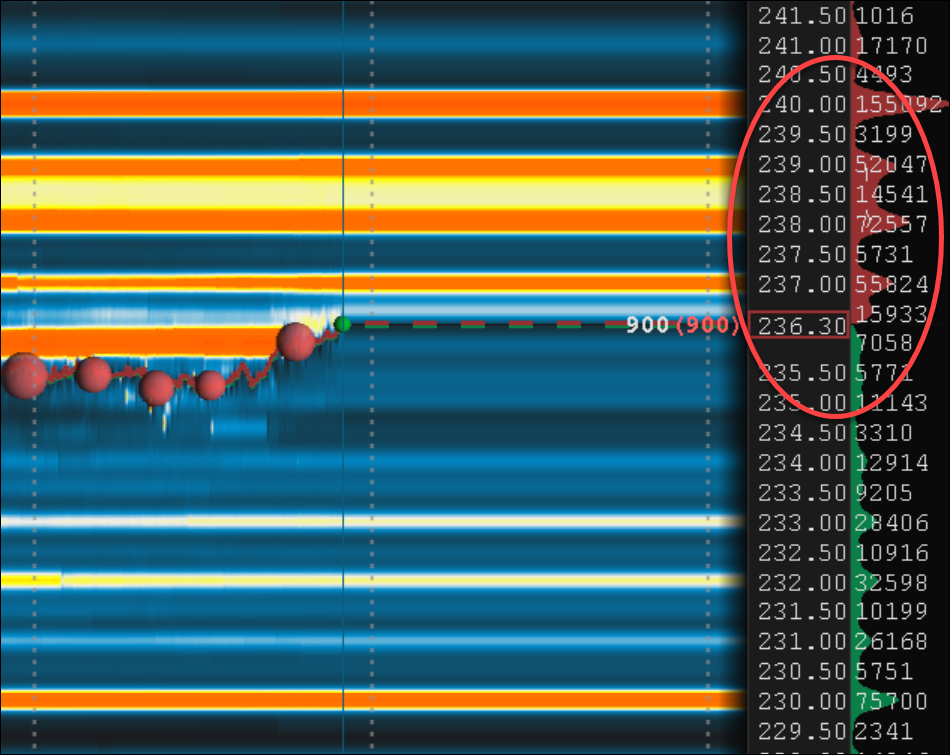

A gap fill at 224 is what I'm betting on, at the minimum.@dl003 Looks like $236 rejection in play, how far down is the retracement before bounce (to time our moves), gap area around $224 and we should close our NTM short calls there?

View attachment 990664

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Thanks. Timing?A gap fill at 224 is what I'm betting on, at the minimum.

No timing yet. Well, within a week.Thanks. Timing?

john tanglewoo

2012 Roadster Owner

Want to clarify my post.I did this exercise last week. TSLA doesn't strongly correlate with US10YR.

Hell, TSLA's correlation to S&P is only 0.5, again not much.

TSLA correlation to S&P is less for the normal look back of 5 years. It's only been 0.5 for the past 2.

Regarding the US10YR, TSLA is negatively correlated by 0.12 (meaning it moves in the opposite direction).

But generally anything less than 0.3 is statistically insignificant.

EVNow

Well-Known Member

Yesterday I sold 240 CC and again 245 CC.

Looks like 240 is already in danger. I don't get much gain by rolling to next week - just $5 (may $7.5). @adiggs would you roll today ?

Also I bought back sold 190 puts (limit orders executed) - should I sell puts for this week again. What strike ? 215 gets me 25 cents.

ps : The way I got caught really badly in DITM puts and got assigned was something like this. The SP ran up and I rolled up the put. Next day SP tanked ("Twitter"). I still haven't recovered from those assigned puts.

Looks like 240 is already in danger. I don't get much gain by rolling to next week - just $5 (may $7.5). @adiggs would you roll today ?

Also I bought back sold 190 puts (limit orders executed) - should I sell puts for this week again. What strike ? 215 gets me 25 cents.

ps : The way I got caught really badly in DITM puts and got assigned was something like this. The SP ran up and I rolled up the put. Next day SP tanked ("Twitter"). I still haven't recovered from those assigned puts.

Eating right through and up...

$236 area holding down so far...moment of truth into the close.

For those in short calls, be mindful of a gap-up into the 50-day ($241 area) which can ignite more fireworks.

$236 area holding down so far...moment of truth into the close.

For those in short calls, be mindful of a gap-up into the 50-day ($241 area) which can ignite more fireworks.

Last edited:

If you are stuck with ITM CC, please cry on the inside and don't type it out. People over in the main thread love days like this. Don't give them the satisfaction, fellow degenerates.

chillerjt

Member

Dropping charts, knowledge and jokes. Please don’t ever leave.If you are stuck with ITM CC, please cry on the inside and don't type it out. People over in the main thread love days like this. Don't give them the satisfaction, fellow degenerates.

tivoboy

Active Member

Sold 12x -cc245 11/24 @3.80 weeklies (thanksgiving week, could be lots of low volume vol) (would have held out for $4 but don't have time today)

This reaction feel’s possibly premature to me….

I agree. Some profit taking wouldn’t surprise me, but today’s CPI print and the accompanying changes in Fed funds futures could precipitate a rally that doesn’t see us revisiting recent lows any time soon.

I show the day's high at $238.135. Above $238.11, but not at close.

I show the day's high at $238.135. Above $238.11, but not at close.

Yeh, intraday touches don't really count I'm told. I meant on a close basis.

SAPharmD

Member

So I guess when the fed pivots next year, the market will begin to show weakness and pull back significantly?

Oh, "daily" chartYeh, intraday touches don't really count I'm told. I meant on a close basis.

I'll go with the more optimistic view.

[Edit: oh wait... just read the rest of that thread

Well I do have 100x ITM -c220's, but I'm not crying over them, I'll be rolling at the same strike and straddling with puts, using the excess premium to close out positions and then write OTM shitputs with freed-up contracts and buy back more contracts with those premiums too, -c270 is a strike I'm OK to sell off my LEAPS and wait for the next pull back, will "survive" selling puts

I did buy back the 50x -c215's and 50x -p210's for this week and STO 115c 11/24 -c250's -> these written mostly against 100x +c240's bought at $195 and my target sell on those is +200%, which is around $250, I'd made enough on all my puts this week, the initial call premium and the -c250 sell to pretty much break even, so although not perfect I'll take it

But not rushing on the rest...

I did buy back the 50x -c215's and 50x -p210's for this week and STO 115c 11/24 -c250's -> these written mostly against 100x +c240's bought at $195 and my target sell on those is +200%, which is around $250, I'd made enough on all my puts this week, the initial call premium and the -c250 sell to pretty much break even, so although not perfect I'll take it

But not rushing on the rest...

Well I do have 100x ITM -c220's, but I'm not crying over them, I'll be rolling at the same strike and straddling with puts, using the excess premium to close out positions and then write OTM shitputs with freed-up contracts and buy back more contracts with those premiums too, -c270 is a strike I'm OK to sell off my LEAPS and wait for the next pull back, will "survive" selling puts

I did buy back the 50x -c215's and 50x -p210's for this week and STO 115c 11/24 -c250's -> these written mostly against 100x +c240's bought at $195 and my target sell on those is +200%, which is around $250, I'd made enough on all my puts this week, the initial call premium and the -c250 sell to pretty much break even, so although not perfect I'll take it

But not rushing on the rest...

Nice work. A lot to keep track of!

I'm still holding these covered calls (would like to hold onto the shares if I could):

11/17

15x -C230 @1.00 (currently red

Wondering about this (nutty?) logic: If I BTC this today or tomorrow it will cost me around $8/share ($12k) over what I got for the contracts, that's like locking in the sale on the shares for $230 when it's at $238 now and might go higher by Friday. If I do nothing and let the clock run out and the SP remains around $238-242 range by Friday close, I end up with more or less the same "punishment" but keep the chance we chop tomorrow and Thursday and close Friday around $230-235 in my back pocket. (However, if the SP goes to 245+ I would be stupid for not freeing up the shares and just rolling to maybe Jan 19, 2024 -C265 for $8.70). Is that nutty overthinking?

11/24

30x -C235 11/24 @ 3.15 (currently red

15x -C240 11/24 @1.00 (currently red

I'm not worried about these just yet.

I would like to apologize to @dl003 for him to read this.Correct you never said SP would stay under 200 because you said it would bounce to 240. The time frame was suppose to play out longer and I'm not disagreeing with that call, I was pretty bearish too.

However all those calls were then revised because you made a mistake and thought it was a different wave? I don't know...you just dismiss when I bring up the 10y but I feel you might be able to be more accurate if you do some TA on the 10year because Tsla doesn't move in a vacuum.

thenewguy1979

"The" Dog

Well I do have 100x ITM -c220's, but I'm not crying over them, I'll be rolling at the same strike and straddling with puts, using the excess premium to close out positions and then write OTM shitputs with freed-up contracts and buy back more contracts with those premiums too, -c270 is a strike I'm OK to sell off my LEAPS and wait for the next pull back, will "survive" selling puts

I did buy back the 50x -c215's and 50x -p210's for this week and STO 115c 11/24 -c250's -> these written mostly against 100x +c240's bought at $195 and my target sell on those is +200%, which is around $250, I'd made enough on all my puts this week, the initial call premium and the -c250 sell to pretty much break even, so although not perfect I'll take it

But not rushing on the rest...

How you keep track of all the wheelin and dealin? Just reading them make my tiny head spun round and round.....

For those 100x ITM -c220 guess the expiration are weeks out so they have no chance of being assigned?

I read here somewhere but cannot track it down is it true ITM Call are seldom assigned whereas ITM Put are almost always assigned?

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K