Yep..I’m going to be more aggressive next month. lolQuestion. Are you all generally more aggressive with weekly CC strike prices on Monthly expiration week?

Last week we were flying high thinking "no way will it hit max pain next Friday" and yet here we are looking like it'll by $680.0000 at the close.

I'm still taking my time in getting aggressive with strike prices but wondering if monthly expiration week is a good once a month time for me to turn it up a little.

Thanks!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

AquaY

Member

A roll isn't really doable to get you out of the loss.Any advise for rolling or taking the loss on 690-680 BPS? I should have dumped or rolled yesterday and today there doesn't seem to be a good roll option with the value already fully baked into the spread (90% loss now).

Widening the spread may be an option. I haven't looked at those #s.

Since this thread is " strategy of the Wheel" originally, is it possible to take assignment and then start writing covered calls?

I mean, you are in a BPS and if you're bullish on the stock you can think of it as buying it at below $690 and then start writing covered calls.

I'd rather do that then lock in a loss if I'm bullish on the underlying.

I am actually in a similar boat with AMZN. I wrote an 8/20 3200 AMZN put that will be exercised today.

I looked at call prices the other day and decided if they went ITM that was what I was going to do.

Well, it's trading at 3182 so we will see how i do next week,

You may not wish to commit that much capitol so that might not work, but looking at my cost of financing it's a good option for me.

Just looking at calls quickly if you owned the stock now you can write a CC for 8/27 @ $11.35

Not recommending that. I looked at it real quickly and figured I'd give you it simply as an example.

Whatever you decide, Good Luck

Last edited:

InTheShadows

Active Member

This is super helpful. I would have been able to recover faster some short puts that went bad on me starting around mid April this year. Some of them I just gave up on and cut for losses a month ago because I was tired of rolling them every week for .02-.05. thus barely covering my fees.NOT-ADVICE of course

Is that expiring today?

There are a variety of possibilities depending on what you think will happen from here.

A choice you could make is to increase the spread size to $20 (double it) while retaining the number of positions and see what net credit roll is available. That will double the amount of capital at risk but might improve the strike enough, along with buying some time, for the position to recover. Or course you would then have 2x the capital at risk and the opportunity to double up on your loss

Or 3x, 4x, etc..

What I would start with is to see how good or bad the roll choices are. As you're beyond the mid point on the spread I would expect a roll for net debit - either by moving the short strike the wrong direction or by paying a net debit to keep the position the same, but 1 week later.

Also think about how much deeper into the pit you are willing to climb.

I've experienced a roll that enabled me to 4x my losses from just eating the loss that was available before the roll. Of course if I'd known ahead of time that would be the result then I wouldn't have done it.

It's these rolls where capital at risk and/or number of positions is changed in favor of more leverage and/or bigger positions that create the really big opportunities for fast improvement of a bad position.

You need to close out the bought side if it is in the money to get assigned the short puts though.A roll isn't really doable to get you out of the loss.

Widening the spread may be an option. I haven't looked at those #s.

Since this thread is " strategy of the Wheel" originally, is it possible to take assignment and then start writing covered calls?

I mean, you are in a BPS and if you're bullish on the stock you can think of it as buying it at below $690 and then start writing covered calls.

I'd rather do that then lock in a loss if I'm bullish on the underlying.

I am actually in a similar boat with AMZN. I wrote an 8/20 3200 AMZN put that will be exercised today.

I looked at call prices the other day and decided if they went ITM that was what I was going to do.

Well, it's trading at 3182 so we will see how i do next week,

You may not wish to commit that much capitol so that might not work, but looking at my cost of financing it's a good option for me.

Just looking at calls quickly if the market opens similarly to where it is now on Monday you can write a CC for 8/27 @ $11.35

Not recommending that. I looked at it real quickly and figured I'd give you it simply as an example.

Whatever you decide, Good Luck

AquaY

Member

I did not do a spread.You need to close out the bought side if it is in the money to get assigned the short puts though.

I did this one bare asssed naked.

