The 150x -p195's, they'll go OTM at some pointCan you clarify. Buy Jan 2025s and roll what weekly?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

tivoboy

Active Member

Yes, take out some covid, but that includes Nov/dec 2021, it was irrational. Take out DEC 2022/JAN 2023 lows, I’m fine with that, THEN lets rebuild some charts.This is the channel formation floating around where ppl are getting the $65 target from. Personally I think COVID and Jan 2022's lows need to be deleted from any TA, but I'm not a chartist.

View attachment 1012531

Problem is, the narrative is quickly forming that as far as the stock goes, SOME MULTIPLE of earnings, is warranted.. there WAS strong buying of course RABID buying some might say when P/E was ~ 25 down when stock was <108$. Now, at 65x with EARNINGS FALLING OR FLAT, nobody wants to warrant a 65x PE.. and that’s TODAY after 30% chopped off in the past ~ 60 days.

So, somewhere IN BETWEEN seems logical if not also probable. So take the ~ $4 EPS for 2024, multiply by ~ 40, we’re at $160… maybe its only 35x we’re at $140.. ok, lets give them a LITTLE more credit, we’re at $155+

Too many ppl now are trying to say “car company”, which would be a 6 or 10x multiple at best, and that in my opinion is just not going to happen.

So I’m going to work over the weekend on my earnings update, target multiple - though where there is interest and buying support for this type of growth and some category combination. And then lay that OVER the TA, but with the 3-4SD carve outs that I mentioned above. That’ll be an interesting exercise.

Into close:

BTO +P170 3/15/24 @$5.70

STO -C240 4/19/24 @$2.50

BTO +P170 3/15/24 @$5.70

STO -C240 4/19/24 @$2.50

Yes, take out some covid, but that includes Nov/dec 2021, it was irrational. Take out DEC 2022/JAN 2023 lows, I’m fine with that, THEN lets rebuild some charts.

Problem is, the narrative is quickly forming that as far as the stock goes, SOME MULTIPLE of earnings, is warranted.. there WAS strong buying of course RABID buying some might say when P/E was ~ 25 down when stock was <108$. Now, at 65x with EARNINGS FALLING OR FLAT, nobody wants to warrant a 65x PE.. and that’s TODAY after 30% chopped off in the past ~ 60 days.

So, somewhere IN BETWEEN seems logical if not also probable. So take the ~ $4 EPS for 2024, multiply by ~ 40, we’re at $160… maybe its only 35x we’re at $140.. ok, lets give them a LITTLE more credit, we’re at $155+

Too many ppl now are trying to say “car company”, which would be a 6 or 10x multiple at best, and that in my opinion is just not going to happen.

So I’m going to work over the weekend on my earnings update, target multiple - though where there is interest and buying support for this type of growth and some category combination. And then lay that OVER the TA, but with the 3-4SD carve outs that I mentioned above. That’ll be an interesting exercise.

Well said! Please share your chart and findings when you're done ;- )

