What in the world now? I thought they were closed due to supply chain issues.Tesla announced new record production in Berlin. 6k/week.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

They said they WILL close for a few weeks not that they ARE closed. They had enough components to build for around 3 weeks from the date of the announcement.What in the world now? I thought they were closed due to supply chain issues.

The QQQ is celebrating with a massive Green Day....Tesla announced new record production in Berlin. 6k/week.

StarFoxisDown!

Well-Known Member

Dear lord I am almost starting to feel bad for the TSLA hold'em crowd at this point. It's not the fact that TSLA is down today, it's that it's down in the face of macro's ripping higher.

Part of me even feels guilty because of all the scenarios that 2024 could have been, TSLA going down and just hanging around 150-250 for most of 2024 is by far the best outcome for me. The longer we stay low and if we continue to go lower, the lower the odds that the stock remotely touches ATH level this year, probably not even to the mid 300's.

And any sustained rally out of these upper 100's/low 200's is getting delayed longer and longer by the macro's refusing to correct and instead go even higher.

I'm tempted to start buying some more 2026 LEAPS but there's really no incentive to do if you really think the macro's have a correction ahead of themselves and thus even if TSLA rallies into the low 200's, it's just gonna be back here in a month or two times

Part of me even feels guilty because of all the scenarios that 2024 could have been, TSLA going down and just hanging around 150-250 for most of 2024 is by far the best outcome for me. The longer we stay low and if we continue to go lower, the lower the odds that the stock remotely touches ATH level this year, probably not even to the mid 300's.

And any sustained rally out of these upper 100's/low 200's is getting delayed longer and longer by the macro's refusing to correct and instead go even higher.

I'm tempted to start buying some more 2026 LEAPS but there's really no incentive to do if you really think the macro's have a correction ahead of themselves and thus even if TSLA rallies into the low 200's, it's just gonna be back here in a month or two times

thenewguy1979

"The" Dog

@Yoona please share the weekly NVDA safe ICs as well when available. It's good for the team to have backup plan. Thanks.alrighty, no extrinsic left and shutting it down; staying within 1σ is very good for IC

View attachment 1014674

time forBreaking Bad moviesgames! i am in the Top 121 Steam players

View attachment 1014675

thenewguy1979

"The" Dog

Dear lord I am almost starting to feel bad for the TSLA hold'em crowd at this point. It's not the fact that TSLA is down today, it's that it's down in the face of macro's ripping higher.

Part of me even feels guilty because of all the scenarios that 2024 could have been, TSLA going down and just hanging around 150-250 for most of 2024 is by far the best outcome for me. The longer we stay low and if we continue to go lower, the lower the odds that the stock remotely touches ATH level this year, probably not even to the mid 300's.

And any sustained rally out of these upper 100's/low 200's is getting delayed longer and longer by the macro's refusing to correct and instead go even higher.

I'm tempted to start buying some more 2026 LEAPS but there's really no incentive to do if you really think the macro's have a correction ahead of themselves and thus even if TSLA rallies into the low 200's, it's just gonna be back here in a month or two times

Even AAPL is rebounding hard......

thenewguy1979

"The" Dog

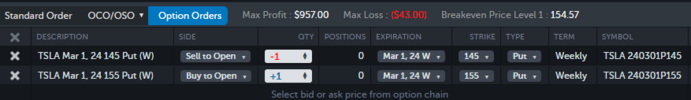

My plan B.

My Plan A. Cheap play. Kinda sad when we seem so close but oh so far. Just $10 away.......

My Plan A. Cheap play. Kinda sad when we seem so close but oh so far. Just $10 away.......

StarFoxisDown!

Well-Known Member

Like everyone and their mom probably, I'm watching for this

Intraday drop below 150 to fill the 146 gap and that's it. Would really like somewhat more of a relief rally to 200 or even 210 sell some more CC's for at least a something before that final leg down to 150. Seems like we'll likely hit that 150 mark in April'ish timeframe.