Last edited:

dc_h

Active Member

NOT-ADVICE of course

Is that expiring today?

There are a variety of possibilities depending on what you think will happen from here.

A choice you could make is to increase the spread size to $20 (double it) while retaining the number of positions and see what net credit roll is available. That will double the amount of capital at risk but might improve the strike enough, along with buying some time, for the position to recover. Or course you would then have 2x the capital at risk and the opportunity to double up on your loss

Or 3x, 4x, etc..

What I would start with is to see how good or bad the roll choices are. As you're beyond the mid point on the spread I would expect a roll for net debit - either by moving the short strike the wrong direction or by paying a net debit to keep the position the same, but 1 week later.

Also think about how much deeper into the pit you are willing to climb.

I've experienced a roll that enabled me to 4x my losses from just eating the loss that was available before the roll. Of course if I'd known ahead of time that would be the result then I wouldn't have done it.

It's these rolls where capital at risk and/or number of positions is changed in favor of more leverage and/or bigger positions that create the really big opportunities for fast improvement of a bad position.

Thanks, I closed for 9.50 on the 8/20 690/680 BPS and rolled a 685\675 to next week for a small loss. First time eating a BPS. Sold more 660/650 for next week. Macros seem to be a danger going forward, but Tesla deliveries, AI and Energy all seem on very bullish path. All in, about breakeven for the week, due to selling puts last Friday. To think I started the week worrying about getting my 725cc's called.

This is what we've discussed a little while back. Having a small spread makes it really hard to manage when it goes ITM. Although it's not as capital intensive and allows your to have more leverage, you end up paying more for the long leg, so your net is not that much better. Once I've gone to $50 spreads, management becomes much better. My rule of thumb is go for lower delta and bigger spreads. This creates a comparable "net" and a safer position imo.Thanks, I closed for 9.50 on the 8/20 690/680 BPS and rolled a 685\675 to next week for a small loss. First time eating a BPS. Sold more 660/650 for next week. Macros seem to be a danger going forward, but Tesla deliveries, AI and Energy all seem on very bullish path. All in, about breakeven for the week, due to selling puts last Friday. To think I started the week worrying about getting my 725cc's called.

InTheShadows

Active Member

I agree. I usually go for -20 delta. I’d rather do less management and rolling.This is what we've discussed a little while back. Having a small spread makes it really hard to manage when it goes ITM. Although it's not as capital intensive and allows your to have more leverage, you end up paying more for the long leg, so your net is not that much better. Once I've gone to $50 spreads, management becomes much better. My rule of thumb is go for lower delta and bigger spreads. This creates a comparable "net" and a safer position imo.

It really sucks when you have to roll because of one strike ITM. then the next week it gets even uglier, and before you know it you are in a multiple week mess trying to do trade repair.

I’d rather have 98% win rate with less than 10% rolls than to be messing with ATM short calls/puts and having to spend the day watching the chart hoping my position stays OTM.

juanmedina

Active Member

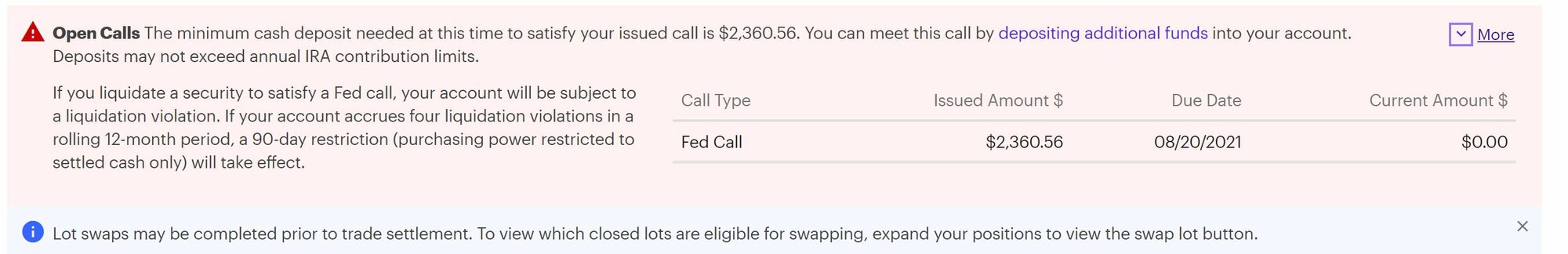

Any idea what happened here:

As of today the account has a buying a power of $50k and technically I have $200k cash because I have BPS for next Friday and sold puts; I also have limited margin enabled on the account. I am not planning on depositing that required money because it is a traditional roll over IRA and rather deposit money in my Roth IRA because I can't take the deduction of the traditional IRA. Any suggestions?

As of today the account has a buying a power of $50k and technically I have $200k cash because I have BPS for next Friday and sold puts; I also have limited margin enabled on the account. I am not planning on depositing that required money because it is a traditional roll over IRA and rather deposit money in my Roth IRA because I can't take the deduction of the traditional IRA. Any suggestions?

I am wondering about early assignment of a covered call... if I sell a weekly on a Monday, and the stock goes over the strike say on Wednesday, what are the chances my shares could be sold before expiration? This happened to me a few weeks ago where I had a 720 cc, the stock went over by a few dollars one day, but I fully expected things to come back down before Friday, so I just left it alone. Should I have been concerned and rolled it before it got close to the strike?

This has been discussed in here often and while early exercise can happen at any time it's still very rare. It would be even rarer in the scenario you've raised as the option would be just ITM. The key thing to be aware of is the time value (theta) remaining in the option. If a CC is around the money and has a few days left then there should typically be enough time value left that its always financially better to just sell the option (and capture the time value) than exercise the option (and lose the remaining time value). However it still won't stop an ignorant or foolish person on the other side of the trade who wants to exercise anyway.I am wondering about early assignment of a covered call... if I sell a weekly on a Monday, and the stock goes over the strike say on Wednesday, what are the chances my shares could be sold before expiration? This happened to me a few weeks ago where I had a 720 cc, the stock went over by a few dollars one day, but I fully expected things to come back down before Friday, so I just left it alone. Should I have been concerned and rolled it before it got close to the strike?

Where options are most at risk of early exercise is where they are DITM and close to expiration (I've had this happen). This is when the time value remaining can be very low such that there's little cost difference between exercising and selling the option. If they want the shares anyway they may just exercise, particularly if the option isn't very liquid. If you have an ITM option (CC or Put) then you should monitor the time value and be prepared to roll the option out once it gets low relative to the option price.

Any idea what happened here:

View attachment 699494

As of today the account has a buying a power of $50k and technically I have $200k cash because I have BPS for next Friday and sold puts; I also have limited margin enabled on the account. I am not planning on depositing that required money because it is a traditional roll over IRA and rather deposit money in my Roth IRA because I can't take the deduction of the traditional IRA. Any suggestions?

Doesn't the “current amount” of $0 indicate that this should go away on its own?

alterac000

Member

Not sure all brokerages handle the same way (I think they do but each may have slightly different margin equity percent requirements)Any idea what happened here:

View attachment 699494

As of today the account has a buying a power of $50k and technically I have $200k cash because I have BPS for next Friday and sold puts; I also have limited margin enabled on the account. I am not planning on depositing that required money because it is a traditional roll over IRA and rather deposit money in my Roth IRA because I can't take the deduction of the traditional IRA. Any suggestions?

In ameritrade my margin buckets are broken down into stock buying power and options buying power. I have seen a similar margin call message whenever my options buying power went below 0. This happened when I was heavy in sold puts during the big drop earlier this year.

Is it possible that despite your 200k in cash, your total options buying power use of your sold puts and BPS took you to below 0 (with TSLA at ~680 you would only need 3 sold puts to use up $204k of options buying power; depending on how many BPS you also had, your total portfolio equity, and calculated margin percent, you may have gone past)? You likely opened these positions during slightly more favorable conditions, but then by end of day yesterday the overall calculations turned negative.

