who is john snowthat’s what I’m waiting for: 169.69. Big drop through 172.50 just now, so that was a significant resistance level. That was mentioned yesterday on the main thread as a John Snow(???) prediction. Don’t know who that is and couldn’t find it. Edit: I rolled out and down my straddles to $185 Jan23, added an additional CSP with the extra cash. Can hardly believe that I’m selling CCs at that level. Did this in anticipation of moving to a new brokerage and won’t be able to trade for a week or two during the transition.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

who is john snow

I’m hesitating to close my sold CCs today. They are +85%A portion of the breakaway gap was filled. Everything that has happened up till this point was setting up for this test. We're going to see if there's big money waiting inside this gap.

I rolled mywho is john snow

-TSLA230915P350

To the end of eternity, Jan2025

You know nothing, Jon Snow.

However @dl003 still knows a lot more than us!

I sold CCs for 0.50 Tuesday last week for 190 rolled to 202.50 2 weeks out for 0.85 creditYes. Quite some margin left, but I'd rather not visit sub 170 again.

Another thing to think about is when selling CC's for next week. We have CPI coming so that may move the stock again next week.

Closed for 0.70 today when they were +85%

Decided not to be greedy

1,35 credit cashed, bought back at 0.70

They once were at $5.50

I half-salvaged this deep losing position at some point.

Will wait for the next deep green day to sell new CCs. Will see what John Snow has for us.

TexasGator

Member

Ortho - isnt that put on the verge of being assigned? looks those are selling for roughly $180 which means zero extrinsic value at roughly170?

Edit: thinking about it more it's really close - technically the SP is a $3-4 from being where there would be no time value left...

Edit2: looking at the Sep2023, i see it was at risk of being assigned today. So going to 2025 helps, but not much

a bit surprising (to me at least)- for very DITM PUTs, even Jan 2025 is not "safe" depending on how far the SP gets pushed down

Edit: thinking about it more it's really close - technically the SP is a $3-4 from being where there would be no time value left...

Edit2: looking at the Sep2023, i see it was at risk of being assigned today. So going to 2025 helps, but not much

a bit surprising (to me at least)- for very DITM PUTs, even Jan 2025 is not "safe" depending on how far the SP gets pushed down

Last edited:

Since the 12/2 -200c expired worthless, 12/9 -200c and 12/16 -210c are looking pretty good, I'm going to kick off the christmas rally into next year by pre-opening their replacement positions. I usually make the worst trades, so could bounce anytime now and my -175c will get DITM soon. You are welcome.Will let 12/2 -200c expire worthless. if it actually get exercised it's fine , no capital gains on this. will reduce margin balance which prob will be between 9-9.25% depending on whether fed does 0.5 or 0.75.

STO 12/9 -200c for $3.39, SP around $194.4

Positions: 12/2 -200c, 12/9 -200c, 12/16 -210c

STO 1/20/2023 -175c for $14.65, SP around $172.8

Positions: 12/9 -200c, 12/16 -210c, 1/20/2023 -175c

I know, I bought back at $177 and sold the new one at $182 I have been going through the assignment-o-rama lately. I will just seem those shares again and sell the same out again and again until we recover. My average share price will probably be 350 by the time we recover.Ortho - isnt that put on the verge of being assigned? looks those are selling for roughly $180 which means zero extrinsic value at roughly170?

Edit: thinking about it more it's really close - technically the SP is a $3-4 from being where there would be no time value left...

Edit2: looking at the Sep2023, i see it was at risk of being assigned today. So going to 2025 helps, but not much

a bit surprising (to me at least)- for very DITM PUTs, even Jan 2025 is not "safe" depending on how far the SP gets pushed down

Oh well

In the mean time I am working and accumulating the money to buy all these shares for ever.

Last edited:

intelligator

Active Member

I’m hesitating to close my sold CCs today. They are +85%

At 172, you should be better than 85% I'd imagine. I closed mine at 75% thinking that I'd avoid having to action later just to earn a few more points... but that's what I chose to do to lock in gains.