Intraday drop below 150 to fill the 146 gap and that's it. Would really like somewhat more of a relief rally to 200 or even 210 sell some more CC's for at least a something before that final leg down to 150. Seems like we'll likely hit that 150 mark in April'ish timeframe.

NVDA is RSI overbought but MACD is curling up@Yoona please share the weekly NVDA safe ICs as well when available. It's good for the team to have backup plan. Thanks.

thenewguy1979

"The" Dog

midday update. Still looking weak.

Keep this up and Cramer going to continue pushing for Tesla to be delisted from Mag 7.

Keep this up and Cramer going to continue pushing for Tesla to be delisted from Mag 7.

The unstoppable force of TSLA's weakness is running up against the immoveable object of Cramer's forecasting. Which will win?

I opened up a 2/9 -c200 position yesterday and it's already down ~70%. Think I'll just close it today and look for an opportunity to resell.

I opened up a 2/9 -c200 position yesterday and it's already down ~70%. Think I'll just close it today and look for an opportunity to resell.

thenewguy1979

"The" Dog

Get the profit rather then wait it out. Tesla has a known habit of popping without any news / reason.The unstoppable force of TSLA's weakness is running up against the immoveable object of Cramer's forecasting. Which will win?

I opened up a 2/9 -c200 position yesterday and it's already down ~70%. Think I'll just close it today and look for an opportunity to resell.

juanmedina

Active Member

Did @dl003 throw the towel?

.

I sold Apple 180p at open for today at $1.27 and for next week at $2.7. I closed them at $0.15 and $0.5.

.

I sold Apple 180p at open for today at $1.27 and for next week at $2.7. I closed them at $0.15 and $0.5.

Last edited:

thenewguy1979

"The" Dog

The SPY and QQQ pullback seem to be pushed out for now. Macro too positive.

Tesla just need to ride the bandwagon and we should be good.

We should be good Macrowise till CPI Feb 13th. Long enough for Tesla to bounce into 210/217 before pullback.

Tesla just need to ride the bandwagon and we should be good.

We should be good Macrowise till CPI Feb 13th. Long enough for Tesla to bounce into 210/217 before pullback.

SebastienBonny

Member

Watch out because we might never get there and since it’s an upward trend (thank god), of course the lowest point gets higher and higher when time goes further.Like everyone and their mom probably, I'm watching for this

Intraday drop below 150 to fill the 146 gap and that's it. Would really like somewhat more of a relief rally to 200 or even 210 sell some more CC's for at least a something before that final leg down to 150. Seems like we'll likely hit that 150 mark in April'ish timeframe.

thenewguy1979

"The" Dog

Here a cheap play for that scenario. Exp April 19th.Watch out because we might never get there and since it’s an upward trend (thank god), of course the lowest point gets higher and higher when time goes further.

Attachments

StarFoxisDown!

Well-Known Member

No that's with the uptrend. If were to test that support today, it would be all the way down at $125.Watch out because we might never get there and since it’s an upward trend (thank god), of course the lowest point gets higher and higher when time goes further.

You have to look at the time axis, each small block is a month of time. So that uptrend line will hit $150 in the month of May. Between now and then, TSLA actually could fall well below $150 and still be above the uptrend line.

So in the near term, next 3-4 months, support for TSLA in this 180 area is pretty weak.

The combination of support levels being well below today's share price now that we broke 1 yr uptrend line around the 215 area combined with TSLA underperformance verse the macro's AND the fact that the macro's have gone too far without a correction is just a bad combination for TSLA.

Obviously the stock could pivot at any time but tbh, there seems to be a very clear intent to drive TSLA down to test what I would call the mother of all uptrend lines, a 4 year uptrend line before Wall St will pivot and ride the stock back higher. I think Wall St wants to scare as much weak hands out of TSLA as possible over the next 3-4 months.

They've managed to completely cap any relief rallies for TSLA that were tied to macros. Hard to see them getting this close to 150 and the gap fill at 146 without taking at least a couple stabs at testing that support level.

Last edited:

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 11K

- Replies

- 5

- Views

- 6K