What would be your safe IC for SPY next week?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

actual Close = 191.97possible 2/23 192-210ish as of now

off by 3 CENTS from last Sunday's guess

Last edited:

ChiefRollo

Member

actual Close = 191.97

off by 3 CENTS from last Sunday's guess

vanna was bullseye 6 days ago in predictingthat’s pretty good; I would have preferred 210.03.

here was the snapshot at that time

if we superimpose the gamma walls back then, that's how i derived 192-210

Last edited:

intelligator

Active Member

^^^ Using Friday's chain, are you seeing 180/182-200 for 3/1 ?

vanna was bullseye 6 days ago in predicting

here was the snapshot at that time

View attachment 1021522

if we superimpose the gamma walls back then, that's how i derived 192-210

View attachment 1021525

Below is Tradytics Vanna data for 3/1, can you check if it looks the same/close in your tool so I can know that Tadytics is fairly accurate? Trady shows mix of red and green on both sides of spot, unlike the one you posted that has green to the right of spot and red to the left.

Also what do the green and red Vanna bars imply in your Vanna tool?

Thank you.

yes, 1σ^^^ Using Friday's chain, are you seeing 180/182-200 for 3/1 ?

vanna doesn't behave like gammaAlso what do the green and red Vanna bars imply in your Vanna tool?

+vanna (green) above/below spot = magnet

- if price is dropping and IV is rising, sp will be pulled into +vex below spot (dealers selling towards +vex)

- if price is rising and IV is dropping, sp will be pulled into +vex above spot (dealers buying towards +vex)

- if price is dropping and IV is rising, sp will be repelled by -vex below spot (dealers buying away from -vex)

- if price is rising and IV is dropping, sp will be repelled by -vex above spot (dealers selling away from -vex)

vanna is most effective in ~20Δ ranges, it will be 0 ATM (ie vanna isn't used to predict bullseye like tall gammas but can be used to predict range)

Last edited:

vanna doesn't behave like gamma

+vanna (green) above/below spot = magnet

-vanna (red) above/below spot = repellant

- if price is dropping and IV is rising, sp will be pulled into +vex below spot (dealers selling towards +vex)

- if price is rising and IV is dropping, sp will be pulled into +vex above spot (dealers buying towards +vex)

this is best illustrated by TSLA 2/3 close 191.97; sp dropping was repelled by -vex 190 (support) and stopped by +gex 192 (magnet)

- if price is dropping and IV is rising, sp will be repelled by -vex below spot (dealers buying away from -vex)

- if price is rising and IV is dropping, sp will be repelled by -vex above spot (dealers selling away from -vex)

vanna is most effective in ~20Δ ranges, it will be 0 ATM (ie vanna isn't used to predict bullseye like tall gammas but can be used to predict range)

Thank you.

Heres' what Tradytics is showing for Vanna for the coming week expiration 3/1, does it match or is similar to yours?

Plain Vanna

VannaGEX

Last edited:

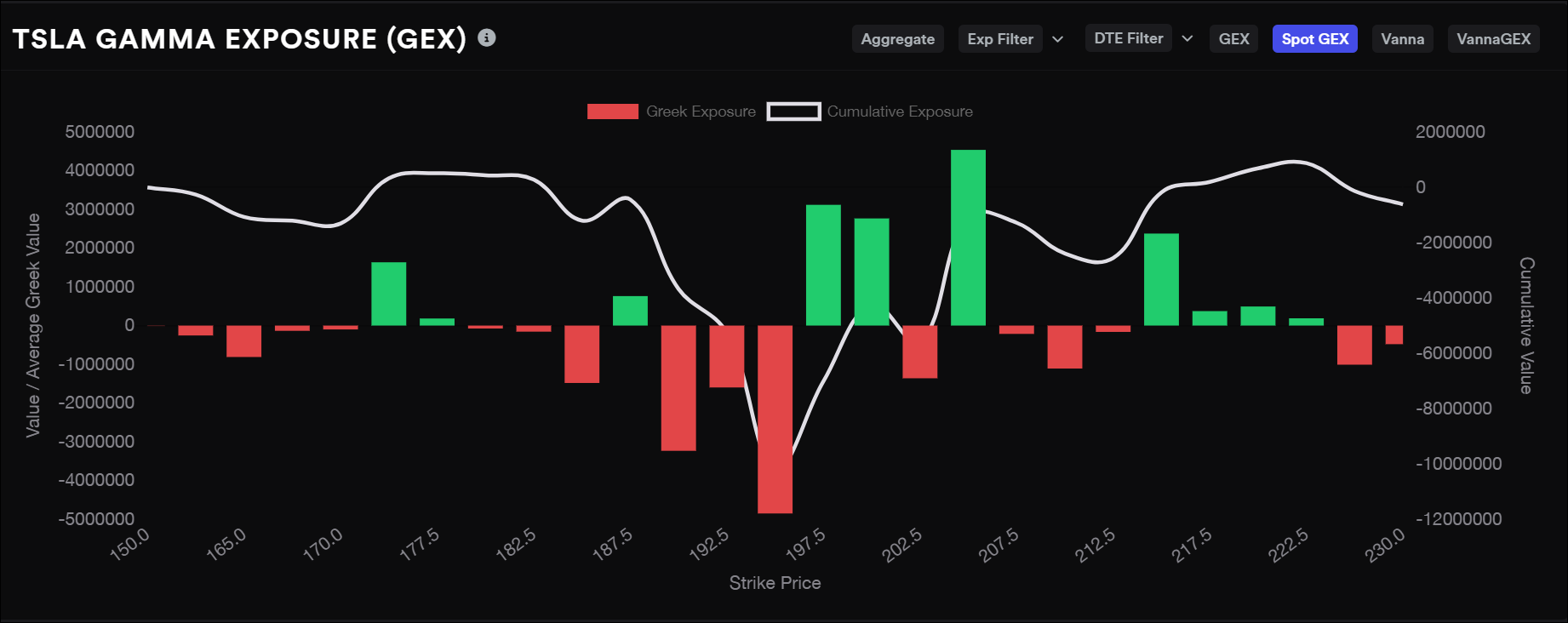

Summary of TradyTics's explanation of their Spot GEX:

Critical note: GEX bars are not predictive of targets, but of dealer support fueling momentum as trading moves toward them

Green bars above spot= Fuels bullish momentum, the larger the bar the stronger the effect

Red bars below spot= Fuels bearish momentum, the larger the bar the stronger the effect

Green bars below spot= Support/pinning

Red bars above spot= Resistance/pinning

Small/no Gamma bars=illiquid zone/prices can move faster inside them

EXAMPLE

TSLA 3/1 expiration:

BULLISH

1) There's dealer resistance from $190 to $197.50 (red bars to the right of spot)

2) If we get past the resistance, then dealers join and help fuel move (green bars after $197.50) until $202.50 where there's dealer selling/resistance (red bar).

3) Get past that and dealers really join the bullish momo all the way to $205.00/$207.50 (red bar)

BEARISH

1) $190 is greased to the downside (the red bar below spot), indicating dealers fueling momentum down if market begins to sell.

2) Some dealer support (i.e., brakes) appears @ $187.50 (small green bar)

3) If trading gets below that then we have a ghost zone (i.e. possible freefall) if TSLA continues to sell down

4) Dealers will help accelerate downtrend at $185 (red bar) all the way until $175.00 (green bar)

Critical note: GEX bars are not predictive of targets, but of dealer support fueling momentum as trading moves toward them

Green bars above spot= Fuels bullish momentum, the larger the bar the stronger the effect

Red bars below spot= Fuels bearish momentum, the larger the bar the stronger the effect

Green bars below spot= Support/pinning

Red bars above spot= Resistance/pinning

Small/no Gamma bars=illiquid zone/prices can move faster inside them

EXAMPLE

TSLA 3/1 expiration:

BULLISH

1) There's dealer resistance from $190 to $197.50 (red bars to the right of spot)

2) If we get past the resistance, then dealers join and help fuel move (green bars after $197.50) until $202.50 where there's dealer selling/resistance (red bar).

3) Get past that and dealers really join the bullish momo all the way to $205.00/$207.50 (red bar)

BEARISH

1) $190 is greased to the downside (the red bar below spot), indicating dealers fueling momentum down if market begins to sell.

2) Some dealer support (i.e., brakes) appears @ $187.50 (small green bar)

3) If trading gets below that then we have a ghost zone (i.e. possible freefall) if TSLA continues to sell down

4) Dealers will help accelerate downtrend at $185 (red bar) all the way until $175.00 (green bar)

Last edited:

According to StockWaves, if TSLA remains weak (below $200-$205), this may be how it'll play out:

thenewguy1979

"The" Dog

Seem 3/1 range will be between 500 and 512 on the Gamma and Vanna Chart. Some recovery week of 3/8 and more drastic drop on 3/15 and 3/22? No Vanna on those weeks yet?

thenewguy1979

"The" Dog

If we bounce past 197.5 chance of reaching 202.5. If not 165 and below will playout. This may aligned with that SPY dumb mid of March per Yoona's chart.According to StockWaves, if TSLA remains weak (below $200-$205), this may be how it'll play out:

View attachment 1021649

Thanks Jim and Yoona.

thenewguy1979

"The" Dog

They all went to the NVDA and SMCI be the house forums. Just crickets here…..

They all went to the NVDA and SMCI be the house forums. Just crickets here…..

... *chirp* ...

@Yoona I investigated TradyTics’s Spot Gamma tool further and learnt that it is not equivalent to Vol-Land’s “Dealer Hedging Requirements.” It’s just plain GEX. I apologize for false excitement.

I reached out to TradyTic’s developer Haider and asked him if they have the data equivalent somewhere else, I’ll post if I hear back.

I reached out to TradyTic’s developer Haider and asked him if they have the data equivalent somewhere else, I’ll post if I hear back.

Last edited:

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K