Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

corduroy

Active Member

Some strange glitches in the matrix today. The Friday $705s -Cs I sold today for $1.02 were up to $5.61 at one point! For comparison the $700s high today was $2.63.

mickificki

Member

instead of a wine room he'll have a beer room!That is going to be one sweet house!

Pretty much - I'll work an example.So for $200k margin (cash) you received back $90kish and bought 100 shares and a DITM call for the same exp date?

I really need to think through this move and do some modeling. I like it!

Yep - see below.can i please have a not-advice example for a dummy like me?

if sp right now is 675, buy a leap jun23 @400 then sell CC 8/6 for example at -c850?

thanks in advance!

(rookie learning leaps)

i am assuming you bought 45 leaps, which is why you can lcc; and then just keep on repeating the cc; and the leaps could be anything lower than 702.5

Here's what I've done. Using a roughly $1M account, I've got about $500k that I used to purchase long dated calls. I went for Jun '23 300 strike calls as they had roughly $50 in time value when I bought them, and close to .9 delta. I was going for share replacements here, and I could buy roughly 2 of these for the same money as I'd spend buying 100 shares. So I got 1.8 delta vs 1.0 delta, and the ability to sell 2 covered calls at a time instead of 1. You can go much closer to the money - I wanted something that I was confident would never go OTM in the next 2+ years I could own the calls.

I also wanted something that had a chance of reaching long term capital gain status (brokerage account) and had a very low time value I'd be paying for, thus the very distant strike.

So I purchased about 15 of those 300 strike Jun '23 calls and 5 of the Dec '21 500 strike calls (trying out different time periods) for a total of 20 calls. I've also got straight shares but I'm not selling CC against those any longer.

I am now able to sell 20 CC each week against those 20 contracts. As mentioned up thread they need to be ITM to get lined up and offset the short calls. This is technically a Diagonal Spread, but selling the calls each week in both an IRA and the brokerage account is no different than selling a series of covered calls.

The one thing that changes if that the CC actually get assigned, then you will either sell the shares you have in the account, or you'll sell shares you don't (yet) have -- go short the shares -- and probably have your broker help you out by BTC the short shares on Monday at market price. Therefore - you'll "take assignment" by proactively issuing a BTC on the short call, and a STC on the long call.

But if you're not taking assignment then there's no difference week to week managing these covered calls. At least that's been my own experience.

The key to this for me is that I am emotionally much more ready to take assignment against these long dated calls. And I think I'm more likely to take assignment on the shorter dated versions. I've got about 4 months to expiration on those Dec calls. And an important element here - I want to close any of those long dated calls (more likely roll) to a new date with no less than 3 months to expiration. If you check out the option chain you'll see that about 1/2 of the time value will fade over the window until you have 3 months to go, and then the last 1/2 will fade over the final 3 months. So by taking assignment or rolling before 3 months to go, the cost to you of the time value is greatly reduced.

Think of the time value you pay for up front as the interest on the loan that enables you to sell the covered calls. You'll need to earn at least that much from the CC (so far looks easy). And if the shares go up fast on you then those long calls will move up in value, helping you generate REALLY nice income. Or that's my theory and how I'm trading it.

I really hope the shares keep going so I'll have an excuse to take assignment at say a 750 share price in the next month or 2 (at most).

Only he knows, but I only risk about 1/20th of mine on weeklies.You're doing options on ALL your shares and bought calls?

1/20th? Crap I thought the instruction book said 20/1. Curse you dyslexia!!Only he knows, but I only risk about 1/20th of mine on weeklies.

Does anyone have a useful rough metric regarding a good volume threshold in the first 30 min that could spell difficulty for Market makers?

I’ll be interested to see if there is the normal 3-4 day delay post earnings rise occurs or a possible reallocation by fund managers away from Amazon and into Tesla (for a first half FOMO august with AI day and shareholders meeting).

On the other hand, Amazon’s miss could trigger a larger rotation out of tech.

also China situation rebounding this week.

I suppose a higher volume premarket rise may be good for share price going upward. My bet is currently on market makers delight but my fingers are crossed for a Gary Black Friday.

Anyway any tips to read the water before the waves form tomorrow? Preferably in volumes?

I’ll be interested to see if there is the normal 3-4 day delay post earnings rise occurs or a possible reallocation by fund managers away from Amazon and into Tesla (for a first half FOMO august with AI day and shareholders meeting).

On the other hand, Amazon’s miss could trigger a larger rotation out of tech.

also China situation rebounding this week.

I suppose a higher volume premarket rise may be good for share price going upward. My bet is currently on market makers delight but my fingers are crossed for a Gary Black Friday.

Anyway any tips to read the water before the waves form tomorrow? Preferably in volumes?

juanmedina

Active Member

Someone on Twitter posted that options for September 2023 will be added tomorrow if we dip I might get another LEAP.

Buckminster

Well-Known Member

I'm on a steep learning curve.

Thank you all for your ideas and explanations on this thread - you have made my beginners luck look like I'm a pro!

- First sold calls closed out for a profit last week.

- First sold puts closed out for a profit this week.

- Sold my first iron condors yesterday. 620,650, 700, 730 for next week.

Thank you all for your ideas and explanations on this thread - you have made my beginners luck look like I'm a pro!

Definitely thinking we are trending up @buttershrimp but see at least one or 2 days a week for the next month that the market goes down hard red for "corona virus fears"

So options for puts and calls!

yay

So options for puts and calls!

yay

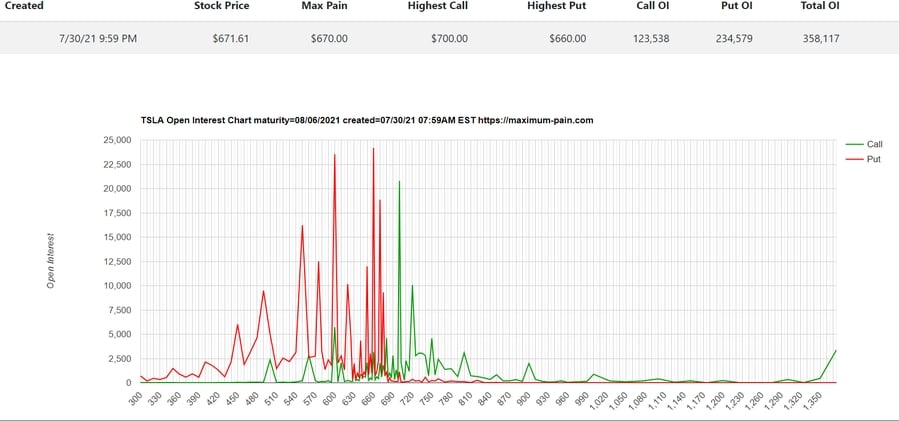

Definitely looks like a close just over $680 will be the target. It will be interesting to see if they let it drift up to that or have to pull it down. Either way I'll be closing out my $675CC.

Next week is already looking interesting as well. A really strong series of Put walls up to $675, small calls at $680 and then a Call wall at $700. Looks like they'll be battling against the momentum to keep it in a narrow range under $700.

Next week is already looking interesting as well. A really strong series of Put walls up to $675, small calls at $680 and then a Call wall at $700. Looks like they'll be battling against the momentum to keep it in a narrow range under $700.

I have a $680CC exp today. Sounds like I'm riding at the edge... It's 401k account. I can either roll to next week $700 for a credit or I can let it get called to sell puts. I'm 50/50 on each strategy.

If we move up to $700+ next week, then my roll would be tested again...

If we move up to $700+ next week, then my roll would be tested again...

pz1975

Active Member

I have the same predicament. I’m going to wait until just before close as I wouldn’t be surprised to see a pushdown during the day. Otherwise I will roll them out and up (and maybe split 50:50 with some sold puts).I have a $680CC exp today. Sounds like I'm riding at the edge... It's 401k account. I can either roll to next week $700 for a credit or I can let it get called to sell puts. I'm 50/50 on each strategy.

If we move up to $700+ next week, then my roll would be tested again...

i bet that either today or next friday the MM want to close at max at 699.99 as it currently looks.

Yesterday i opened 15x next week 680/620 BPS. Took ~50% profit yesterday/today.

Used that to fund 20x next week 700/650 BPS. IF they manage to push us down on e.g. tuesday i will "take more risk" and roll the 650->620 or so & as soon as we bounce above 675 this will be reversed again. One way of "playing the dip" IF it happens - but still have my position intact if it doesnt happen.

Also BTO 5x 20/8 730c & 10x 20/8 720c to get more delta + vega-exposure. The theta from above pay for this over time. They will be sold at latest on 19/8 before the IV-Crush of AI-Day.

Also i could not resist a small side-bet for today. Opened 10x 702.5/710 Bear Call Spread. Max loss 7500 bucks, max-gain 700 bucks. But that keeps me awake

Yesterday i opened 15x next week 680/620 BPS. Took ~50% profit yesterday/today.

Used that to fund 20x next week 700/650 BPS. IF they manage to push us down on e.g. tuesday i will "take more risk" and roll the 650->620 or so & as soon as we bounce above 675 this will be reversed again. One way of "playing the dip" IF it happens - but still have my position intact if it doesnt happen.

Also BTO 5x 20/8 730c & 10x 20/8 720c to get more delta + vega-exposure. The theta from above pay for this over time. They will be sold at latest on 19/8 before the IV-Crush of AI-Day.

Also i could not resist a small side-bet for today. Opened 10x 702.5/710 Bear Call Spread. Max loss 7500 bucks, max-gain 700 bucks. But that keeps me awake

juanmedina

Active Member

I have some 700s for today and it seems that I am going to have to be glued to the computer today. Premiums for next week are decent.

macros are rising steadily, TSLA just follows.I have some 700s for today and it seems that I am going to have to be glued to the computer today. Premiums for next week are decent.

Volume tapered off.

Normally we see a pushdown starting 14h or 15h. Maybe you can close it then. If there is no pusdown after 15:30 then one should get the hell out of that position (or roll .. or something

not advice

My Aug 6th BPS were at distant enough strikes that I closed them today for 60 or 70% profit and moved them out to Aug 13th 540/640s. The new positions are worth a $6 credit give or take. Probably a $5 net credit between the close and open (I didn't roll - did the two trades separately so I didn't track all that closely). If the shares reverse I'm comfortable with rolling these straight out for awhile and collect the large premiums with being ITM or close. I don't see a really big drop down towards $550 to be something to worry about right now.

With the pop in the share price this morning I've opened lcc's for next week / Aug 6th at the 720 strike. These were good for a $8 credit. These were around the .25 delta and are my version of an "I dare you" strike. The plan here is that if these go ITM or close, I'll roll out a week for a big strike improvement, and if challenged again, I'll likely let the time tick by and close these at the Aug 20th expiration. I clearly work at a truly conservative level relative to @Lycanthrope. But that's also been true since the very early pages of the thread

These lccs are against long dated calls, with some of them against Dec '21 500 strike calls. It's going to be tough for me, but I'm going to start ratcheting up how close OTM I'm selling these calls. I'd like to put myself for assignment between now and say the September monthly expiration.

If they still aren't assigned by then, I think that I'll be rolling out those Dec '21s to get me about 9 or 12 months worth of time to expiration. The idea here is that I'll close regardless of share price around 3 months to go (minimize the net time value I'm paying for). I'm also discovering that emotionally it's a lot easier to be taunting going ITM each week on options expiring sooner, than it is to be so aggressive against calls expiring in 2 years. And I do want that subset of options I'm being really aggressive with (by my standards).

My net position across the board is 540/640 BPS (expiring Aug 13th) and 720cc (expiring Aug 5th). I have access to 'free' credit call spreads and have chosen not to open any of those. I don't want that incremental risk on the board in case of a really big move upwards, and the strike I'd be out at (800/900) is worth maybe $0.40 premium. The 'free' money can turn into really expensive money too quickly, and I don't have much of a plan for dealing with it - so don't do it.

I'll be continuing to evaluate the credit call spreads as we get closer to the Aug 13th expiration - probably the start of that week.

I also don't -need- any more risk, and can probably take a lot of risk off of the table. The combination of positions is generating about 2x my targeted weekly income, which already provides for all of the sushi I could possibly want . And all of this is for income, while the shares (and long calls) I own provide more than adequate exposure to longer term upwards moves in the share price.

. And all of this is for income, while the shares (and long calls) I own provide more than adequate exposure to longer term upwards moves in the share price.

With the pop in the share price this morning I've opened lcc's for next week / Aug 6th at the 720 strike. These were good for a $8 credit. These were around the .25 delta and are my version of an "I dare you" strike. The plan here is that if these go ITM or close, I'll roll out a week for a big strike improvement, and if challenged again, I'll likely let the time tick by and close these at the Aug 20th expiration. I clearly work at a truly conservative level relative to @Lycanthrope. But that's also been true since the very early pages of the thread

These lccs are against long dated calls, with some of them against Dec '21 500 strike calls. It's going to be tough for me, but I'm going to start ratcheting up how close OTM I'm selling these calls. I'd like to put myself for assignment between now and say the September monthly expiration.

If they still aren't assigned by then, I think that I'll be rolling out those Dec '21s to get me about 9 or 12 months worth of time to expiration. The idea here is that I'll close regardless of share price around 3 months to go (minimize the net time value I'm paying for). I'm also discovering that emotionally it's a lot easier to be taunting going ITM each week on options expiring sooner, than it is to be so aggressive against calls expiring in 2 years. And I do want that subset of options I'm being really aggressive with (by my standards).

My net position across the board is 540/640 BPS (expiring Aug 13th) and 720cc (expiring Aug 5th). I have access to 'free' credit call spreads and have chosen not to open any of those. I don't want that incremental risk on the board in case of a really big move upwards, and the strike I'd be out at (800/900) is worth maybe $0.40 premium. The 'free' money can turn into really expensive money too quickly, and I don't have much of a plan for dealing with it - so don't do it.

I'll be continuing to evaluate the credit call spreads as we get closer to the Aug 13th expiration - probably the start of that week.

I also don't -need- any more risk, and can probably take a lot of risk off of the table. The combination of positions is generating about 2x my targeted weekly income, which already provides for all of the sushi I could possibly want

LN1_Casey

Draco dormiens nunquam titillandus

I'm just sitting back, sipping my morning tea watching the stock price today. I feel fairly certain that the MMs will keep it under 700, as there are a lot of call there.

If not, hey, put time.

If not, hey, put time.

Separate from all the trading reports, I wanted to say (as I do periodically) how valuable this thread is for me also. I get trading strategy ideas (the spreads!) and strike / indicator / timing ideas.

I rarely mimic any trade directly, but all of that goes into the hopper when choosing my own positions. This becomes an important component of the soup of stuff I consider as I make things happen for my own family. And I really appreciate the time that people invest letting us (me!) know what they're doing and why.

I rarely mimic any trade directly, but all of that goes into the hopper when choosing my own positions. This becomes an important component of the soup of stuff I consider as I make things happen for my own family. And I really appreciate the time that people invest letting us (me!) know what they're doing and why.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K