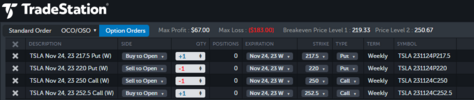

I need it to stay above 220 this week so I don't have to close out my 50x -p220, and next week looking for it to stay above 230, pleaseWe’re below any real support at this point (we’d have to get back up above $235 to think we’re at SOME support), and there is nothing substantial between here and ~ $213

On a positive note, all those -c250's we wrote seem very distant right now, although I could imagine a +5% reversal tomorrow, you know how it goes sometimes...