intelligator

Active Member

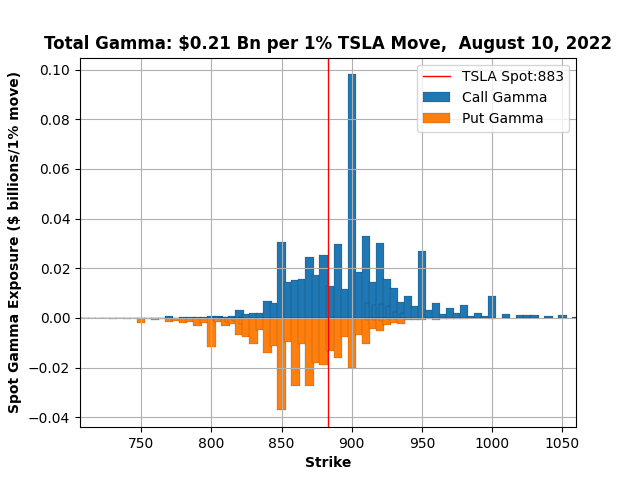

900 seems so distracting  how about some more sideways trading for a 870-875 close Thursday? 800 CSP would fare well, so would 840/740 BPS. 855 CC not so well, will look for roll opportunity before noon. Today's MMD to mid 850s was the ideal time to close it for 70% but didn't have an order in to snag it while away... an 850 Friday close would hit them all.

how about some more sideways trading for a 870-875 close Thursday? 800 CSP would fare well, so would 840/740 BPS. 855 CC not so well, will look for roll opportunity before noon. Today's MMD to mid 850s was the ideal time to close it for 70% but didn't have an order in to snag it while away... an 850 Friday close would hit them all.