AquaY

Member

There's no way to calculate the probability but I'd say it is smallI am wondering about early assignment of a covered call... if I sell a weekly on a Monday, and the stock goes over the strike say on Wednesday, what are the chances my shares could be sold before expiration? This happened to me a few weeks ago where I had a 720 cc, the stock went over by a few dollars one day, but I fully expected things to come back down before Friday, so I just left it alone. Should I have been concerned and rolled it before it got close to the strike?

Generally speaking it should not be called unless it is deep ITM and even then, usually selling the long call is more profitable.

It had happened to me when I screwed up on a Dividend stock and wrote a CC for expiration after the record date. I was surprised i was called away and then realized how I screwed up.

AquaY

Member

But isn't a Fed call or Reg T call only from a new trade where intra day margin was okay but closing prices changed it or from Option assignment?Not sure all brokerages handle the same way (I think they do but each may have slightly different margin equity percent requirements)

In ameritrade my margin buckets are broken down into stock buying power and options buying power. I have seen a similar margin call message whenever my options buying power went below 0. This happened when I was heavy in sold puts during the big drop earlier this year.

Is it possible that despite your 200k in cash, your total options buying power use of your sold puts and BPS took you to below 0 (with TSLA at ~680 you would only need 3 sold puts to use up $204k of options buying power; depending on how many BPS you also had, your total portfolio equity, and calculated margin percent, you may have gone past)? You likely opened these positions during slightly more favorable conditions, but then by end of day yesterday the overall calculations turned negative.

There's no way to calculate the probability but I'd say it is small

Generally speaking it should not be called unless it is deep ITM and even then, usually selling the long call is more profitable.

It had happened to me when I screwed up on a Dividend stock and wrote a CC for expiration after the record date. I was surprised i was called away and then realized how I screwed up.

My own addition that I suspect @AquaY will agree with is that far, far less than 1% of options in roughly that state get assigned. By far far less, I'd go down to 1% of 1% of 1% (1 in 1 million) and say that it is far, far less than that. But that's a guess on my part.

The reason is as already noted - if the option has time value remaining, then the owner of that option doing an early exercise just gifted you that time value. There are big, well funded participants in the market that are busy hunting pennies, nickels and dimes (at volume) - giving away quarters or $ in time value is .. not desirable.

Generally speaking that sort of early assignment is good for you as you receive the time value as profit. The obvious circumstance I can identify where that's not good is the position has a large unrealized capital gain (brokerage account) and now you'll have the joy of paying the taxes on that sale come tax time.

My own experience with deep ITM options (>$100 ITM) over this year was that I was never assigned. I did keep track of the time value on a regular basis and mostly found that it was close enough to $0 with 1 week to expiration that my pattern was to roll from 1 week to 2 weeks to expiration each week. Or roll from 1 week our to 3, 4, even 5 weeks to expiration. I mostly did not allow those deep ITM options to get into their final week to expiration, and certainly not get to day before expiration (because they were SO deep ITM).

I had some -685p that got assigned on a Thursday evening before expiration when the stock price was <600My own addition that I suspect @AquaY will agree with is that far, far less than 1% of options in roughly that state get assigned. By far far less, I'd go down to 1% of 1% of 1% (1 in 1 million) and say that it is far, far less than that. But that's a guess on my part.

The reason is as already noted - if the option has time value remaining, then the owner of that option doing an early exercise just gifted you that time value. There are big, well funded participants in the market that are busy hunting pennies, nickels and dimes (at volume) - giving away quarters or $ in time value is .. not desirable.

Generally speaking that sort of early assignment is good for you as you receive the time value as profit. The obvious circumstance I can identify where that's not good is the position has a large unrealized capital gain (brokerage account) and now you'll have the joy of paying the taxes on that sale come tax time.

My own experience with deep ITM options (>$100 ITM) over this year was that I was never assigned. I did keep track of the time value on a regular basis and mostly found that it was close enough to $0 with 1 week to expiration that my pattern was to roll from 1 week to 2 weeks to expiration each week. Or roll from 1 week our to 3, 4, even 5 weeks to expiration. I mostly did not allow those deep ITM options to get into their final week to expiration, and certainly not get to day before expiration (because they were SO deep ITM).

alterac000

Member

I don't know...But isn't a Fed call or Reg T call only from a new trade where intra day margin was okay but closing prices changed it or from Option assignment?

Wow you solved hell. Very impressive seriously.I was sufficiently deep ITM on those puts that I was typically rolling 1 week before expiration. I was definitely rolling more than 2 days before expiration.

My trigger / decision point was the time value. As that approaches 0 and as DTE approaches the likelihood of early assignment increases. I was deep enough in the doodoo that the early roll made me comfortable I would avoid early assignment. I was also typically rolling 2 weeks at a time, and even rolled 4 weeks once. My thought process on those was that I was completely dependent on a big share price move in my favor and I was far enough ITM that needing a week to get all of that back didn't sound unlikely. That 4 week roll also didn't budge the strike

Most of the rolls were getting me $1-2 credits for a 2 week roll. I mentally round those to 0 but of course that isn't actually 0. There was one memorable roll for $0.02 because the commissions made a $0.01 roll into a net debit.

The BPS cure is, I think, reasonably straightforward to describe. Using a single $760 strike put that has $76k cash backing it, assuming a cash secured put. I changed that into 4 $200 BPS which used $80k cash (margin) to back them. I also tested changing into 8 $100 put credit spreads but the resulting short put wasn't much different.

Those 4 spreads got me to a dramatically better short put strike. Something like changing those $760 strike puts into 460/660 strike put credit spreads. I also pulled in the expiration by a week (nearly no difference keeping the expiration the same). The new position was still ITM but by $20 or so instead of $120ish.

I was expecting I would need to roll the spreads a few times to finish resolving them, but the shares had a friendly move for me and I closed that mess out the week that I rolled.

There are a few things going into why this worked.

1) Changing from 1 csp to 4 BPS (put credit spread) added leverage to the position.

2) That increased my rate of gain from share price moves in my favor, as well as enhanced my rate of loss for share price moves against me.

3) Most importantly - it got my strike back into the land of significant time value so I became exposed to both share price moves in my favor as well as time decay in my favor. The previous position never had very much time value, so there was very little time decay value to be had.

The risk here, and why I went with such a very large spread size ($200) was if the shares had fallen dramatically. Say $640 at roll time, down to $540. In that case I would have ended up at $120 ITM (where I started) except then I would have had a 4x increase in the number of those ITM positions, increasing the size of the loss by 4x. I felt that was a good risk to take, but it was on the table.

Leverage gains also means that leveraged losses are on the table. I believe that the real value was putting significant time value back into play, and is what would have gotten me to resolution with a few weeks.

@adiggs can you expand on receiving time value as profit if the option is exercised early? When it's exercised, the contract is essentially "completed" and you are not getting anymore money for it. I am not sure how you would get the time value.My own addition that I suspect @AquaY will agree with is that far, far less than 1% of options in roughly that state get assigned. By far far less, I'd go down to 1% of 1% of 1% (1 in 1 million) and say that it is far, far less than that. But that's a guess on my part.

The reason is as already noted - if the option has time value remaining, then the owner of that option doing an early exercise just gifted you that time value. There are big, well funded participants in the market that are busy hunting pennies, nickels and dimes (at volume) - giving away quarters or $ in time value is .. not desirable.

Generally speaking that sort of early assignment is good for you as you receive the time value as profit. The obvious circumstance I can identify where that's not good is the position has a large unrealized capital gain (brokerage account) and now you'll have the joy of paying the taxes on that sale come tax time.

My own experience with deep ITM options (>$100 ITM) over this year was that I was never assigned. I did keep track of the time value on a regular basis and mostly found that it was close enough to $0 with 1 week to expiration that my pattern was to roll from 1 week to 2 weeks to expiration each week. Or roll from 1 week our to 3, 4, even 5 weeks to expiration. I mostly did not allow those deep ITM options to get into their final week to expiration, and certainly not get to day before expiration (because they were SO deep ITM).

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K