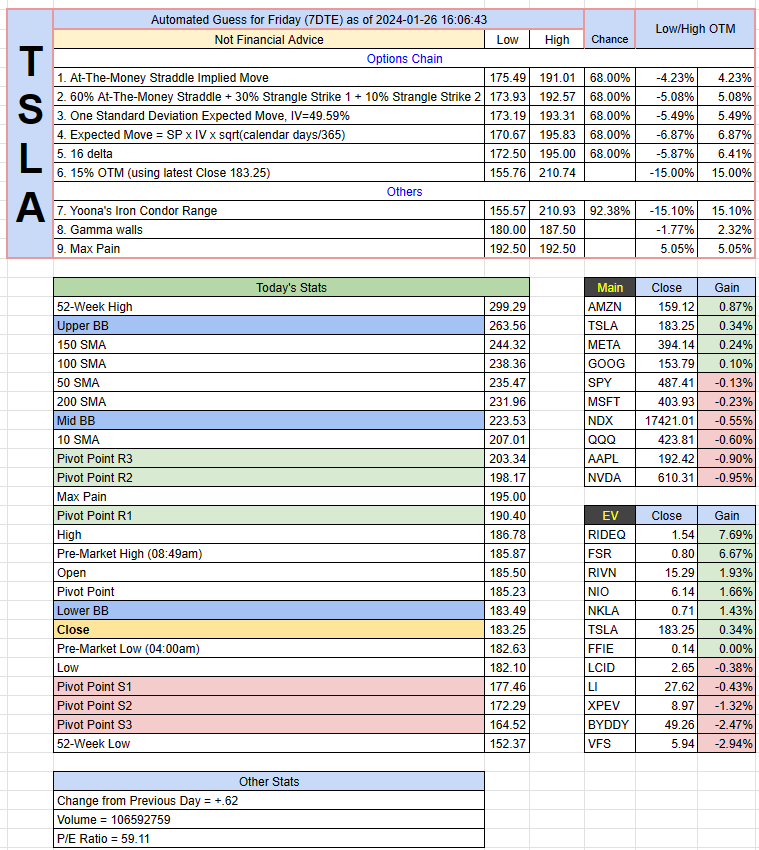

2/2 options market guessing 170-195ish

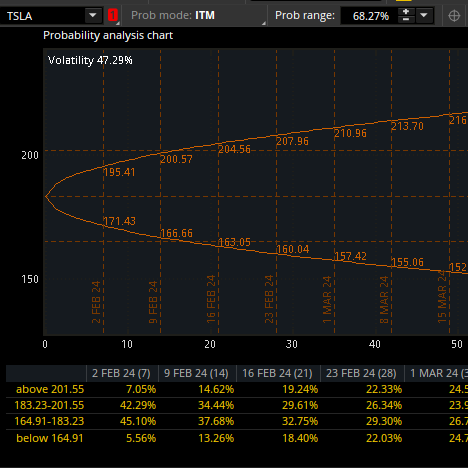

looking one month ahead, watch out for 160 on 2/23

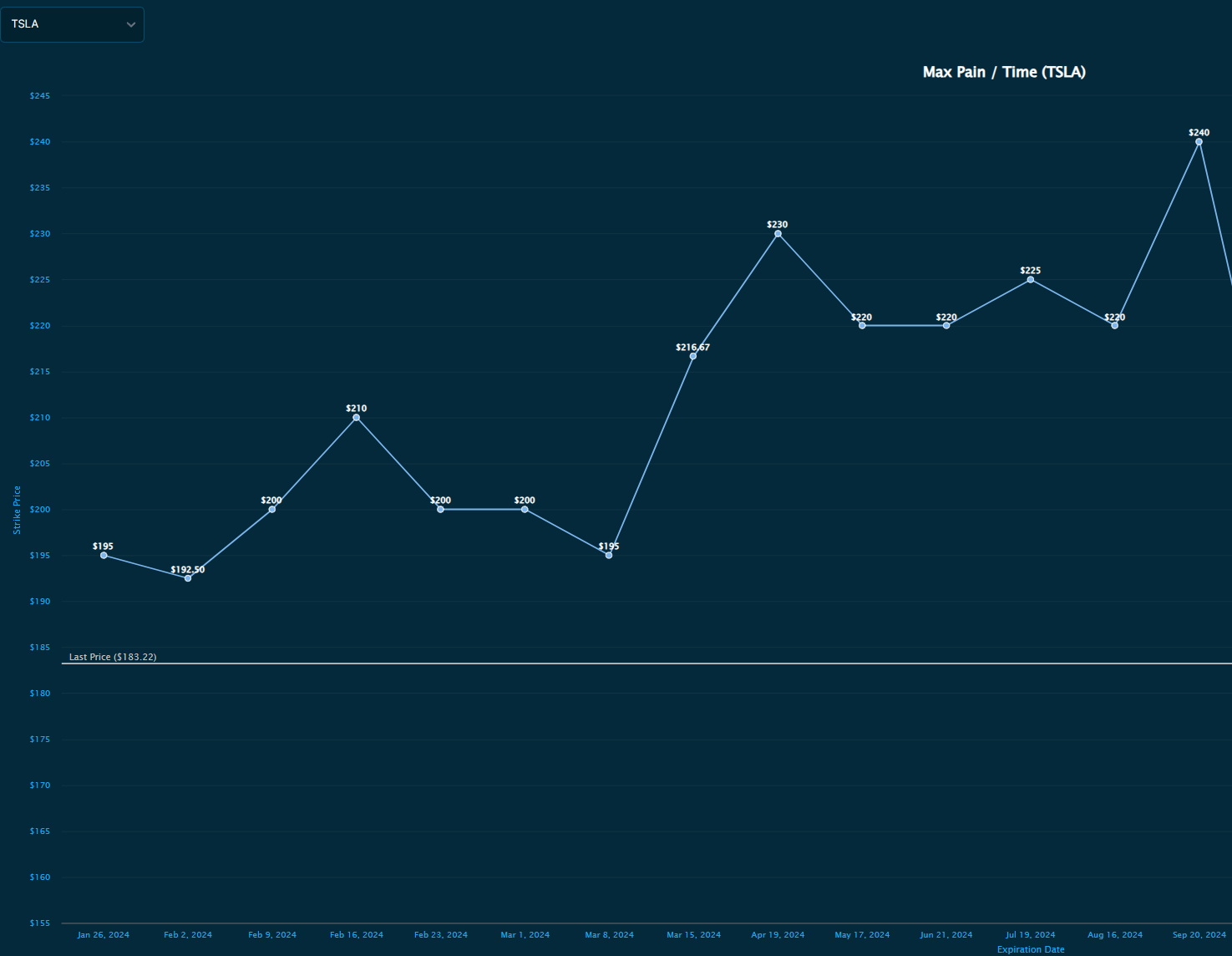

max pain ahead

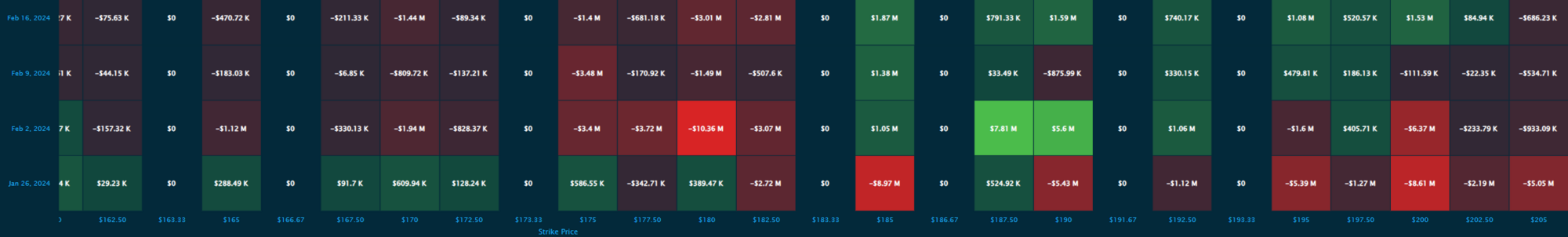

net premium flow not too bad today

looking at net premiums, 180 and 187.50 are next week's large bets

similar to yesterday, we finished on green candles

looking one month ahead, watch out for 160 on 2/23

max pain ahead

net premium flow not too bad today

looking at net premiums, 180 and 187.50 are next week's large bets

similar to yesterday, we finished on green candles

Well, boys and girl, was a green day, I'll take it!

Has been a nasty week, actually An awful 4 weeks, one of the worst I can ever remember, but I think most of us were better positioned than in the past, I haven't heard any horror-stories from anyone, no margin-calls, etc.

So I believe we've learned something from the past

Has been a nasty week, actually An awful 4 weeks, one of the worst I can ever remember, but I think most of us were better positioned than in the past, I haven't heard any horror-stories from anyone, no margin-calls, etc.

So I believe we've learned something from the past

you know, i was just thinking of saying the same thingWell, boys and girl, was a green day, I'll take it!

Has been a nasty week, actually An awful 4 weeks, one of the worst I can ever remember, but I think most of us were better positioned than in the past, I haven't heard any horror-stories from anyone, no margin-calls, etc.

So I believe we've learned something from the past

if you've been here for quite a while and you're still experiencing large losses, then you're really not paying attention

once in a while is ok, but don't make it consistent

tivoboy

Active Member

Anything after 3/15/24 is OLD MONEY at best… and even then it’s only higher probably due to more OLD MONEY post Mar 2024 monthly expiry. So, I think this curve is going to start to flatten more, so if we were to take it TODAY and track it against closes, I think we’re going to continue to be consistently BELOW MP on relative closes. I’m making a new worksheet.2/2 options market guessing 170-195ish

View attachment 1012548

View attachment 1012560

looking one month ahead, watch out for 160 on 2/23

View attachment 1012549

max pain ahead

View attachment 1012550

Well I will admit that my portfolio is down 20% YTD, but that's paper losses, realised gains at +$200k, and that's including a load of short puts that went dITM in the dump downyou know, i was just thinking of saying the same thing

if you've been here for quite a while and you're still experiencing large losses, then you're really not paying attention

once in a while is ok, but don't make it consistent

And I'm not intending to panic sell the longs down here, will just keep selling against them until expiry, strong possibility to at least recuperate the initial costs

But I think I'm done with expensive LEAPS, they're too stressy when they fall in price, underwater very fast...

Last edited:

thenewguy1979

"The" Dog

If I have initially learned about Option / Strategies from this group versus from that infamous reddit site, I would be 10x more well off and be a more handsome doggy then what I look nowWell I will admit that my portfolio is down 20% YTD, but that's paper losses, realised gains at +$200k, and that's including a load of put losses in the dump down

And I'm not intending to panic sell the longs down here, will just keep selling against them until expiry, strong possibility to at least recuperate the initial costs

But I think I'm done with expensive LEAPS, they're too stress when they fall in price, underwater very fast...

The only loss I have incurred was when I stray off the path and become greedy. Else all was goods.

the reason i sold NVDA IC on Wed is because i noticed that NVDA never had 3 consecutive 10%+ OTMs, so the chance of a low OTM this week is highshutdown time, i might be spending more time with NVDA and SPY so you may see me less

it's always 2 weeks large up and then rest a bit

low 7dte OTM is perfect for IC

now you know!

thenewguy1979

"The" Dog

Are we expecting a big knock your socks off move for TSLA next week - Yoona's safe ICs is at 15%. Seem to even be higher then this week.2/2 options market guessing 170-195ish

View attachment 1012548

View attachment 1012560

looking one month ahead, watch out for 160 on 2/23

View attachment 1012549

max pain ahead

View attachment 1012550

net premium flow not too bad today

View attachment 1012555

looking at net premiums, 180 and 187.50 are next week's large bets

View attachment 1012557

similar to yesterday, we finished on green candles

View attachment 1012559

probably 173-193 at the mostAre we expecting a big knock your socks off move for TSLA next week - Yoona's safe ICs is at 15%. Seem to even be higher then this week.

I have 1 year of income lurking in CASH.TO waiting for that kind of moment.I pray it's enough.... I think Orthosurg needs to join in....

(I am far more worried about a $10 drop Monday than I $10 rise)

thenewguy1979

"The" Dog

Paper lost is not a loss till the contract is closed.Well I will admit that my portfolio is down 20% YTD, but that's paper losses, realised gains at +$200k, and that's including a load of short puts that went dITM in the dump down

And I'm not intending to panic sell the longs down here, will just keep selling against them until expiry, strong possibility to at least recuperate the initial costs

But I think I'm done with expensive LEAPS, they're too stressy when they fall in price, underwater very fast...

Acknowledging that concepts can help avoid panicking situation. Easier said then done.

The only 3 previous times in TSLA history of 6 weekly red candles (the last one 7.5 years ago), the following weeks were green.

https://x.com/Jake__Wujastyk/status/1750876655826993350?s=20

https://x.com/Jake__Wujastyk/status/1750876655826993350?s=20

Last edited:

yeyyyy!The only 3 times in TSLA history of 6 weekly red candles (the last one 7.5 years ago), the following weeks were green.

https://x.com/Jake__Wujastyk/status/1750876655826993350?s=20

⚡️ELECTROMAN⚡️

Village Idiot

I would love to discuss this further, but I don't want to be an annoyance on this thread. It just seems like options are so restrictive with the 100 shares and expiration dates.100%

This is one of the ways to work around the hesitation and risk of timing issue. Options are oddly more forgiving and malleable in this instance.

EVNow

Well-Known Member

This is one of the ways to work around the hesitation and risk of timing issue. Options are oddly more forgiving and malleable in this instance.

I don't understand what this means .... options (buying) is leveraging. As with any leverage adverse SP movement will make the matters worse. Then there is the while time value thing ....

Damn some people are so bearish, talking about becoming the nurse from Dumb Money and even brought in sp from GJ. Tesla has always traded at a premium even when they were about to go bankrupt. It's a "lets wait to see if Elon pulls a rabbit out of a hat" kind of stock and there are plenty of people willing to wait for that moment. Becoming profitable was that first rabbit hat pull. Now people are waiting for FSD or optimus so it will trade at a premium as the upside is too huge to miss out if it happens.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K