Bank of Canada hiked interest rates again by 0.5%, the interest rate is getting ridiculous on some of my lines (almost 10%). Decided instead of just buying time selling CCs to pay for margin interest and just tread water (and more work to file taxes), just sold some additional chairs to raise cash at $172.31. Now I'm margin safe to $43/share, and if I inject outside lines can ride it to $0/share. Guess I will have fun stay poor with the permanent chair losses if I don't manage to buy them back somehow. It's really hard to sell CC and make 30% annually (margin interest + capital gain taxes) so this sucks but I'm trying to cut down my margin balance further instead of paying 10% interest while having paper losses which is double the pain.Since the 12/2 -200c expired worthless, 12/9 -200c and 12/16 -210c are looking pretty good, I'm going to kick off the christmas rally into next year by pre-opening their replacement positions. I usually make the worst trades, so could bounce anytime now and my -175c will get DITM soon. You are welcome.

STO 1/20/2023 -175c for $14.65, SP around $172.8

Positions: 12/9 -200c, 12/16 -210c, 1/20/2023 -175c

Last edited:

It may look scary but the under plumbing is pretty constructive.@dl003 Any relief for us showing in your cards?

The last time the hourly RSI hit OS territory, we were already at the prior low (187). This time, we were still way off the prior low (166).

Double bullish divergence can be observed on the hourly timeframe. Last time we didn't see one until the very last hours around sub 170s area.

What this is telling me is the selling pressure this time around is less potent than last time.

Moreover, my 172.5 level is still holding so I see no reason for panicking. The reason I thought 172.5 would hold is because that was slightly below the opening gap in the morning when MS's Jonas told institutions the sell off in TSLA was overdone. However, institutions didn't have much of a chance to accumulate TSLA at the 170-173 area because, as we all know, a massive frenzy of short covering took place that morning and the stock never looked back.

Now, if we were to believe Jonas' reputation, we'd have to bet that, despite the nasty FUD campaign on all fronts, institutions are locked and loaded inside this gap, just waiting for traders to get flushed out. It's possible that we go all the way down to 166 but for today, my motto is going to be "if they could have, they would have." If the market was truly that bearish on TSLA, nothing would be stopping bears from filling the gap all the way through. So, what's stopping them today? They so close!! I guess we'll find out tomorrow.

Last edited:

chiller

Member

Ortho - isnt that put on the verge of being assigned? looks those are selling for roughly $180 which means zero extrinsic value at roughly170?

Edit: thinking about it more it's really close - technically the SP is a $3-4 from being where there would be no time value left...

Edit2: looking at the Sep2023, i see it was at risk of being assigned today. So going to 2025 helps, but not much

a bit surprising (to me at least)- for very DITM PUTs, even Jan 2025 is not "safe" depending on how far the SP gets pushed down

After a few poorly timed rolls and predictions (surely we will test ATH again within the year!) I have ended up with JAN 2025 -400P.

They are showing as 0 in extrinsic value, but since the spread is so wide, it is still some value there compared to the bid.

I do not want to be exercised, but unsure how to deal with this in a "nondestructive" manner.

Repeated sell offs on heavy volume outpacing the rest of the market and mega caps that are going sideways with below average (AMZN) to really below average (MSFT, QQQ) volume is not a good look.

Oversold and all that, yet where are the buyers?

Coming when you least expect it was the MO of the past.

Fair question: Whither TSLA if SPY visits 3K over the next few months?

Oversold and all that, yet where are the buyers?

Coming when you least expect it was the MO of the past.

Fair question: Whither TSLA if SPY visits 3K over the next few months?

I have -430p June 2024After a few poorly timed rolls and predictions (surely we will test ATH again within the year!) I have ended up with JAN 2025 -400P.

They are showing as 0 in extrinsic value, but since the spread is so wide, it is still some value there compared to the bid.

