Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

EVNow

Well-Known Member

It tells me only fools are buying / selling options nowWhat do you think might explain the narrow range? It’s curious to me as well.

Could it be many TSLA tea-leaf readers are over-banging the doom trap-door drum and $170-$190 is indeed sufficient for true range given we fell from $240 already, and sometimes the data steering us in our face might be telling us something?

Seriously - we may see some movement tomorrow / Monday on premiums. People tend to buy on last day for P&D (probably waiting for Troy and other forecasters last numbers). Even for ER, IV shoots up on last day.

ps :

Looks like that last bearish cross over happened when we hit the 100 low point

Good point re IV boost. I’ll save some contracts to write for Monday vs more tomorrow.It tells me only fools are buying / selling options now

Seriously - we may see some movement tomorrow / Monday on premiums. People tend to buy on last day for P&D (probably waiting for Troy and other forecasters last numbers). Even for ER, IV shoots up on last day.

Theres also my camp who dont look at earnings at all and just trade the chart.There seem to be two trading camps. Those that look one or two quarters ahead and think TSLA will go down more after already dropping 30% this year, and those that can look a little into the future and see Cyber ramp, FSD, and Gen 2 vehicle causing another major breakout, and are accumulating here.

I don't have a crystal ball, but I'm hoping the bottom is in.

Essentially expectation of low volatility. Too low to go dramatically lower, too high to go dramatically higher. Unclear what catalysts might change either.What do you think might explain the narrow range? It’s curious to me as well.

Could it be many TSLA tea-leaf readers are over-banging the doom trap-door drum and $170-$190 is indeed sufficient for true range given we fell from $240 already, and sometimes the data steering us in our face might be telling us something?

To me, I am slightly more bullish on TSLA right now. The CT is doing well, Tesla is advertising, Tesla has mind share, Elon isn't making headlines over stupid sh!t he says, it is clear that Tesla has better prospects than Ford, GM, or Toyota in the medium-term. ...but I know all it takes to change is a single tweet...

$DJT has crazy high IV for the moment following IPO, I'm eyeing up a calendar diagonal jan 2025 +p50 @$36 / April 5th -p65 @$12

Yes, the IV on the LEAPS is pretty crazy, but the weeklies it's higher, and unlikely to settle down too soon... I would expect the SP to drop hard once Donald dumps stock to pay his legal bills, plus the links to the US elections likely to keep the stock volatile

Yes, the IV on the LEAPS is pretty crazy, but the weeklies it's higher, and unlikely to settle down too soon... I would expect the SP to drop hard once Donald dumps stock to pay his legal bills, plus the links to the US elections likely to keep the stock volatile

Last edited:

Not to get into politics, but I would recommend staying the hell away from that one on either side. It is something that can be manipulated with a token amount of money since there are so few tradable shares. It is like a meme stock where the company has complete control of 80% of the equation, and the remainder has to really want to cause pain more than make money.$DJT has crazy high IV for the moment following IPO, I'm eyeing up a calendar diagonal jan 2025 +p50 @$36 / April 5th -p65 @$12

Yes, the IV on the LEAPS is pretty crazy, but the weeklies it's higher, and unlikely to settle down too soon... I would expect the SP to drop hard once Donald dumps sick to pay his legal bills

Knightshade

Well-Known Member

Not to get into politics, but I would recommend staying the hell away from that one on either side. It is something that can be manipulated with a token amount of money since there are so few tradable shares. It is like a meme stock where the company has complete control of 80% of the equation, and the remainder has to really want to cause pain more than make money.

On top of that its largest shareholder has significant financial reason to ask the board, which is comprised of those exceedingly friendly to him, to waive his 6 month share lock in, allowing for a dump to come at any time.... so yeah regardless of politics wouldn't touch that company with a 45 foot pole.

Short it to hell, mate!$DJT has crazy high IV for the moment following IPO, I'm eyeing up a calendar diagonal jan 2025 +p50 @$36 / April 5th -p65 @$12

Yes, the IV on the LEAPS is pretty crazy, but the weeklies it's higher, and unlikely to settle down too soon... I would expect the SP to drop hard once Donald dumps stock to pay his legal bills, plus the links to the US elections likely to keep the stock volatile

He is paying legal fees out of his donor's money. Fines/settlements are different, but he can stall that for at least 10 months. Since the NY appeals court gave him a reprieve on the appeal bond he doesn't need that nuclear option.I would expect the SP to drop hard once Donald dumps stock to pay his legal bills...

