermediate target, MAY sell ITM 10/20 calls at $240 for more premium Like $20.

Mid-day QTA update

TSLA well below lower 2sigma, in the past when this happened TSLA usually rose to get back over.

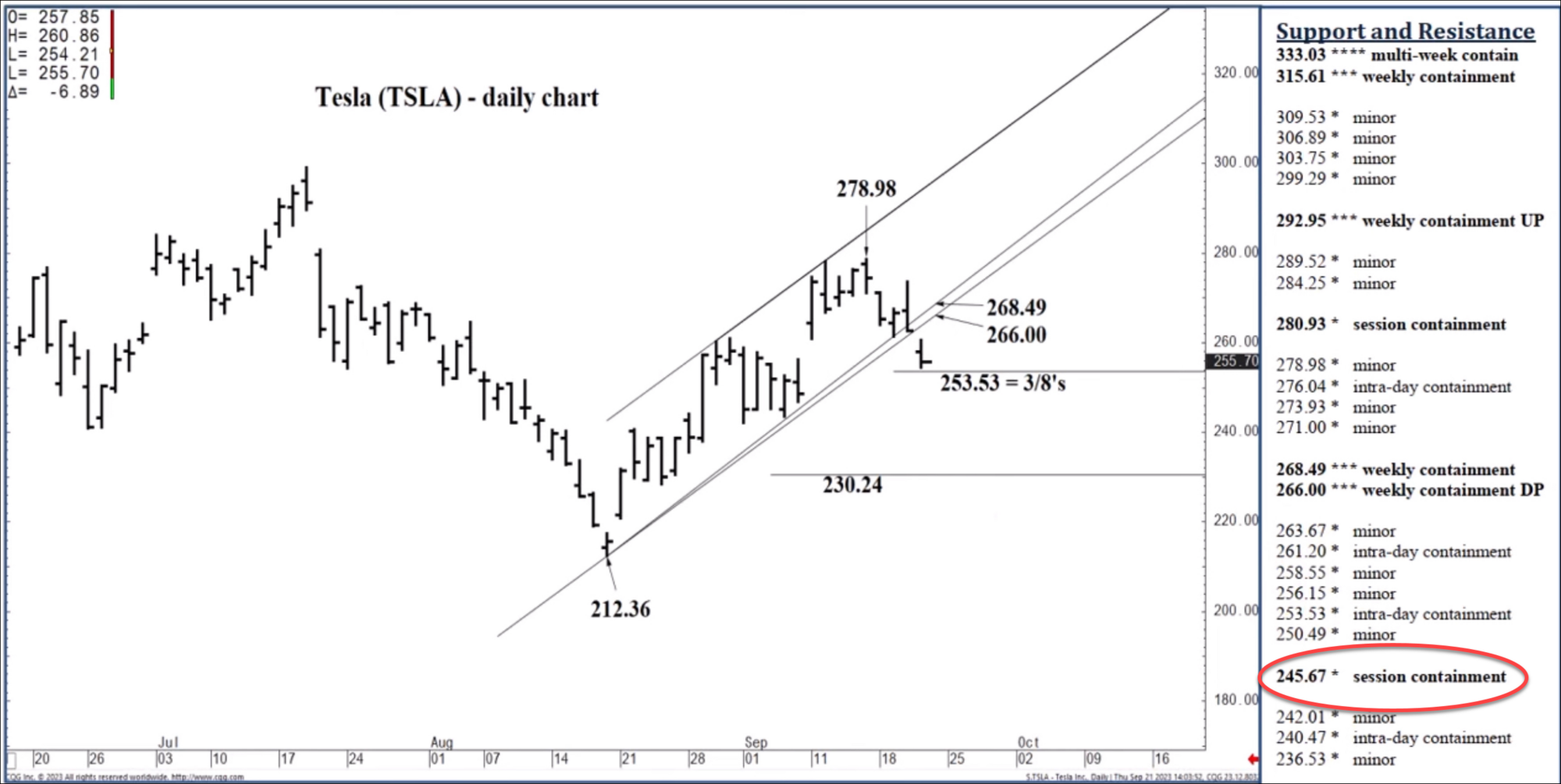

Also $245 area held today (Cary nailed the session containment again, see below from yesterday). Question is do we go lower on Monday (low volume day due to Yom Kippur usually) and rest of next week. You'd think the mystery Q3 P&D coming up on 10/2 might cause some interest and price improvement this coming week, perhaps a dud is expected across the board?

TSLA well below lower 2sigma, in the past when this happened TSLA usually rose to get back over.

Also $245 area held today (Cary nailed the session containment again, see below from yesterday). Question is do we go lower on Monday (low volume day due to Yom Kippur usually) and rest of next week. You'd think the mystery Q3 P&D coming up on 10/2 might cause some interest and price improvement this coming week, perhaps a dud is expected across the board?

EXOTIC1

Member

Wall

Guess you just have to bet on the side that’s rigged.

it’s a totally rigged game. … Many of the legacy auto maker stocks are up today including Ford ……. Yet Tesla is down over 4%This is really crazy stuff. TSLA down while F up 2.3% on the leak that the UAW leadership wants to cripple them for months. Please make this make sense….

Guess you just have to bet on the side that’s rigged.