I do not want to be exercised, but unsure how to deal with this in a "nondestructive" manner.

Once they get assigned, I will join you in the 2025 assignement fest

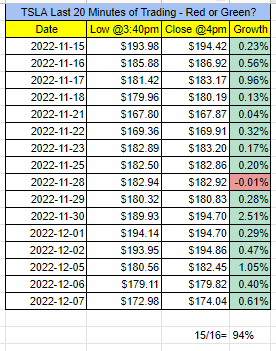

i've been noticing that TSLA is climbing just before end of day, so i checked...

TSLA Last 20 Minutes of Trading - Red or Green?

in the last 16 days, there is 94% probability of sp going up in the last 20 minutes

for Thanksgiving 11/25 half day, used 12:40pm to 1pm

TSLA Last 20 Minutes of Trading - Red or Green?

in the last 16 days, there is 94% probability of sp going up in the last 20 minutes

for Thanksgiving 11/25 half day, used 12:40pm to 1pm

What's the sensitivity if the 3:40 time hack is varied by say +/- 3 minutes?i've been noticing that TSLA is climbing just before end of day, so i checked...

TSLA Last 20 Minutes of Trading - Red or Green?

in the last 16 days, there is 94% probability of sp going up in the last 20 minutes

View attachment 882524

for Thanksgiving 11/25 half day, used 12:40pm to 1pm

Have JAN 25 -P across the board ranging from 350 to 270. I was aggressive in rolling them right from the start and managed to bring down the strike prices a good amount over the past year, was not afraid to trade time for leverage figured the other options could turn out worse.I have -430p June 2024

Once they get assigned, I will join you in the 2025 assignement fest

I am locked in now until JUN 25 options float, think they are due in MAR 23. Don't know if I will still have those -P or shares. Possible to still have -P but I would guess SP would have to go up to at least 200 and stick for that to happen

Reports of China now sold out after a 900 dollar incentive. Record quarter is already baked in, will be the greatest in Tesla history, yet here we are.

If I could change one inexplicable event over the past 18 months it would be that ridiculous post Hertz news rally. I was dumbfounded and it warped my sense of the market. I had a pretty good handle on things until then, if that had never happened I think I would be in a great position compared to current state of affairs.

It is just money folks, maybe when you have enough of it should just walk away from the sewer that is WS. Kind of like a Godfather theme.... Just when I thought I was out....

I took the close >174 as a minor, pyrrhic victory... (I was born optimistic, I'll take whatever I can and cling to it)i've been noticing that TSLA is climbing just before end of day, so i checked...

TSLA Last 20 Minutes of Trading - Red or Green?

in the last 16 days, there is 94% probability of sp going up in the last 20 minutes

View attachment 882524

for Thanksgiving 11/25 half day, used 12:40pm to 1pm

I've no idea where the markets or the SP goes, but after several days of heavy shorting I would expect a relief-rally of some description soon, no?

Same thing here I thought the SP would follow an exponential curve like the growth of sales. I thought the SP was entering the S-curve like the adoption of EVs. Totally delusionalHave JAN 25 -P across the board ranging from 350 to 270. I was aggressive in rolling them right from the start and managed to bring down the strike prices a good amount over the past year, was not afraid to trade time for leverage figured the other options could turn out worse.

I am locked in now until JUN 25 options float, think they are due in MAR 23. Don't know if I will still have those -P or shares. Possible to still have -P but I would guess SP would have to go up to at least 200 and stick for that to happen

Reports of China now sold out after a 900 dollar incentive. Record quarter is already baked in, will be the greatest in Tesla history, yet here we are.

If I could change one inexplicable event over the past 18 months it would be that ridiculous post Hertz news rally. I was dumbfounded and it warped my sense of the market. I had a pretty good handle on things until then, if that had never happened I think I would be in a great position compared to current state of affairs.

It is just money folks, maybe when you have enough of it should just walk away from the sewer that is WS. Kind of like a Godfather theme.... Just when I thought I was out....

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K