Safer to stay away from anything with those initials.

bmd00

Member

What's amazing is that the chart often shows us how the stock will move on earnings. In a sense, the chart is the crystal ball.Theres also my camp who dont look at earnings at all and just trade the chart.

Agree 1000%.Not to get into politics, but I would recommend staying the hell away from that one on either side. It is something that can be manipulated with a token amount of money since there are so few tradable shares. It is like a meme stock where the company has complete control of 80% of the equation, and the remainder has to really want to cause pain more than make money.

Case study- VFS

Pl be careful with these meme stocks .

Morgan Stanley reduces its Q1 Non-GAAP diluted EPS projection to $0.24 from $0.29, while keeping the FY'24 EPS forecast unchanged at $1.51.

Last edited:

tivoboy

Active Member

No, just no.$DJT has crazy high IV for the moment following IPO, I'm eyeing up a calendar diagonal jan 2025 +p50 @$36 / April 5th -p65 @$12

Yes, the IV on the LEAPS is pretty crazy, but the weeklies it's higher, and unlikely to settle down too soon... I would expect the SP to drop hard once Donald dumps stock to pay his legal bills, plus the links to the US elections likely to keep the stock volatile

Mod, pls purge everything from 05:07 AM till now, other than possibly the new lowering of EPS guidance on TSLA.

I'm still in wait-n-see mode. From the 15m to the 2h timeframe, RSI has registered new overbought highs across the board. I can't short this until it attempts another spike and fails. There's a chance it just going to crash from here but slim. If the spike happens today or Monday and fails, I'll take the short but if not, I guess I'll just roll the dice on P&D. Bull/bear pivot is now 166.

what chart?What's amazing is that the chart often shows us how the stock will move on earnings. In a sense, the chart is the crystal ball.

bmd00

Member

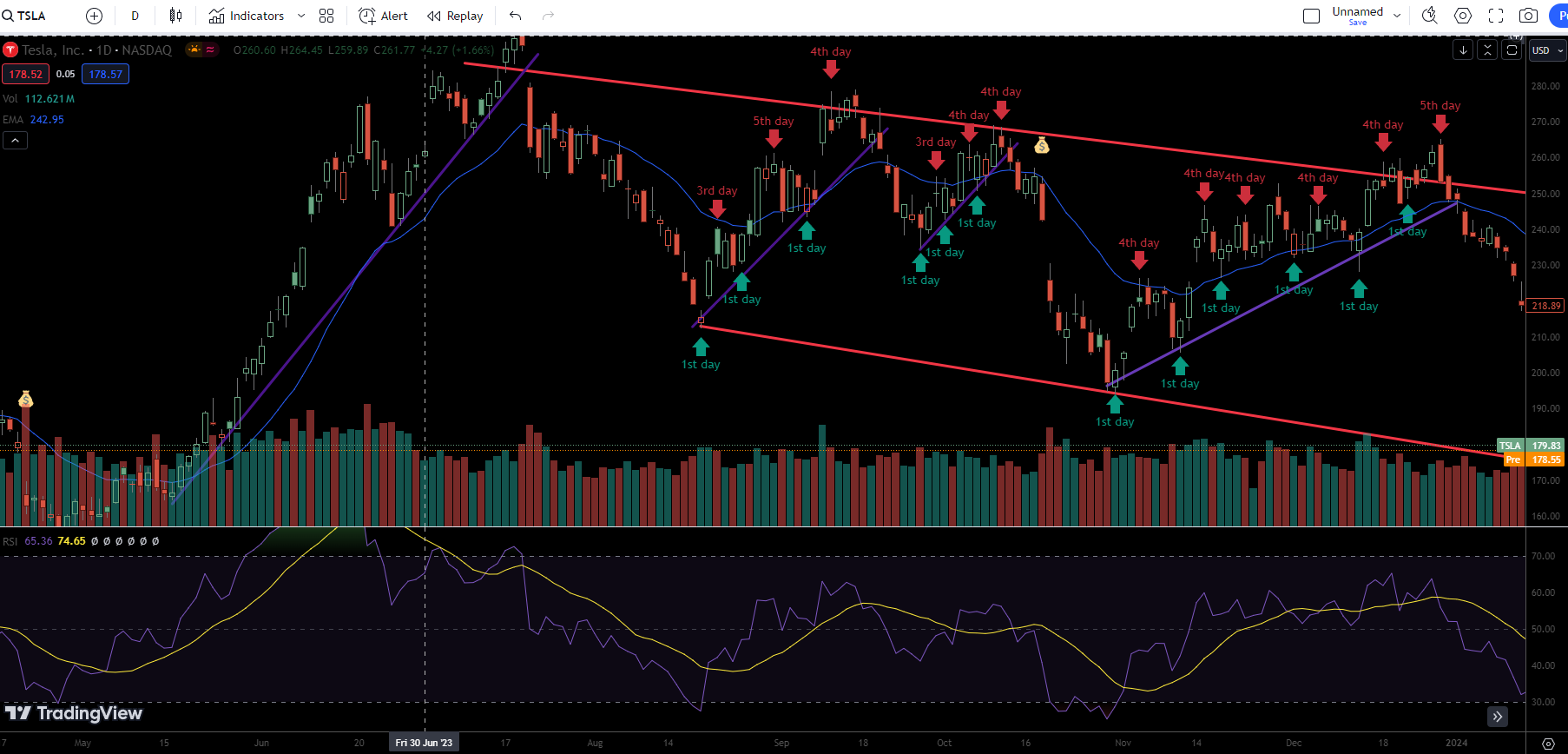

TSLA has a long history of rallying for 4 days before consolidating and retracing. Sometimes it's 3 days other times it's 5, but 4 is the most common. The point isn't to expect the 4th day to be a top before a retracement. This is just another pattern that SP respects and can be used to help trade.

Here's a look at the 2nd half of 2023. Near the 4th day of each wave, you'll usually start to see some inclinations of resistance. This resistance is more obvious in the lower time frames.

Looking at the most recent rally, beginning 3/15, we can see SP retraced on 3/21 and reversed on 3/22 with SP opening at its low and rallying throughout the day. That was day 1. The shooting star formed on Tuesday, day 3, was the top of this wave. Now we're in consolidation and retracement.

SP now needs a strong reversal day and a clear support level to start its next move higher. If this comes today or Monday, expect a jump on Tuesday next week. If SP consolidates but doesn't show strong support and a reversal day before P&D we'll likely fall, at least at the open, on Tuesday. If SP falls through 172 on Monday or Tuesday, which I'm not expecting but also not ruling out, SP is likely headed lower than 160.

Here's a look at the 2nd half of 2023. Near the 4th day of each wave, you'll usually start to see some inclinations of resistance. This resistance is more obvious in the lower time frames.

Looking at the most recent rally, beginning 3/15, we can see SP retraced on 3/21 and reversed on 3/22 with SP opening at its low and rallying throughout the day. That was day 1. The shooting star formed on Tuesday, day 3, was the top of this wave. Now we're in consolidation and retracement.

SP now needs a strong reversal day and a clear support level to start its next move higher. If this comes today or Monday, expect a jump on Tuesday next week. If SP consolidates but doesn't show strong support and a reversal day before P&D we'll likely fall, at least at the open, on Tuesday. If SP falls through 172 on Monday or Tuesday, which I'm not expecting but also not ruling out, SP is likely headed lower than 160.

bmd00

Member

what chart?

Here's just 1 example. SP showed us before Q3 2023 earnings that it was going to fall on earnings.Comparing Nov 2022 to today there are a lot of similarities. In both cases we had bullish RSI divergence, increasing selling volume leading up to a bottom on Nov 22nd, 2022 and Mar 15th, 2024, and a gap up the day after with increasing volume. I am using Nov 2022 as a reference for today and watching for deviations, which will occur at some point. We shouldn't assume history will repeat itself the same, but we can watch for similarities and differences.

View attachment 1030266

View attachment 1030267

This is exactly what I did leading up to Q3 earnings last year (July - Oct 2023). I noticed SP was behaving similarly to July - Oct 2019 and I used that time as a reference. In 2019, before Q3 earnings report, SP broke above its descending resistance trendline and out of the wedge it had been forming for several months. SP then gaped up on Q3 earnings.

View attachment 1030270

As a huge TSLA bull, I expected and hoped the same thing would happen in 2023. However, SP never broke above its descending resistance line pre-Q3 earnings but instead broke down below its ascending support trendline and subsequently gaped down on Q3 earnings. When I noticed this deviation and the support line break, I exited my long positions and bought puts. I made a killing after Q3 earnings.

View attachment 1030269

For the record, there are a lot of times when TSLA is not necessarily behaving like it did in the past, or not close enough to reference. I struggle with this because I'm always looking for patterns when they don't always exist.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K