thenewguy1979

"The" Dog

Market is overblown on AI lately. All Elon have to do was mentioned AI 100x last earning and we would have Moon

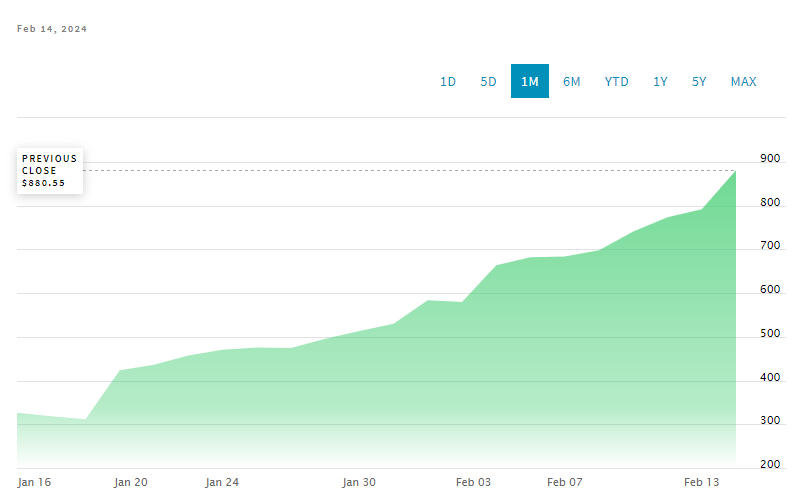

SMCI - 1000% YTD

Based on recent data last 2 out of 3 times we have a big green candles are followed by additional gain the next day.

SMCI - 1000% YTD

Based on recent data last 2 out of 3 times we have a big green candles are followed by additional gain the next day.

Last edited: