Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

TYVM, i enjoy posts like this that make me thinkHere's just 1 example. SP showed us before Q3 2023 earnings that it was going to fall on earnings.

thenewguy1979

"The" Dog

Closed my NVDA -875P/-945C. Done for the week.

They could have expired but taking the safer route.

Next week holding:

4/5 -182.5C for TSLA

4/5 +165P/-155P for TSLA

4/5 -900P for NVDA

4/5 -892.5 for NVDA

will close out anything that reached 50% profit, not waiting till expiration....

Good luck guys.

They could have expired but taking the safer route.

Next week holding:

4/5 -182.5C for TSLA

4/5 +165P/-155P for TSLA

4/5 -900P for NVDA

4/5 -892.5 for NVDA

will close out anything that reached 50% profit, not waiting till expiration....

Good luck guys.

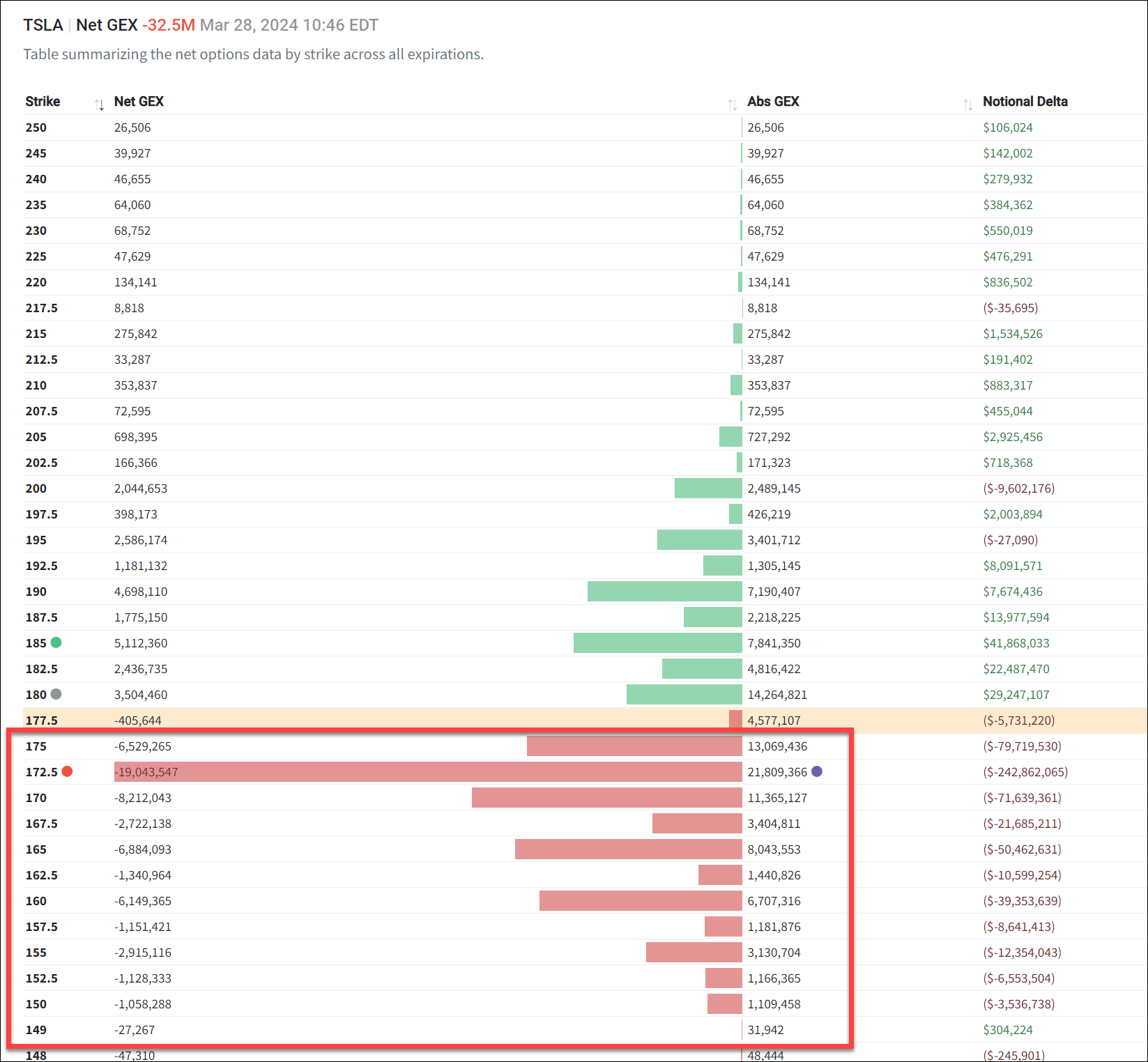

Next week seems Put heavy/-GEX positioning.

For those that follow MM moves, what does it mean when ppl say "with that many puts 'they' won't let share price fall down there so they don't have to pay out," or "when everyone expects 'A' (dump) we get 'B' (opposite)" Is there any truth to that and does it work?

4/5

For those that follow MM moves, what does it mean when ppl say "with that many puts 'they' won't let share price fall down there so they don't have to pay out," or "when everyone expects 'A' (dump) we get 'B' (opposite)" Is there any truth to that and does it work?

4/5

tivoboy

Active Member

How much would it cost to +p ~ 140-145, one of the two for 4/5… just as a maginot line hedge.Next week holding:

4/5 -182.5C for TSLA

4/5 +165P/-155P for TSLA

4/5 -900P for NVDA

4/5 -892.5 for NVDA

thenewguy1979

"The" Dog

.17 to .11 for 4/5How much would it cost to +p ~ 140-145, one of the two for 4/5… just as a maginot line hedge.

Took this opportunity to rolled my June 250 naked short calls to 1/2025 450 naked short calls. Add some more -450Cs in the process as a hedge for further down side but getting rid of those -250Cs helps me be ready in the event of a spike. Win-win.

Last edited:

EVNow

Well-Known Member

I'm still curious why people play P&D and ER weeks. Is it the lure of higher premiums ... ?4/5 -182.5C for TSLA

4/5 +165P/-155P for TSLA

Took this opportunity to rolled my June 250 naked short calls to 1/2025 naked short calls. Add some more -450Cs in the process as a hedge for further down side but getting rid of those -250Cs helps me be ready in the event of a spike. Win-win.

Nice to hear DL having a glimmer of a chance for a spike

What does this mean, large put movement (bearish)?

tivoboy

Active Member

That was going to be my question too!… it reads like a several order of magnitude spike in TOTAL premiums paid - and red I guess means PUTS, and a S…t. TON of them? But, maybe it’s just the point in time marker. ;-)

yes, OTM ASK call-put = net large put buys

Ugh. So now I’ve got to ask, is there any truth if there are so many puts down below share price won’t “go there”?yes, OTM ASK call-put = net large put buys

No, just no.

Mod, pls purge everything from 05:07 AM till now, other than possibly the new lowering of EPS guidance on TSLA.

Y'all wanted to talk about other stocks too. NVDA, MSCI, AAPL. Then DJT qualifies as well

But it's a dangerous one, because it can quickly become political. The last few posts about DJT got very close to meeting the mod hammer.

don't panic, could be hedgeUgh. So now I’ve got to ask, is there any truth if there are so many puts down below share price won’t “go there”?

My default scenario has been a spike since earlier in the week, as my conditions were met. Whether that spike marks the end of this potential DCB or the beginning of a bull run, I'll be on my toe the whole time. If it's a new bull run, it'll be the 1st wave so I'd rather hold -450C and give it time to pull back and consolidate once 220-240 is hit, vs trying to stop it with June -250C. As such, I'm comfortable with adding more -450Cs, counting on both a consolidation and an IV crush within the next 3 months. Please don't misconstrue this post as a bullish call for 250.Nice to hear DL having a glimmer of a chance for a spike

OK folks, I will take the wisdom of the hive-mind here and stay out of it... although I did the calculations and it was a pretty safe trade, but yeah, also would make me feel a bit queasy touching that stock...Y'all wanted to talk about other stocks too. NVDA, MSCI, AAPL. Then DJT qualifies as well

But it's a dangerous one, because it can quickly become political. The last few posts about DJT got very close to meeting the mod hammer.

My default scenario has been a spike since earlier in the week, as my conditions were met. Whether that spike marks the end of this potential DCB or the beginning of a bull run, I'll be on my toe the whole time. If it's a new bull run, it'll be the 1st wave so I'd rather hold -450C and give it time to pull back and consolidate once 220-240 is hit, vs trying to stop it with June -250C. As such, I'm comfortable with adding more -450Cs, counting on both a consolidation and an IV crush within the next 3 months. Please don't misconstrue this post as a bullish call for 250.

Yep, all clear, thanks.

I guess this means EOD or Monday for our chance for a pre-P&D spike, or one right after if market doesn't hate the numbers. I imagine all the near-term hedges unwinding and +P being closed (even if not all of them) can add fuel to a run too.

I remember you saying once that bull runs are more anxiety provoking for you than bear attacks. I totally get it now.

The -450C is 1/2025?

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K