Last edited:

SpeedyEddy

Active Member

Not too bad to be on the sideline, but the only -P (240 dec) is bugging me, so I am buying some counterputs to cover for an assignment-loss on a real dump before dec 15, that looks more likely every day now. Only 7 dollars left (but I hope I can roll them in time) assignment up until 226 is neutral, so in this phase 230 will be my most important support. So I buy earlier puts to broaden the buffer on an early drop

[Edit] Still far from capitulation and shorters seem to keep the powder dry, luring the buy-the-dippers in[/Edit]

[Edit] Still far from capitulation and shorters seem to keep the powder dry, luring the buy-the-dippers in[/Edit]

Last edited:

I think everyone expects lower numbers than Q2. It's also hard for me to see any margin improvement yet so unless Tesla pulls a rabbit out of their hat I'm not expecting a boost from earnings. Macro is unlikely to rally hard either IMO. We will need to see good news on inflation and GDP growth.Also $245 area held today (Cary nailed the session containment again, see below from yesterday). Question is do we go lower on Monday (low volume day due to Yom Kippur usually) and rest of next week. You'd think the mystery Q3 P&D coming up on 10/2 might cause some interest and price improvement this coming week, perhaps a dud is expected across the board?

Bright spot might be when (and I'm pretty sure it happens) Jpow comes out next week to talk the market up a little, that and perhaps some hype when the CT event is announced but that might be fully baked in by now. IDK.

Sold calls today and grabbed a few puts so we will probably hit ATH next week.

Last edited:

Maybe it's because I took the cheaper of the two subs - gets you real-time quotes tooI've been using OptionStrat for quite a while,

but I've never seen the volume bars above/below the strikes.

How do you get these bars? Or is this the paid version...?

intelligator

Active Member

Got out of jail free (except the fee) closed a BPS I foolishly opened yesterday 9/22 +p237.5/-p247.5 for even money. Now it can close above that , I don't care

OK, so, I rolled down next week's 20x -c270's to -c260 to grab an extra $1.50, also to taunt the trading gods a bit to get the stock up

With this dump was getting nervous on my insurance and was thinking ahead a bit, what if Elon starts to sell beginning 2024, he implied he would well next year, not a give, but it's a risk and could be disasterous

So I decided to roll 100x Now 17 +p200 to March +p200 - almost 100% profit on those Nov puts, plus the profit from the short puts I sold this week and I hope the 50x -p240's sold for next...

However, somehow I bought 200x, not sure if that's a broker technical issue (as I had an order I cancelled to change the price), or whether I fat-fingered it

Anyway, given the sentiment I decided to leave them in place for now and sold another 50x -p240 against them leaves 100x contracts free for rolling down if necessary

I'm confident I can recuperate the costs of those - just needs 50c premium short weekly puts, so not going to panic about them and appreciate the insurance for the moment

With this dump was getting nervous on my insurance and was thinking ahead a bit, what if Elon starts to sell beginning 2024, he implied he would well next year, not a give, but it's a risk and could be disasterous

So I decided to roll 100x Now 17 +p200 to March +p200 - almost 100% profit on those Nov puts, plus the profit from the short puts I sold this week and I hope the 50x -p240's sold for next...

However, somehow I bought 200x, not sure if that's a broker technical issue (as I had an order I cancelled to change the price), or whether I fat-fingered it

Anyway, given the sentiment I decided to leave them in place for now and sold another 50x -p240 against them leaves 100x contracts free for rolling down if necessary

I'm confident I can recuperate the costs of those - just needs 50c premium short weekly puts, so not going to panic about them and appreciate the insurance for the moment

john tanglewoo

2012 Roadster Owner

Great minds! I opened 25x -C297.5 10/20 for an average of 5.70

Just closed all these for 2.28. If we continue to dip next week I will be loading the boat selling puts.

Last edited:

tivoboy

Active Member

It is not a rigged game, BUT in the short to medium term duration for TSLA and other stocks it is a highly manipulated game. Here, we try and divine that manipulation and either participate or stay out of the way for various time horizons. Over longer term durations, 9-12+ months, fundamentals, market demands, domestic and international policies and objectives and the companies management will prevail and drive share price. Some higher, some lower.Wall

it’s a totally rigged game. … Many of the legacy auto maker stocks are up today including Ford ……. Yet Tesla is down over 4%

Guess you just have to bet on the side that’s rigged.

SpeedyEddy

Active Member

No, I don’t write for or whisper into Barron’s articles…….All the production lines upgrades (that will be touted as production issues)

Last edited:

Sold a $232.5 9/29 put for $237 [$2.37 lol ] right at the close. I’m guessing we get a dead cat bounce on Monday….or it goes to zero.

Last edited:

john tanglewoo

2012 Roadster Owner

You mean for 2.37 right? Otherwise you sir found the loophole!!Sold a $232.5 9/29 put for $237 right at the close. I’m guessing we get a dead cat bounce on Monday….or it goes to zero.

SpeedyEddy

Active Member

Ugly weekly candle ending on the low.

don’t make the mistake I and many over here made end of ‘22 to sell puts that eventually came DITM. (Got some now, but covered by buying nearer ones, using profits to buy new ones)Just closed all these for 2.28. If we continue to dip next week I will be loading the boat selling puts.

thenewguy1979

"The" Dog

sometimes the cat don't bounce, it just fall flat and died. Just 1 week till PD and then earning. Fear is in the air. The non-announcement of CT does not help. Even if it get announced and pricing is off the chart the cat will fall harder. Who know? This is just a casino.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K